With the holiday season now closed and US Transact data available through December 24, we look back on December holiday spend to examine key trends by region, subindustry, and channel.

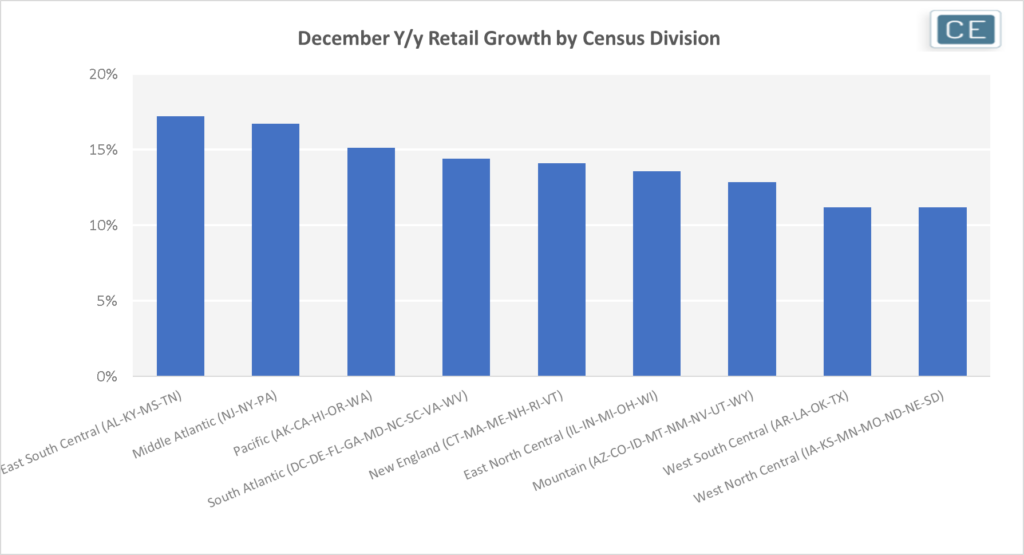

US NAICS Retail spend was up double digits year-over-year across all census divisions for the pre-Christmas December shopping period. The strongest growth was in the East South Central and Middle Atlantic divisions at 17.2% and 16.7%, respectively. The West North Central and West South Central divisions had the weakest growth, still at 11.2% each.

