Two years into the Chicken Sandwich Wars, the battlefield has altered, with more distance between the top four when it comes to third-party delivery sales.

Key Takeaways

• In September, challenger brand McDonald’s took 25% of spend among top brands, followed by Wendy’s with 16%.

• When it comes to the number of chicken sandwiches sold, McDonald’s and Chick-Fil-A are neck-and-neck.

• Most brands studied have sold increasing numbers of chicken sandwiches from 2020 to 2021, except for Popeyes.

The Chicken Sandwich Wars have been raging so fiercely and for so long now that there’s even a Wikipedia page about it. Originally started with the launch of Popeyes’s chicken sandwich, the Chicken Sandwich Wars now include the biggest names in quick service restaurants such as McDonald’s, Wendy’s, Jack in the Box, Burger King, KFC, Chick-Fil-A, and Zaxby’s.

Burger King was the latest to join the fray with the launch of their Ch’King earlier this year. As the war only continues to add more participants, Edison Trends analyzed over 170,000 transactions to see how competition has fared nearly two years in.

Which Quick Service Restaurants are selling the most chicken sandwiches?

**

**

**

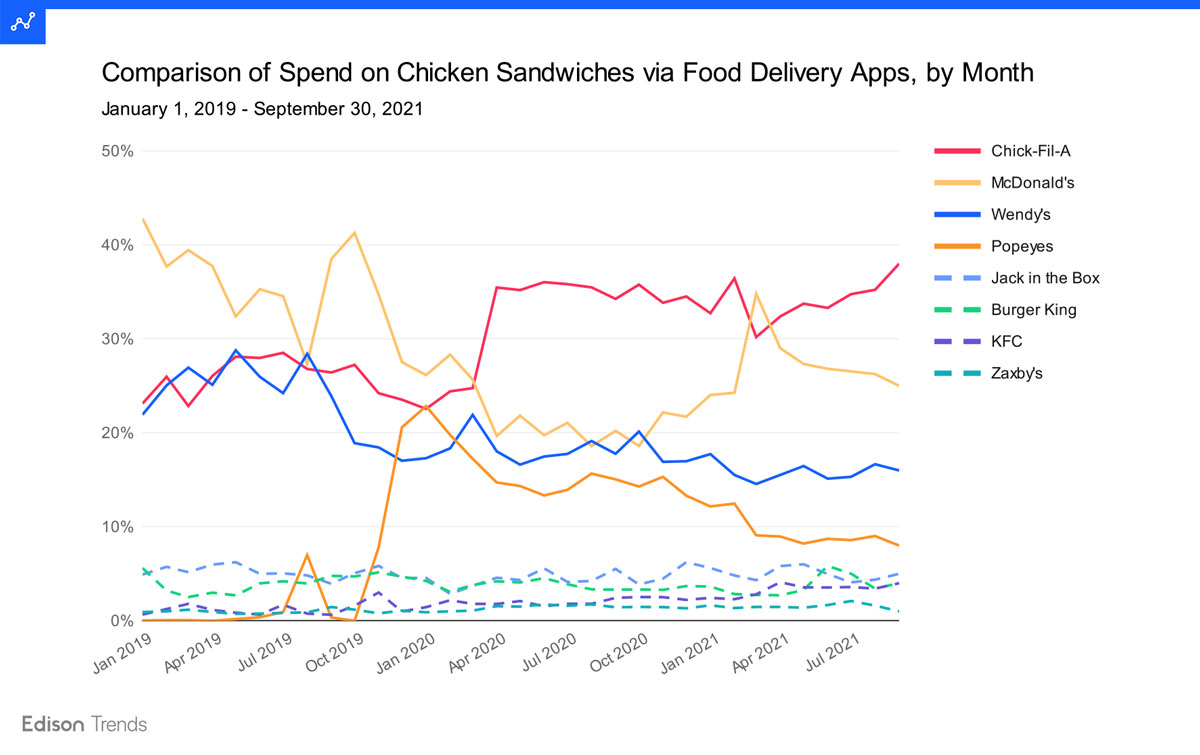

Figure 1a: Chart shows the estimated online comparison of spend on chicken sandwiches via food delivery apps, by month, from January 1, 2019 - September 30, 2021, comparing Chick-Fil-A, McDonald’s, Wendy’s, Popeyes, Jack in the Box, Burger King, KFC, and Zaxby’s, according to Edison Trends. This analysis was performed on over 170,000 transactions from 18 food delivery services. Note: due to rounding, numbers may not add to 100%.

