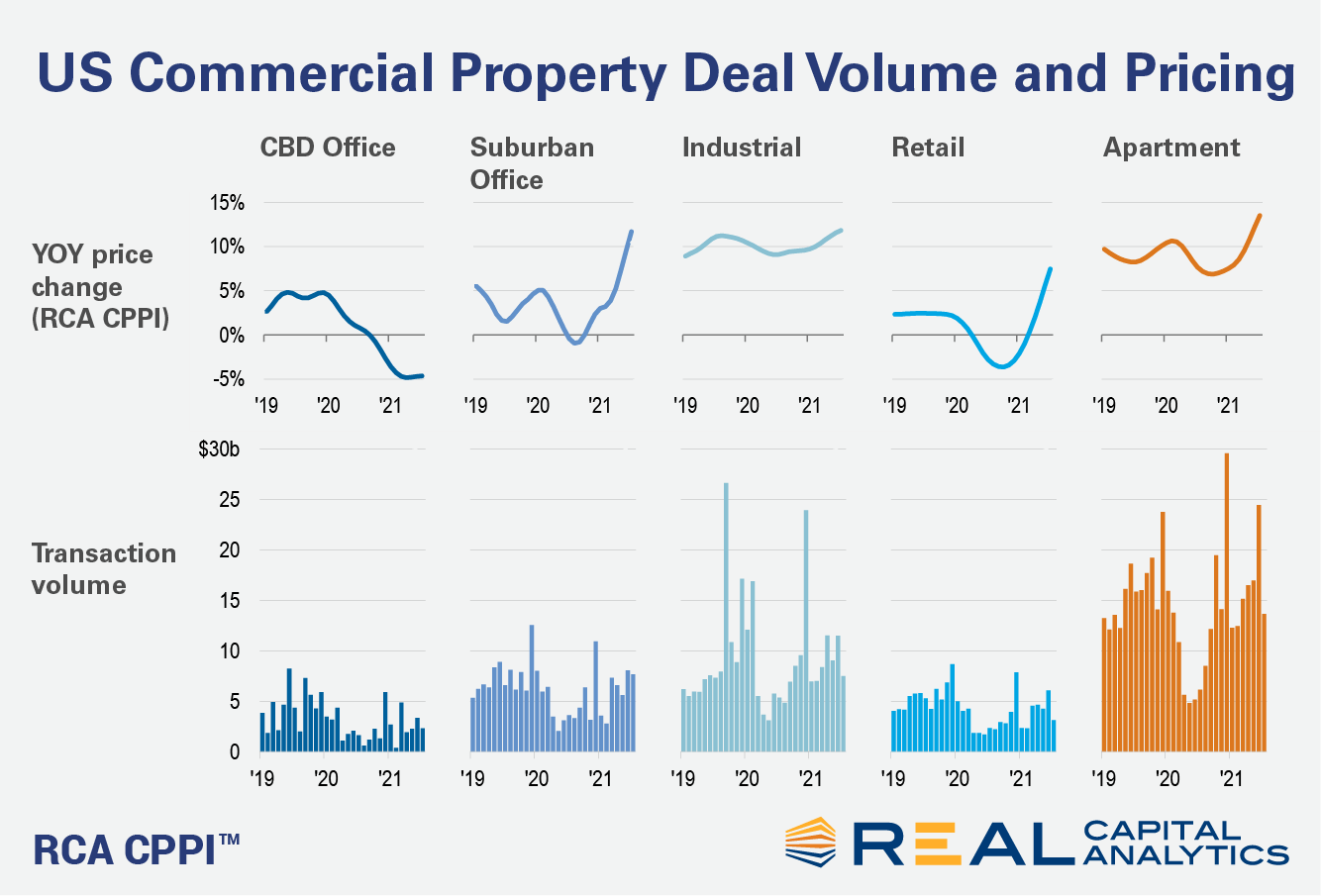

U.S. commercial real estate sales climbed in July and the rate of price growth accelerated as most but not all property sectors advanced past the pandemic recovery phase. Deal volume for the month rose 74% from a year ago and was above the average pace set across each July since 2005.

The apartment sector was the lead destination for capital in July, constituting 35% of total commercial real estate investment, the latest edition of US Capital Trends shows. The office sector gained ground, comprising 26% of sales volume in the month. Suburban office deal activity is propelling the office sector as sales of CBD properties remain muted because of uncertainty about office space use in urban areas.

The apartment market also led price gains in the month of July, as shown in the latest RCA CPPI: US report released this week. Prices of apartment buildings rose 13.5% from a year earlier, the fastest pace since the housing boom of 2005-06. The US National All-Property Index accelerated to an 11.8% year-over-year pace.

Pricing in the office sector has followed the disparate trends in deal activity. The suburban office price index jumped 11.7% in July from a year ago, while the CBD office index fell 4.6%.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.