Still the top category in digital advertising, CPG takes on aspects of nearly every other vertical, with multiple sub-categories and products that span the entire digital landscape. We analyzed the top 5 CPG advertisers over the last 3 years, for seasonal, spend, and creative trends, to explain what keeps it at the top of the (individually wrapped) food chain.

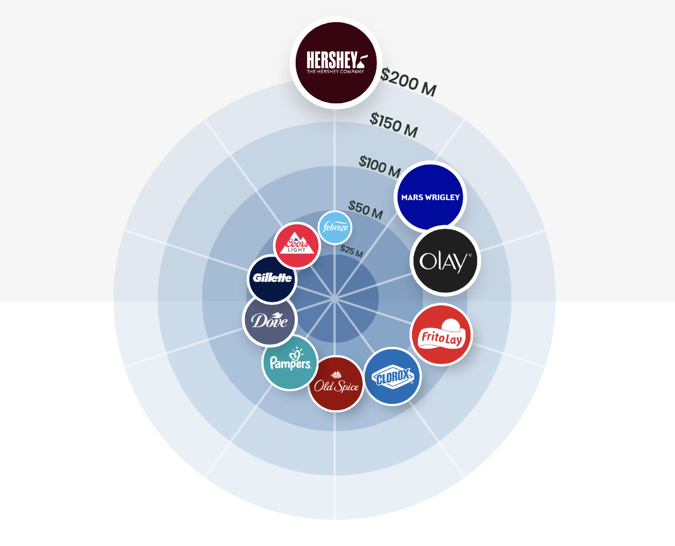

The Hershey Company takes the cake

True, The Hershey Company isn’t synonymous with cake, but their sweet treats topped ad spend for H1 of the last 3 years with over $200MM for candy, mints and gum brands combined. Though, not to be outdone, CPG giant Procter & Gamble trailed slightly with $193MM from their top 4 brands: Olay, Clorox, Old Spice, and Pampers.

The Covid effect: Category trends during quarantine

CPG was at the forefront of consumer needs as Covid19 began shutting down the country in March, 2020, and none more so than cleaning and disinfecting products. Taking a look at the Household Cleaning Supplies sub-category, we see the significant uptick in spend beginning in March, 2020, as Desktop Video, Facebook and Instagram increased across the board, even leading into 2021.

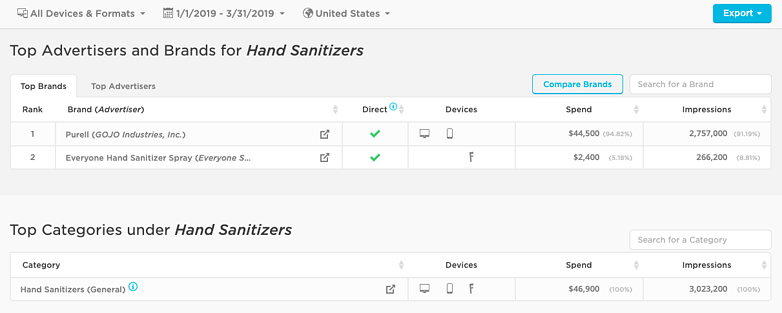

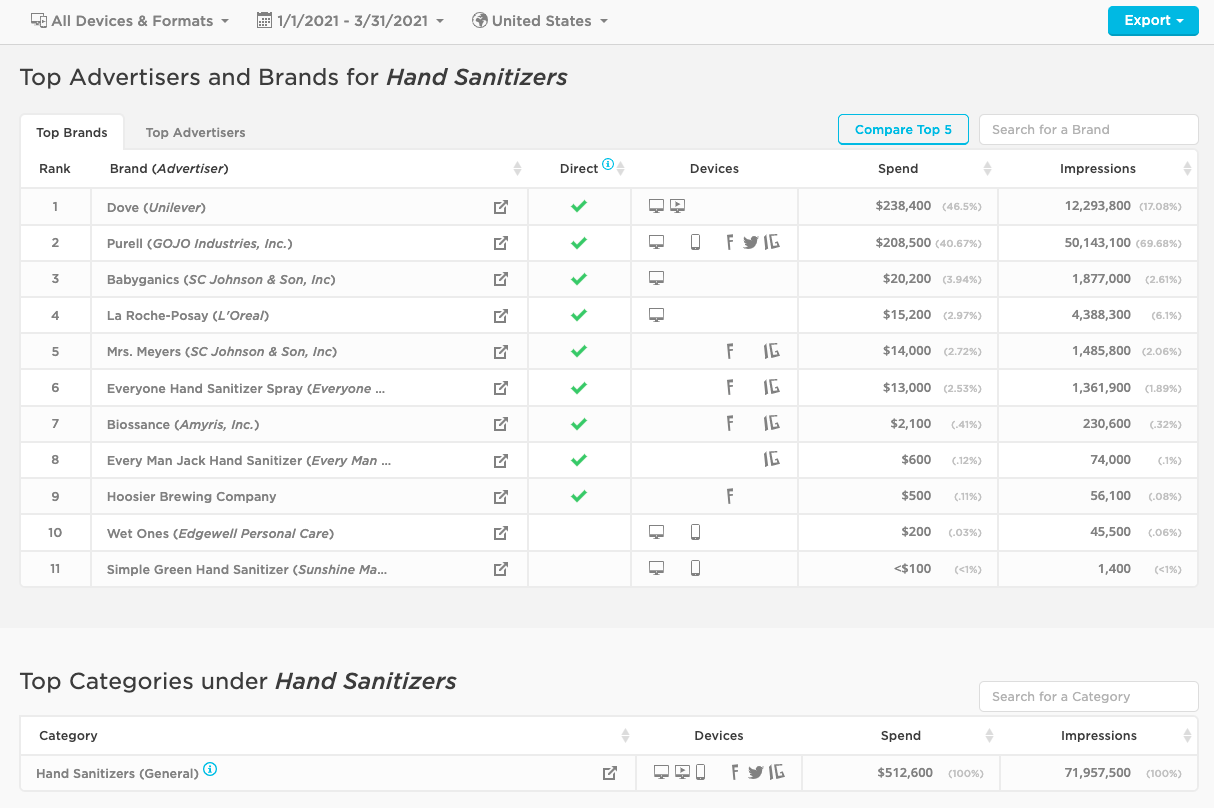

We can see the same pattern, even more pronounced, in the Hand Sanitizers sub-category. In H1, 2019 there were very few advertisers promoting hand sanitizer products, but the germ killer became a hot commodity during Covid with several brands jumping in the sanitizing game.

Thirsty for more?

From The ongoing battle between Pepsi and Coca-Cola, to the standoff between Molson Coors and Diageo, to a spotlight on instagram spend, our new CPG report is packed full of morsels you can sink your teeth into.

CPG is no doubt a major player in the digital sphere, and Pathmatics Explorer has much more to offer, including our updated taxonomy with even deeper category insights.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.