Looking at the top quick-service restaurants selling chicken sandwiches through food delivery apps, it’s easy to see the big bite Popeyes took out of Chick-Fil-A and McDonald’s when Popeyes introduced their chicken sandwich on August 12, 2019. That sandwich sold out soon after, but Popeyes began climbing again in November 2019 and in January 2020 earned 23% of the money spent on chicken sandwiches among the eight brands analyzed.

Burger King debuted their Ch’King sandwich on June 3, 2021. In that month, they grabbed 5% of third-party chicken sandwich spend among these brands, compared to 9% for Popeyes, who stood just above them in the rankings that month.

Chick-Fil-A has mostly maintained the top position since April 2020, with the exception of March 2021. The rise of McDonald’s to take top place in that month coincided with the release of their Crispy Chicken Sandwich on February 24, 2021.

In September, Chick-Fil-A took in 38% of the money spent on chicken sandwiches through food delivery apps among these brands. McDonald’s was second with 25%; Wendy’s took 16%, and Popeyes 8%. The final four were Jack in the Box with 5%, Burger King and KFC with 4% each, and Zaxby’s with 1%.

The top four brands are much more spread out now than at the beginning of 2020. In January 2020, Chick-Fil-A, McDonald’s, Wendy’s and Popeyes each grabbed between 17% and 26% of spend on chicken sandwiches (among these brands), clustering them together. But in August 2021, the top four spread from 8% to 38%. The top two (Chick-Fil-A and McDonald’s) together grabbed 63% of spend.

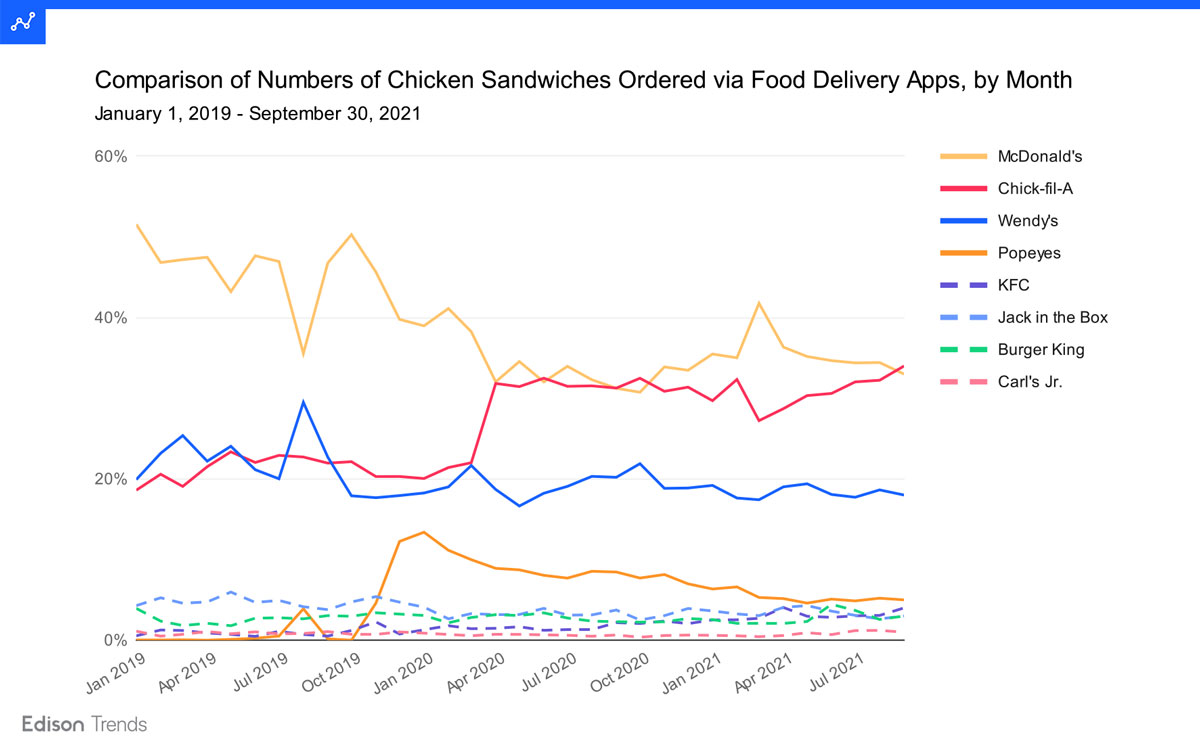

Figure 1b: Chart shows the comparison of numbers of chicken sandwiches ordered via food delivery apps, by month, from January 1, 2019 - September 30, 2021, comparing McDonald’s, Chick-Fil-A, Wendy’s, Popeyes, KFC, Jack in the Box, Burger King, and Carl’s Jr, according to Edison Trends. This analysis was performed on over 170,000 transactions from 18 food delivery services. Note: due to rounding, numbers may not add to 100%.

