Many businesses, small and large, have taken a hit due to the coronavirus outbreak. But one category, in particular, enjoyed predicted and substantial gains: online grocery delivery. The pandemic converted millions of Americans into first-time online grocery shoppers, fueling a 54% growth in web sales across the category in 2020.

So how did grocery delivery connect with consumers during the height of the pandemic? Drizly, Instacart and Shipt emerged as the top three advertisers in the grocery delivery category during this period. Let’s take a closer look at their respective advertising strategies.

Drizly leverages meme culture to make an impression

Sales growth for Drizly, the on-demand alcohol delivery service, soared over 400% in May 2020. According to a report by Drizly, consumers ordered more frequently and in larger quantities during the first weeks of nationwide lockdowns, indicating that consumers were exhibiting a “stock up” mentality.

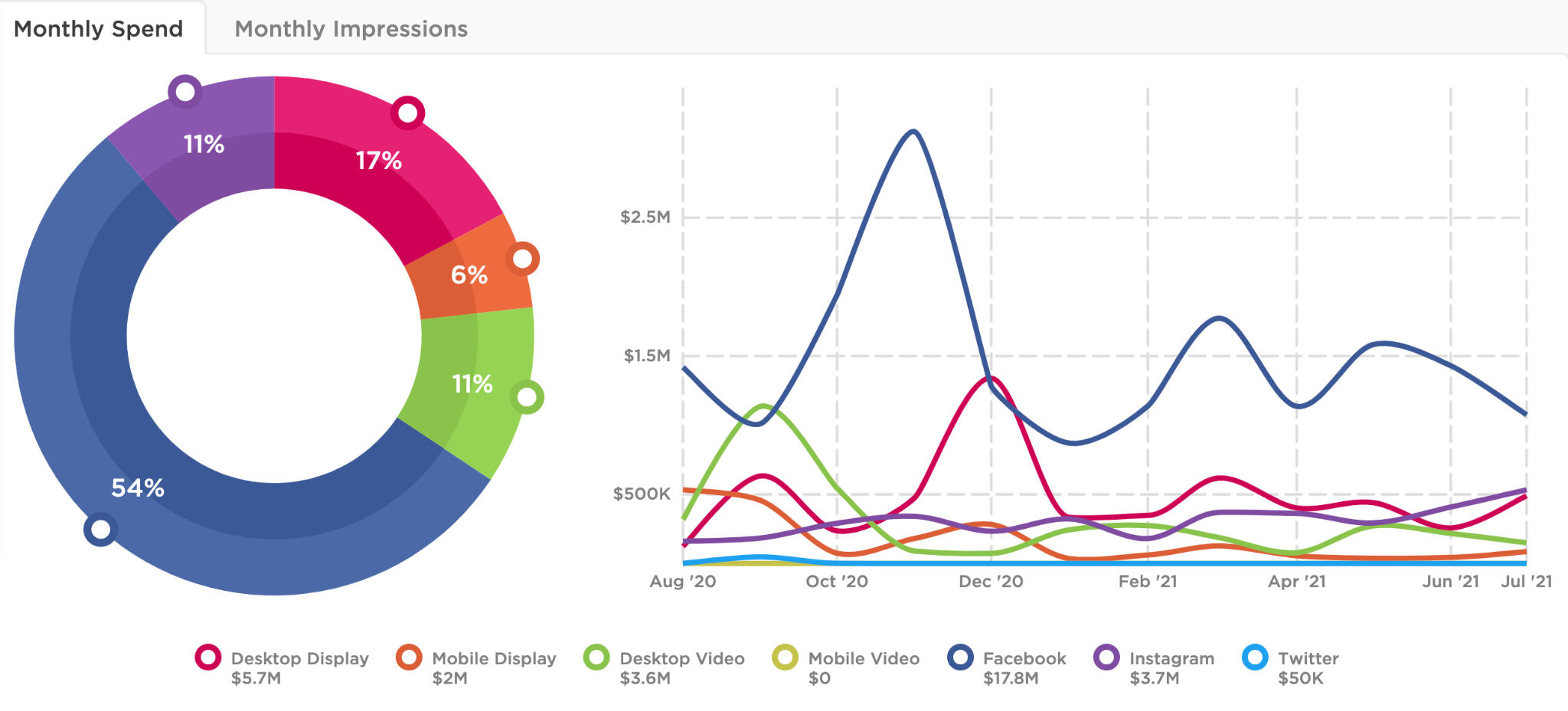

From August 2020 to July 2021, Drizly invested over $32.7M into digital ads, yielding over 3.5B total impressions. Even though Drizly was the top category spender during this period, they also ran the least amount of ads (1,211), with second place spender, Instacart, pushing over double the amount of creative (2,450).

