Key takeaways:

SBUX average ticket growth surged, transactions normalized

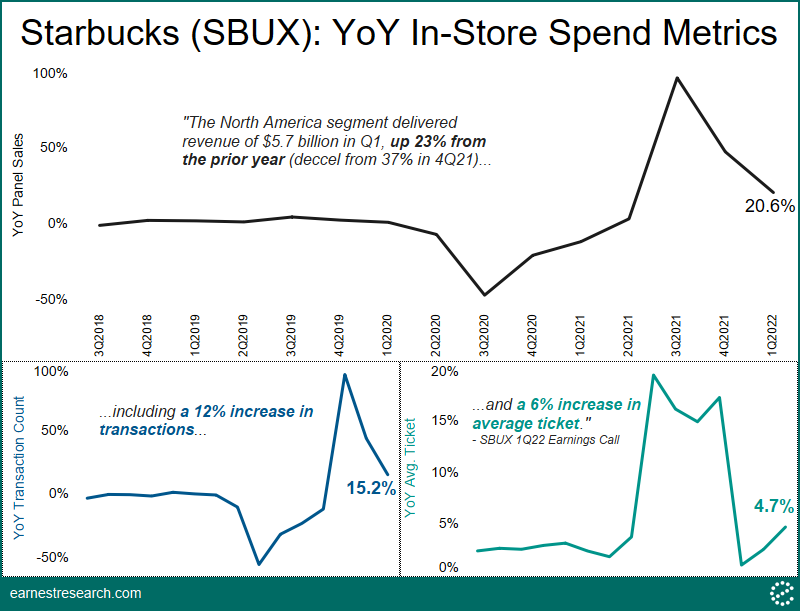

Starbucks North American revenue grew 23% YoY in 1Q22 on a 12% YoY increase in transactions and a 6% YoY increase in average ticket, directionally consistent with Earnest Research transaction data. Transaction growth continued to normalize, while average ticket growth accelerated above pre-pandemic levels as the company raised prices in October to adjust for inflation.

My Starbucks Rewards spending grew, non-loyalists returned

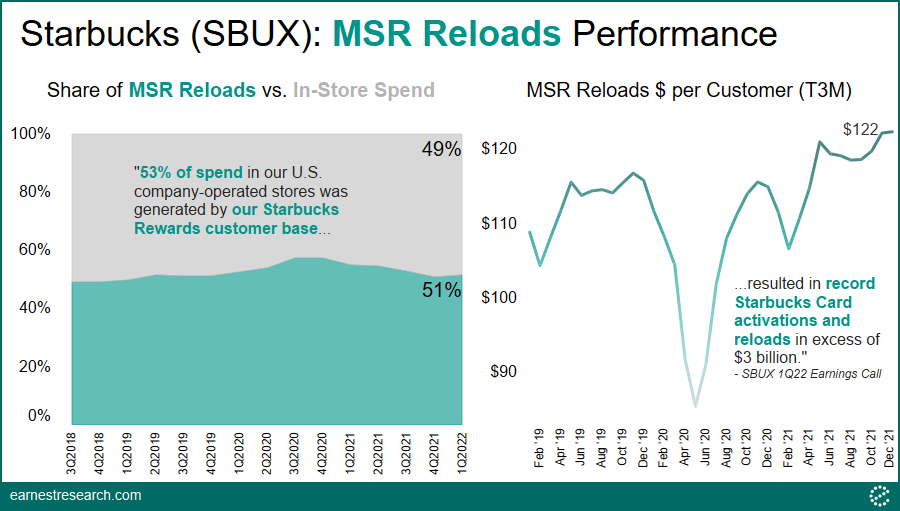

Management cited record Starbucks Card activations and reloads during 1Q22—with reloads per customer up 5% from their pre-COVID peak—which is corroborated by our transaction data. Earnest Research transaction data also closely tracked My Starbucks Rewards (MSR) spending mix spend in the quarter (Earnest 51% vs 53% reported).