Census Division Spend Growth

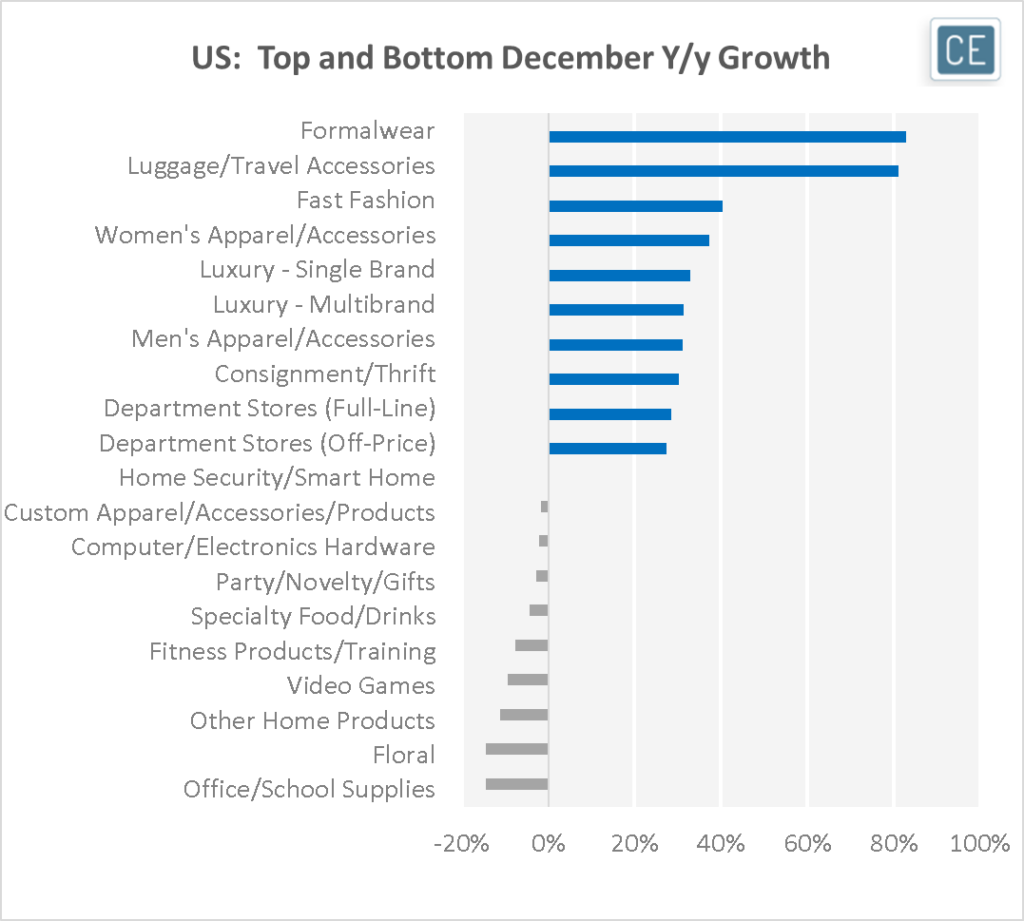

With more businesses and entertainment venues open versus last year, giving Americans more reasons to go out, subindustries selling clothing saw the largest growth in the December holiday season. Formalwear was especially strong at 82.9% year-over-year growth, but in general nine of the top ten fastest growing subindustries sell apparel. Luggage was the one other high growth subindustry, also with a tailwind from consumers venturing away from their homes. In contrast, the biggest declines in spend came from subindustries that cater to self-entertainment or working at home – Office Supplies, Other Home Products, Video Games, and Fitness Products/Training.

**

Subindustry Spend Growth**

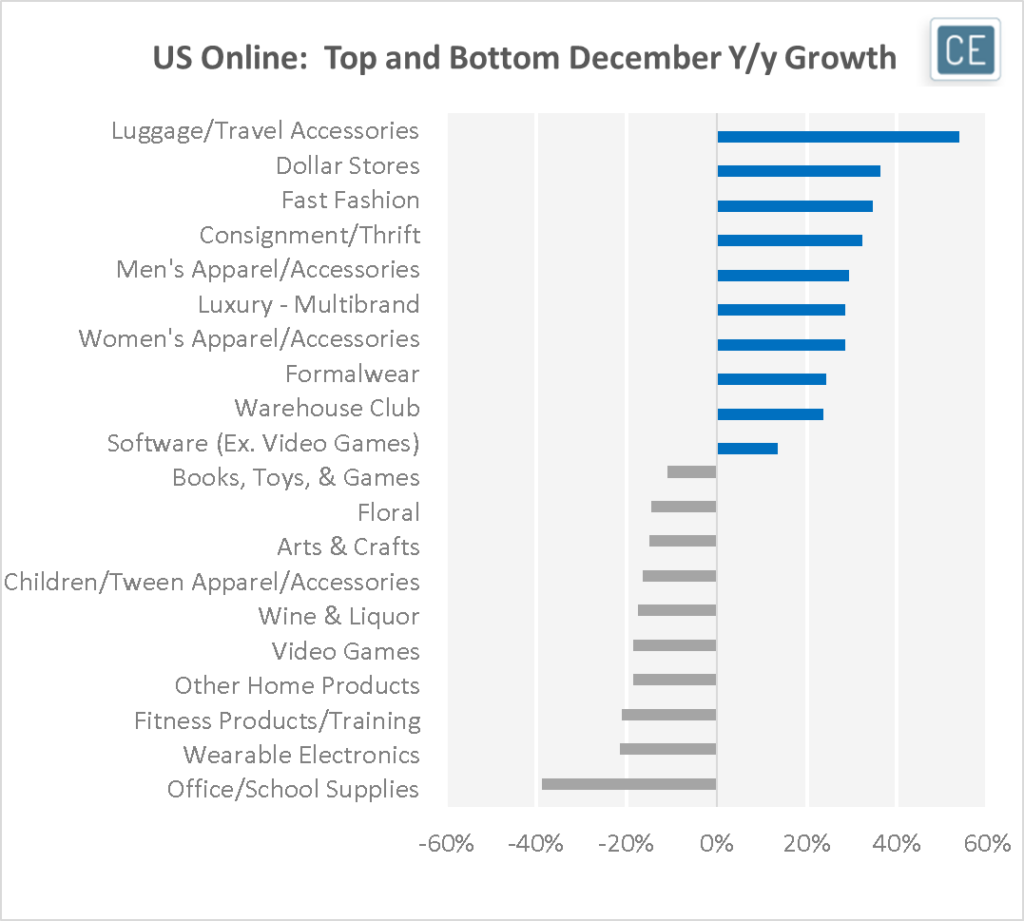

Channel shifts were also an important theme this holiday season, and the subindustries showing the highest and lowest growth online did have some interesting deviations from the combined channel trends. Although Luggage was still a top-growth online subindustry, in general online growth seemed to favor value outlets such as Dollar Stores, Fast Fashion, and Consignment/Thrift stores. Among the categories that saw the largest declines in December holiday spend online but not overall were Wearable Electronics, Wine & Liquor, and Children/Tween Apparel /Accessories.

**

Online Subindustry Spend Growth**

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.