Source: https://www.corelogic.com/intelligence/single-family-investor-activity-surges-in-the-second-quarter/

2021 is shaping up to be a very different year for investors than 2020. After pulling back their market activity at the onset of the pandemic, investors had a business-as-usual winter, before capturing the highest market share seen in the last 10 years in the second quarter.

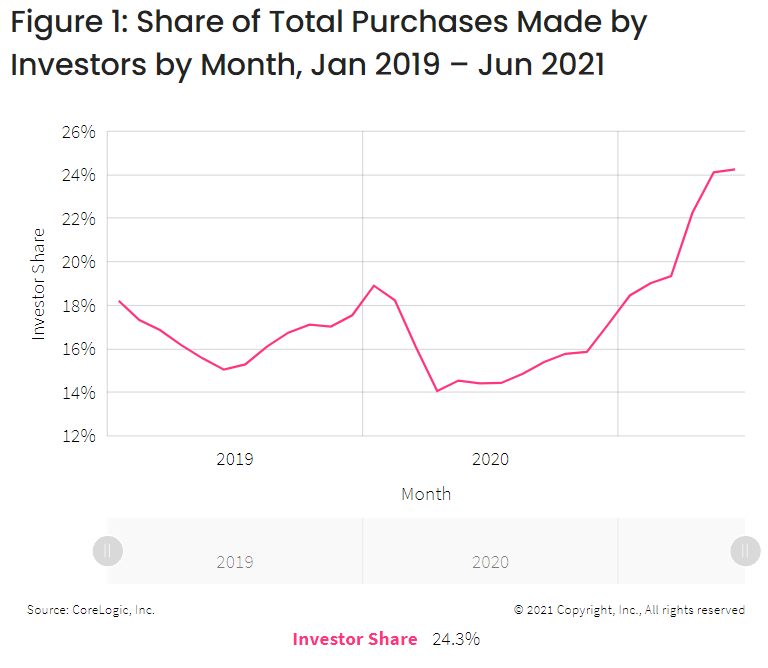

Figure 1 shows the share of total purchases that were made by investors in each month. 2019 shows the normal seasonal pattern. Investor purchase shares are highest in the winter months when owner-occupied buyers are less active. The ”COVID effect” is evident in 2020, when the spring and summer drop was far steeper than shown in 2019. For instance, during 2019 the January-to-April drop was two percentage points; in 2020, the January to April drop was five percentage points. By January 2021, investor activity had returned to a similar level seen at the same time in 2019 and 2020. However, the usual summer decline has been replaced with a summer surge in 2021. In May and June, investors made nearly a quarter of all purchases. Some bounce-back in investor activity was expected as the pandemic dampened, but a rise in the summer months is something that has not been seen in the last 10 years.

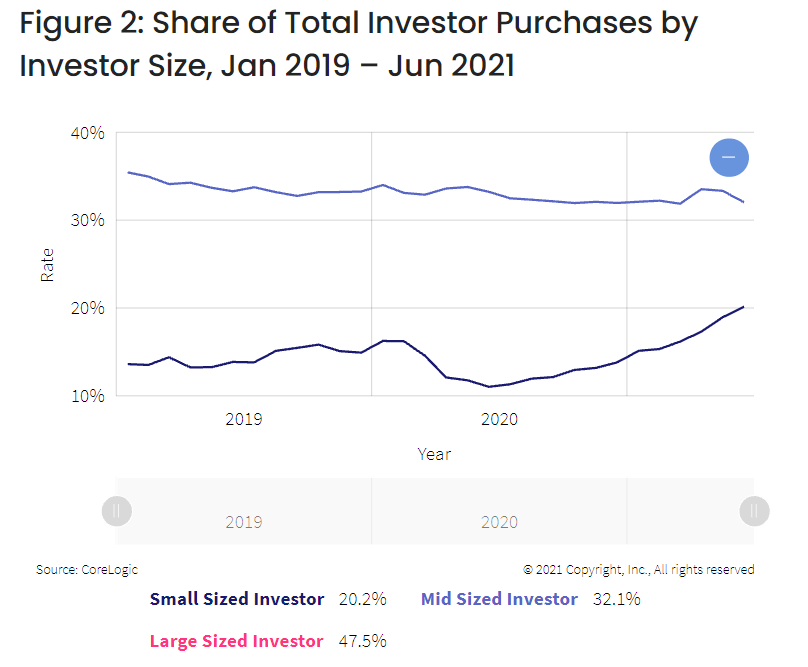

Figure 2 shows that large investors (those who retain 100 or more properties) are largely responsible for this rise. Of all investor purchases made in June 2021, 20% were made by large investors. This is much higher than 11% in 2020 or 14% in 2019. Small investors (those who retain between 3 and 10 properties), have declined slightly and now account for less than half of investor purchases at 46% in June. Mid-sized investors (those who retain 11-99 properties) have stayed constant, oscillating around 35% percent in the past 30 months. The pandemic seemed to drive away large investors, but they are now making up their largest share of investor purchases seen in the past decade.

