Low mortgage rates and faster home price growth are not endemic to the U.S.

Mortgage rates hit a record low in the U.S. at the beginning of 2021. That was one factor that led to the acceleration in annual home-price growth to double-digit levels this year in many communities. While each of us may see the pick-up in price growth in our neighborhoods, that experience is not unique to Americans.

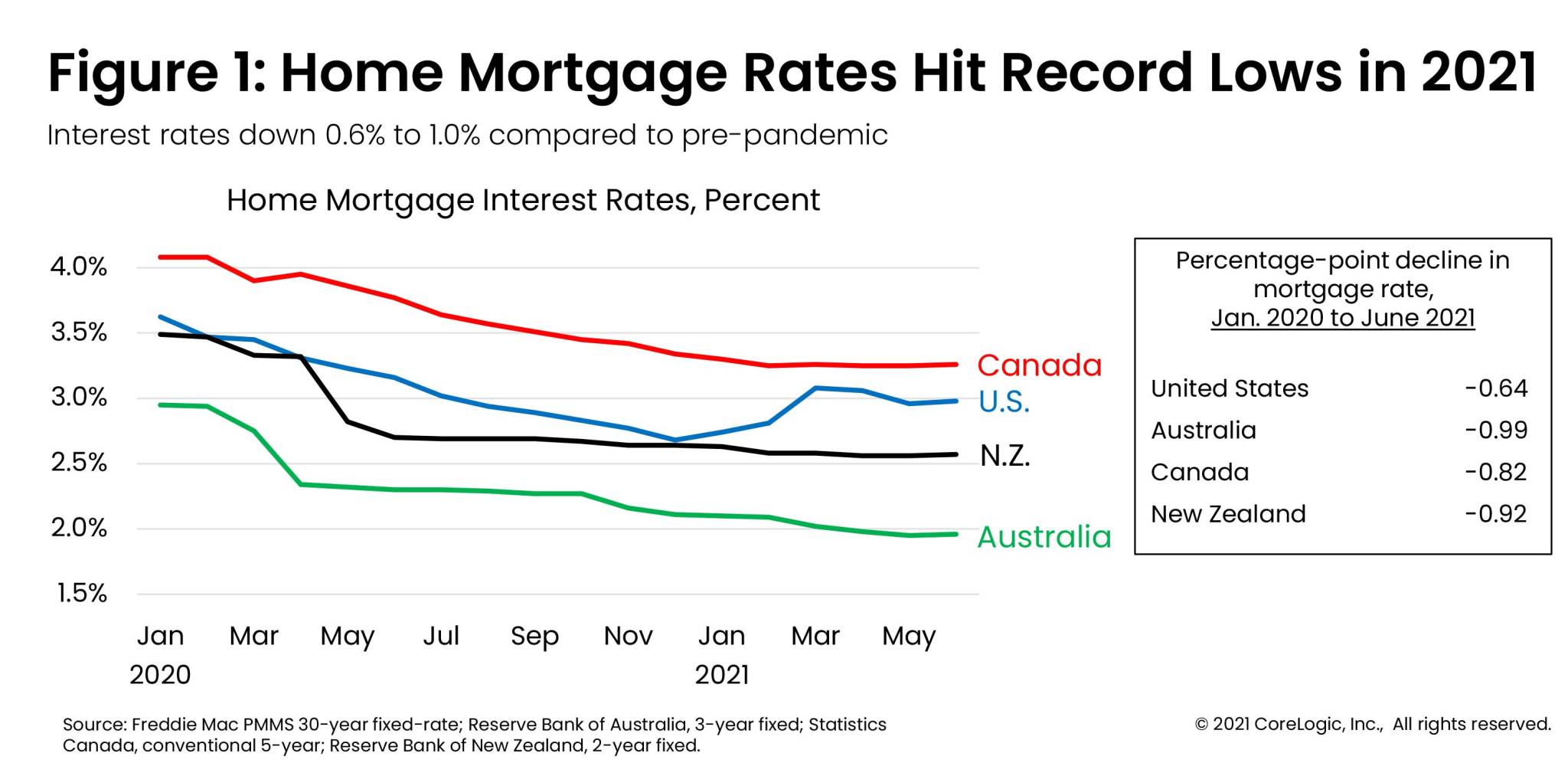

Many countries chose aggressive economic policy to combat the 2020 recession. As examples, the central banks in the U.S., Australia, Canada, and New Zealand cut interest rates. Comparing rates on popular mortgage loan products in each, mortgage rates in June 2021 were lower compared to January 2020 by up to one percentage point. Just like in the U.S., Australia, Canada, and New Zealand hit record lows for mortgage rates in 2021.

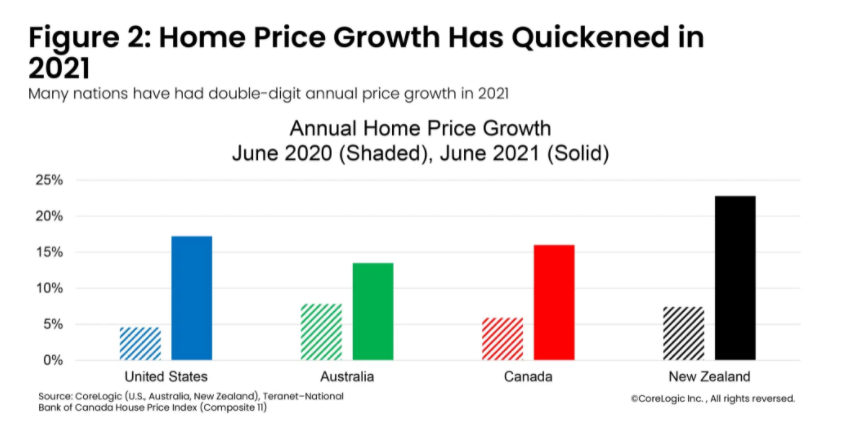

Low interest rates stimulated buyer demand, and at the same time the pandemic and recession further curtailed the supply of homes for sale. Home price growth began to quicken in each of these countries toward the end of 