Loyalty program spend as a percent of total spend continued to revert to pre-pandemic levels, down from nearly 60% during the peak of quarantine shut-downs in 2020. The gradual recovery shows that non-MSR members are returning to Starbucks, giving the company an opportunity to broaden adoption. Loyalty programs like MSR will likely be key in the post-pandemic world as QSR restaurants look to increase their share of wallet amid shifting work and eating patterns.

My Starbucks Rewards (MSR) members spend more

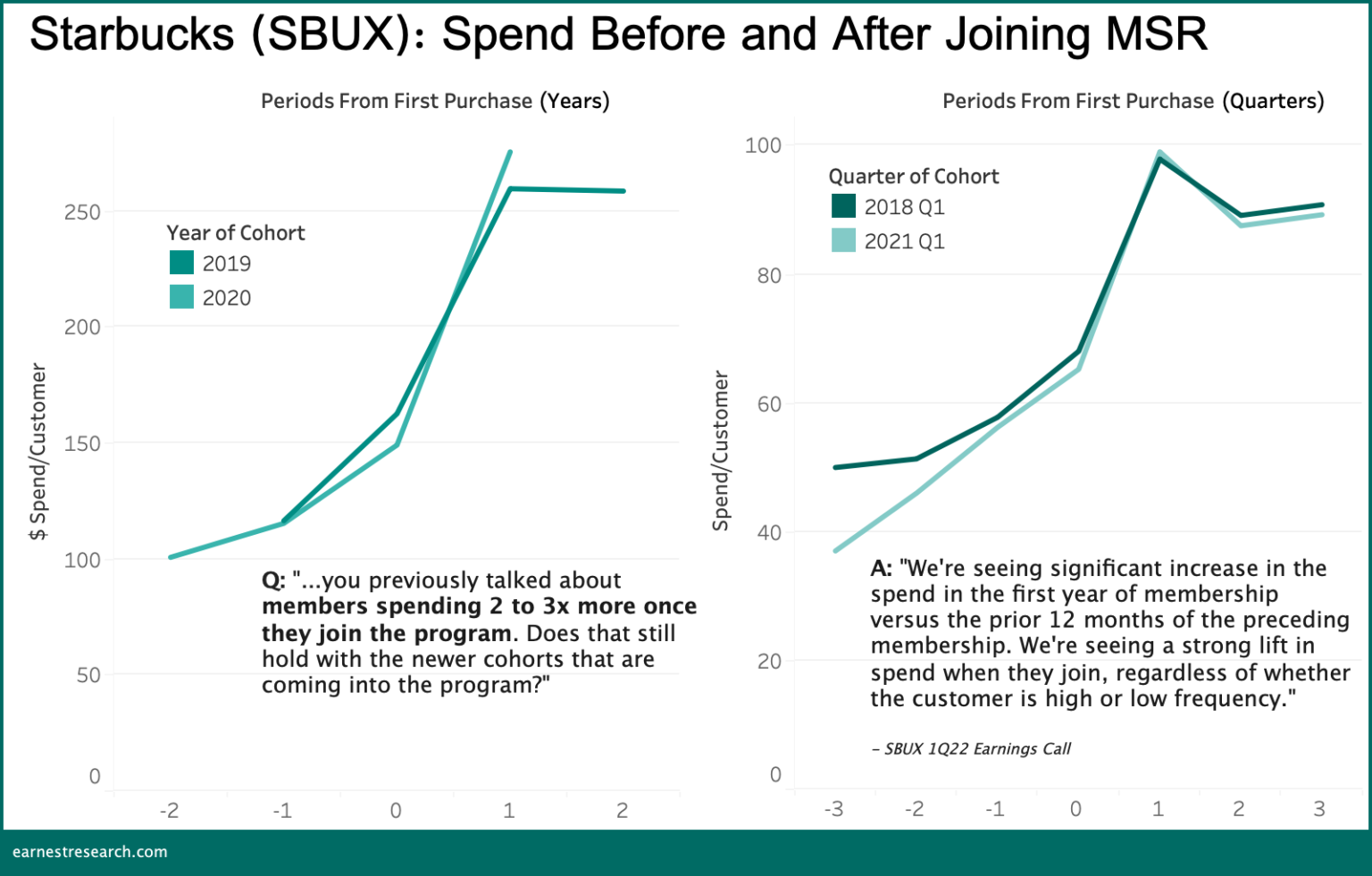

Starbucks management reiterated that the company sees 2-3x lift in spend when customers join the MSR program. A study of cohorts of Earnest Research Consistent Shoppers who joined the MSR program showed that panelist behavior was consistent with management’s claim between 2018-2021.

Cohorts (defined by their first year in the program) more than doubled their spend at Starbucks, from $110 in the year prior to joining MSR to over $250 in the year after joining. Cohorts (defined by their first quarter in the program) also nearly doubled their spend from $55 in the quarter prior to joining to about $100 in the quarter after. Furthermore, in