Uber Leads in UK Rideshare with 76% Market Share, followed by challenger brand Bolt (20%)

Key Takeaways

• As of mid-August 2021, Uber, Bolt, and Ola have recovered, even surpassing their pre-pandemic sales peaks from before the March 2020 pandemic-induced low

• The average cost per ride for these rideshare services has hovered between £9-£12 for the majority of the past year

• In year-over-year growth, Gett saw the largest increase at 173%, while market share leader Uber had 64%

Since seeing demand decrease in the last year following the pandemic, the rideshare industry has been making a gradual recovery around the globe. In April of this year, Uber announced their plan to recruit 20,000 more drivers in the United Kingdom as demand began ramping up again. To see exactly how much UK rideshare services have recovered since the start of the pandemic, Edison Trends analyzed over 120,000 transactions.

How has UK rideshare usage changed in 2021?

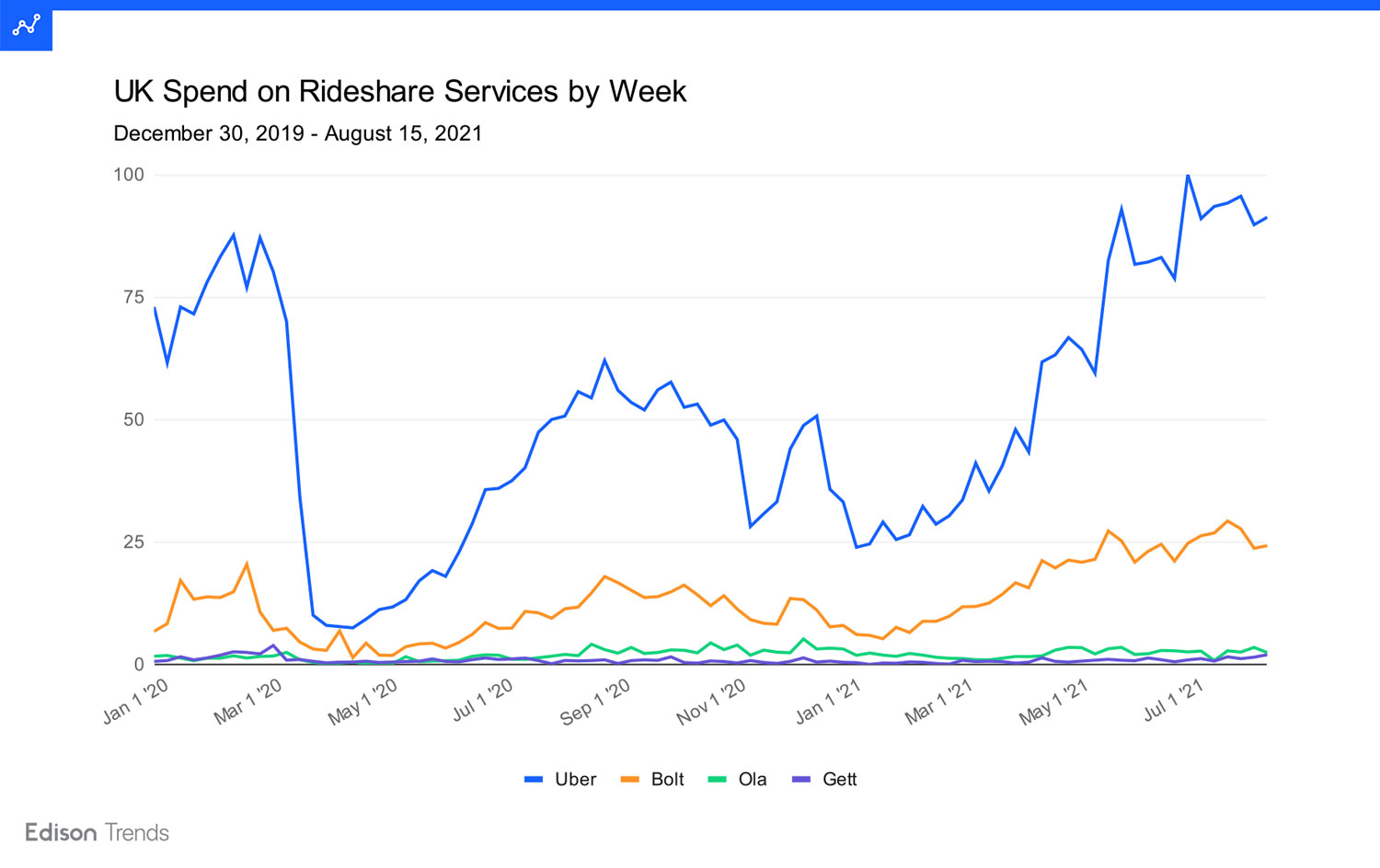

Figure 1a: Chart shows estimated online UK spend on rideshare services by week, from December 30, 2019 - August 15, 2021, comparing Uber, Bolt, Ola, and Gett, according to Edison Trends. This analysis is based on over 120,000 transactions. Note: the highest spend per week was set to 100, and all other values scaled accordingly.

