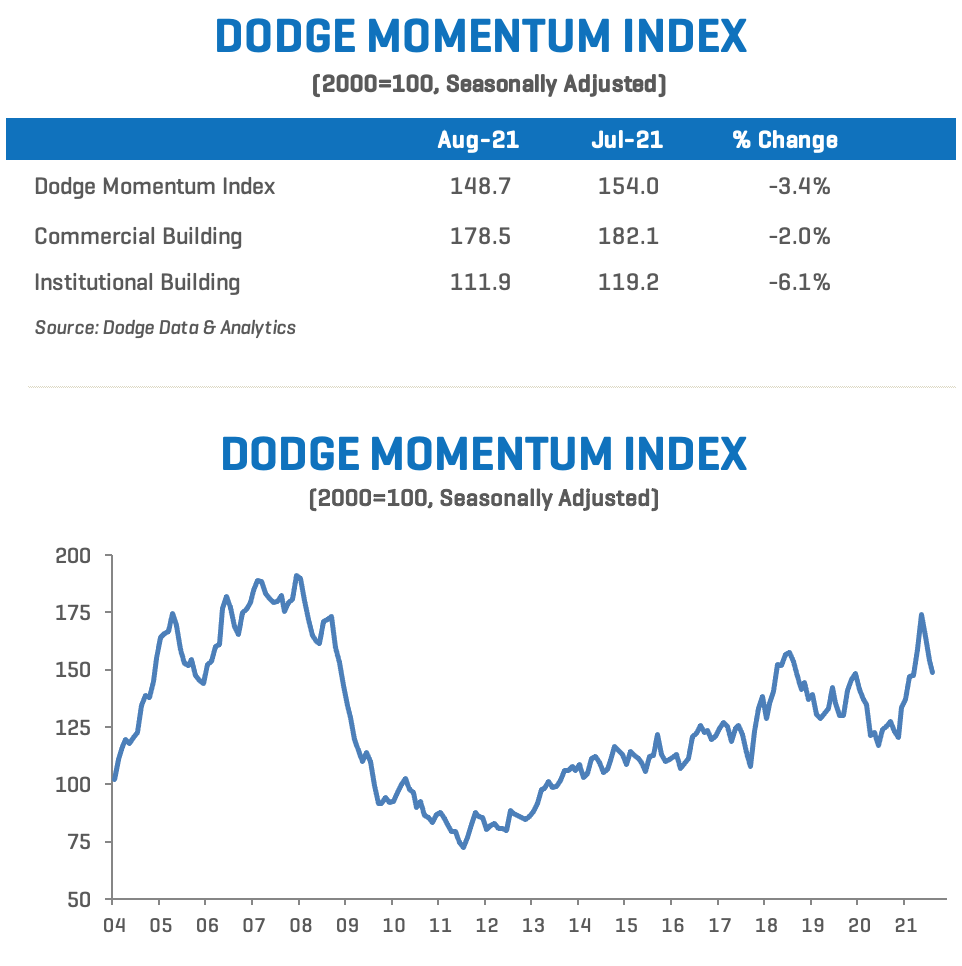

The Dodge Momentum Index dropped 3% in August to 148.7 (2000=100) from the revised July reading of 154.0. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

The commercial planning component lost 2% in August, while the institutional component fell by 6%.

Projects entering the earliest stages of planning have declined following the torrid pace set in the spring. The decline in August was the third consecutive drop in the Momentum Index, which is now off 14% from the most recent high in May, since May the commercial component is down 10% and the institutional component is 22% lower. This reversal comes as prices for materials used in nonresidential buildings increase in combination with a shortage of labor and a rising number of new COVID-19 cases from the Delta variant, all working in concert to undermine confidence in the fledgling construction recovery. There were some pockets of strength in August, however, as more data center, education and warehouse projects moved into planning relative to the prior month. Additionally, the overall level of the Momentum Index is 19% higher than one year ago; institutional planning was up 17% and commercial planning was 20% higher than last year.

A total of 21 projects with a value of $100 million or more entered planning during August. The leading commercial projects were a pair of $165 million Google Data Centers in New Albany, OH, and Lancaster, OH. The leading institutional projects were the $158 million Sentara Albemarle Medical Center in Elizabeth City, NC and the $140 million Apex Outpatient Center in Cleveland, OH.

Despite the recent declines in the Momentum Index, it is still too early to call this a retrenchment or a new cyclical downturn. Demand for nonresidential buildings remains weak, but the recent rising number of new COVID cases should not cause the same amount of disruption as previous waves did. As the economy continues to trudge forward, momentum will return to the construction sector and moderate growth in projects entering planning will return.

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.