According to its most recent earnings call, profitability remains a long-term goal for Blue Apron (NYSE: APRN). The meal kit pioneer has faced increased competition from other meal kit companies in recent years. Additionally, the industry has seen challenges related to seasonal demand and high operational and marketing costs. But how does Blue Apron measure up against other meal kit competitors? We looked at a few of the major meal kit companies—including Blue Apron, HelloFresh, Home Chef, Marley Spoon, and Sunbasket—to see how market share, customer retention, and quarterly transactions per customer compare within the industry as of the end of 2021.

Appetite for HelloFresh has grown compared to other meal kit companies

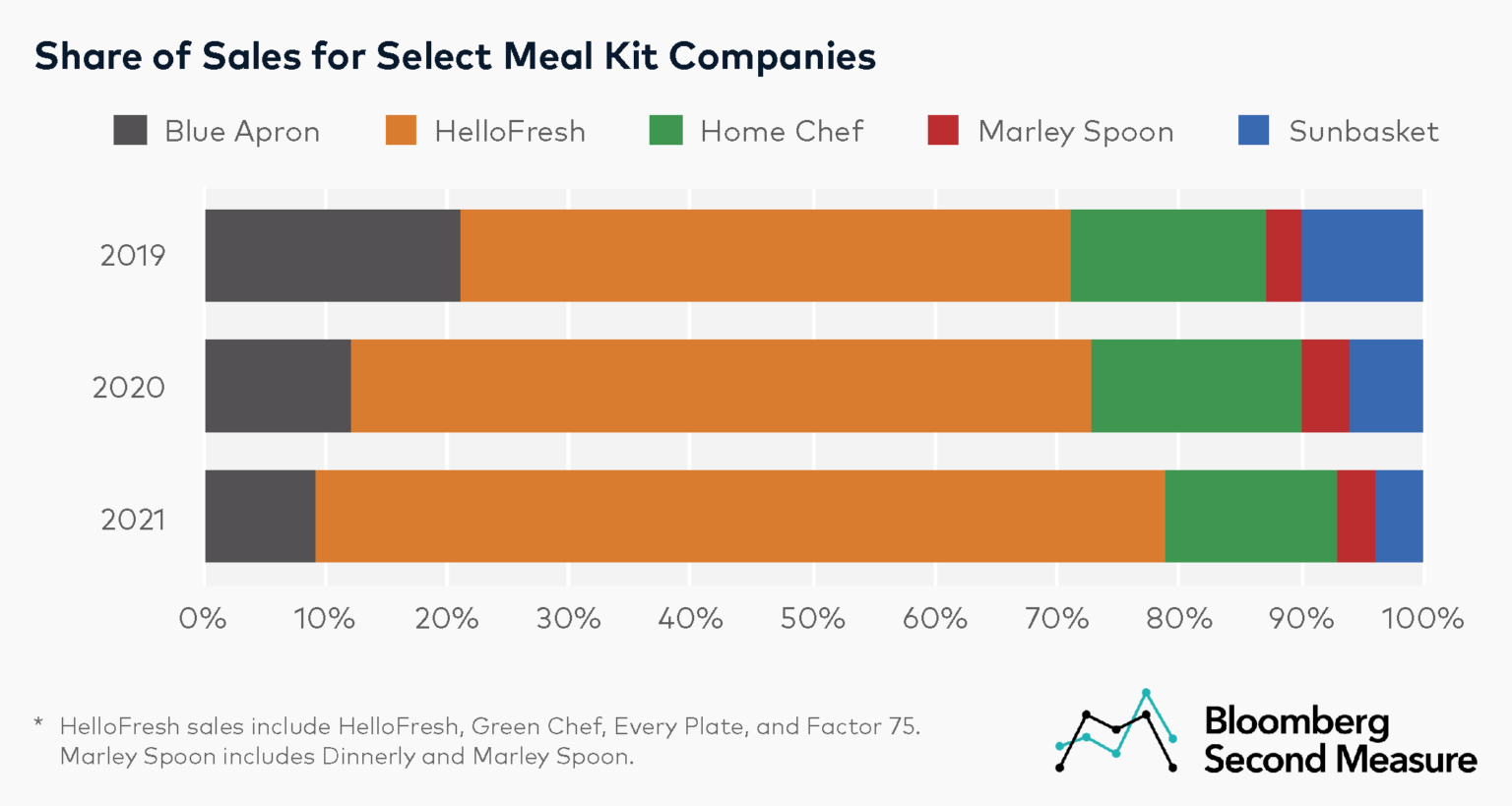

Among these meal kit competitors, market share decreased for Blue Apron, Sunbasket and Home Chef between 2019 and 2021. In 2019, Blue Apron held 21 percent of sales, a share that decreased to 9 percent in 2021. Similarly, Sunbasket’s market share declined from 10 percent in 2019 to 4 percent in 2021. For Home Chef, which is owned by grocery giant Kroger (NYSE: KR), market share dipped from 16 percent to 14 percent in the same time frame. However, its share of sales surpassed Blue Apron’s in 2020. Market share for Marley Spoon Inc, which consists of Marley Spoon and Dinnerly, remained flat in 2019 and 2021, accounting for 3 percent of meal kit market share.

On the other hand, HelloFresh has been eating up meal kit market share. HelloFresh had sizzling sales in the early months of COVID-19, as consumers turned to subscription services to fill basic needs. While some of these meal kit companies—Home Chef, Marley Spoon, and HelloFresh—experienced rising sales between 2019 and 2021, HelloFresh’s sales growth outpaced its competitors, which contributed to its increased market share. HelloFresh’s increasing market share may also be attributed to its acquisitions of smaller meal kit companies, such as Green Chef in 2018 and Factor 75 in 2020, and the launch of EveryPlate in 2018 as a lower cost alternative. HelloFresh and these subsidiaries accounted for half of meal kit sales among the analyzed competitors in 2019, growing its meal kit market share to 69 percent in 2021. Notably, Bloomberg Second Measure data only includes U.S. sales through each company’s own website.

Transactions per customer at meal kit companies are increasing compared to pre-pandemic levels

All meal kit companies in our analysis offer weekly deliveries of fresh ingredients and recipes chosen by the customer. Consumers have the option to pause and resume shipments as they wish, and they are only charged per delivery.

