The recently announced partnership between Amazon and Affirm for the latter to provide shoppers with Buy Now Pay Later (BNPL) options on purchases over $50 dominated headlines. But does a company as large as Amazon really need the extra support from point-of-sale-lending? In today’s Insight Flash we dig into the specifics of the partnership, looking at cross-shopping trends between the two merchants, which subindustries see the biggest gaps in average ticket from BNPL shoppers, and repeat usage behavior from BNPL services.

Cross-shop analysis highlights that Affirm is a strong choice of partner for Amazon. 71% of Affirm users in the last year have also shopped at Amazon.com, versus only 45% of our overall panel. Additionally, the average Affirm shopper spends $79.43 on Amazon versus $37.11 for the average Amazon shopper. Given this group is already shopping on Amazon more and already spending over twice as much with each purchase, there is a lot of potential value that Amazon can unlock by allowing Affirm to finance purchases and give these shoppers more spending power. Having the ability to buy now and pay later on Amazon may also encourage them to shift more high-ticket purchases to the site and consolidate their Affirm payments with a single merchant.

Cross-Shop Patterns

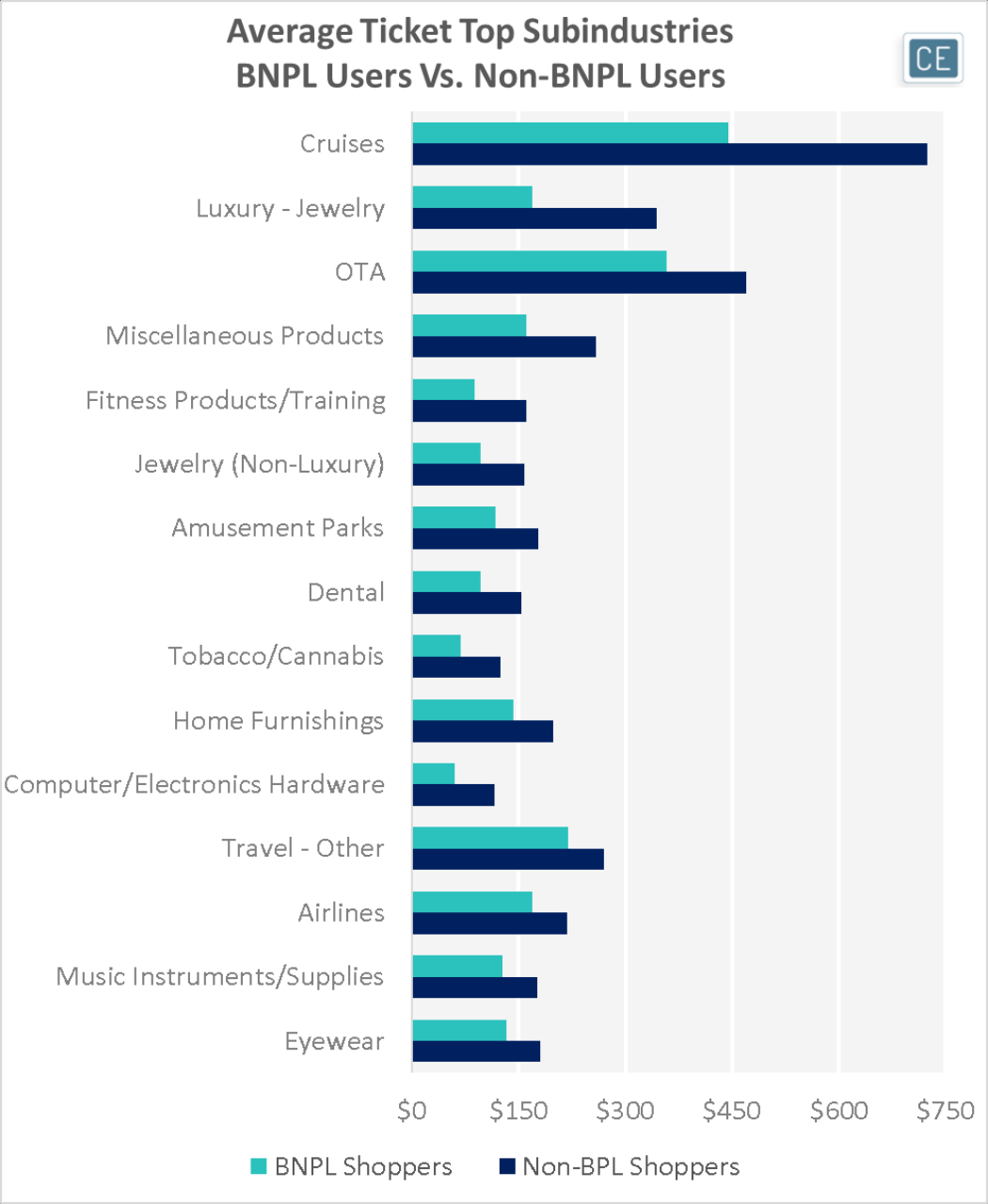

