Source: https://www.reveliolabs.com/news/business/hundreds-poached-as-cybersecurity-talent-wars-rage-on/

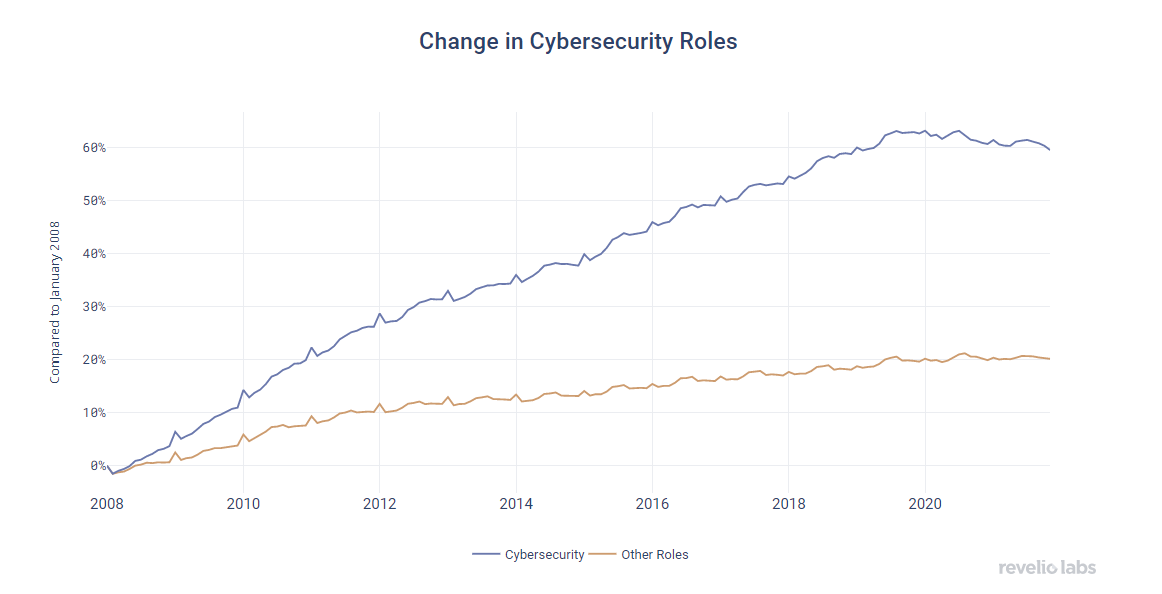

The bipartisan Infrastructure Investment and Jobs Act will invest about $2 billion on cybersecurity, and support public and private entities as they respond to, and recover from, significant cyberattacks. Cybersecurity roles have been growing much faster than all other roles in the last decade. But with this renewed focus, can the government actually compete with the high salaries of the finance industry for the most sought after talent?

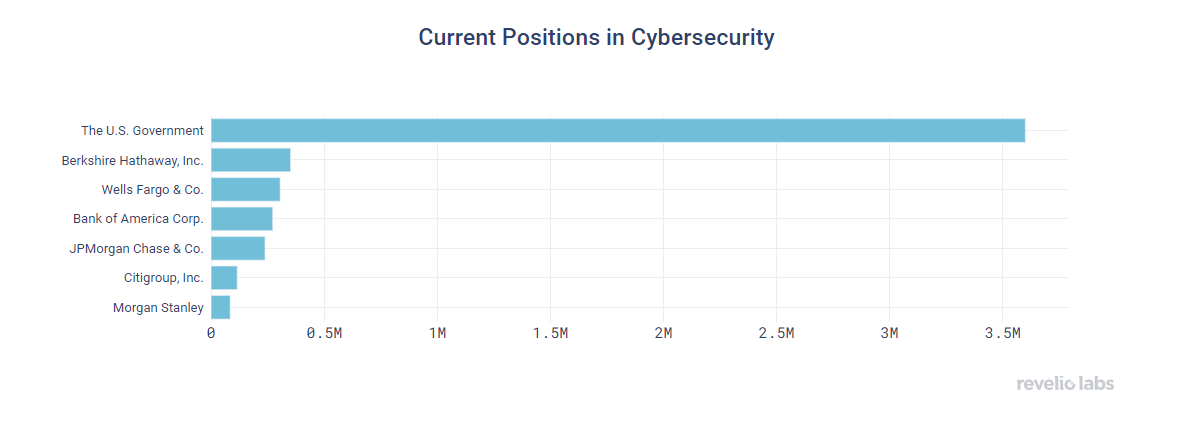

The United States Government has a much higher number of cybersecurity personnel, followed by big players in the financial services industry.

