At the start of lockdowns, sales of hand sanitizer surged 838%. Cleaning brands simply couldn’t keep up as store shelves were wiped clean by anxious shoppers. Distilleries even pivoted from making bourbon and vodka and started pumping out the disinfectant instead.

The sanitizer-buying frenzy has eased since then, but popular cleaning brands Clorox, Lysol, and Purell are betting we won’t abandon our germaphobe tendencies after we’re vaccinated — at least, not yet. All three brands are advertising more now than they did during stay-at-home orders.

Pathmatics Explorer captures data for each of these advertisers, so let’s take a look at their strategies throughout the pandemic and after the beginning of vaccine distributions.

Clorox

Like sanitizer, Clorox Wipes became a hard-to-find item as coronavirus fears prompted shoppers to buy up the packs faster than they could be produced.

Perhaps hoping to steer people toward its available offerings, Clorox’s top creatives in 2020 and 2021 highlighted various cleaning tips and products to decontaminate your home from floor to ceiling, including its Splash-Less Bleach, Fabric Sanitizers, All-Purpose Bleach Spray Cleaner, and Disinfecting Mopping Cloths.

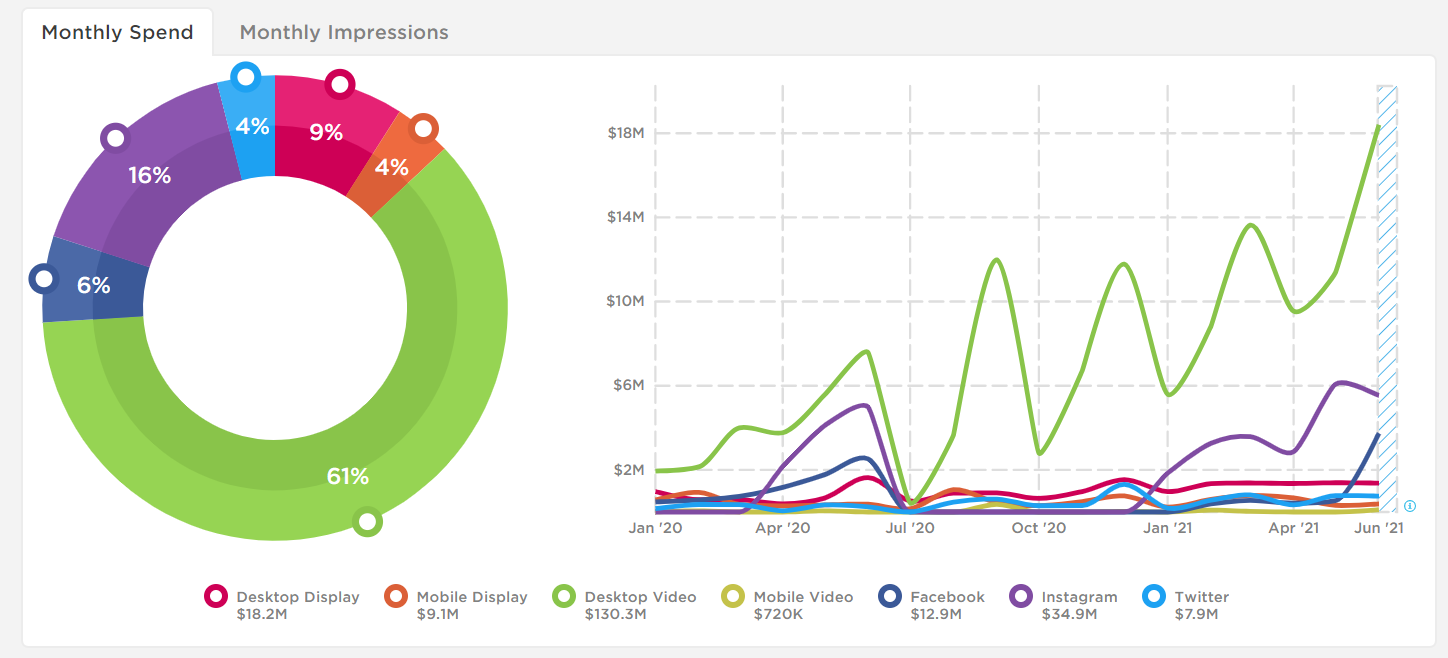

Clorox’s spend has increased throughout the pandemic, but growth has been choppy and far more budget has been spent since vaccine rollouts in December. In fact, Clorox’s spending in the first half of 2021 ($112M) has already surpassed its spending in all of 2020 ($102M).

