Introduction

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through April 2021.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

“Natural hazard events and job loss in the oil and gas industry during the past year continue to affect local delinquency rates, despite a general decline in delinquency rates in many urban areas. Of all metros, Odessa and Midland, Texas, had the largest one-year jumps in serious delinquency rates, followed by Lake Charles, Louisiana, which was hit hard by Hurricanes Laura and Delta in 2020.”

– Dr. Frank Nothaft

Chief Economist for CoreLogic

30 Days or More Delinquent – National

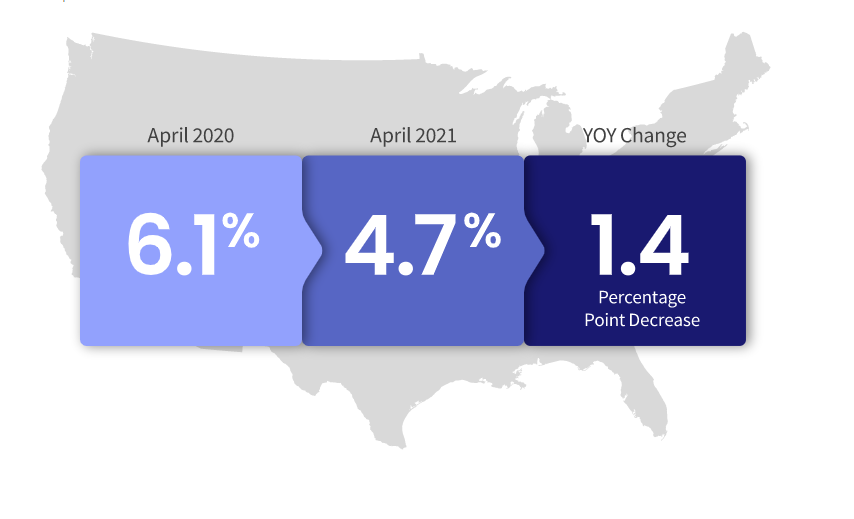

In April 2021, 4.7% of mortgages were delinquent by at least 30 days or more including those in foreclosure.

This represents a 1.4-percentage point decrease in the overall delinquency rate compared with April 2020.

Opportunity to Bounce Back

CoreLogic’s data for April 2021 reports its first year-over-year decrease and the lowest overall delinquency rate since the onset of the pandemic as job and income recovery enables more homeowners to remain or return to “current” mortgage payment status. Additionally, in an effort to help borrowers who are in forbearance programs, financial institutions and government entities are continuing to enact provisions that give homeowners ample opportunity to bounce back and keep their homes.

“The sharp rebound in the economy, as well as a potent combination of government fiscal and regulatory help, is fueling unprecedented demand for residential housing and enabling people to buy and stay in their homes. The drop in delinquency rates is a further manifestation of the benefits of these tail winds. Barring an unforeseen change, we expect rates to continue to fall and home prices rise over the next 12-to-18 months.”

– Frank Martell

President and CEO of CoreLogic

Loan Performance – National

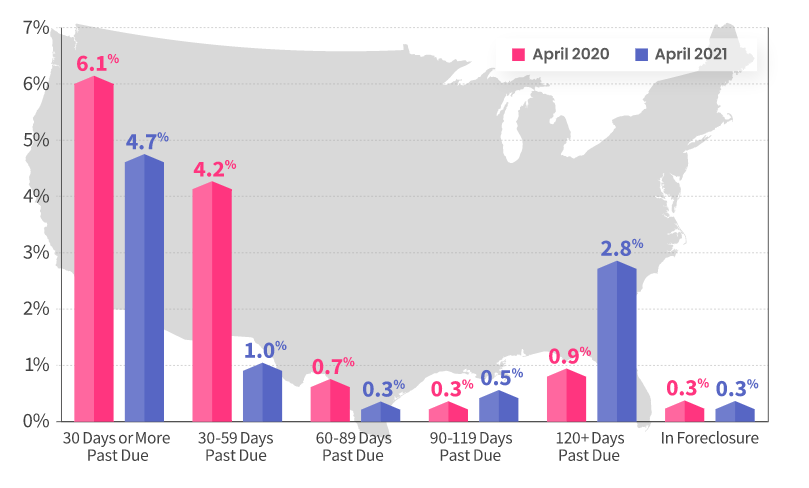

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for April was 4.7%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1% in April 2021, down from 4.2% in April 2020. The share of mortgages 60 to 89 days past due was 0.3%, down from 0.7% in April 2020. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 3.3%, up from 1.2% in April 2020.

As of April 2021, the foreclosure inventory rate was 0.3%, unchanged from April 2020.