Drizly ran ads with its partnered brands in top-selling categories during the pandemic, including red wine, canned cocktails, vodka, and beer. While not directly promoting Drizly’s services, the ads did link out to a landing page for customers to complete their transaction through the Drizly app. Drizly’s branded top creative leveraged the power of memes to employ humor and rub elbows with younger millennial and older Gen Z users.

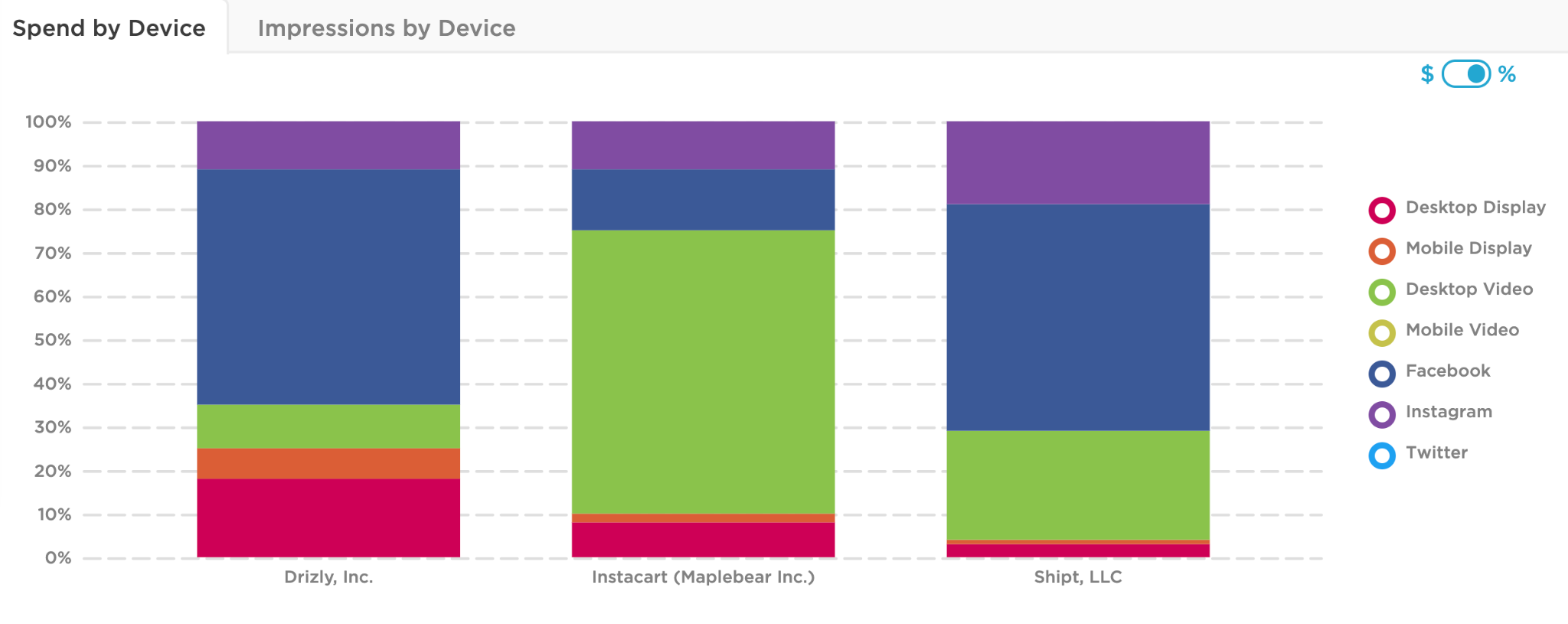

In terms of spend share, Drizly allocated over 54% of its budget to Facebook, with desktop display coming in at a distant second (17%).

The alcohol delivery service earmarked $3.1M for Facebook ads in November 2020 to ramp up for a boozy holiday season. And as COVID case numbers began to spike across the country, Drizly would continue to experience record demand for their service into late 2020 and early winter 2021.

