U.S. Single-Family Rents Up 10.9% Year Over Year in October

Overall Single-Family Rent Growth

U.S. single-family rent growth increased 10.9% in October 2021, the fastest year-over-year increase in over 16 years, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. The October 2021 increase was more than three times the October 2020 increase, and while the index growth slowed last summer, rent growth is running well above pre-pandemic levels when compared with 2019.

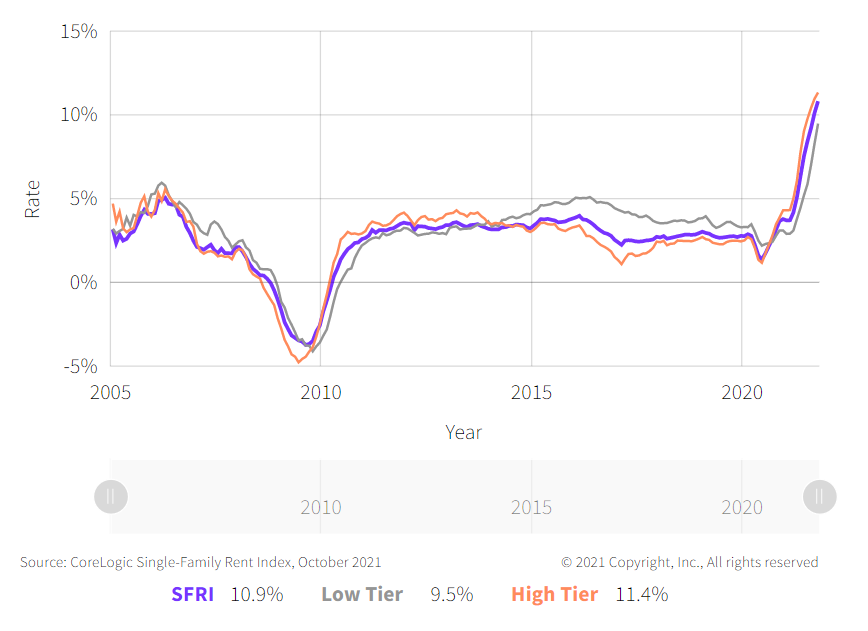

Single-Family Rent Growth by Price Tier

Rent growth accelerated for all price tiers in October, though rents for high-priced rentals showed the highest increase. The low-price tier is defined as properties with rent prices less than 75% of the region’s median rent, and the high-price tier is defined as properties with rent prices greater than 125% of a region’s median rent (Figure 1).

Rent prices for the low-price tier increased 9.5% year over year in October 2021, up from 2.8% in October 2020. Meanwhile, high-price rentals increased 11.4% in October 2021, up from a gain of 3.5% in October 2020. This was the fastest increase in the history of the SFRI for both the low- and high-price rent tiers.

Figure 1: National Single-Family Rent Index Year-Over-Year Percent Change By Price Tier

