In our last global P&L article, we noted that hotel profitability improved across much of the globe as the industry continued its slow recovery. In this latest update with October data, we saw similar trends in P&L data although there were notable outliers in each world region.

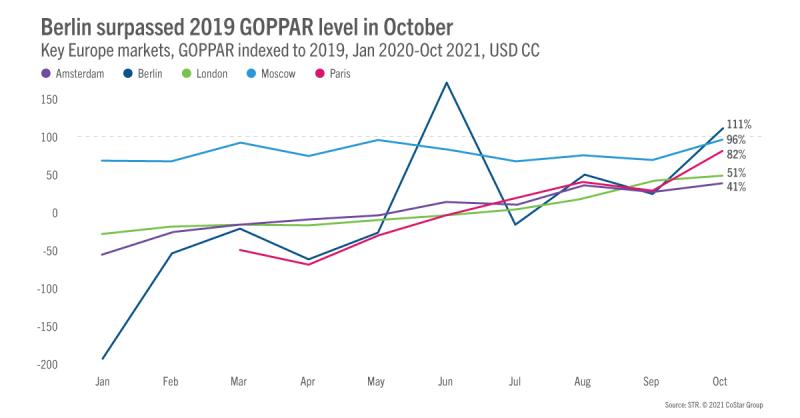

Berlin stands out as European markets show improvement

Among the major European markets, Berlin achieved an October gross operating profit per available room (GOPPAR) of US$95.82, which was 111% of the 2019 comparable. Berlin was the only major market in Europe that was able to surpass its October 2019 GOPPAR level. Looking back at this past year, this feat is not a first for Berlin as it reached 168% of its 2019 comparable back in June.

Moscow, which had been steadily leading GOPPAR recovery in Europe, reported an October 2021 GOPPAR of US$57.73 (96% of the 2019 comparable). Paris showed improvement during the last month and reached 83% of its 2019 comparable.

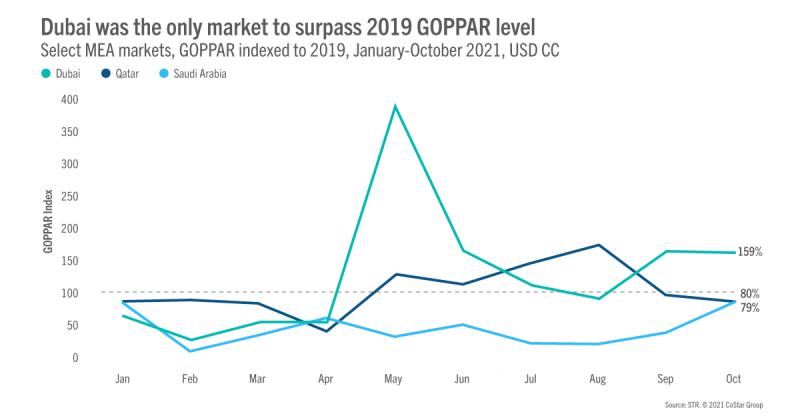

Dubai was the big leader in the Middle East

Lifted by the opening of Expo 2020 and the ICC Men’s T20 World Cup, Dubai’s October 2021 GOPPAR reached US$178 (159% of the 2019 comparable), while total revenue per available room (TRevPAR) came in at US$316.

While two other top markets, Qatar and Saudi Arabia, did not reach 2019 GOPPAR levels, both still realized strong profits. Qatar’s October 2021 TRevPAR level was US$129, while GOPPAR was US$49 (79% of the 2019 comparable). Saudi Arabia realized a TRevPAR of US$128 and a US$42 GOPPAR (80% of the 2019 comparable).

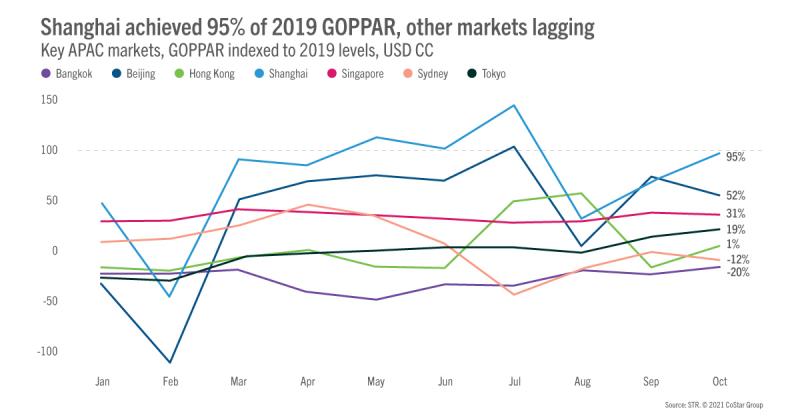

Asia Pacific profitability recovery lagged behind other regions

Due to strong domestic demand, Shanghai and Beijing outperformed the other major APAC markets in terms of profits—Shanghai was just shy of achieving the comparable 2019 GOPPAR level. Other APAC markets still struggled when compared with October 2019 levels, including Tokyo (1%), Sydney (-12%), and Bangkok (-20%).

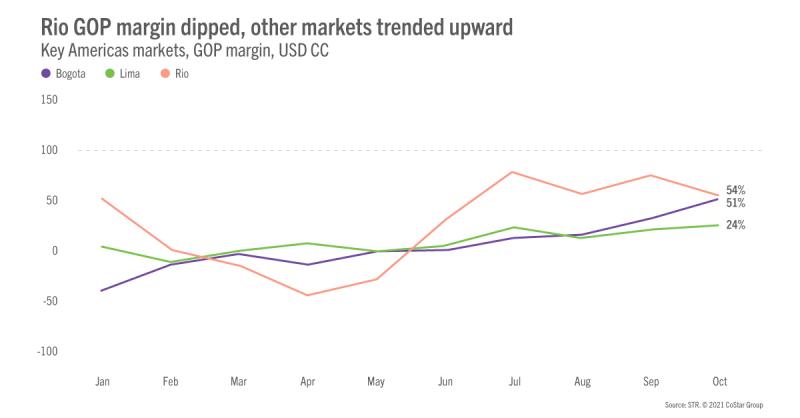

Slow, steady improvement in South America

Of the top three markets in South America, Bogota realized the highest GOPPAR level at US$26, while Lima achieved the largest GOP margin at 54%.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.