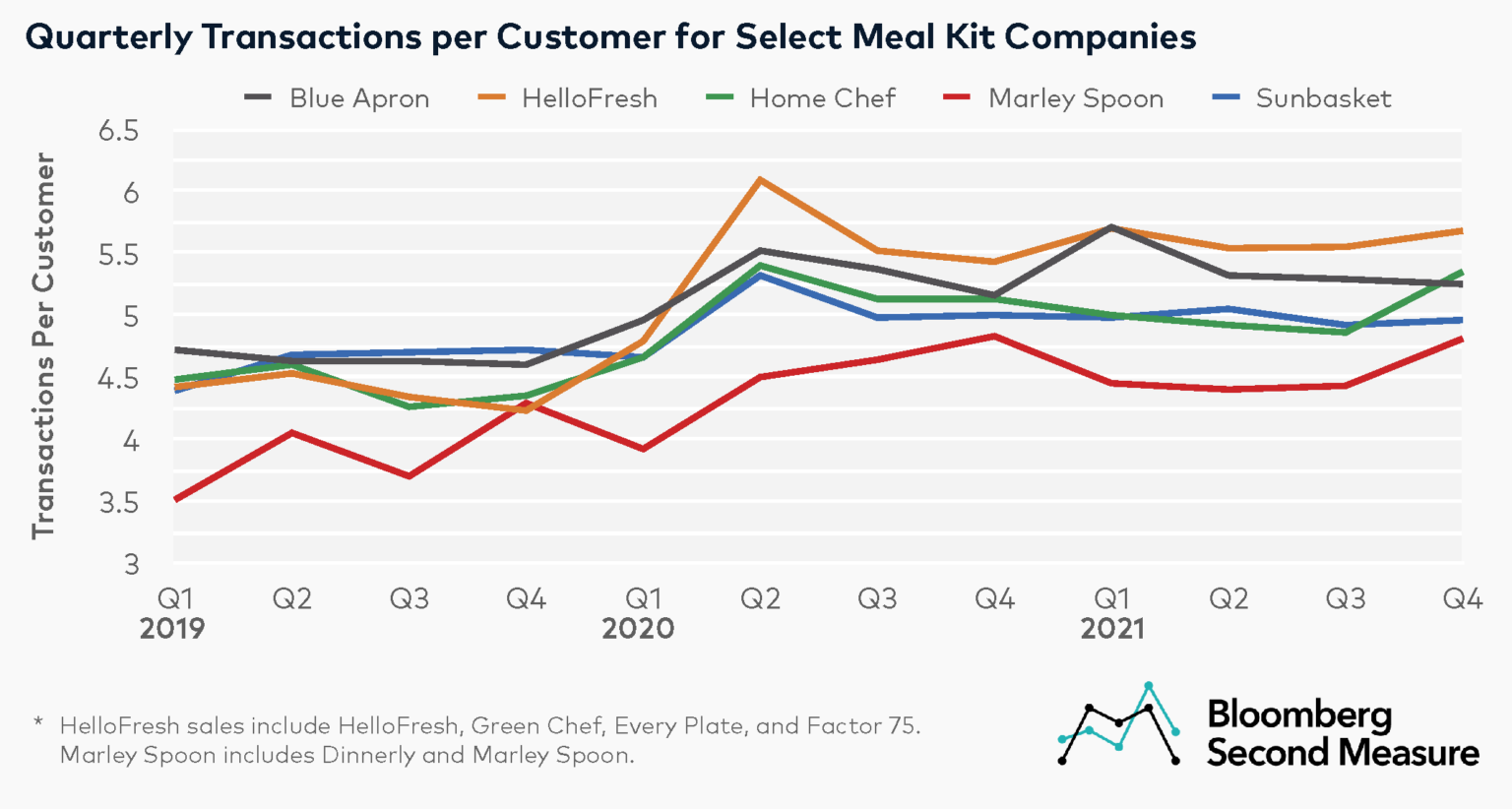

Our data shows that quarterly transactions per customer at these meal kit companies have grown over the past two years. Compared to the same quarter in 2019, the average transactions per customer in Q4 2021 increased 14 percent for Blue Apron, 34 percent for HelloFresh, and 23 percent for Home Chef.

Customers at HelloFresh transact the most frequently in a given quarter, compared to customers at the other analyzed meal kit companies. In the fourth quarter of 2021, customers at HelloFresh and its subsidiaries made an average of 5.7 transactions. Home Chef earned second place, with an average of 5.4 transactions, followed by Blue Apron with 5.3 transactions. Marley Spoon customers made the fewest purchases, with an average of 4.8 transactions in Q4 2021.

