Quick Service Restaurant breakfast food challengers Starbucks and Taco Bell also saw significant growth of 340% and nearly 250%, respectively.

Key Takeaways

• 2021 U.S. digital spend on breakfast items via delivery apps is up 263% from 2020

• Breakfast item delivery sales have been steadily increasing since mid-March 2020

• Dunkin’ saw the greatest year-over-year increase in breakfast food sales — up more than 750%.

• Starbucks saw year-over-year sales grow by 340%.

They say breakfast is the most important meal of the day, and nowhere is that truer than at quick service restaurants. Just recently, Burger King and Tim Hortons both added new breakfast sandwich options to their menus, and Wendy’s reported better-than-expected earnings due in large part to their new breakfast offerings. While Quick Service Restaurant (QSR) breakfast seems to be booming now, there were concerns in 2020 that the breakfast wars were a bust. To get to the truth of QSR breakfast sales, Edison Trends took a deep dive into over 70,000 transactions and analyzed sales from the end of 2019 to now.

How much has U.S. digital spend on breakfast food items changed in the last year?

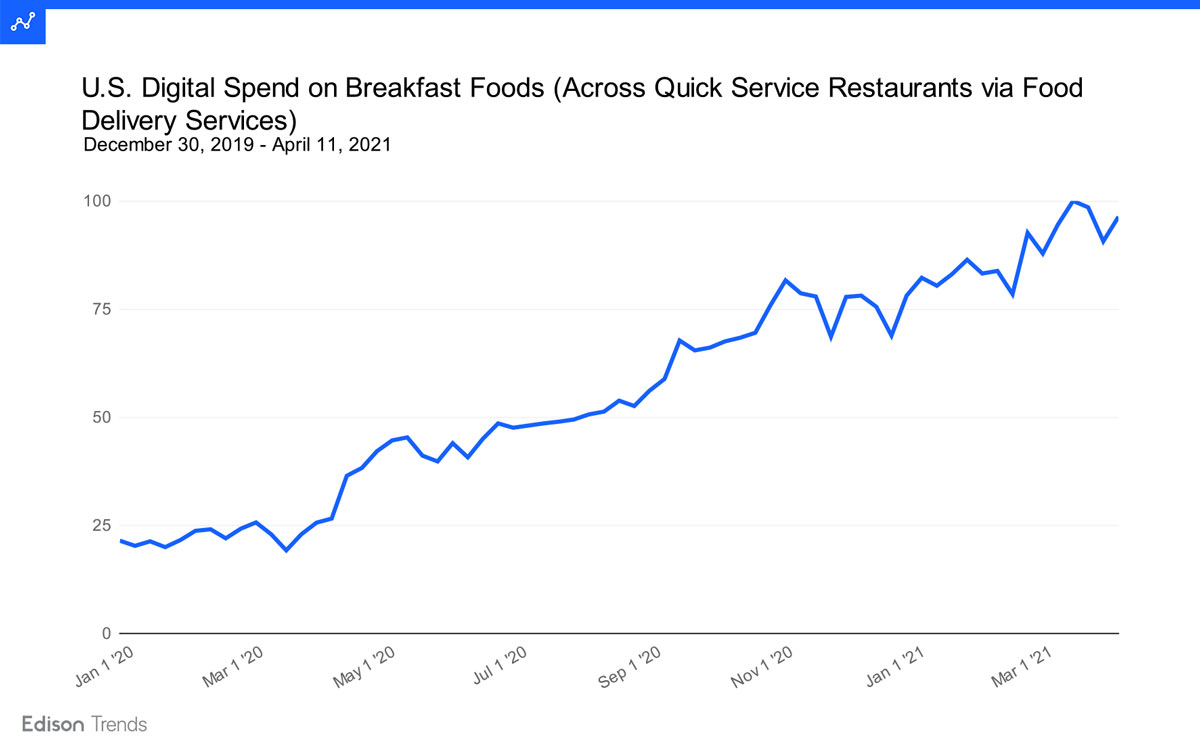

Figure 1: Chart shows national online spend on breakfast food items at quick service restaurants through food delivery services from December 30, 2019 - April 11, 2021, according to Edison Trends. Note: The week with the highest spend was set to 100, and other values were scaled accordingly. This analysis was performed on over 70,000 pickup and delivery transactions from UberEats, Doordash (including Caviar), Grubhub (including Seamless, Eat24, and Tapingo), as well as NeighborFavor, Bite Squad, delivery.com, Delivery Dudes, Fooda, Food Dudes Delivery, Ritual, BeyondMenu, WaitrApp, EatStreet, Mealeo, Yelp, and Zifty. The analysis includes all food items listed in the “breakfast” sections of these restaurants’ websites, and includes both pickup and delivery orders.

