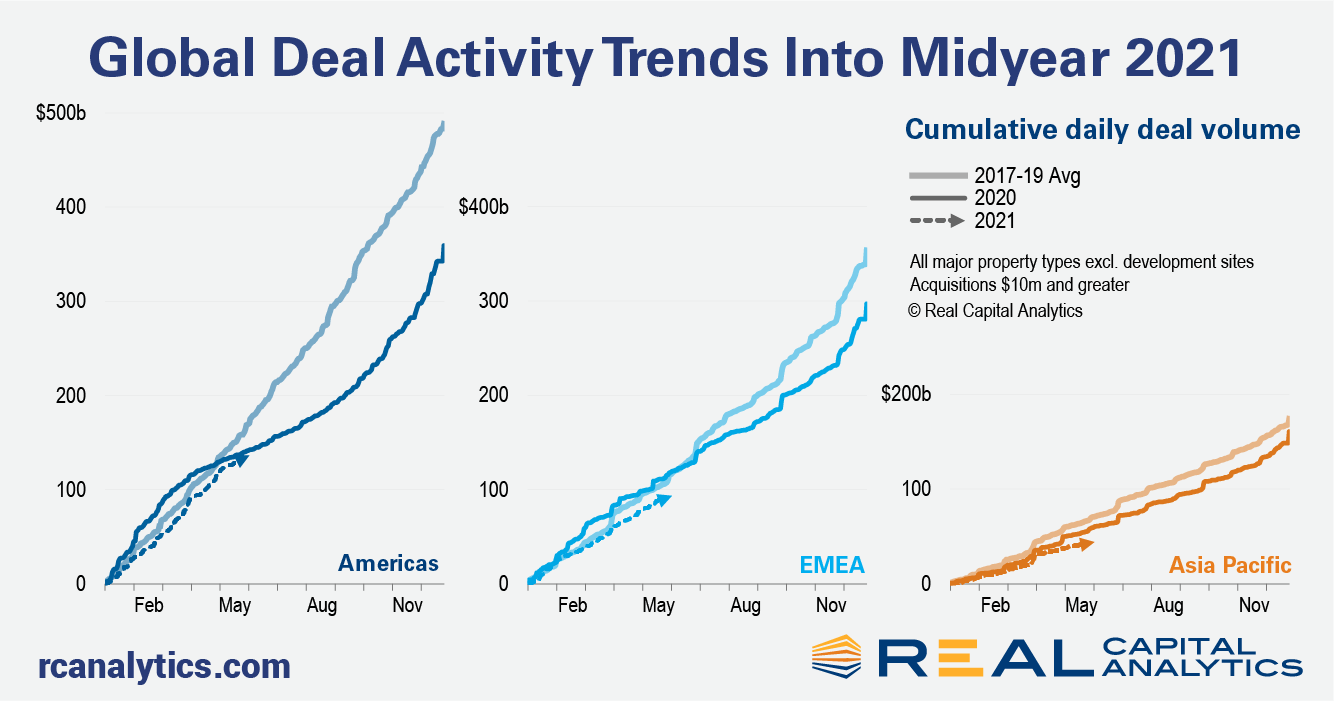

As we approach the midpoint of the year, it’s worth examining how commercial real estate markets are faring in comparison with the year of Covid’s eruption and prior years.

RCA’s tracking of global commercial real estate sales shows all three global zones — the Americas, Asia Pacific, and Europe, the Middle East and Africa (EMEA) — remain deeply impacted.

Volumes observed now across all zones globally are lower than both 2020 and the average of 2017-19 activity, but the severity of the drop varies across the world.

-In EMEA, the $92 billion invested through May 31 into income-producing properties is the closest to normal activity: just 17% lower than the pre-Covid average. It is however less than the amount of capital spent during the same period in 2020 — the first quarter of 2020 in Europe was very promising, with the crisis troubling volumes only later.

–The situation for the Americas reads similarly, but the cumulative figure of $135 billion at the end of May suggests that 2021 volume could eventually catch up to the 2020 total. This volume is 18% lower than the average of 2017-19.

–In Asia Pacific, activity has been curtailed since the beginning of the year. The $43 billion spent in the first five months of 2021 represents less than two-thirds of that spent at the same point in an average, undisrupted year.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.