Introduction

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through July 2021.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes transition rates between states of delinquency and separate breakouts for 120+ day delinquency.

“Even if loan modification or income recovery is unable to help delinquent homeowners become and remain current on their payments, the double-digit rise in home prices may help them avoid a distressed sale. Homeowners with substantial home equity are far less likely to experience a foreclosure sale, and fortunately, the CoreLogic Home Equity Report found the average owner gained $51,500 in equity in the past year — a five-fold annual increase.”

– Dr. Frank Nothaft

Chief Economist for CoreLogic

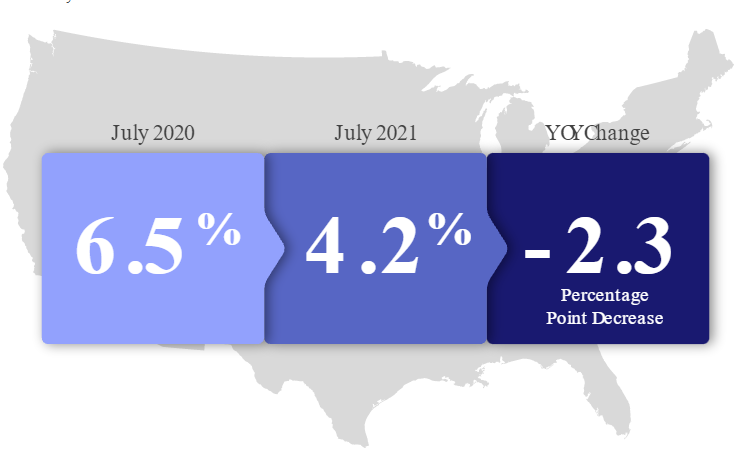

30 Days or More Delinquent – National

In July 2021, 4.2% of mortgages were delinquent by at least 30 days or more including those in foreclosure.

This represents a 2.3-percentage point decrease in the overall delinquency rate compared with July 2020.

Six Months Past Due

While we continue to see serious delinquencies improve, approximately one million people nationwide have been unable to make payments for at least half a year. In fact, the share of borrowers six months or more past due made up about one-half of the total delinquencies in July, with many still leaning on options such as forbearance, loan modifications and other government provisions to keep from entering foreclosure.

“Declining delinquency levels are an encouraging sign of economic improvement and the durability of the housing market. Looking ahead to the end of many forbearance and other assistance programs, many borrowers receiving support must consider their financial options, including a potential loan modification, to ensure they stay current and keep foreclosures at bay.”

– Frank Martell

President and CEO of CoreLogic

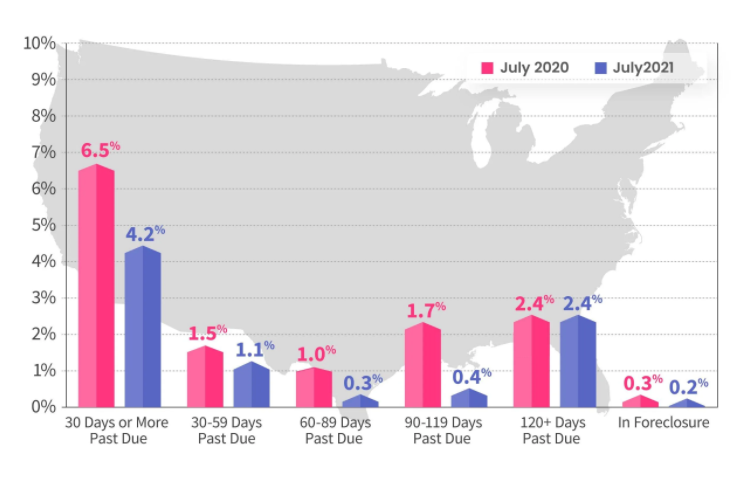

Loan Performance – National

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for July was 4.2%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.1% in July 2021, down from 1.5% in July 2020. The share of mortgages 60 to 89 days past due was 0.3%, down from 1% in July 2020. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 2.8%, down from 4.1% in July 2020. While still high, this is the lowest serious delinquency rate since May 2020.

As of July 2021, the foreclosure inventory rate was 0.2%, down from 0.3% in July 2020.

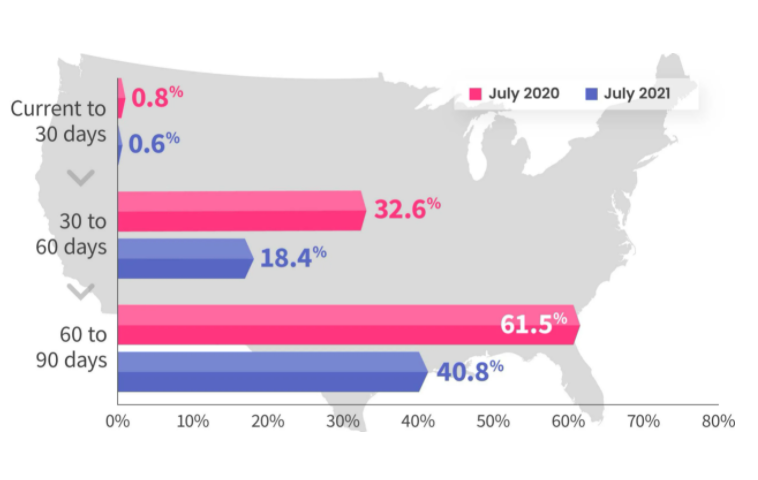

Transition Rates – National

CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The share of mortgages that transitioned from current to 30-days past due was 0.6%, down from 1% in June 2020. This is the lowest foreclosure rate recorded since CoreLogic began recording data (1999).

