Canadian investors have been one of the most resilient sources of capital throughout the pandemic era so far. Since the beginning of 2020 they have largely maintained their capital outlay, though there has been a marked shift in where that capital has headed.

Up until 2019, the U.S. had been garnering an increasing share of Canada’s overseas spending. However, since 2020, Canadian investors have diverted their attention outside North America, with around half of outbound allocations leaving the continent. Asia Pacific accounted for around a quarter of outflows, up from just 10% between 2015 and 2019.

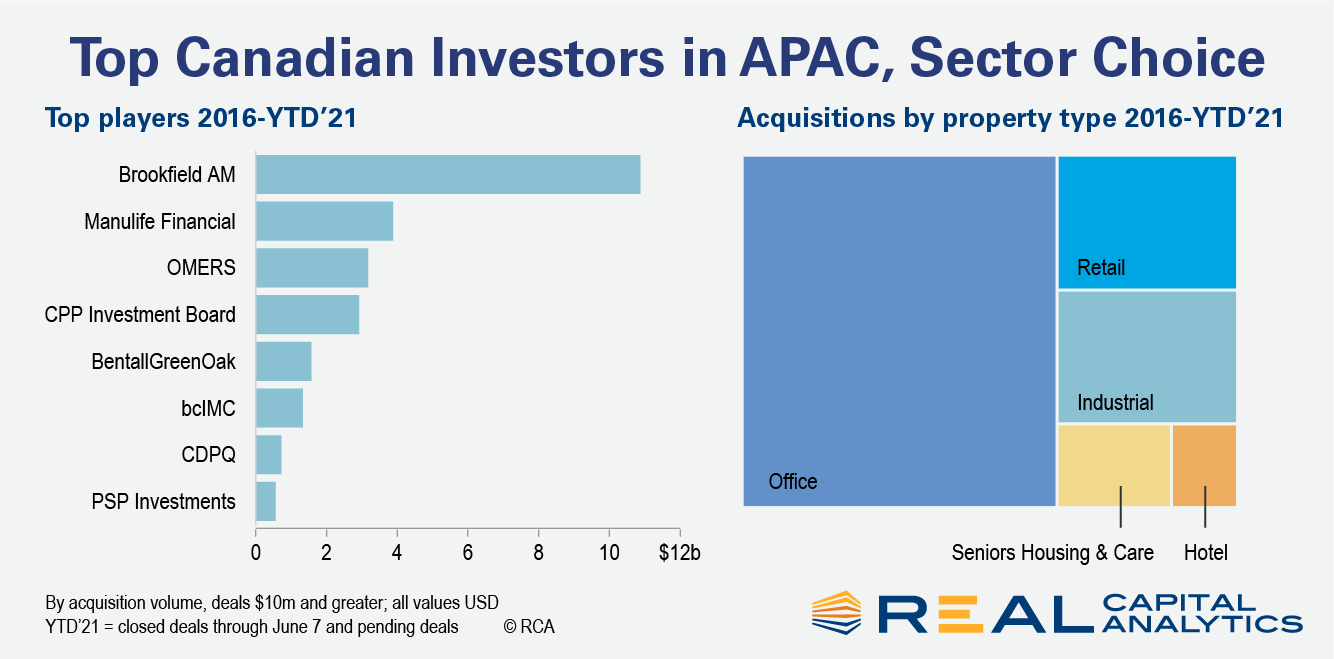

This uptick in deal activity had been in the works for some time – Canadian institutions have been growing their teams across the Asia Pacific region steadily over the past decade. The established players that had been around since the wake of the Global Financial Crisis, such as CPP Investment Board, Brookfield, and CDPQ subsidiary Ivanhoé Cambridge, expanded their teams on the ground, while relatively newer players established offices in the region.

As a result, both the pool of active Canadian players in the region, as well as their dealmaking abilities and appetites, have grown significantly. Up until 2018, a typical year would feature deals done by two or three major Canadian players. After 2018, however, the breadth of capital widened significantly, with deals from at least five different major players each year.

A case in point is Oxford Properties, the real estate investment arm of pension fund OMERS, which opened a Singapore office in early 2018. In the second half of that year, it announced its multibillion-dollar privatization of the Investa Office Fund. QuadReal, the real estate arm of bcIMC, another pension fund, made its maiden acquisition in Shanghai in 2018 a year after opening its Hong Kong office. Since then, the institutional investor has completed two deals each year from 2019 to 2021.

