But Rebounded to Pre-Pandemic Level as the Economy Recovered in 2021

Access to mortgage credit in underserved areas has always been one of the major concerns for housing policy experts and community activists. In previous years, Home Mortgage Disclosure Act (HMDA) data has been used to assess at what level the mortgage service needs in these communities are met. Though HMDA data is the most comprehensive publicly available detail on home mortgage loans across the U.S. residential mortgage market the data is dated when released only on an annual basis.

For this blog, we follow the Federal Housing Finance Agency’s (FHFA) definitions for an underserved area for both low-income and minority census tracts1. The FHFA uses these to assess the affordable housing performance of the government-sponsored enterprises it regulates.

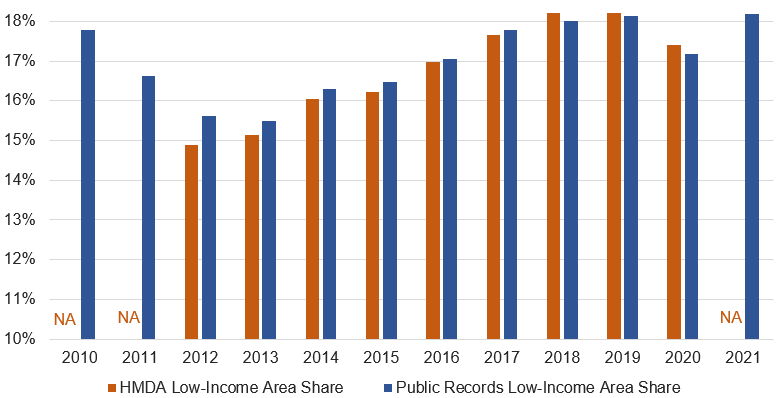

Figure 1: Low-Income Area Share Dropped Slightly in 2020

Share of First Lien, Home-Purchase Loans in Low-Income Census Tracts

Figure 1 compares the annual trend of low-income area share of all 1st lien home purchase loan originations in the HMDA data and the CoreLogic’s public records. While HMDA data is not yet available for 2021, Figure 1 illustrates the most recent trend using CoreLogic data through September 2021, which has closely mirrored HMDA trends in prior years2. The share of home-purchase mortgage lending in low-income areas increased steadily prior to the pandemic and reached the highest share in 2019. However, the share dropped by one percentage point during 2020 to the lowest since 2016, most likely because of the concerns that the COVID-19 pandemic and recession has had disproportionally more negative impact on borrowers in lower income communities. Nevertheless, as the economy continued to recover in 2021, the CoreLogic’s public records through September 2021 show that the share of home-purchase mortgage originations in these areas has rebounded back to 2019 level.

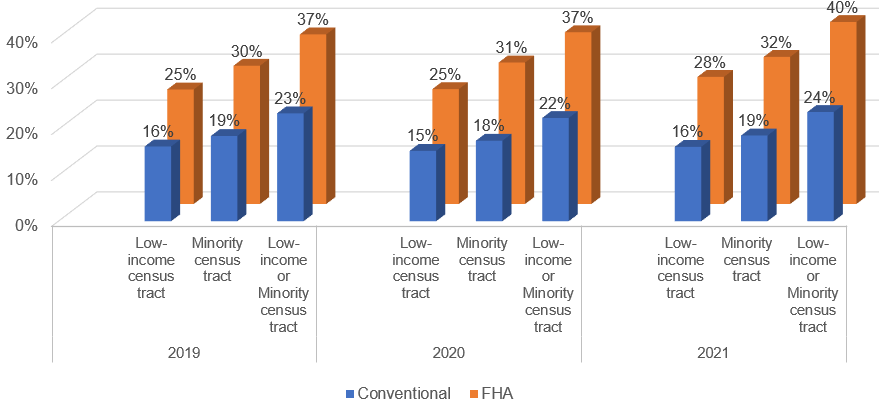

Figure 2. FHA has a Larger Share of Loans in Low-Income Areas

Percent of Home-Purchase Originations, by Census Tract Location of Home

Federal Housing Administration (FHA) insured loans tend to have a higher share of low-income and high-minority census tract lending than conventional loans (Figure 2)3. The share of FHA loans in these neighborhoods did not change in 2020. In contrast, the conventional loans share declined by one percentage point in 2020 compared with 2019. However, year-to-date, loan originations have made a rebound and appear to be on track to meet the 2019 share. The application share (includes all loan applications in HMDA data whether originated or not) in these neighborhoods dropped by one percentage point in 2020, which shows that the demand for conventional loans in these areas dropped slightly.

We expect to see the share of loans made in underserved neighborhoods to remain at least at the pre-pandemic level or higher as households who live and buy in these communities benefit from improving labor market, wages, and the overall economy. CoreLogic will continue to monitor and share these trends with its public records data.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.