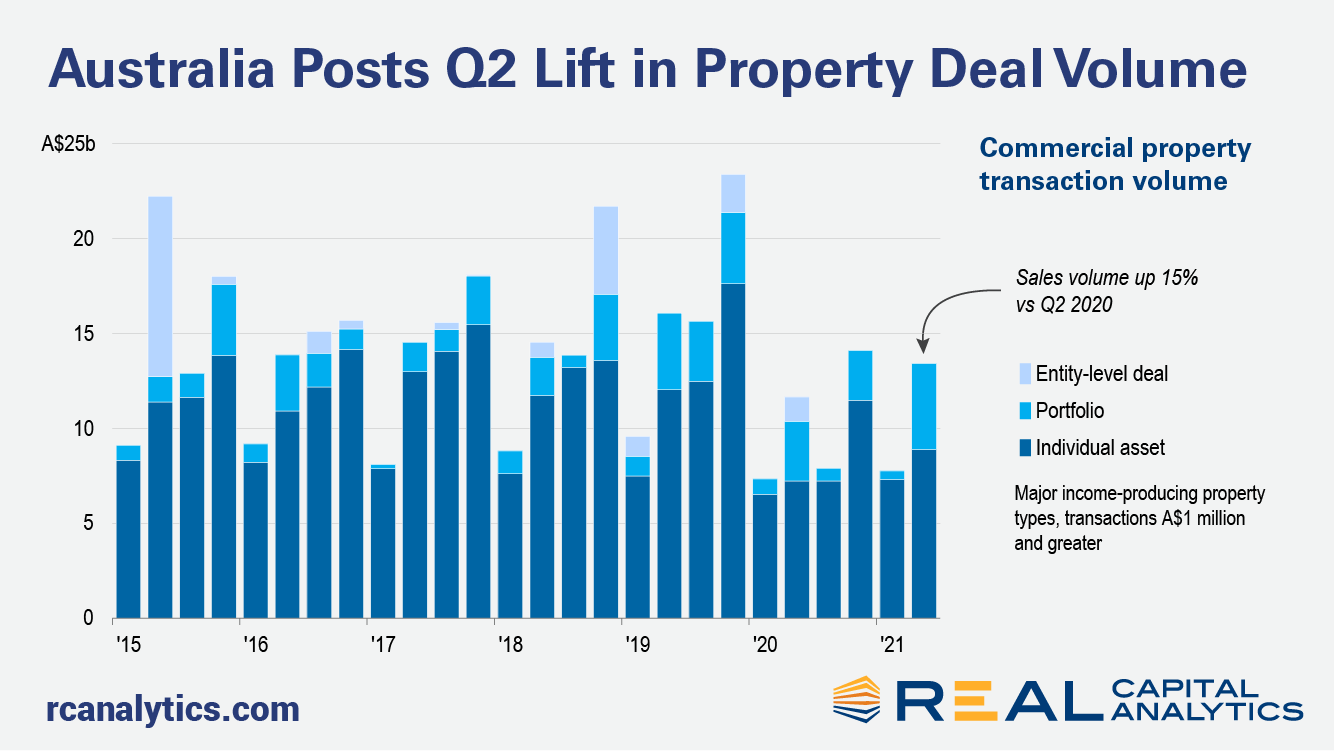

Australian commercial real estate sales rose in the second quarter, fueled by increased deal appetite among domestic investors and a multibillion-dollar logistics deal, the latest Australia Capital Trends report shows. Sales of income-producing properties priced A$1 million and greater totaled A$13.4 billion (US$9.9 billion) in Q2 2021, a 15% improvement on deal levels of a year ago.

The biggest boost for the quarter was Blackstone’s sale of the 45-property Milestone Industrial Portfolio. The transaction was the largest portfolio deal on record in Australia. Enthusiasm for the industrial sector was widespread in the quarter, with more than 550 industrial assets changing hands.

After a lackluster first quarter, investors headquartered in Australia spent just under A$9.9 billion in the second quarter, a 60% increase from the year prior. For the year to date, domestic investors have acquired assets evenly across the office, industrial and retail sectors.

Retail transaction activity blossomed further in the second quarter of 2021, with total sales for the year so far of A$5.0 billion.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.