the run-up to joining the program, customers tended to slowly increase their spend at Starbucks before ultimately joining MSR. The spend growth accelerated once the customer joined MSR. This suggests that while many of these loyal customers would likely have a higher spend at Starbucks anyway, the MSR program is a catalyst for reaching that 2-3x spend figure.

Breakfast at Starbucks is back, but midday is also promising

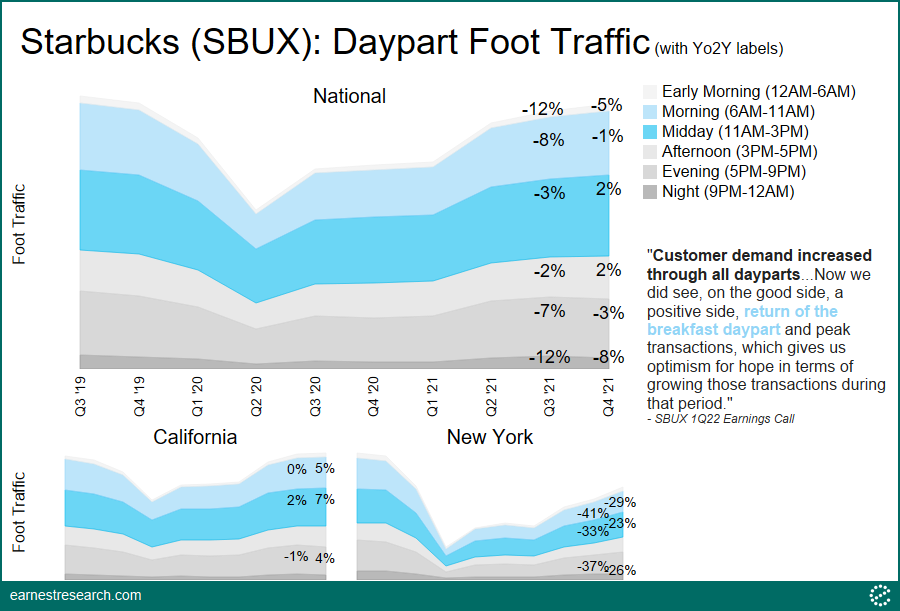

Starbucks management specifically called out the “return of the breakfast daypart” during their 1Q22 earnings call. Earnest Research foot traffic data revealed Starbucks visits between 6am-11am had one of the largest improvements from the quarter ending in October to the quarter ending in December, from -8% to -1% Yo2Y, respectively. Earnest Research data further suggests that Starbucks’ morning traffic was nearly recovered to pre-COVID levels in 1Q22.

The data also revealed that the fastest growing dayparts in 1Q22 were Midday and Afternoon (11-5p), +2% Yo2Y. This later daypart is likely prompting a shakeup of Starbucks’ product lineup to cater to consumers looking for snacks and later-in-day non-coffee alternatives.