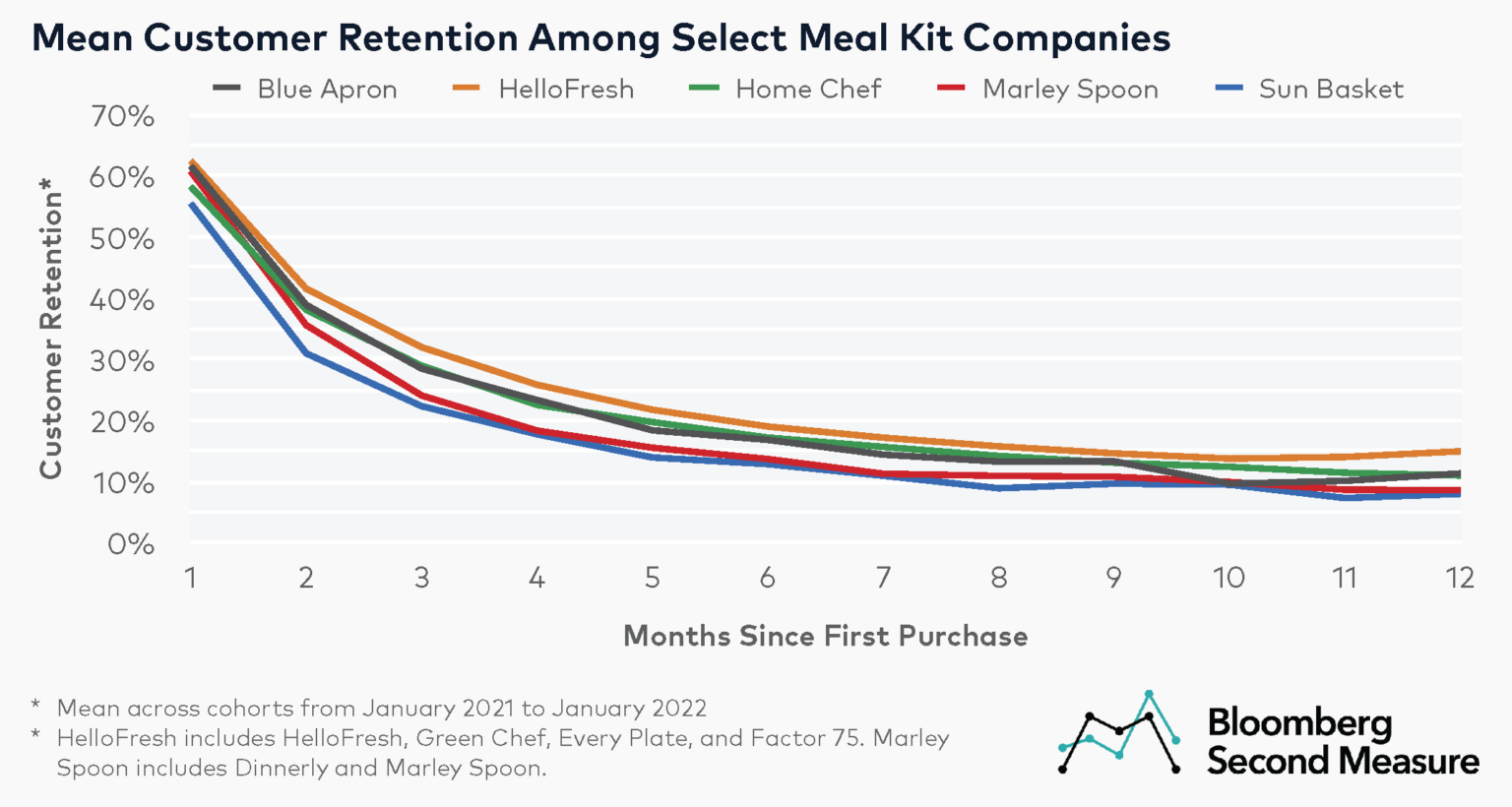

Many meal kit customers still aren’t coming back for seconds

Customer retention continues to be a challenge for meal kit companies. Consumers may be enticed to sign up for a meal kit with a discount or during a promotional period, but most do not stay long-term. Among cohorts who made their initial purchase in 2021, 62 percent of customers at Blue Apron and HelloFresh made another purchase the following month. After 12 months, average customer retention at HelloFresh was 15 percent, compared to 11 percent at Blue Apron and Home Chef. Sunbasket had the lowest average customer retention, with only 8 percent of customers returning after 12 months.

Some meal kit companies have been launching non-subscription options. For example, Blue Apron customer retention may be affected by its option to purchase meal kits without a subscription. In addition, most of the companies in the analysis offer gift cards. These transactions are observed at the time of purchase, but purchases made with gift cards are not captured in Bloomberg Second Measure data.

Meal kits are experimenting with new products to find the recipe for success

Some of these meal kit companies have experimented with other offerings and partnerships. For example, Blue Apron launched a wine club in 2015. HelloFresh also offered a wine club starting in 2017, but has since discontinued it. Several of these meal kit companies, including Blue Apron and Sunbasket, have also launched their own “heat-and-eat” meals that require little to no prep. Interestingly, grocery delivery services like Instacart and GoPuff have also branched out to ready-to-eat meals as an alternative to third-party food delivery companies like DoorDash and Uber Eats.

More recently, Blue Apron partnered with Panasonic to sell the electronic company’s new four-in-one countertop oven, along with specific recipes using the appliance. Other strategies that Blue Apron has launched include partnering with the meditation app Calm to offer a free 3-month subscription with the purchase of a third Blue Apron box, as well as partnerships with Disney to offer menu items tied to new movie releases. As these promotions and partnerships suggest, meal kit companies are continuing to search for the right mix of ingredients that will draw–and ultimately keep–customers.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.