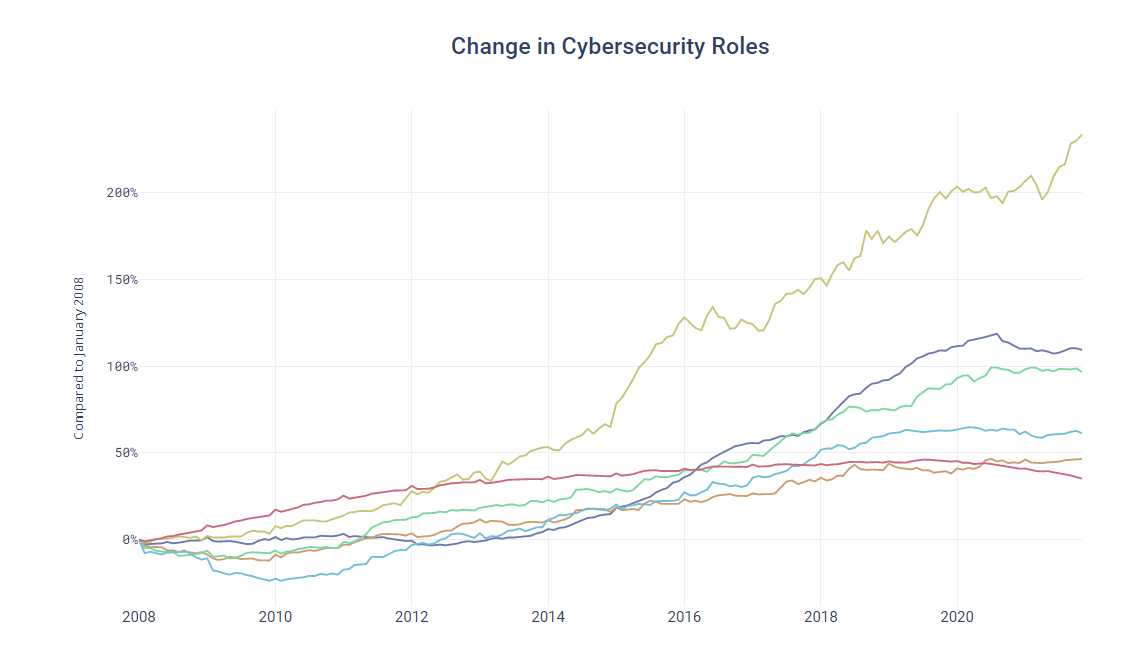

However, as we track the growth of these roles, we see that the Government has lost its edge over financial companies since 2016, and lost its lead in growing headcount of cybersecurity roles.