Spending on breakfast foods through food delivery services has increased steadily since the start of the pandemic. During the week of April 5, 2021, seven popular Quick Service Restaurant chains in breakfast saw customer spending on breakfast foods through food delivery services up 263% over the equivalent week in 2020.

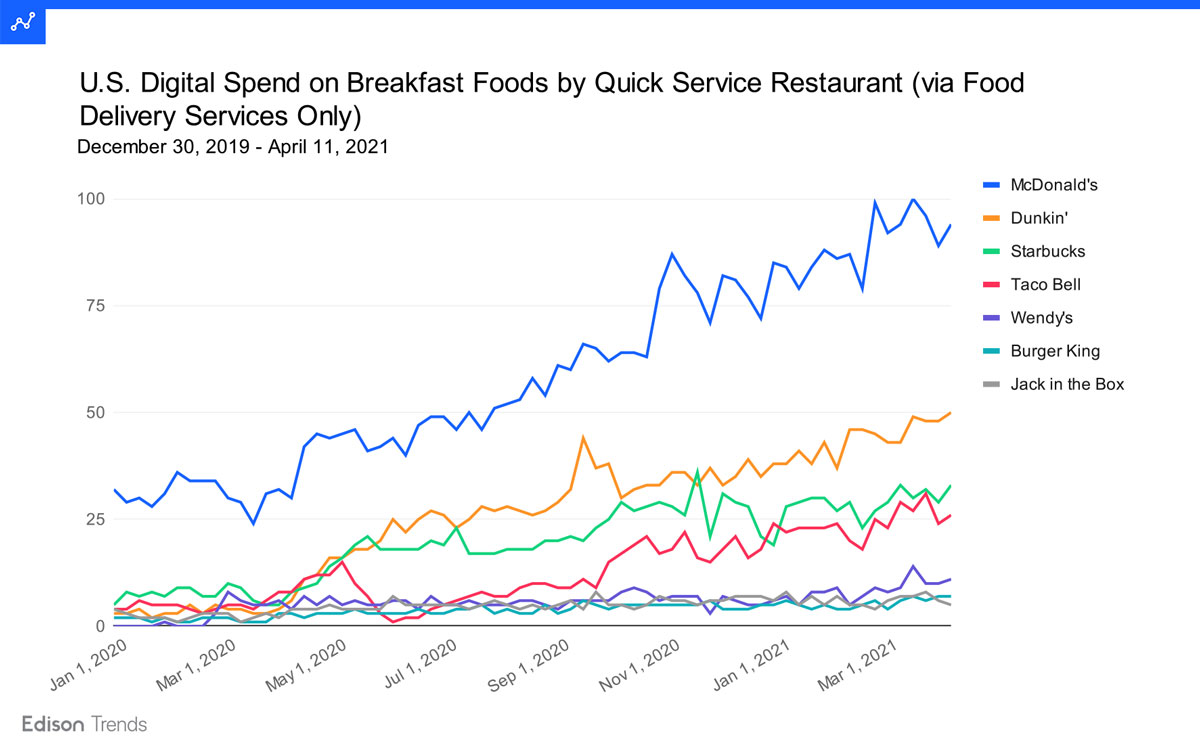

Figure 2: Chart shows national online spend on breakfast food items at quick service restaurants through food delivery services from December 30, 2019 - April 11, 2021, comparing McDonald’s, Dunkin’, Starbucks, Taco Bell, Wendy’s, Burger King, and Jack in the Box, according to Edison Trends. Note: The week/vendor with the highest spend was set to 100, and other values were scaled accordingly. This analysis was performed on over 70,000 pickup and delivery transactions from UberEats, Doordash (including Caviar), Grubhub (including Seamless, Eat24, and Tapingo), as well as NeighborFavor, Bite Squad, delivery.com, Delivery Dudes, Fooda, Food Dudes Delivery, Ritual, BeyondMenu, WaitrApp, EatStreet, Mealeo, Yelp, and Zifty. The analysis includes all food items listed in the “breakfast” sections of these restaurants’ websites, and includes both pickup and delivery orders.

Looking at individual chains’ YOY growth as of the week of April 5, Dunkin’ saw the largest increase, growing over 750%. They also saw a pronounced increase in spend in the fall. This occurred after the reintroduction of their fall menu. Starbucks was second for YOY growth with a 340% increase, and Taco Bell third with just under 250%. McDonald’s grew 208%, Wendy’s 156%, and Burger King 133%, while Jack in the Box grew 34%. McDonald’s also saw a sharp spike in November, which occurred after the addition of several new items in late October.