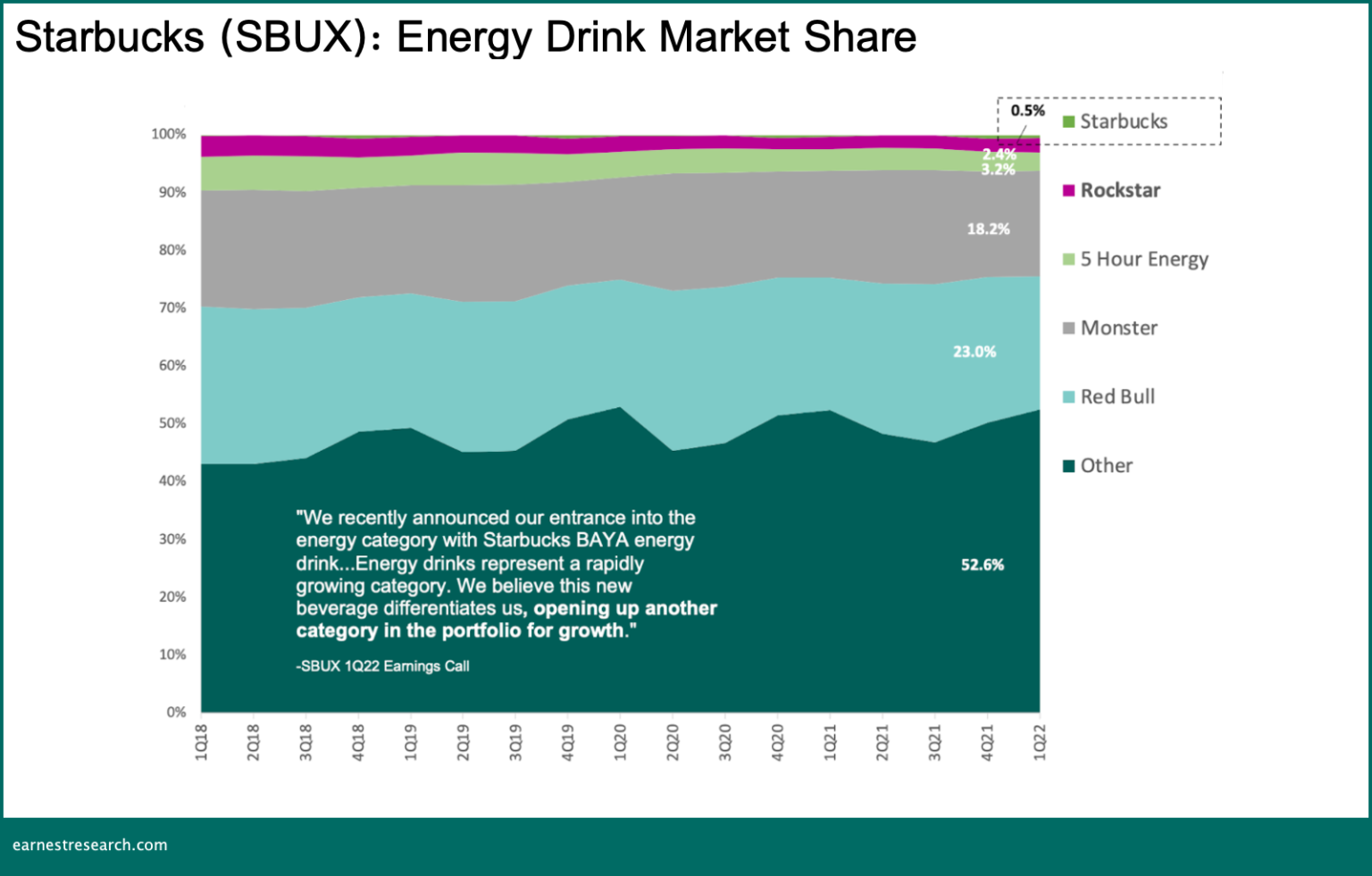

Starbucks’ new energy drink BAYA has room to grow

Starbucks recently introduced BAYA energy drinks as part of their plan to break into the growing energy drink market. Earnest Research Scanner data, which measures transactions from in-store point-of-sale systems across major US grocery and drugstore chains, tracks this product’s performance. Starbucks controlled 0.5% of the fractured energy drink market in 1Q22, lagging behind market leaders Red Bull (23%), Monster (18%), and others. As BAYA rolls out, its adoption could be a broader sign for whether Starbucks products can win share outside of the coffee category.