Over 60% of Clorox’s budget was dedicated to desktop video, garnering 7.2 billion impressions. Impressions were split between desktop video (36%), Instagram (24%), and desktop display (18%).

Lysol

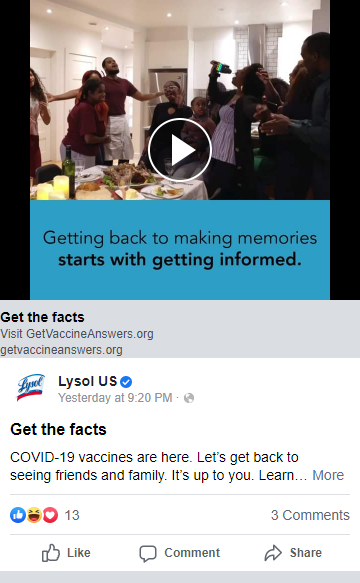

n addition to promoting its disinfecting products, Lysol’s top creatives during the pandemic featured several PSAs educating consumers about the COVID-19 vaccine. The ads, which were part of the Ad Council and COVID Collaborative’s COVID-19 vaccine education initiative, encourage viewers to visit GetVaccineAnswers.org for additional information.

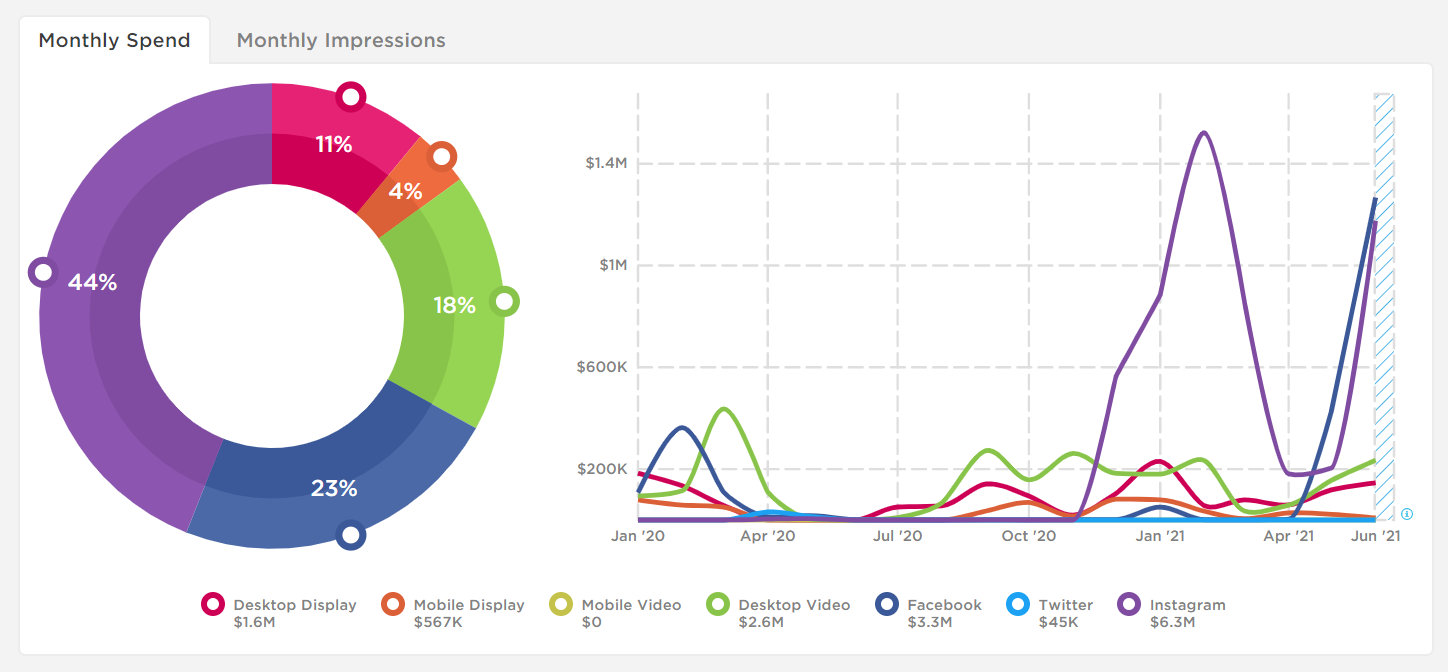

While Clorox increased its spending throughout the spring 2020 stay-at-home orders, Lysol went the opposite direction and slashed its spending after the initial pandemic panic-buying period. Then, in September, the brand ramped up its spending by over $300,000 as its disinfecting wipes and sprays started coming back in stock.