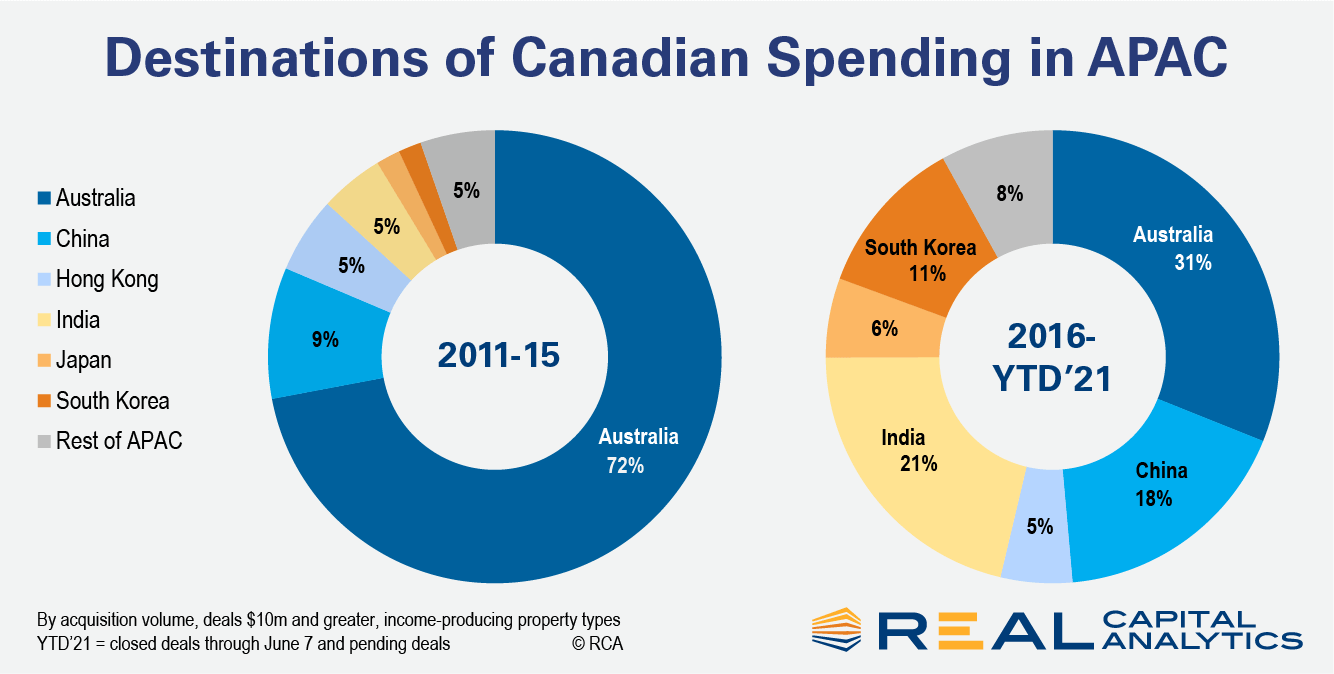

Another reason for the surge in spending is the diversification of targets. In the earlier half of the past decade, Australia was the main destination for Canadian spending, accounting for almost three quarters of all capital deployed. China, the next most popular destination, received less than a tenth of Canadian investments.

In the latter half of the decade, Canadian investors began to target the rapidly developing economies of China and India much more actively, with Australia garnering only about a third of investment. Brookfield completed the largest ever commercial real estate deal in India, a US$2 billion purchase of an office portfolio, in 2020. CPP Investment Board, meanwhile, notched deals across eight different country-markets during the same five-year period.

Having more people on the ground and a wider spread of targets has ensured that momentum has continued even throughout the pandemic. Since 2020, Manulife has completed investments across Australia, China, Hong Kong and Indonesia.

In contrast with most other cross-border players, the Canadians have not piled into logistics and industrial assets during the pandemic era, with offices still the dominant property type targeted. Still, many of the major players have been increasing exposure via construction and development rather than standing assets.

CPP Investment Board, for example, has had longstanding relationships with the likes of ESR and Goodman, and now holds an industrial portfolio spanning all the major markets. QuadReal has announced two logistics development ventures in China and Australia this year, each valued at almost US$1 billion.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.