Happy Valentine’s Day from Consumer Edge! In light of the recent holiday, today’s Insight Flash provides a sneak peak of our new CE Transact UK Cohort data to analyze similarities and differences in how Americans and Brits find love online. We dig into which daters spend more on app bonus features, how many return to spend on the app when their dates are unsuccessful, and what cross-shop looks like in the US and across the pond in the UK. Although payment card data isn’t capturing iOS app store spend, this analysis at least allows for comparison of these services among a similar group of shoppers buying through the websites or other app stores.

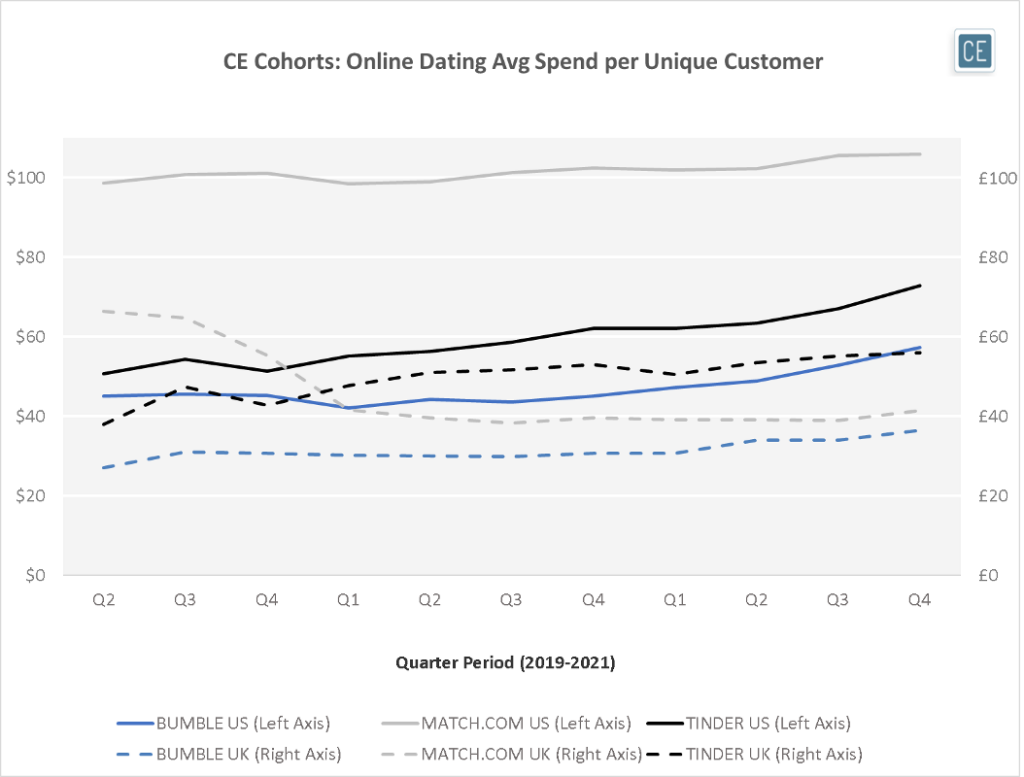

One feature of the new cohort data is that it allows users to look at trends for individuals spending money directly on the apps. In the US, Match.com users who pay for the service spend more per user per quarter than users of Bumble or Tinder. In contrast, in the UK Tinder garners the highest spend per user. Across the geographies, even taking currency conversion into account, US daters seem more likely to think they can buy love than UK daters. They spend more per quarter on Match.com and Bumble, but about the same amount on Tinder.

ARPU (excludes iOS)