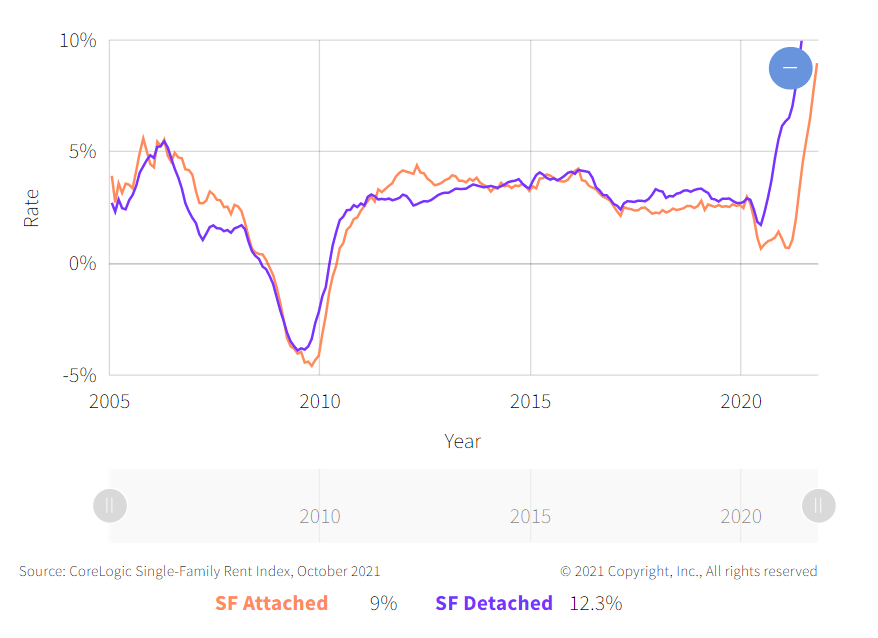

Single-Family Rent Growth by Property Type

Differences in rent growth by property type emerged after the pandemic as renters sought out standalone properties in lower density areas (Figure 2). The detached property type tier is defined as properties with a free-standing residential building, and the attached property type tier is defined as a single-family dwelling that is attached to other single-family dwellings, which includes duplexes, triplexes, quadplexes, townhouses, row-houses, condos and co-ops.

Detached homes are preferred by would-be homebuyers who have been either been priced out of the market or unable to find a home in today’s supply-constrained market, which has pushed rent up for these homes. Annual rent growth for detached rentals was 12.3% in October, compared with 9% for attached rentals.

Figure 2: Rent Growth for Detached Properties was Double That of Attached Properties

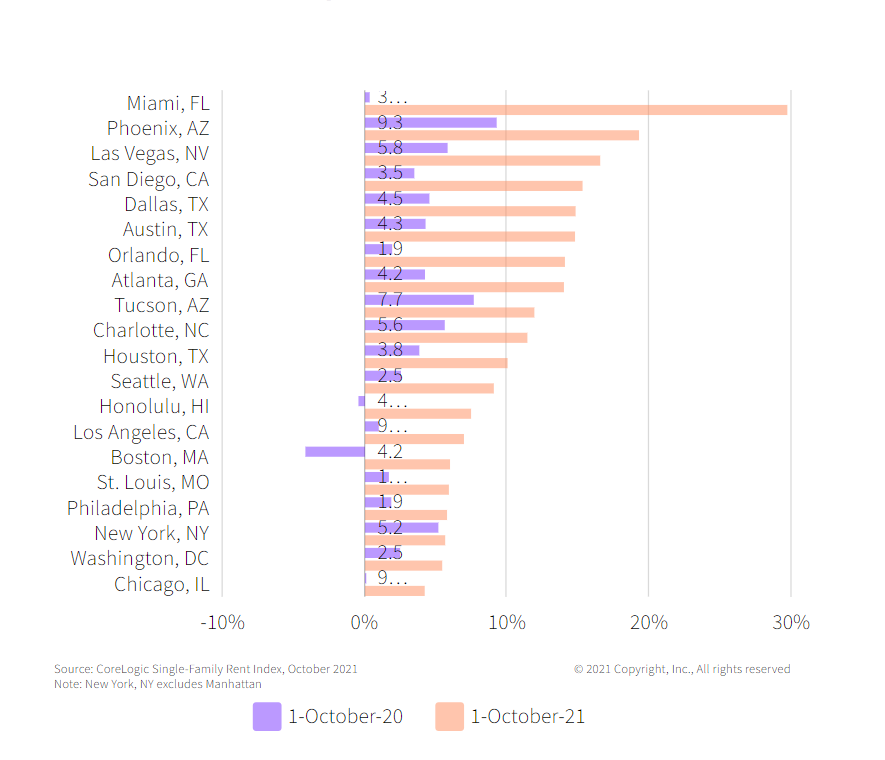

Metro-Level Results

Figure 3 shows the year-over-year change in the rental index for 20 large metropolitan areas in October 2021. Among the 20 metro areas shown, Miami, with an increase of 29.7%, stood out with the highest year-over-year rent growth in October, followed by Phoenix at 19.3%. Chicago had the lowest increase at 4.2%, and Boston (+6%) showed significant improvement from a year ago when rents decreased 4.2%. All 20 metros shown in Figure 3 had higher rent growth than a year earlier.

Figure 3: Single-Family Rent Index Year-Over-Year Percent Change in 20 Markets

Single-family rent growth hit its sixth consecutive record high in October 2021, mirroring record price increases in the for-sale housing market. Annual rent growth in October 2020 had already recovered from pre-pandemic lows, and annual rent growth this October was more than three times that of a year earlier. Rent growth should continue to be robust in the near term, especially as the labor market continues to improve.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.