When it comes to the top restaurants for numbers of individual chicken sandwiches sold through third-party services, McDonald’s has been jousting with Chick-Fil-A since April 2020. Both restaurants saw their numbers of chicken sandwiches ordered climb during this time, but Chick-Fil-A’s third-party orders climbed more than McDonald’s, bringing down the percentage that McDonald’s saw. In March 2020, McDonald’s was selling 38% of the chicken sandwiches ordered from these eight restaurants through third-party apps; in April 2020, the number was 32%. Chick-Fil-A, on the other hand, went from 22% to 32% during that time.

Still, McDonald’s has mostly maintained first place over the past two years, experiencing a bump in March 2021 after the debut of their Crispy Chicken Sandwich. The initial success of Popeyes’ own chicken sandwich in early 2020 can also be seen, though by September 2021 their third-party chicken sandwich sales accounted for only 5% of those sold among these eight brands. September also saw Chick-fil-A pull about even with McDonald’s, with each taking 33-34% of the chicken sandwiches sold among these brands. The average McDonald’s item cost less than the average Chick-fil-A item, accounting for Chick-fil-A seeing the larger share of spend in Figure 1a.

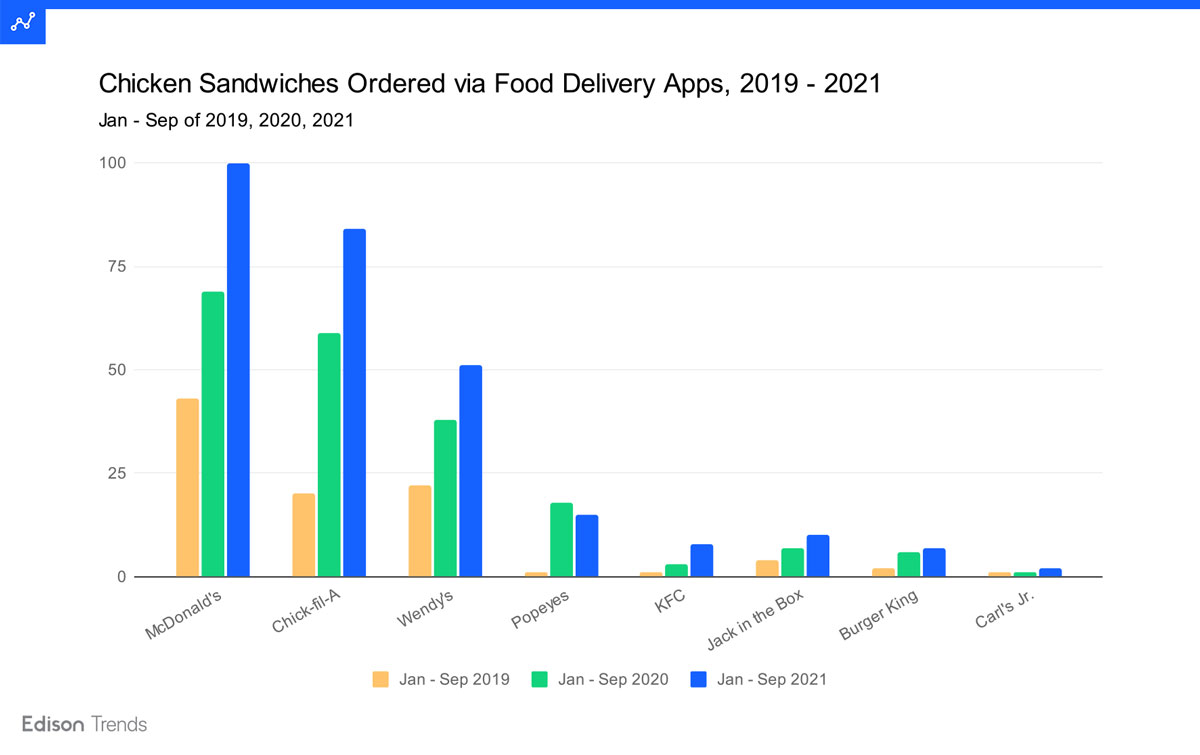

Figure 1c: Chart shows estimated online chicken sandwiches ordered via food delivery apps from Jan - Sep 2019, 2020, and 2021, for McDonald’s, Chick-Fil-A, Wendy’s, Popeyes, KFC, Jack in the Box, Burger King, and Carl’s Jr, according to Edison Trends. This analysis was performed on over 130,000 transactions from 18 food delivery services. Note: The highest number of orders per period was set to 100, and all other numbers scaled accordingly.