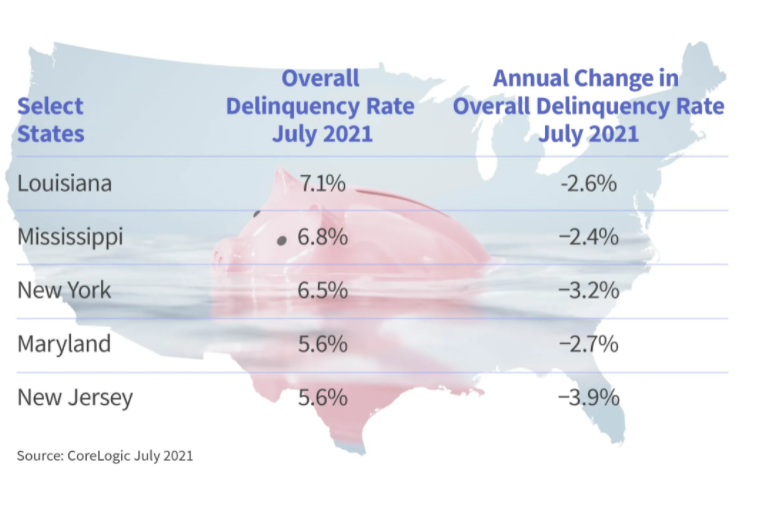

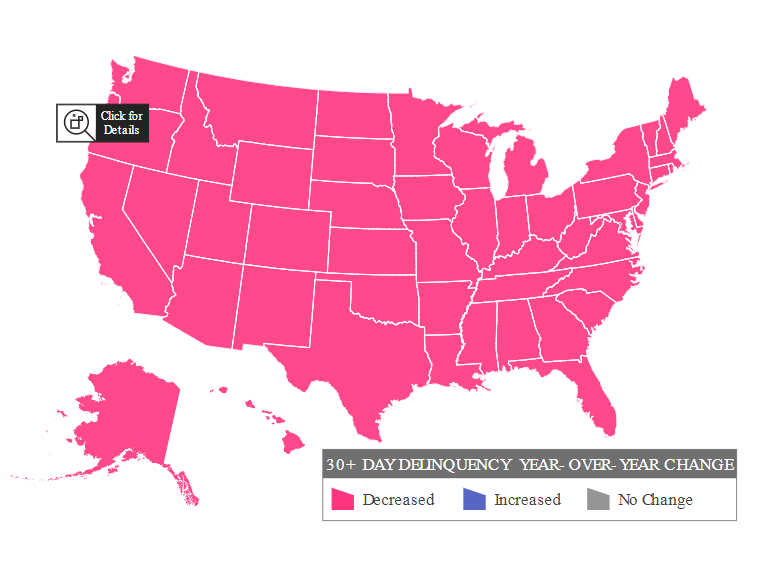

Overall Delinquency – State

Overall delinquency is defined as 30-days or more past due, including those in foreclosure.

In July, all U.S. states logged a decrease in annual overall delinquency rates, with New Jersey (down 3.9 percentage points), Florida (down 3.5 percentage points) and Nevada (down 3.3 percentage points) leading with the largest declines.

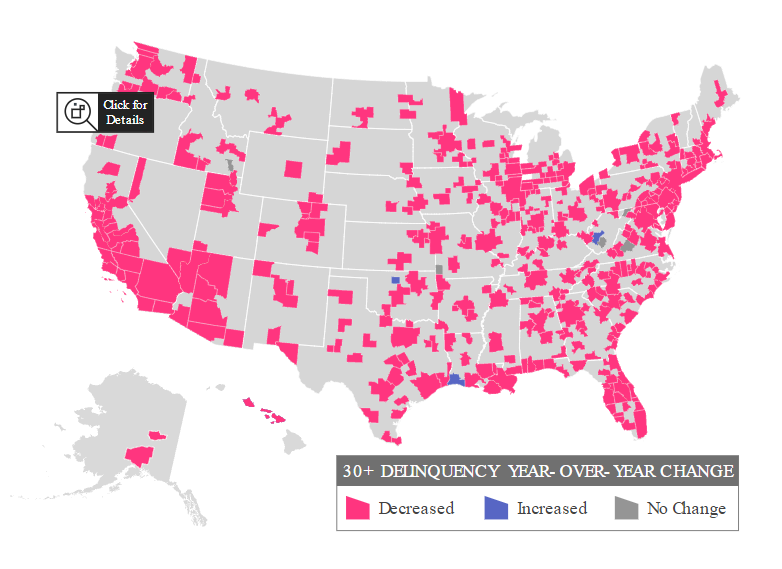

Serious Delinquency – Metropolitan Areas

Serious delinquency is defined as 90 days or more past due including loans in foreclosure.

There were 3 metropolitan areas where the Serious Delinquency Rate increased.

There were 381 metropolitan areas where the Serious Delinquency Rate remained the same or decreased.

Summary

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.