Though Fish and Chips may be a British staple, fast food popularity in the UK is quite diverse overall. In today’s Insight Flash, we take advantage of our newly launched CE Transact UK Cohort data to analyze where Brits go for a quick bite. We dig into which chains are the most popular in which countries, which pizza chains have seen the highest return behavior, and what cross-shop looks like across burger brands.

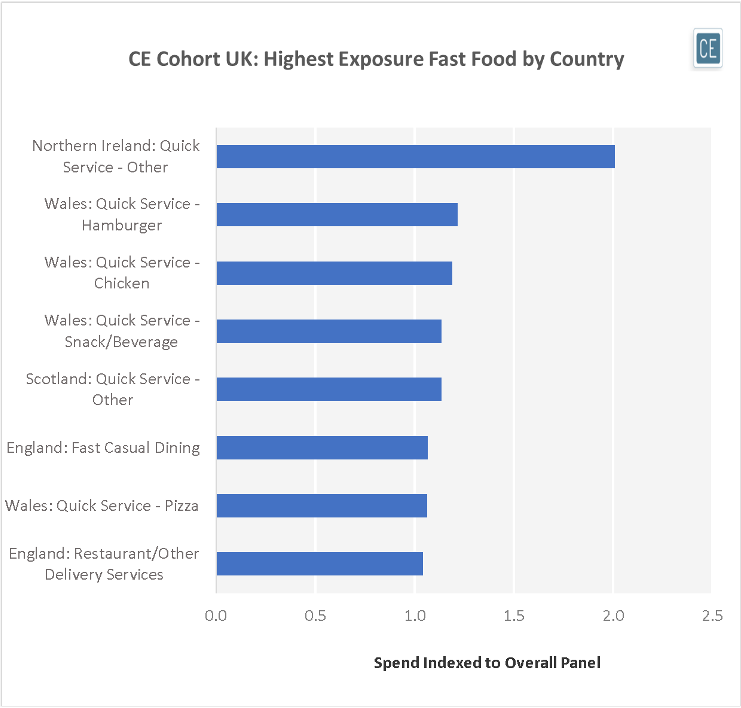

The UK Cohort data allows users to cut spend by cardholder geography, seeing which chains receive disproportionate spend from which country’s residents. In the case of Limited-Service restaurants, the popularity of Tim Hortons in Northern Ireland means that this country’s residents spend twice as large a percentage of their dollars at “Other” Limited-Service restaurants as does the UK overall. In Wales, Hamburger fast food restaurants are 1.22x more popular than in the rest of the UK and Chicken restaurants are 1.19x more popular. The Scottish show similar, though less dramatic, preferences to the Northern Irish and are 1.13x as likely to spend at Other Quick Service restaurants. England’s tastes are more expensive, skewing towards higher-end Fast Casual Dining and delivery services.

Geo Exposure

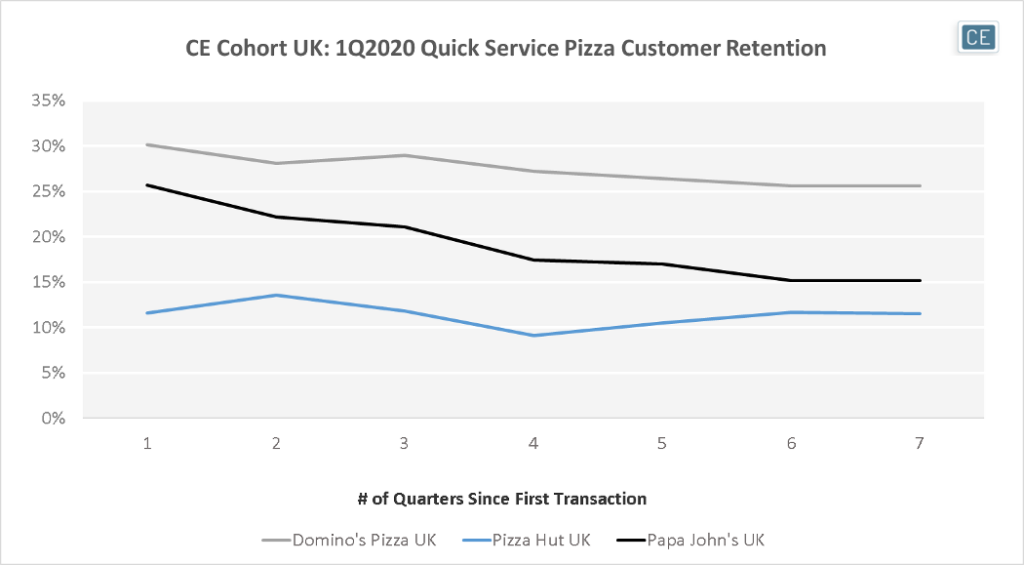

Digging deeper to compare across chains, CE Cohort UK also allows for understanding customer repeat purchase behavior. For instance, users can see if those who turned to pizza parlors at the beginning of the pandemic continued purchasing as restaurants re-opened. Among those who first ordered from each pizza chain in calendar 1Q2020, 30% ordered from Domino’s one quarter later, versus 26% for Papa John’s and only 12% for Pizza Hut. By the most recent quarter 4Q2021, Pizza Hut hadn’t shown any additional loss in return customers, but Domino’s had slipped to only 26% returning and Papa John’s had dropped to 15%.

Retention

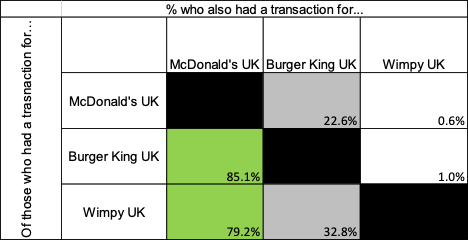

Although return purchasing is one measure of loyalty, cross-shop is another important measure. How likely are your customers to visit competitors versus staying loyal to your brand? Among UK burger brands, McDonald’s does seem to have the strongest foothold. 85% of Brits who purchased at Burger King in the last six months also spent their pounds at McDonald’s, and 79% of those who purchased at Wimpy did. Of McDonald’s customers, however, only 23% made a purchase at Burger King and less than 1% made a purchase at Wimpy. While McDonald’s does have an advantage with far more locations in the UK, higher cross-shop rates between Burger King and Wimpy imply that loyalty isn’t as strong even when footprint is taken into account.

Cross-Shop

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.