Looking at the subindustries where BNPL shoppers currently spend less per transaction than the overall population may give some indication of where Amazon could see Affirm spend concentrate, or overall which merchants should be looking at forming their own BNPL partnerships. BNPL shoppers tended to make smaller transactions (or transactions subsidized by spend through BNPL) at travel providers, especially Cruise lines and Online Travel Agencies. Both Luxury and Non-Luxury Jewelry also saw smaller average tickets from BNPL shoppers. Finally, unsurprisingly given how much spend at companies like Peloton comes from financing, BNPL shoppers also spend much less per transaction than the overall population on Fitness Products/Training.

Subindustry Average Ticket Gap

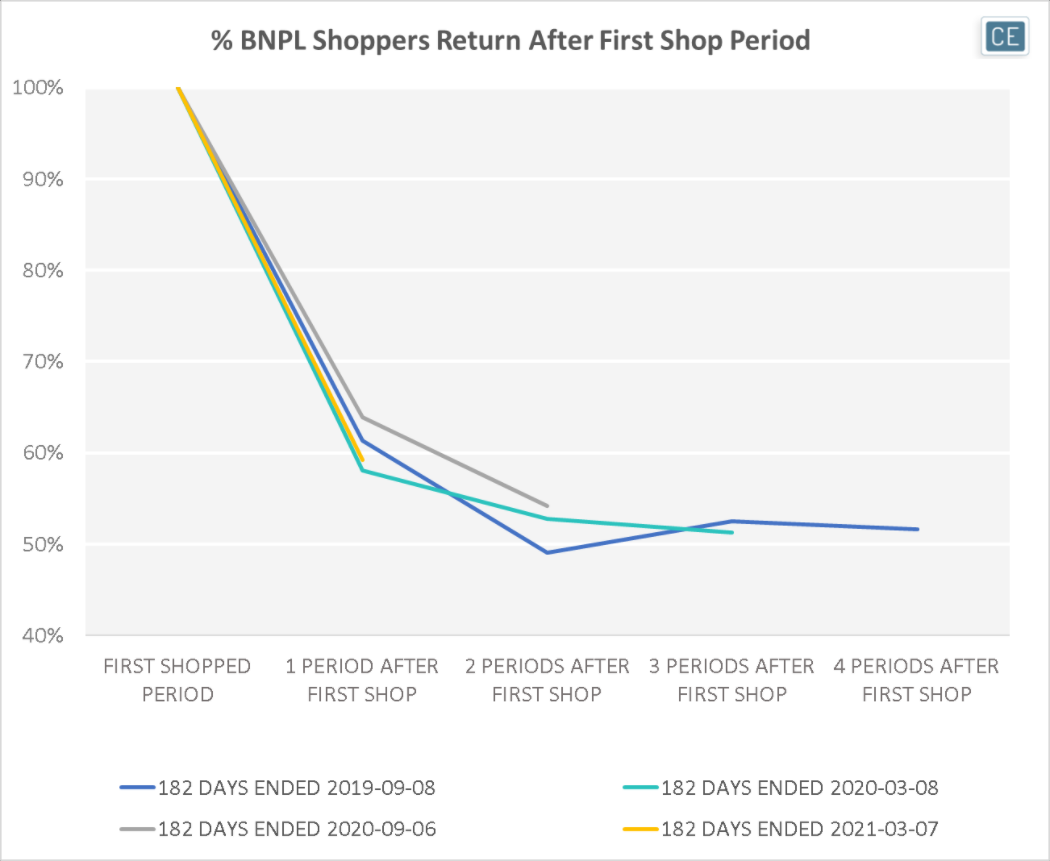

BNPL users tend to stick with these services. Looking at shoppers who began using BNPL services in several different six-month periods since 2019, about 60% had spend in a BNPL service again in the six months following. Even among those who first used a BNPL service in the six months ending 9/8/2019, over half used one again in each subsequent six month period through the most recent six months. This sort of sticky return behavior is a huge part of Amazon’s strategy in services such as Amazon Prime, so the company may see additional loyalty from adding a BNPL payment option to its offering.

Repeat BNPL transactions

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.