Transition Rates – National

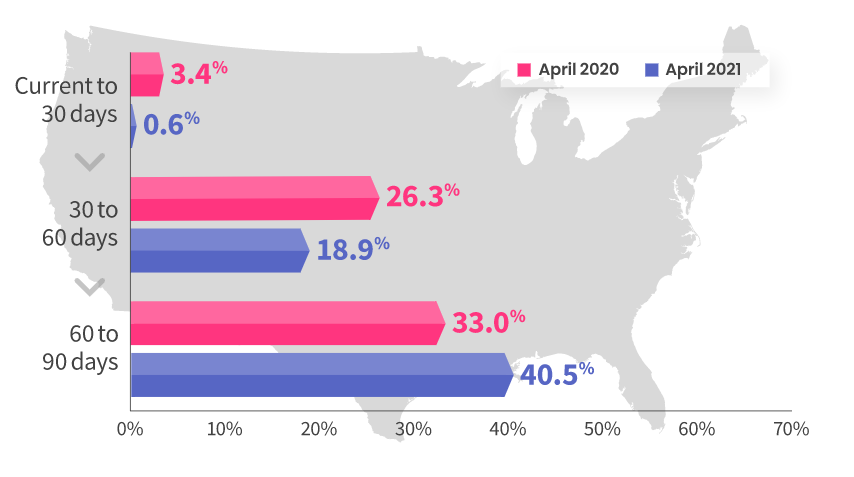

CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The share of mortgages that transitioned from current to 30-days past due was 0.6%, down from 3.4% in April 2020.

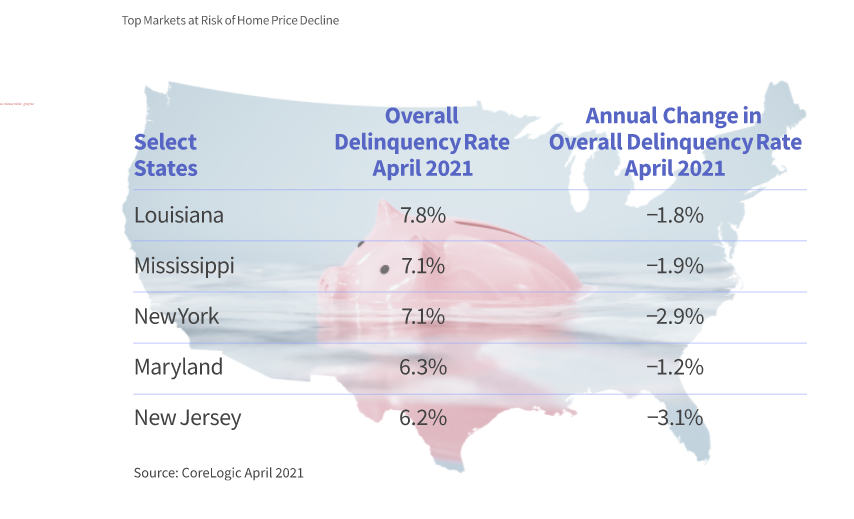

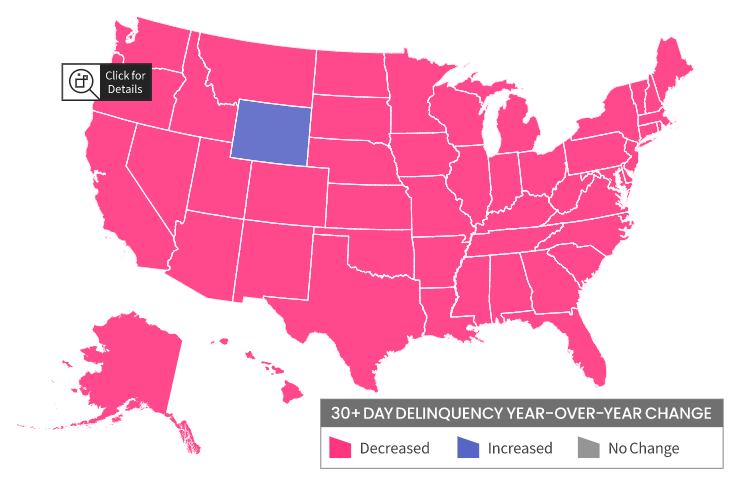

Overall Delinquency – State

Overall delinquency is defined as 30-days or more past due, including those in foreclosure.

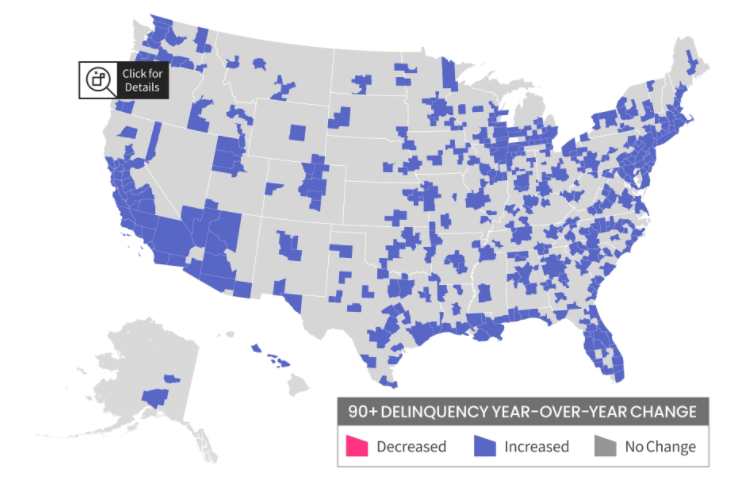

Serious Delinquency – Metropolitan Areas

Serious delinquency is defined as 90 days or more past due including loans in foreclosure.

There were 384 metropolitan areas where the Serious Delinquency Rate increased.

There were 0 metropolitan areas where the Serious Delinquency Rate remined the same or decreased.

Summary

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.