Saved by the pandemic, Instacart doubles its ad spend

During the COVID-19 lockdown, Instacart became an essential service for millions of Americans quarantined at home. In May 2020, the online grocery delivery service reported that demand had been the highest in the company’s history. Customer order volume ballooned more than 500% YOY. The next few months accelerated Instacart’s growth (which, in 2019, was losing $25 million every month). The company recorded its first monthly profit in April 2020, netting $10 million.

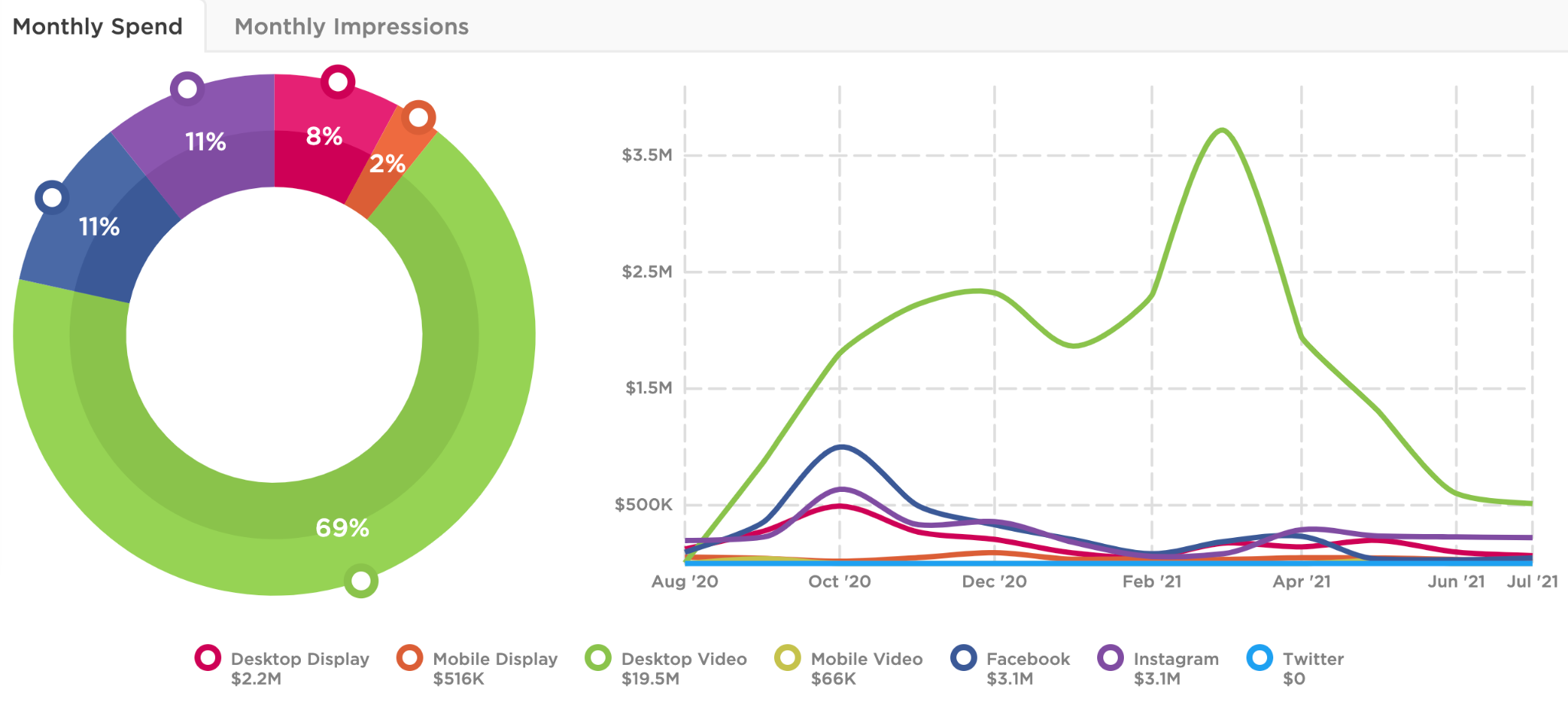

Instacart funneled over $28.4M into its digital ad campaigns, yielding over 2.4B paid impressions from its efforts. By comparison, Instacart spent only $11.3M on ad campaigns in 2019, back when the company was hemorrhaging capital daily. The on-demand grocery delivery app published the most creative of the top three advertisers in its category for the period (2,450).