2020, and by June 2021 each had double-digit annual price growth. Annual price growth in the U.S. and New Zealand tripled compared to one year earlier, and in Australia and Canada, growth about doubled.

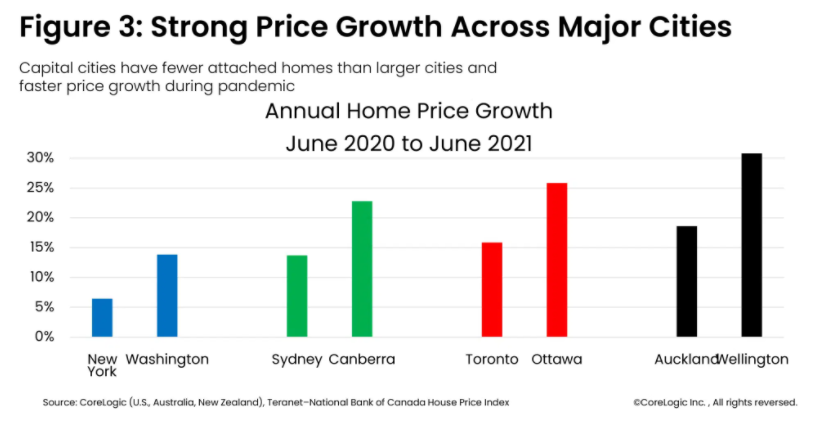

While price growth has not been uniform within each country, price growth has quickened in most communities and has been more robust for single-family detached houses than for single-family attached. One reason detached houses have had faster price growth during the past year is because homebuyers have revealed a preference for more space within and outside their home during the pandemic. National capital cities tend to have less population density than the largest cities in the country and have fewer attached homes. Thus, price growth in national capitals has been higher than for larger cities during the pandemic.

As the pandemic wanes and the global economy recovers, we expect gradual upward pressure on mortgage rates, additional for-sale supply to come on to the market, and a moderation of home price growth next year.

Summary:

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.