While market share may rise or fall, examining the numbers of individual chicken sandwiches ordered through third-party services shows that most brands are growing their chicken sandwich orders. Looking at quantities of sandwiches sold in the first 9 months of each year from 2019 to 2021, McDonald’s increased their numbers 61% from 2019 to 2020, and 45% from 2020 to 2021; Chick-Fil-A’s numbers grew 189% and 43% over those periods.

Popeyes was the only restaurant in this analysis whose numbers slipped, dropping 20% between 2020 and 2021. The largest growth from 2020 to 2021 in chicken sandwiches sold was shown by KFC, with a 171% increase.

How much is consumer demand growing for new chicken sandwich item entrants across digital ordering platforms?

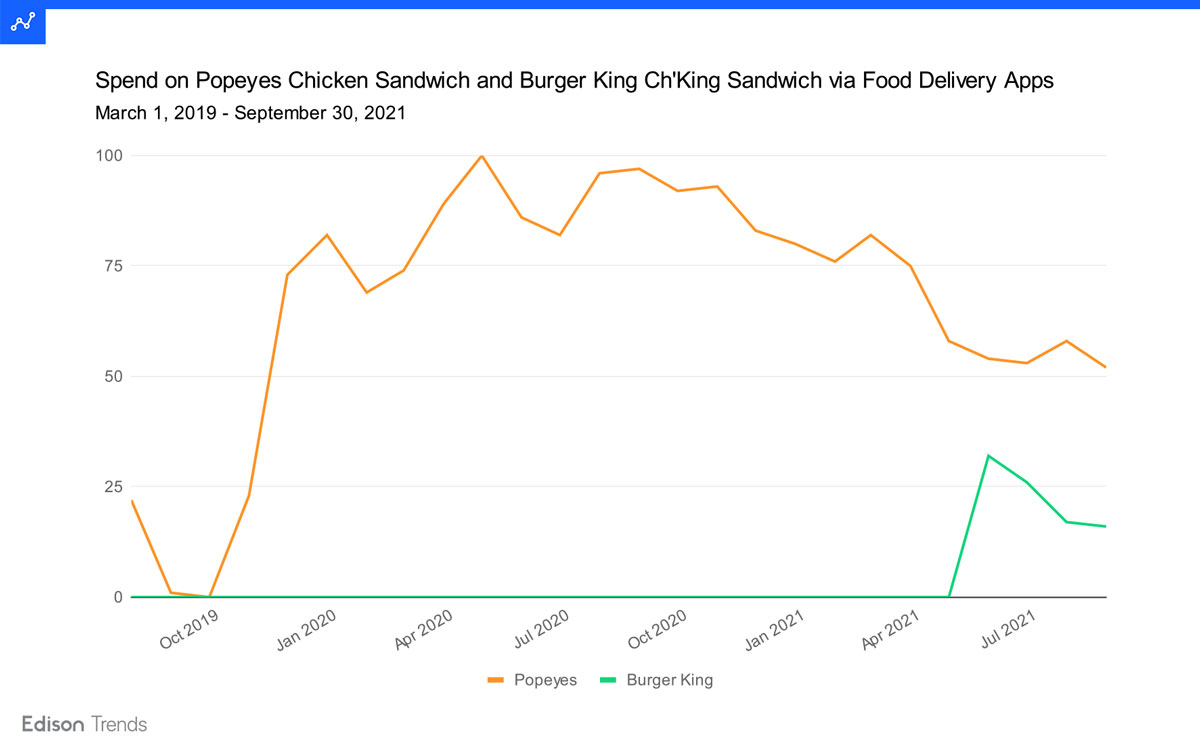

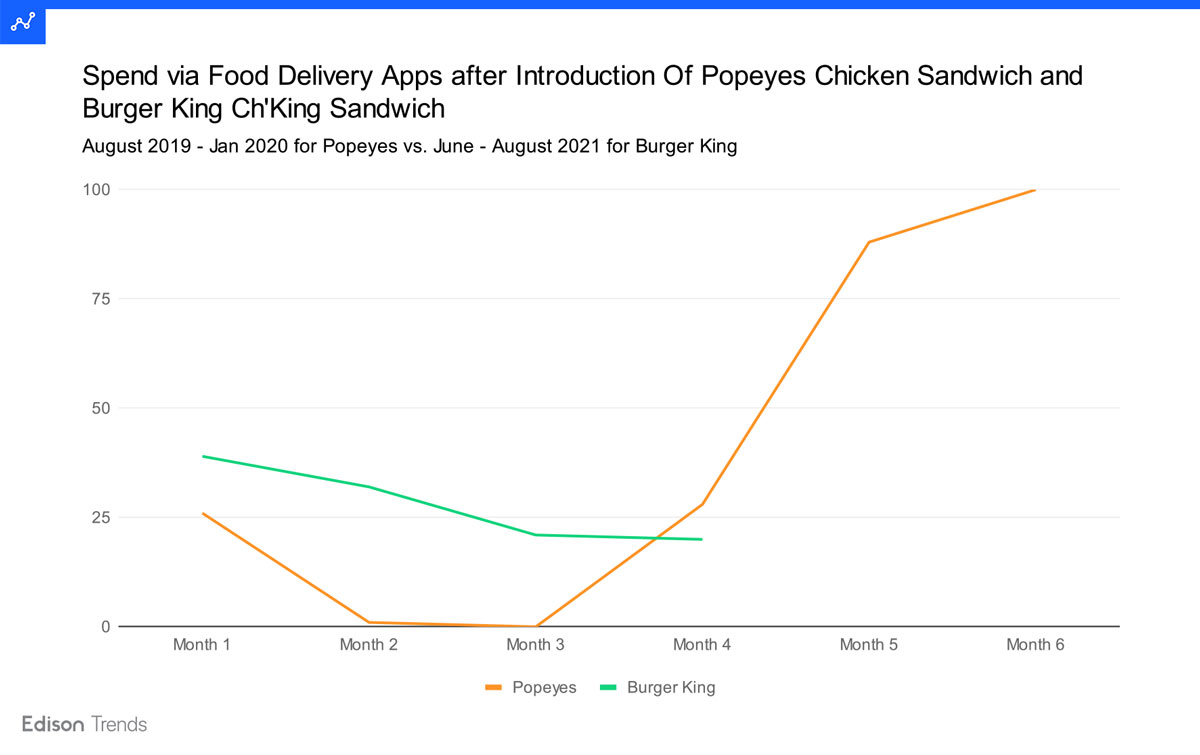

Figure 2a: Chart shows estimated online spend on Popeyes’s Chicken Sandwich vs. Burger King’s Ch’King Sandwich via food delivery apps from March 1, 2019 - September 30, 2021, according to Edison Trends. This analysis was performed on over 13,000 transactions from 12 food delivery services. Note: the highest spend per month was set to 100, and all other values scaled accordingly.