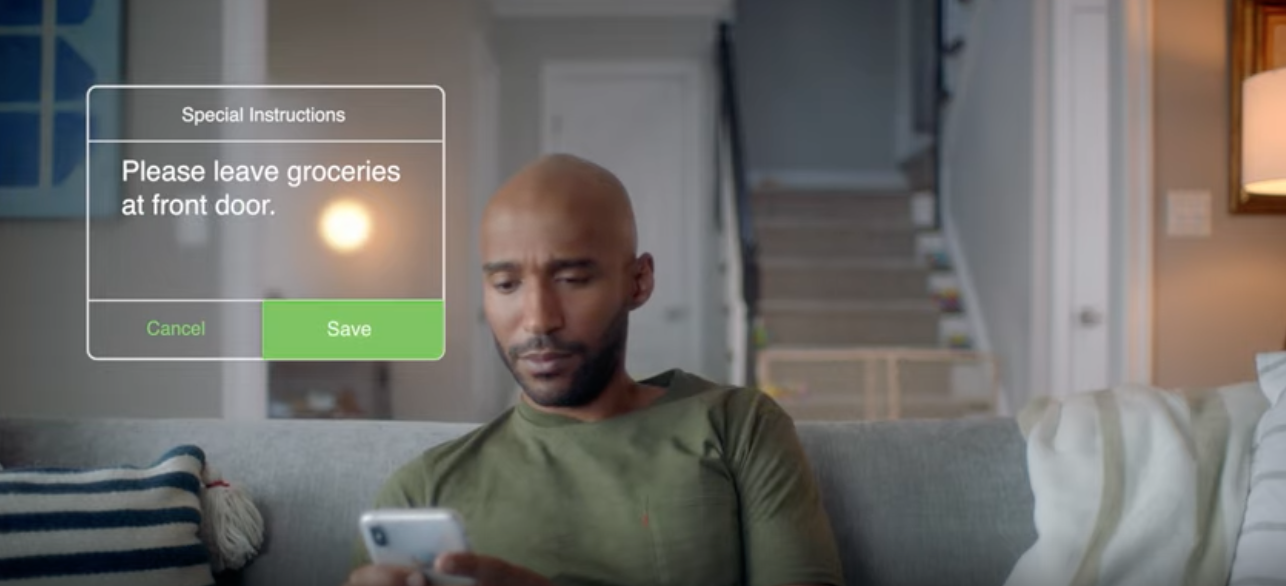

The brand allocated most of its budget to desktop video ads (65%), primarily taking the form of 30-second video spots taking aim at busy, overwhelmed parents sharing space with their kiddos in quarantine. In early 2021, young children were not eligible to receive the COVID-19 vaccine, making them vulnerable to the virus and putting parents in a precarious position when it came to providing the basic necessities for their families. The supportive tone and clear messaging in Instacart’s video campaigns offered stressed-out parents a quick, hassle-free, and seamless grocery delivery solution right at their fingertips.

Instead of focusing on the customer, Shipt shines a spotlight on its super-star shoppers

Shipt offers same-day grocery delivery, as well as everyday essentials, including home goods and electronics. In January 2021, the Target-owned grocery delivery service saw its user base explode by 57% YOY. Since then, their same-day delivery service has expanded to all major product categories at Target. It’s not unusual for a Shipt shopper to drop into a nearby partner store, like CVS, to grab other items for the user; it’s how Shipt maintains its edge over competitive platforms like Instacart.

