Monthly home price gains have started slowing in most U.S. metros

The latest release of the S&P CoreLogic Case-Shiller Index indicated that home price growth remained strong in August, clocking in a 19.8% annual growth, same as the month prior. Nevertheless, after 10 months of double-digit annual home price growth nationally, home price acceleration is showing signs of reprieve. In addition to the national growth rate stalling, the 10-city annual growth slowed from 19.2% to 18.6%, and the 20-city annual rate was down from 20% to 19.7% in August, non-seasonally adjusted.

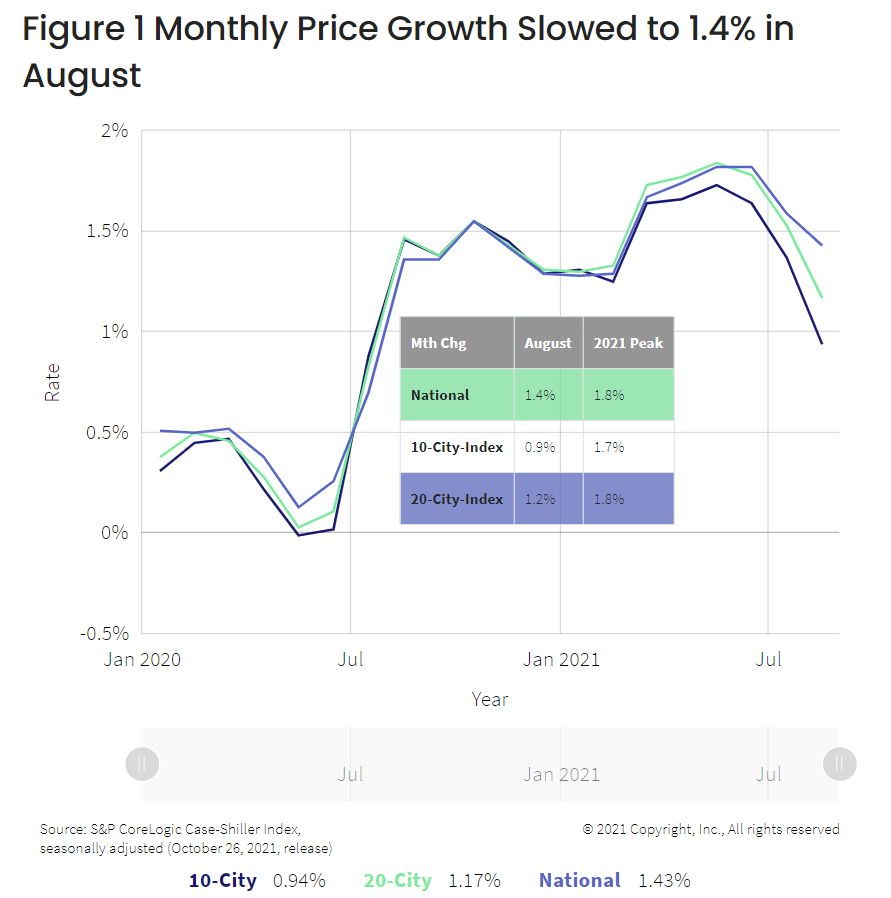

At the same time, seasonally adjusted monthly changes in the three indexes further highlight the slowing trend. After the onset of the pandemic and home price growth taking a step back in May and June of 2020, monthly price increases surged with all three indexes, seeing a 1.5% monthly jump by August 2020. The last time home prices increased at such a pace was in 2013. By April of this year, monthly increases hovered closer to 2%.

With limited inventories, bidding wars and perception of unsustainable price growth, buyer fatigue set in this summer, taking some pressure off monthly gains in home prices. For the last two consecutive months, monthly home price gains have trended lower. Nationally, monthly increases slowed from 1.8% in June to 1.4% in August. August monthly increase was the slowest since February 2021. Both the 10-city and 20-city indexes monthly growth rates declined although the 10-city index rate slowed more notably. For both city indexes, the August monthly increase was the slowest since July 2020. Figure 1 illustrates the trend in monthly gains for the three indexes over the last 20 months.