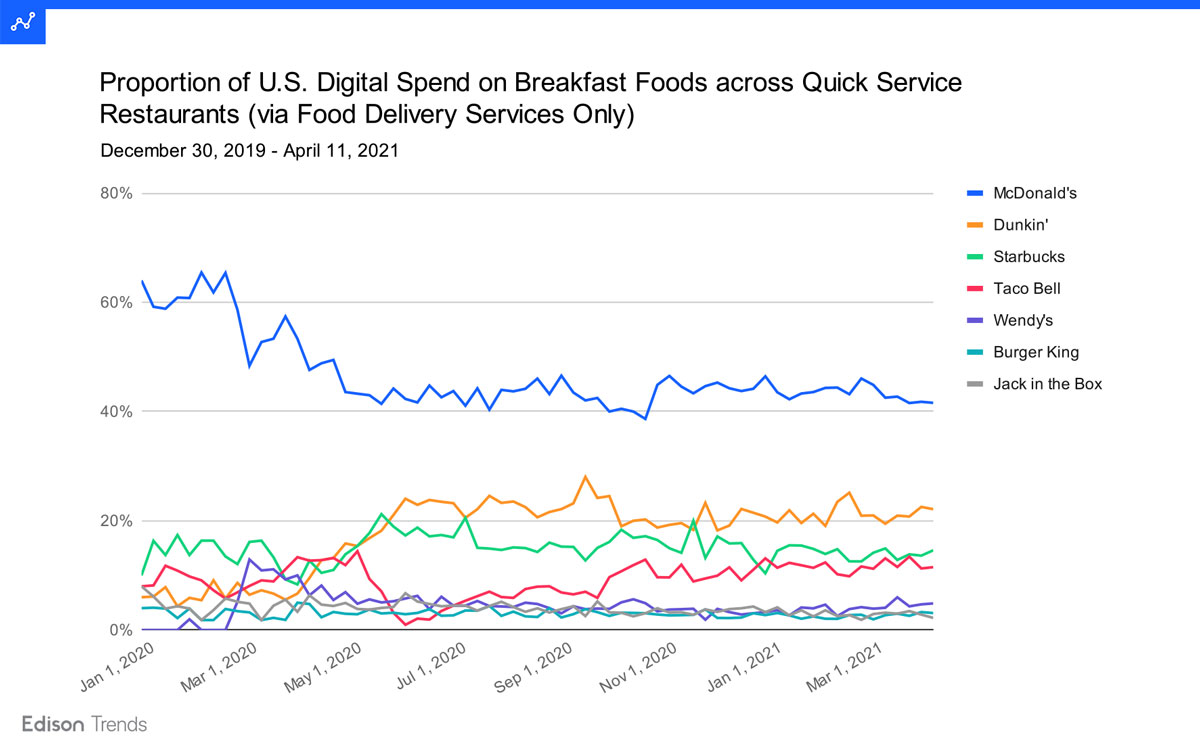

Figure 3: Chart shows proportion of national online spend on breakfast food items at quick service restaurants through food delivery services from December 30, 2019 - April 11, 2021, comparing McDonald’s, Dunkin’, Starbucks, Taco Bell, Wendy’s, Burger King, and Jack in the Box, according to Edison Trends. This analysis was performed on over 70,000 pickup and delivery transactions from UberEats, Doordash (including Caviar), Grubhub (including Seamless, Eat24, and Tapingo), as well as NeighborFavor, Bite Squad, delivery.com, Delivery Dudes, Fooda, Food Dudes Delivery, Ritual, BeyondMenu, WaitrApp, EatStreet, Mealeo, Yelp, and Zifty. The analysis includes all food items listed in the “breakfast” sections of these restaurants’ websites, and includes both pickup and delivery orders.

Among these seven restaurants, McDonald’s took in the largest slice of what customers spent online on breakfast foods through food delivery services, though that slice is not as large as it was a year ago. As of the week of April 5, 2021, the restaurant took in 42% of what customers spent on breakfast foods between these brands. A year before, it had been 48%. Dunkin’ is currently second with 22%, with Starbucks in third at 15% and Taco Bell next with 12%. Wendy’s takes 5%, Burger King 3% and Jack in the Box 2%.

To learn more about the data behind this article and what Edison Trends has to offer, visit https://trends.edison.tech/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.