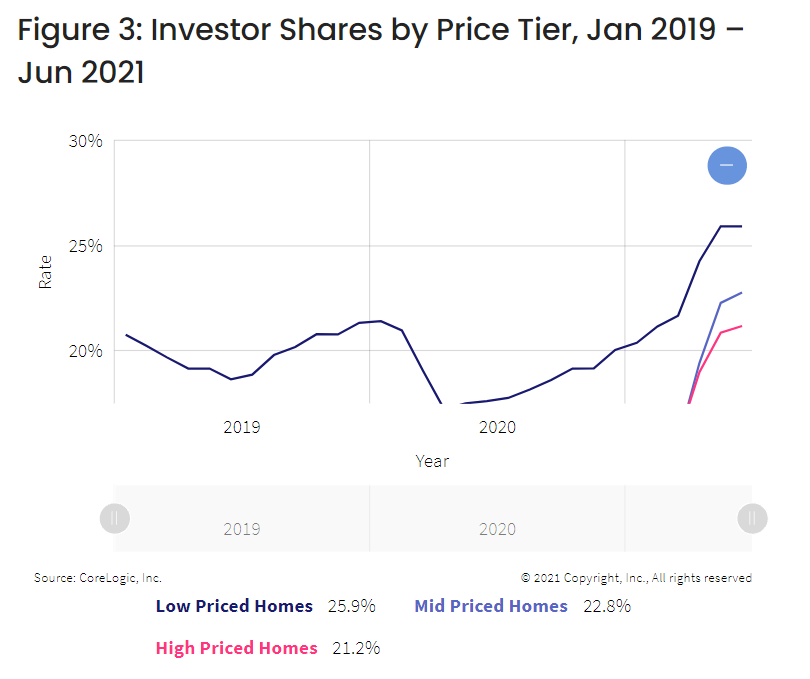

Investors are wading into previously uncharted waters. Historically, investor presence is heaviest in lower priced homes, and while this remains the case, their share in higher price tiers of markets has seen the starkest increase throughout 2021. Figure 3 shows investor shares by MSA price tier. Homes in the top and middle third of sales prices in their respective metropolitan area were purchased by investors 21% and 23% of the time in June 2021, respectively. This is up from 11% for both tiers in June 2020. Low price tiers have seen an increase too, though it is less extreme, from 18% to 26% from June 2020 to 2021.