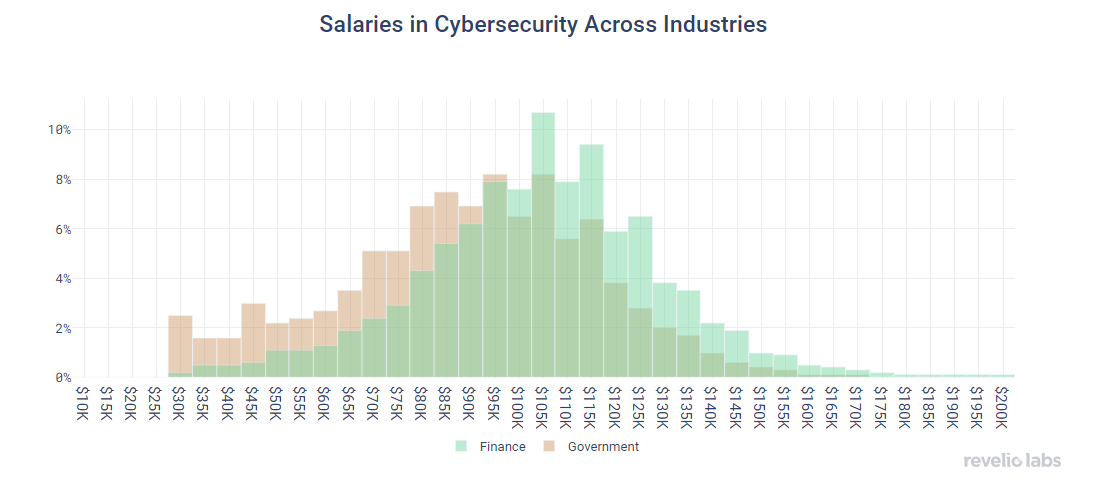

What can explain the US Government losing its edge in the cybersecurity workforce? One explanation is through salaries. The plot below shows the distribution of salaries for Cybersecurity Consultants in Finance and Government. The salary distribution in Finance is much higher than that of Government:

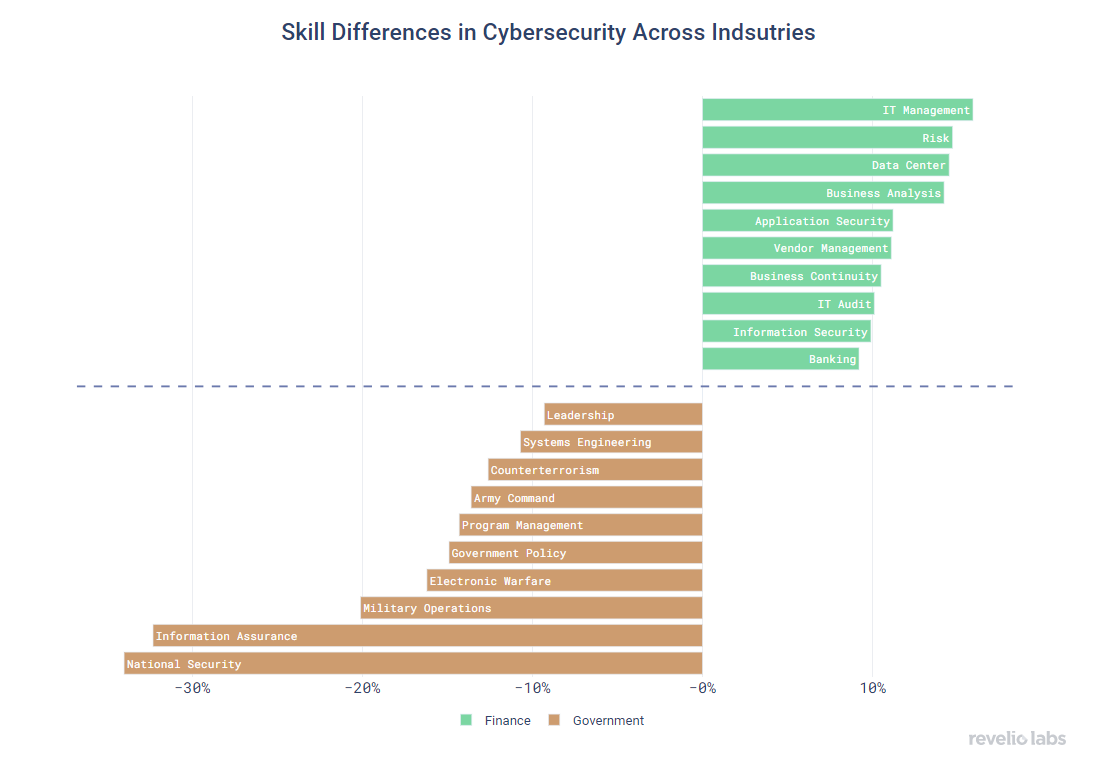

Turning to skills of the cybersecurity workforce in Government and Finance, the plot below shows the difference between the share of Security Consultants with specific skills, highlighting the skills that are the most different between the same role in two different industries.

Cybersecurity roles in Finance have much more common technical skills like IT Management or Data Center Management, whereas cybersecurity in Government requires Military skills that are much harder to find.

Key Takeaways:

To learn more about the data behind this article and what Revelio Labs has to offer, visit https://www.reveliolabs.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.