Home Price Index Highlights: November 2021

Overall HPI Growth

National home prices increased 18.1% year over year in November 2021, according to the latest CoreLogic Home Price Index (HPI®) Report . The November 2021 HPI gain was up from the November 2020 gain of 8.1% and was the highest 12-month growth in the U.S. index since the series began in 1976. The increase in home prices was fueled by low mortgage rates, low for-sale supply and an influx in homebuying activity from investors. Projected increases in for-sale supply and moderation in demand as prices grow out of reach for some buyers could slow home price gains over the next 12 months.

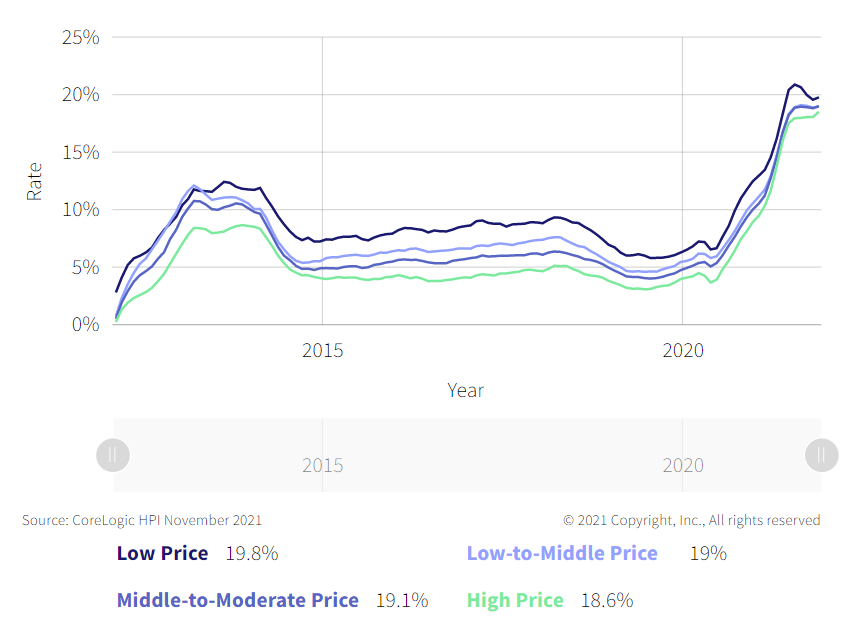

HPI Growth by Price and Property Type Tiers

CoreLogic analyzes four individual home-price tiers that are calculated relative to the median national home sale price. Home price growth remained at a high level for all four price tiers in November. The lowest price tier increased 19.8% year over year in November 2021, compared with 19% for the low- to middle-price tier, 19.1% for the middle- to moderate-price tier, and 18.6% for the high-price tier.

CoreLogic also provides the HPI separately for detached — or freestanding — properties and attached -properties (such as condos or townhouses). Appreciation for detached properties (19.4%) was 1.4 times that of attached properties (13.6%) in November. The gap in HPI growth between detached and attached properties widened after the pandemic began as remote work allowed many employees to buy homes further from their office and in areas where property prices and population density are lower and detached housing is more common. This gap has narrowed since the spring of 2021 and in November was the smallest in ten months.

Figure 1: Home Prices Accelerate at All Price Levels

Year-Over-Year Change in HPI by Price Tier

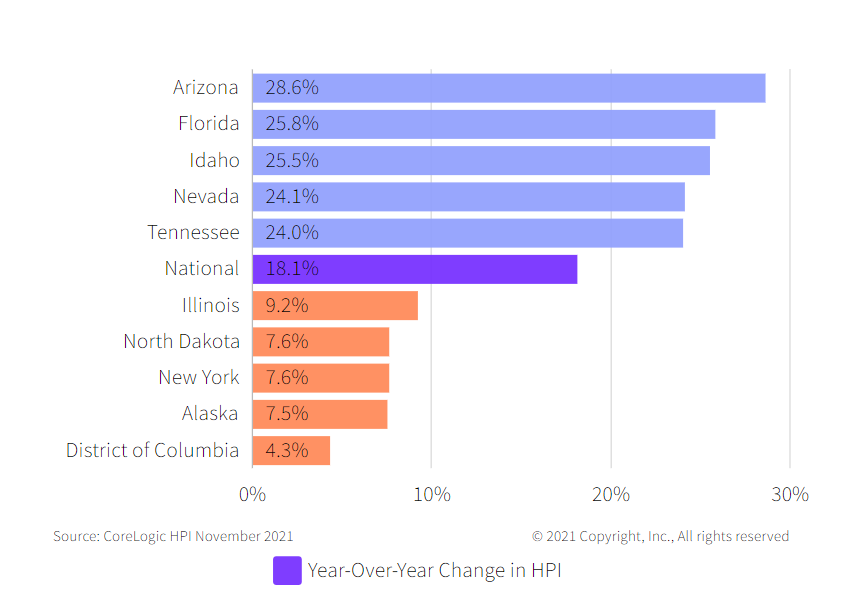

State-Level Results

Figure 2 shows the year-over-year HPI growth in November 2021 for the 5 highest- and lowest-appreciating states. While all states showed annual increases in HPI in November, appreciation was strongest in Arizona, with appreciation of 28.6%, followed by Florida (+25.8%) and Idaho (+25.5%). At the low end, Washington, D.C., saw home prices increase 4.2%, and home prices in Alaska increased 7.5%. Population growth in some states added to homebuying demand in 2021, pushing up home prices. Arizona, Florida, Idaho and Nevada were all in the top 10 for percentage increase in population growth in 2021.

The surge in home price appreciation was felt across the country, with most states showing higher appreciation in November 2021 than in November 2020. Florida had the biggest acceleration in home price growth from November 2020 (+7.7%) to November 2021 (+25.8%). Washington, D.C. saw a slowdown in appreciation with prices increasing 4.2% in November 2021 compared with 6.2% in November 2020.

The U.S. housing market had a record-breaking year in 2021, with annual price appreciation reaching the highest level recorded in the 45-year history of the index. For current homeowners, home price increases led to record levels of home equity, but for potential buyers, appreciation posed affordability challenges. Though home price growth remains at historic highs, it is projected to slow over the next year. However, economic growth and inflation will most likely lead to increases in mortgage rates, which will further erode affordability.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.