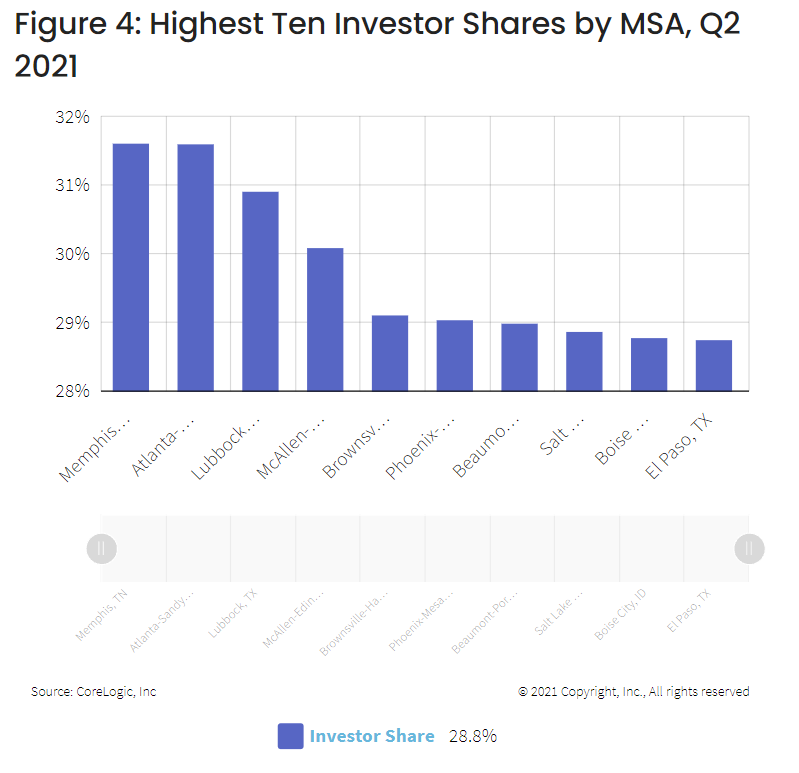

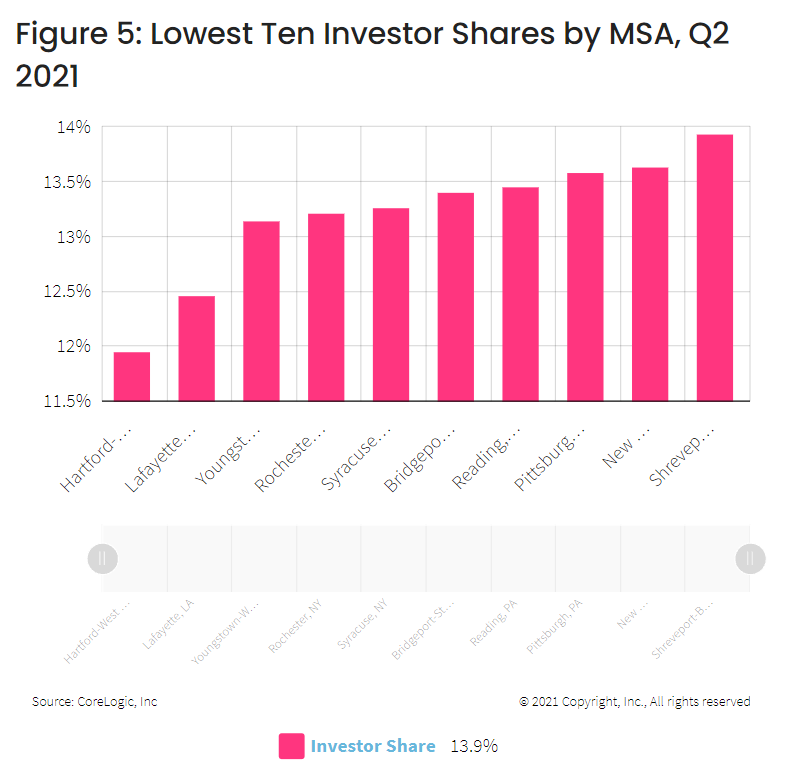

Investors are focusing their attention on the South and Mountain-West and limiting their activity in the Northeast. The ten MSAs with the highest investor shares are shown in Figure 3. Seven of these are in the South, and the other three in the Mountain-West. Investors are likely more attracted to locations where tenant rights laws are more favorable for landlords, have high population growth and high house price growth. Figure 4 shows the bottom ten MSAs. Aside from two exceptions in Louisiana, the bottom ten are all located in the Northeast, where it is likely that low levels of economic and population growth are signaling to investors that demand will be low.

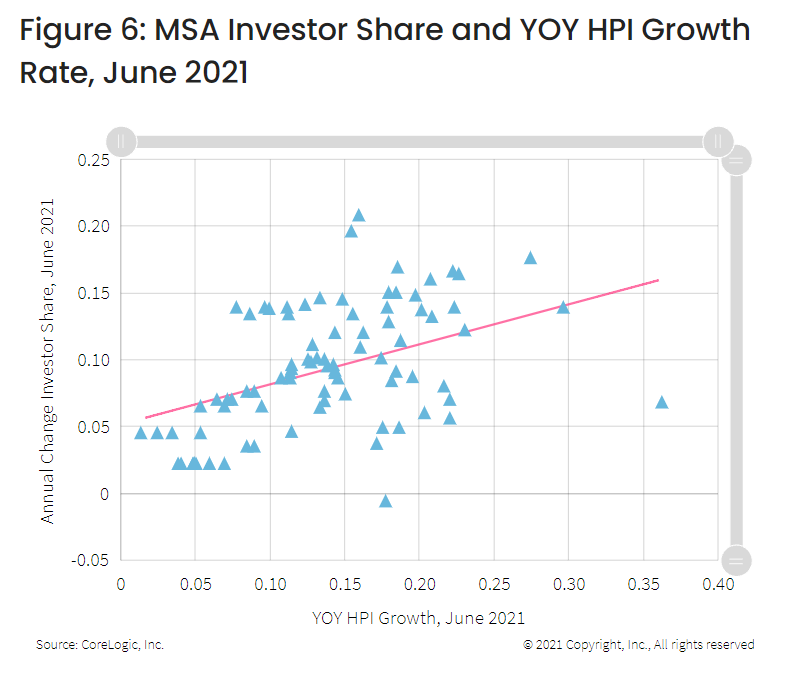

Given that home price appreciation is on an unprecedented growth streak, it would be reasonable to make a connection between that and the surge in investor activity. Figure 5 shows a clear connection between MSA level 12-month price appreciation and increases in investor activity. However, we are unable to say which way this causation is running. It could be that investors, being a significant share of the market, are driving price appreciation to record levels. It is also possible that they are seeing high appreciation markets and extrapolating the current trends, forecasting that the factors that have contributed to high levels of price growth will persist.

Will the high share of investors in the market stick? While possible, much like the recent record home price appreciation, it is likely that things will taper down. A three-month spike does not make a new normal, but when exactly it will end is difficult to predict.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.