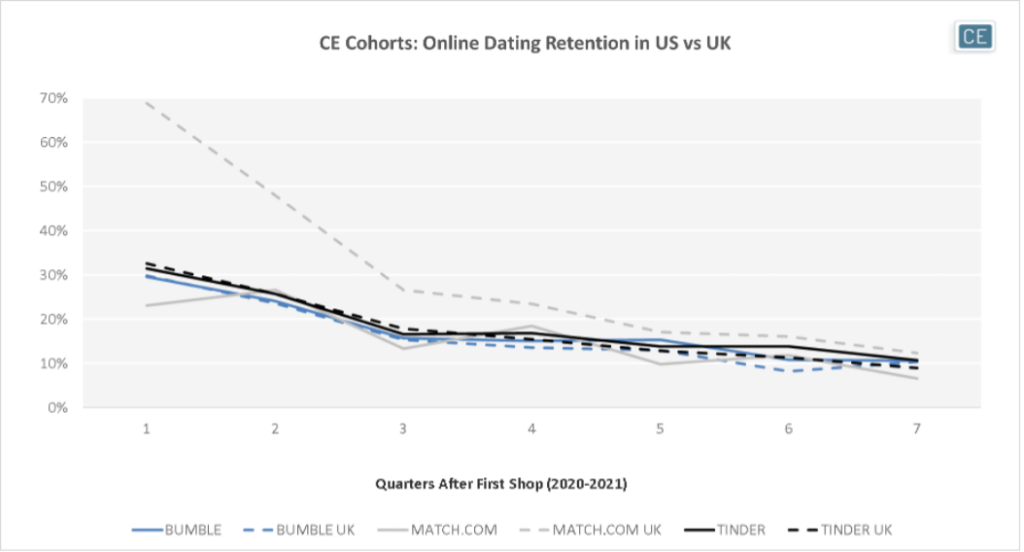

One interesting dynamic in the online dating business is that if you’re successful, you customers are actually less likely to come back after having found love. Still, it is interesting to compare repeat purchase behavior across geographies. A plan option involving a monthly payment with a long commitment makes Match.com UK customers tied into the site with a 69% return rate one quarter after their first payment. However, even after the year lapses, Match.com UK still has the highest longer-term retention in any geography across our tracked set at 12% seven quarters after the first purchase. Whether this means Match.com UK is more or less successful is up for debate, but it is interesting to note that Match.com US actually has the lowest longer-term retention rate at 6.6%.

Retention (excludes iOS)

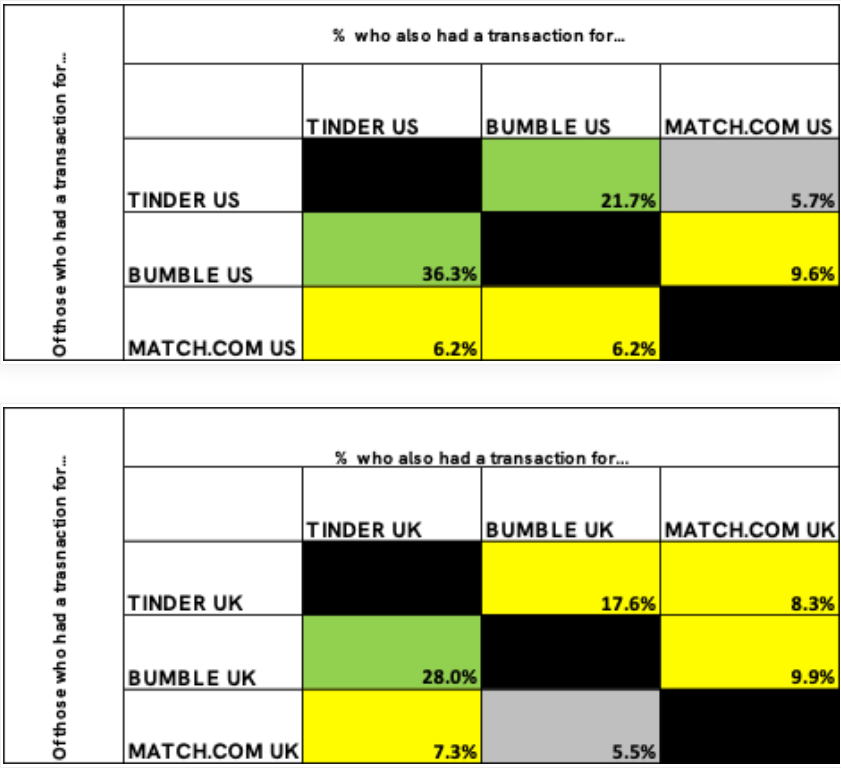

In order to avoid looking for love in all the wrong places, dating app users in the US and UK often try as many places as possible. In both the US and the UK, those who pay for Bumble are also likely to pay for Tinder. 36.3% of those who paid for Bumble in the US last year also paid for Tinder, and 28.0% of those who paid for Bumble in the UK last year also paid for Tinder. However, while the reverse is true in the US, where 21.7% of those who pay for Tinder have also paid for Bumble, it is not so in the UK. Only 17.6% of those who pay for Tinder in the UK also pay for Bumble. Those who have invested the time in a Match.com profile tend to be less likely to try their hand at other dating sites.

Cross-Shop (excludes iOS)

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.