Figure 2b: Chart shows estimated online spend on Popeyes’s Chicken Sandwich vs. Burger King’s Ch’King Sandwich via food delivery apps in the months since each sandwich’s introduction, according to Edison Trends. This analysis was performed on over 13,000 transactions from 12 food delivery services. Note: the highest spend per month was set to 100, and all other values scaled accordingly.

Both Popeyes and Burger King have introduced new chicken sandwiches in the last two years. Popeyes, which had no chicken sandwiches on the menu prior, went nationwide with their simply-named Chicken Sandwich and Spicy Chicken Sandwich on August 12, 2019. Burger King, which did have chicken sandwiches on the menu previously, introduced its new Ch’King Sandwich varieties (regular, spicy, deluxe, and spicy deluxe) on June 3, 2021.

How do the two debuts compare, in terms of spend through third-party services? Popeyes faced issues when their new chicken sandwich sold out “due to unprecedented demand” shortly after being introduced. As a result, Burger King saw twice the spend on its debut sandwich that Popeyes did on theirs in the first 4 months. However, by May 2020, spend on the Popeyes sandwich had soared to 365% over that of its debut month. It’s too early to tell what fate holds for the Ch’King sandwich, spend on which has declined since its introduction.

To learn more about the data behind this article and what Edison Trends has to offer, visit https://trends.edison.tech/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.