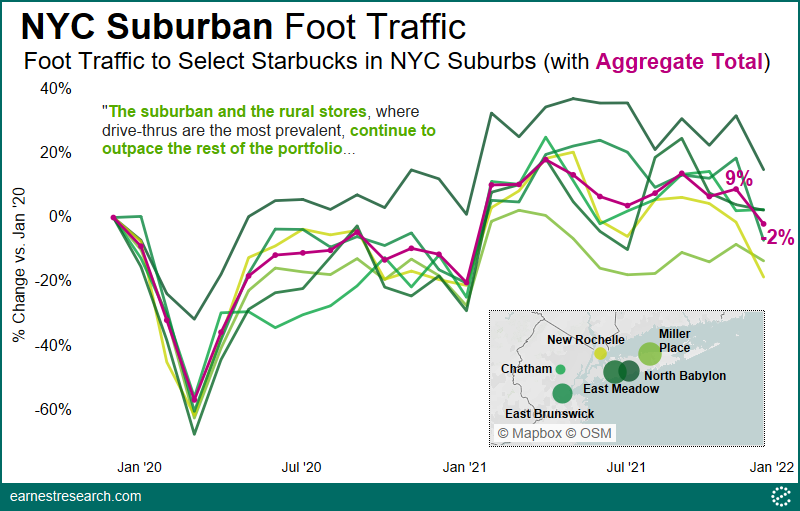

Suburbs meaningfully outperformed urban foot traffic for Starbucks

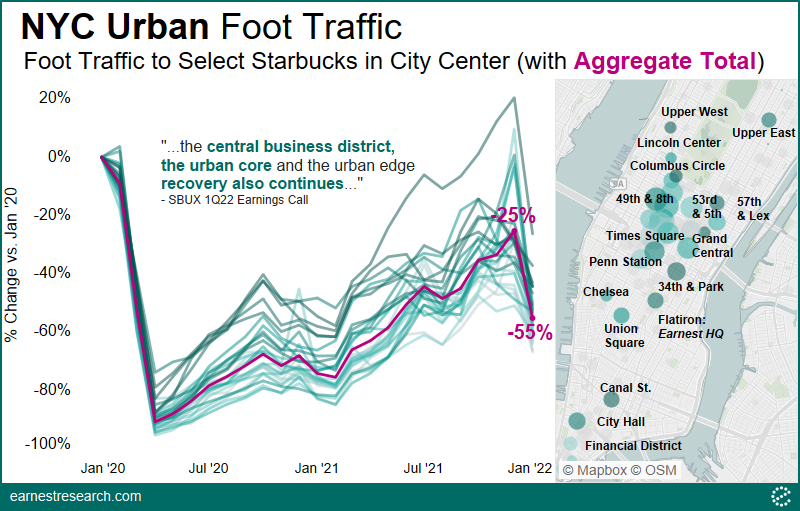

“The suburban and the rural stores, where drive thrus are the most prevalent, continue to outpace the rest of the portfolio,” according to Starbucks management—despite Earnest Research data suggesting some urban recovery pre-Omicron. Earnest Research store level foot traffic data revealed visits to Starbucks in the suburbs of New York City traffic grew 9% above January 2020 levels in December 2021, but fell to -2% in January 2022 as a part of a larger slowdown when the Omicron wave was at its height.”

Conversely, visits to Manhattan Starbucks reached 75% of pre-COVID levels in December 2020, falling below 50%. Like many QSR brands that once relied on commuter activity, Starbucks is planning on expanding focus to new zip codes and dayparts as it adapts to the new work-from-home economy.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.