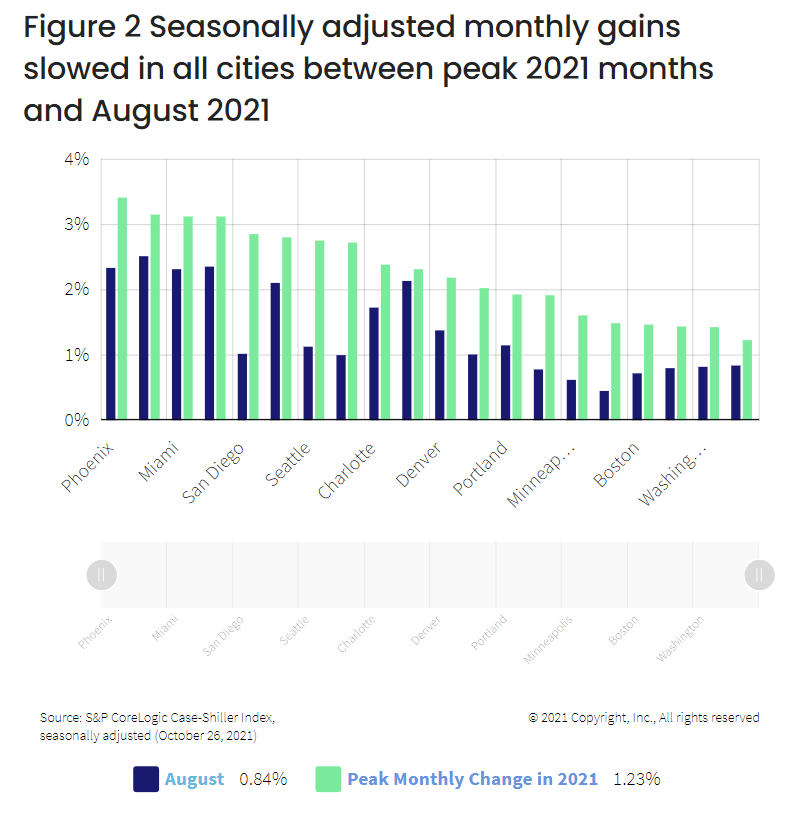

Among the 20 cities reported by the S&P CoreLogic Case-Shiller, all saw slowing of monthly gains between the peak months in 2021, which varied across cities, to August 2021 (Figure 2). In Phoenix, which was seeing the strongest monthly gains in the group since March 2021 and had strongest annual home price growth for 26 consecutive months, gains slowed in August to 2.3% from 3.4% in June. Most notable slowing of monthly gains was evident in San Diego, CA, down from 2.9% in April to 1% in August, followed by San Francisco which slowed from 2.7% to 2.1%, and Seattle, WA– from 2.8% to 1.1%. As a result of the slowing in Phoenix, AZ, monthly gains in August were strongest in Tampa and Las Vegas.

Atlanta, GA reported the smallest decline in monthly gains and showed a relatively robust 2.1% gain in August, down from 2.3% in July.

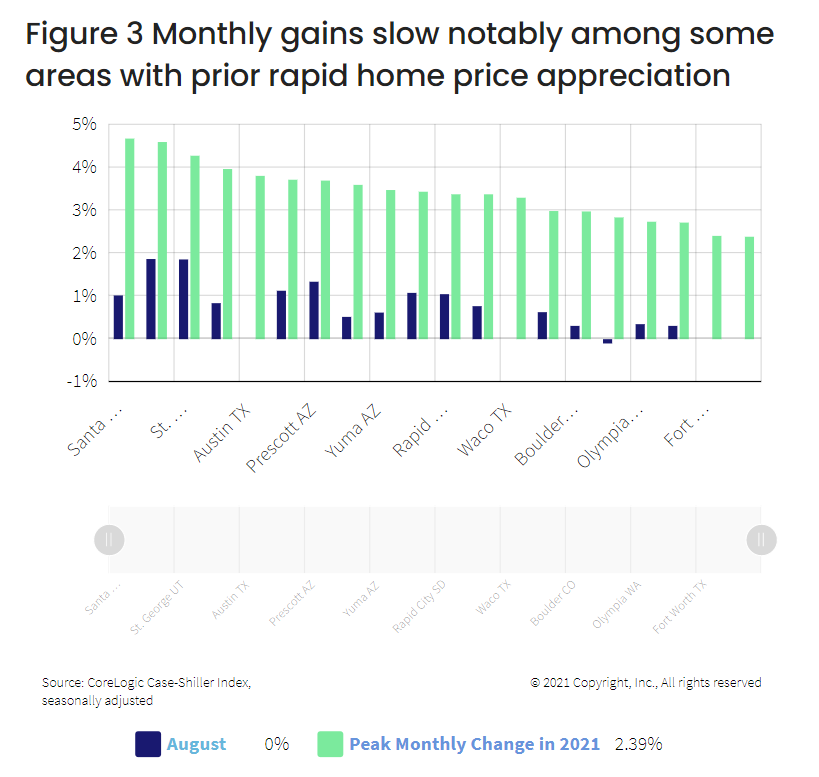

In addition to 20 cities reported by the S&P Dow Jones Indices, CoreLogic estimates the Case Shiller Home Price Index for more than 400 other metropolitan and micropolitan areas in the U.S. Among these metropolitan areas, almost all – 92% – experienced slowing of monthly increases in August. Interestingly, the most significant decrease was among metro areas that enjoyed robust home price growth over the past year. Figure 3 lists the top 20 metropolitan areas with most significant slowing of monthly gains and highlights the peak monthly gain in 2021 compared to August. Austin, TX experienced the largest decline in monthly gains from 3.8% in May to no change in prices in August. The greater Dallas metropolitan area likewise had no monthly price growth in August. Also, Boise, ID – which has been a poster child for strong home demand over the last couple of years, also joined the group of metros with largest declines in monthly gains, as did St. George, UT.

Lastly, while slowing of monthly gains have generally characterized housing markets across the country, there was a group of markets that continued to enjoy stronger monthly gains in August. Out of 17 markets with monthly increases, eight were in the South East, including Florida, South Carolina, North Carolina and Georgia. This is not surprising as these markets are popular among snow birds and with winter peeking it’s cold head and the ability of some workers to continue to work from home, areas that offer warm weather and affordability appear to remain popular among homebuyers. Even when looking at areas that rank with highest monthly gains in August, 13 out of the top 20 are in Florida.

Going forward, annual home price growth is likely to continue slowing from the current rate of almost 20%. According to the latest CoreLogic HPI Forecast, home price growth will gradually slow over the next year, reaching a 2% annual gain in September 2022. Deceleration may be more prominent in areas where home price growth has outpaced the income growth, pricing local households out of the market. In Phoenix, AZ, which has ranked as the strongest home price growth market among the locals and included in the 20-city Case Shiller Index for 26 consecutive months, home prices may take a dip and decline about 0.4% next September compared to current prices. Similarly, several markets in Texas, Wyoming, Louisiana and Idaho are forecasted to take a small dip by the fall of next year. With the current unsustainable rate of home price growth, seeing signs of gradual slowdown is a welcomed change, which suggests a housing market with a better demand-and-supply balance lies ahead.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.