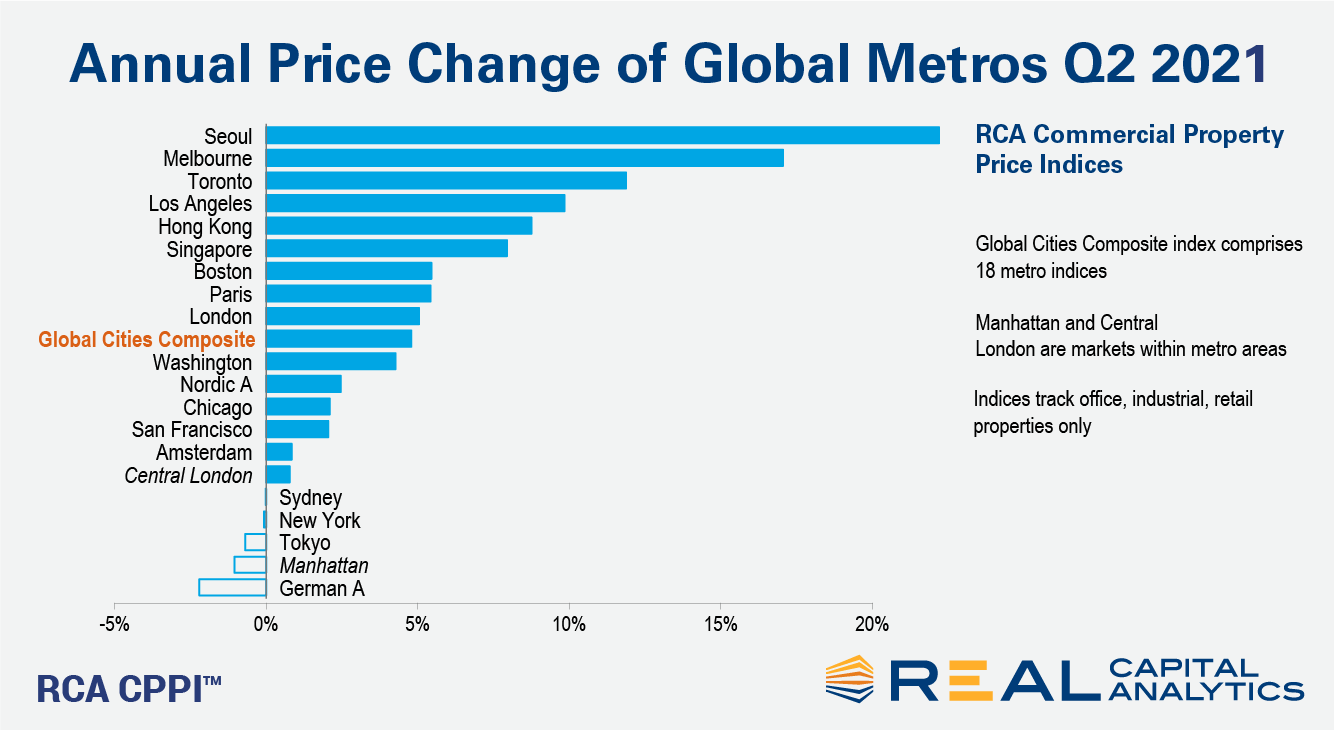

Global commercial property price growth accelerated in the second quarter of 2021, the third successive quarter of increasing gains. The headline price index rose 4.8% from a year prior and 1.5% from the previous quarter, the latest RCA CPPI Global Cities report shows.

Seoul posted the largest price increases into midyear. Prices rose 22% year-over-year, bolstered as domestic investors who had been thwarted by global travel restrictions employed their spending power at home. Prices in Melbourne rose as investors piled into the industrial sector. Los Angeles, too, was a beneficiary of increased interest in industrial properties such as warehouses.

Since the Covid-19 pandemic began commercial real estate prices have generally proven resilient. While growth in the RCA CPPI Global Cities Composite Index did moderate during the peak of the pandemic in mid-2020, at no point did growth threaten to go into reverse.

Some key markets are under pressure, however, notably New York and the central area of Manhattan. Here, uncertainty over future working trends has cast a pall over the office market. Manhattan prices dipped 1% in the second quarter from a year earlier.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.