In September, McDonald’s and Chipotle took in the most online spend compared to other QSR and fast casual restaurants.

Key Takeaways

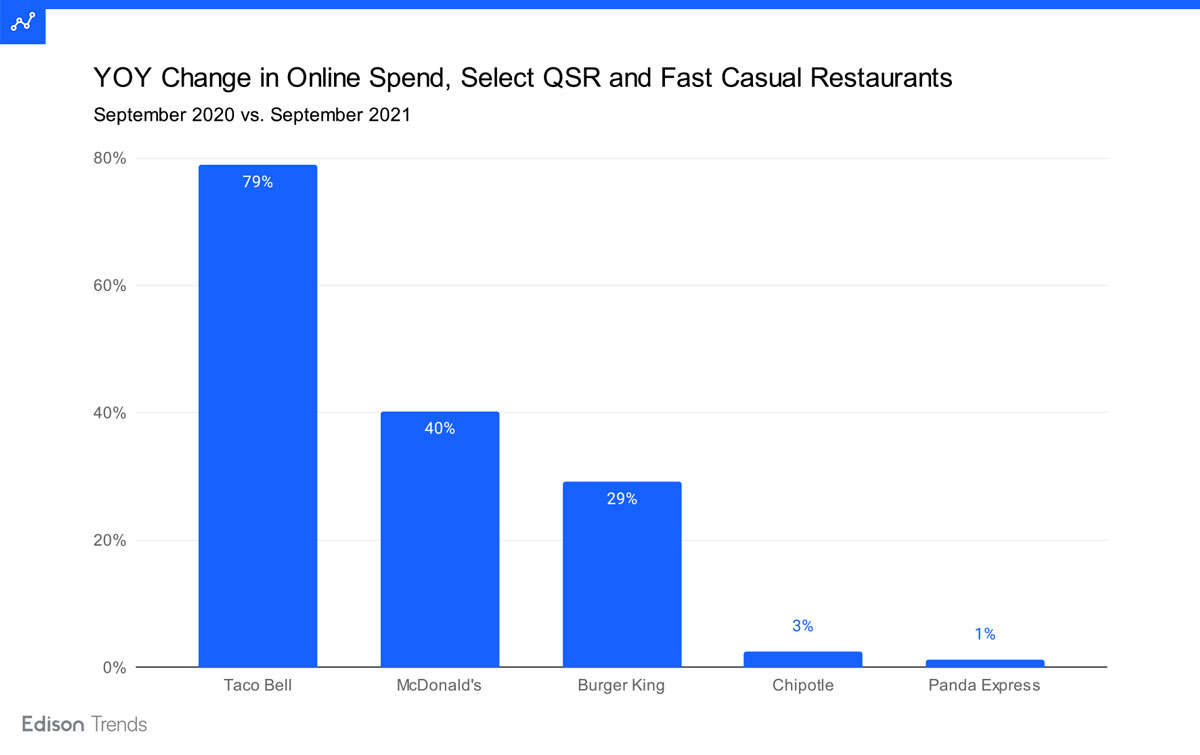

• In September, McDonald’s and Burger King saw the next highest YoY growth of digital ordering after Taco Bell, with spend up 40% and 29%, respectively.

• Previously, in the early months of the pandemic (January to May 2020), Panda Express grew digital spend the most at 199%, followed by Chipotle 172%, and Taco Bell 121%.

When it comes to how people consume fast food, the landscape has transformed dramatically since early 2020. While partnerships between fast food chains and food delivery companies have existed for years now, the use of online platforms — both third party and direct — for fast food purchases has skyrocketed in usage. As a recent McKinsey report noted, “Lockdowns and physical-distancing requirements early on in the pandemic gave the category an enormous boost, with delivery becoming a lifeline for the hurting restaurant industry.”

To understand exactly how much online spend has increased since 2020, Edison Trends took a deep dive into over 1.3 million transactions.

How much has online spend on QSR and fast casual restaurants increased since the start of 2020?

Figure 1: Chart shows estimated online spend on select QSR and fast casual restaurants from January 1, 2019 - September 30, 2021, for McDonald’s, Chipotle, Taco Bell, Panda Express, and Burger King, according to Edison Trends. This analysis is based on over 1.3 million transactions. Note: the highest spend per month was set to 100, and all other values scaled accordingly.

Looking at what customers spent on these restaurants, both directly and through third-party services, shows just how much change has taken place since before COVID-19. From January to May 2020, Panda Express grew 199%, Chipotle 172%, and Taco Bell 121%. Burger King and McDonald’s grew 105% and 93%, respectively.

As of September 2021, among these restaurants, McDonald’s was taking in the most spend on online orders. In that month their customers spent 21% more online than Chipotle’s. Taco Bell was next, and Panda Express and Burger King rounded out the group.

Which QSR or fast service restaurant has experienced the greatest year-over-year growth in online spend?

Figure 2: Chart shows estimated year-over-year change in online spend for select QSR and fast casual restaurants, comparing September 2020 vs. September 2021 for Taco Bell, McDonald’s, Burger King, Chipotle, and Panda Express, according to Edison Trends. This analysis is based on over 100,000 transactions.

Chipotle and Panda Express each showed little change over the past year. Taco Bell, on the other hand, grew their online spend 79% YOY. McDonald’s grew 40%, and Burger King 29%.

To learn more about the data behind this article and what Edison Trends has to offer, visit https://trends.edison.tech/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.