Spending grew steadily as supplies increased, dipped briefly in March and April 2021, and hit an all-time high of $2.8M in June.

Lysol spent most of its budget on Instagram (47%) which is significant given that the brand didn’t start advertising on the platform at all until December. The rest of its advertising dollars were divided between Facebook ads (21%) and desktop video (18%).

Purell

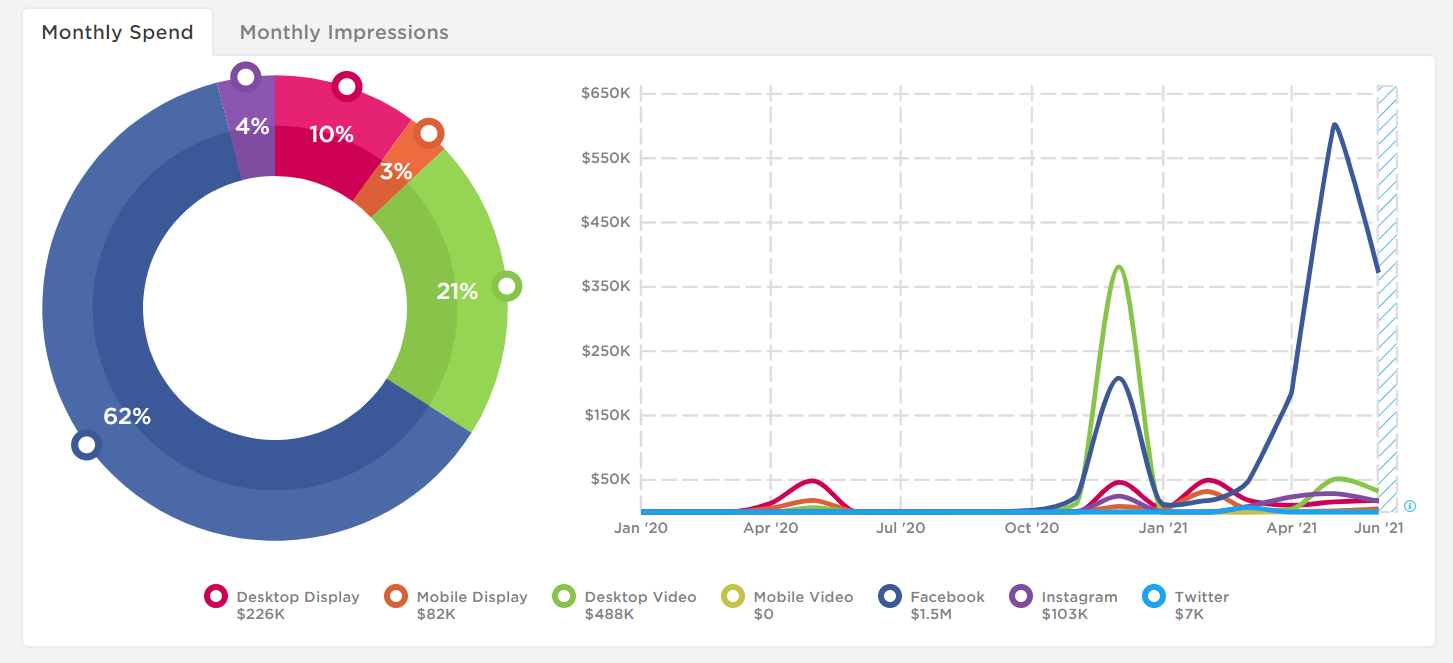

Throughout most of 2020, Purell stayed quiet as it struggled to ramp up hand sanitizer production to meet the surge in demand. By December, supply caught up and the brand made a $668K spending push to let consumers know sanitizer was once again available on store shelves.

But as the vaccine rollout accelerated, sanitizer sales dipped in early 2021, resulting in a surplus. Purell once again started ramping up advertising spend in April, this time encouraging customers to stock up on sanitizer for days on the playground, backyard barbecues, and weekend getaways. In fact, the brand spent more in May 2021 than in any other month of the pandemic.

Purell took a different approach from both Clorox and Lysol, dedicating the majority of its advertising budget to Facebook ads (61%). Another 20% of its spend went toward desktop video ads, nearly all of which appeared on YouTube in December to notify people that its products were available just in time for holiday gatherings.

While each of these popular cleaning brands took a different approach to digital advertising during the pandemic, all three have increased their spending since vaccines became available in December.

But as consumers start feeling more comfortable going out, will they give up their compulsive cleaning habits? The coming months will be a critical test as we learn more about how long vaccines protect people and how effective they are against any new variants of the virus, so cleaning brands will have to adjust their advertising strategies accordingly.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.