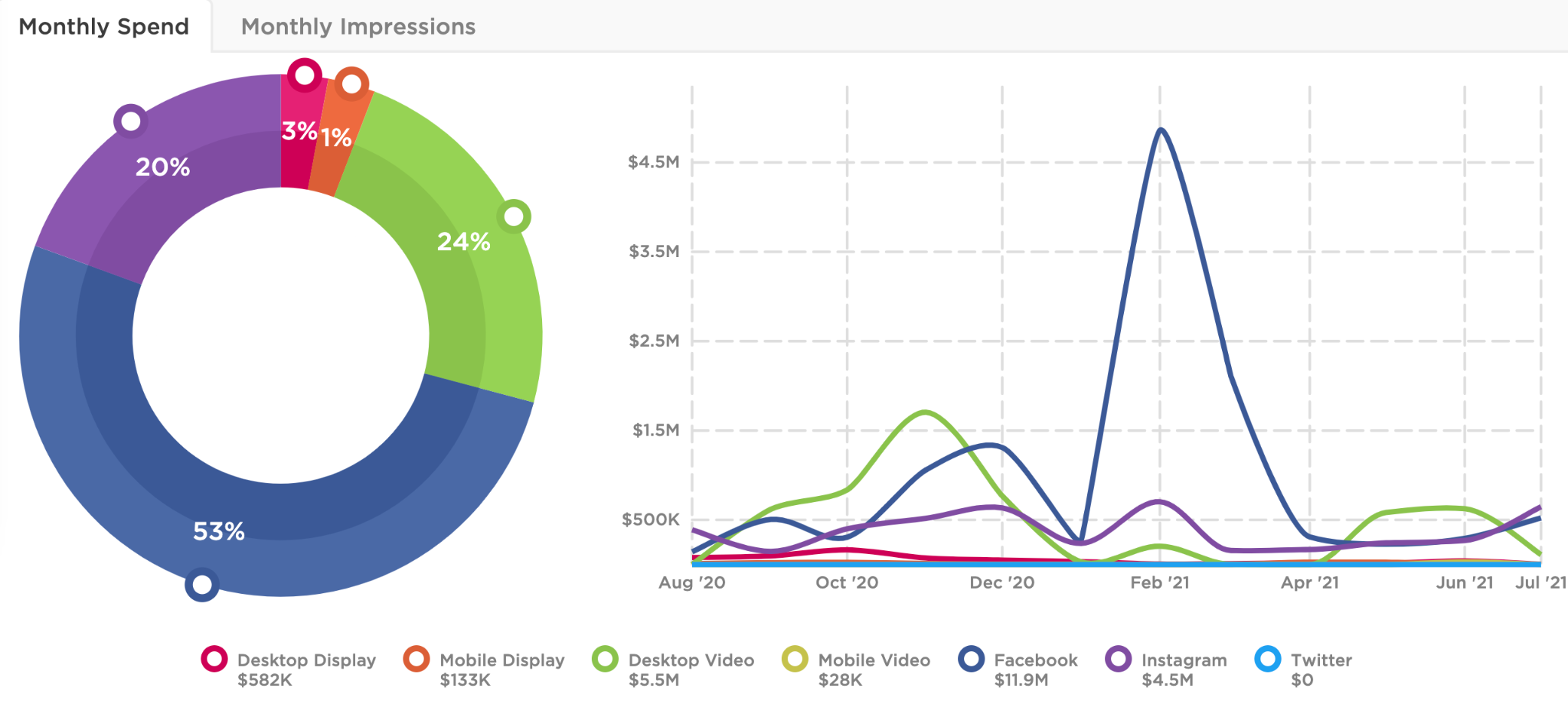

Shipt spent over $22.6M on its digital ads during this period, pulling in over 2.2B impressions from its 1,700+ creative.

Shipt leans into a mixture of fun, lighthearted video and static campaigns, promoting their under an hour delivery guarantee and highlighting shoppers’ consideration and attention to detail. The latter of the two is a key selling point for Shipt. When it comes to grocery delivery services, many user complaints stem from a poor shopper experience; shoppers grab the wrong item, forget them entirely, or pick overripe or even moldy produce. Shipt attempts to address these consumer doubts at the source with an ad that shows a shopper diving into a grocery store freezer to snag the last pizza as if they were buying it for themselves.

Shipt funneled most of its ad budget into Facebook (53%), spending the most in February 2021 ($4.8M) to promote its partnership with CVS Pharmacy. It’s worth noting Shipt finalized this partnership deal in 2019. If that’s the case, why did it take Shipt well over a year to promote such a lucrative collaboration?

During the pandemic, grocery delivery apps went from “nice to have” to “need to have.” The growth of online grocery does not mean that in-store shopping will completely vanish. On the contrary, many of those same customers are now returning to stores, preferring to pick their own produce and browse the aisles. However, some of those online gains will stick, and with U.S. online grocery sales forecasted to surpass $100 billion this year, grocers will be incentivized to adapt to changing shopping habits.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.