The spring 2020 drop due to social distancing was precipitous for Uber, which fell 91% in the UK between the weeks of February 10 and March 30, 2020. During this period, Ola dropped 92%, Gett 87%, and Bolt 81%. Uber, Bolt, and Ola have now recovered beyond their highest point in March 2020, while Gett remains below the high they experienced in the week of March 2, 2020.

Looking at YOY change in spend on each service in the UK (comparing the week of August 9, 2021 to that of August 10, 2020), Gett saw the largest increase at 173%. Bolt was second with 107%, while Uber had 64% and Ola 35%.

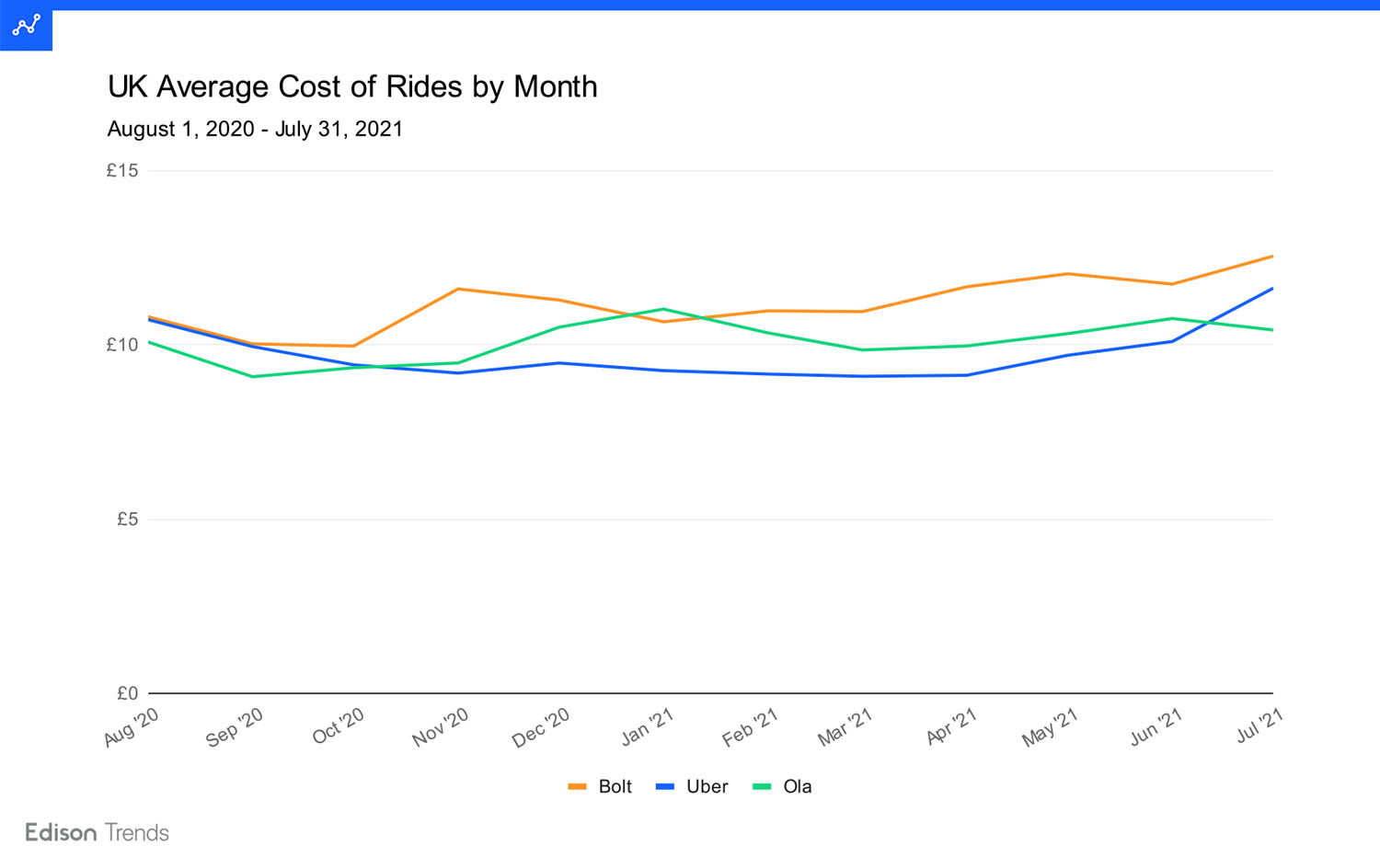

Figure 2a: Chart shows estimated online average cost of UK rides by month, from August 1, 2020 - July 31, 2021, comparing Uber, Bolt, and Ola, according to Edison Trends. This analysis is based on over 120,000 transactions.

The average cost per ride for these rideshare services has hovered around £9-£12 for most of the past year. As of July 2021, Bolt had the highest average ride cost at £13, followed by Uber at £12 and Ola at £10. When it comes to YOY change, Ola’s average cost has increased the most since July 2020, with a rise of 21%. Bolt has increased 17%, while Uber rose 13%.

