An unexpected side effect of the pandemic has been the extraordinary rise in home prices during 2021. That has increased the need for jumbo loans — mortgage loans that exceed the loan limits of Fannie Mae and Freddie Mac.

When mortgage rates dropped at the onset of the pandemic in 2020, the effects were felt immediately in the market for conforming loans — mortgages that can be packaged into federally backed mortgage securities. Mortgage rates on jumbo loans were slower to come down and reached an all-time low during 2021. Analysis of CoreLogic public records showed that 2021 had the largest dollar volume of jumbo loan originations since 2005 due to record-low jumbo interest rates and ever higher home values.

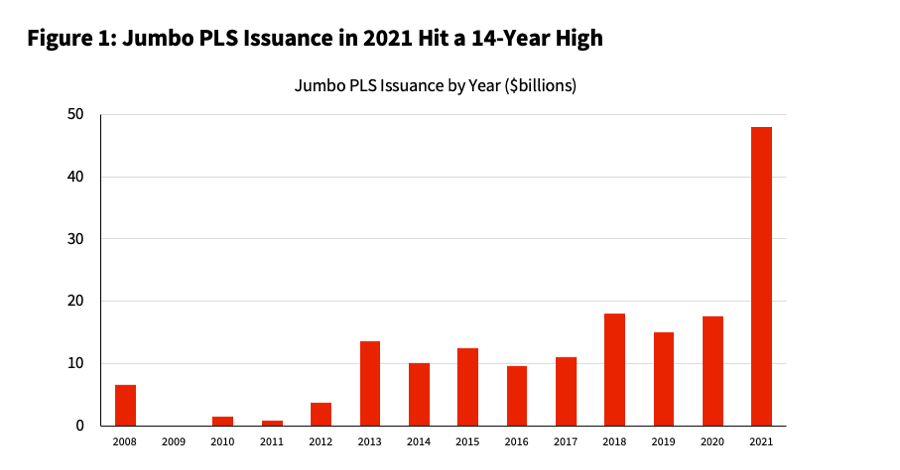

While many jumbo loans are held in bank portfolios, some are placed in private-label securities. Jumbo loan securitization more than doubled in 2021 from the prior year and was the largest issuance since 2007.

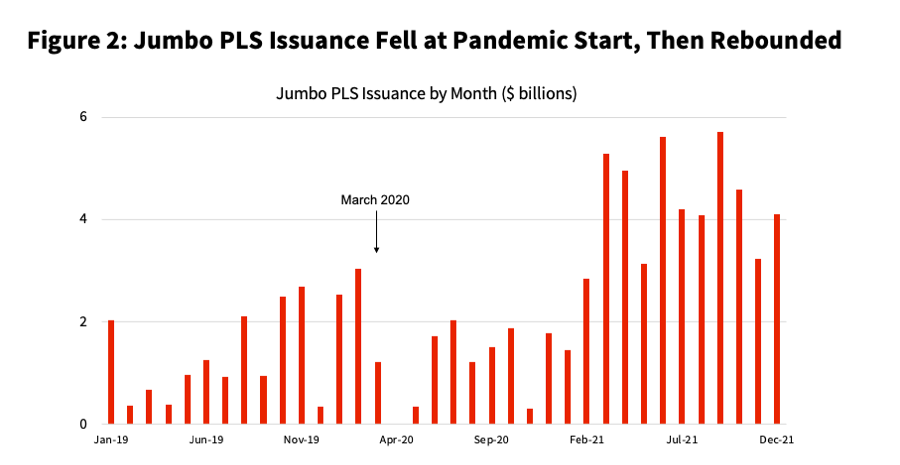

The resurgence in jumbo securitization is noteworthy given the temporary dearth of issuance when the pandemic began. Issuance dried up in April 2020, and May of that year saw only about one-tenth of February’s volume. Volume picked up starting in the summer of 2020 before taking off in 2021.

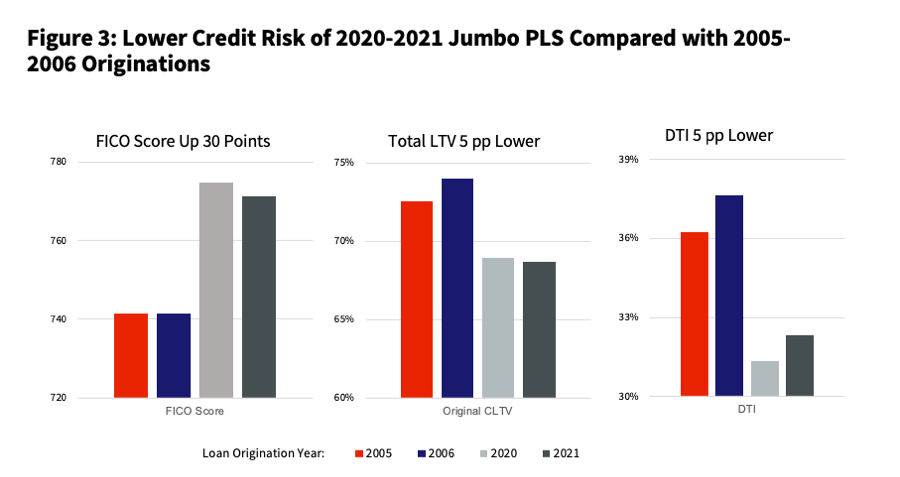

Credit quality of the jumbo loans packaged in today’s securities is far higher than those that were securitized during the housing bubble of 2005 and 2006. When compared to housing bubble borrowers, borrowers whose jumbo loan was securitized in 2021 had, on average, a credit score that was 30 points higher and a loan-to-value ratio and a debt-to-income ratio that were each 5 percentage points lower.

We expect jumbo loan originations and securitization in 2022 to be less than last year for three reasons.

First, the conforming loan limit was raised 18% at the start of 2022, shrinking the jumbo loan market. Second, the CoreLogic Home Price Index Forecast projects a moderation in price gains during 2022, thus slowing the jumbo market expansion during the year. Finally, higher mortgage rates in 2022 will reduce jumbo refinance.

Summary:

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.