Which UK rideshare service has the greatest market share?

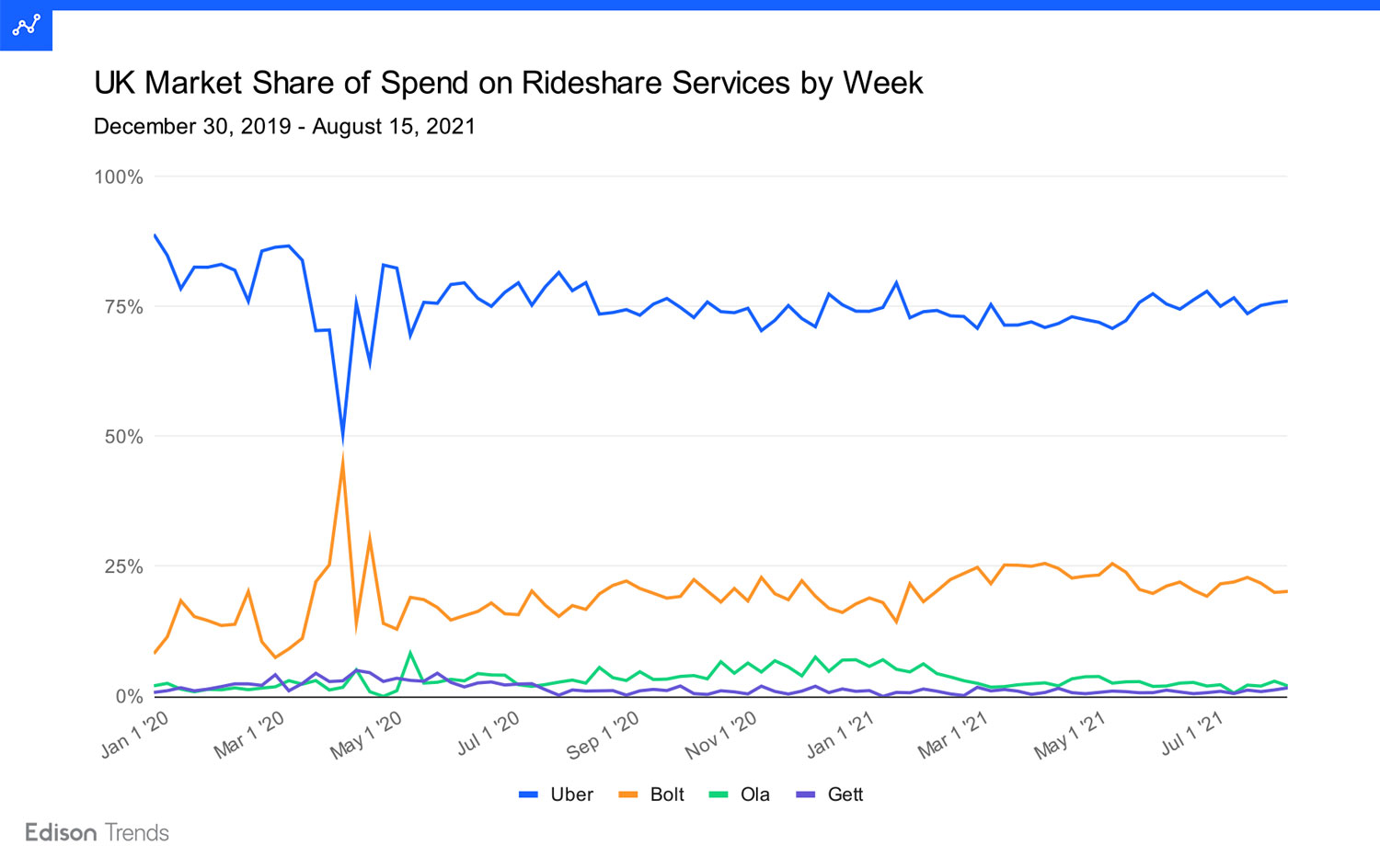

Figure 2: Chart shows estimated online UK market share of spend on rideshare services by week, from December 30, 2019 - August 15, 2021, comparing Uber, Bolt, Ola, and Gett, according to Edison Trends. This analysis is based on over 120,000 transactions. Note: due to rounding, numbers may not add to 100%.

Market share of spend between rideshare services has remained steady for most of the past two years in the UK—with the exception of spring 2020, when diminished activity due to social distancing hit Uber more dramatically than it did Bolt. This resulted in a week (April 6, 2020) in which Uber and Bolt were fairly close in share (51% and 45% respectively), but by late May 2020 the picture again resembled its appearance before COVID-19. As of the week of August 9, 2021, Uber held the lead with 76% share, followed by Bolt with 20%, and Ola and Gett, each with 2%.

To learn more about the data behind this article and what Edison Trends has to offer, visit https://trends.edison.tech/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.