According to ATTOM’s February 2022 U.S. Foreclosure Market Report, foreclosure filings in February 2022 were up 11 percent from January 2022 and 129 percent from February 2021.

ATTOM’s latest foreclosure activity analysis found there were a total of 25,833 U.S. properties with foreclosure filings reported in February 2022. The report noted that lenders repossessed 2,634 of those properties through completed foreclosures (REOs), down 45 percent from January 2022 but up 70 percent from February 2021. The report also noted that lenders started the foreclosure process on 16,545 of those properties in February 2022, up 40 percent from January 2022 and 176 percent from February 2021.

ATTOM’s latest foreclosure report revealed that nationwide one in every 5,320 housing units had a foreclosure filing in February 2022, while states with the highest foreclosure rates were New Jersey (one in every 2,510 housing units with a foreclosure filing); Illinois (one in every 2,521 housing units); Ohio (one in every 2,801 housing units); South Carolina (one in every 3,001 housing units); and Nevada (one in every 3,112 housing units).

Also according to the report, among metros with a population of at least 200,000, those with the highest foreclosure rates in February 2022 included Cleveland, OH (one in every 1,483 housing units with a foreclosure filing); Atlantic City, NJ (one in every 1,832 housing units); Columbia, SC (one in every 1,890 housing units); Lakeland, FL (one in every 1,983 housing units); and Chicago, IL (one in every 2,058 housing units).

The latest ATTOM report noted that other than Cleveland and Chicago, among metros with a population greater than 1 million, those with the worst foreclosure rates in February 2022 included: Jacksonville, FL (one in every 2,452 housing units); Las Vegas, NV (one in every 2,472 housing units); and Orlando, FL (one in every 2,655 housing).

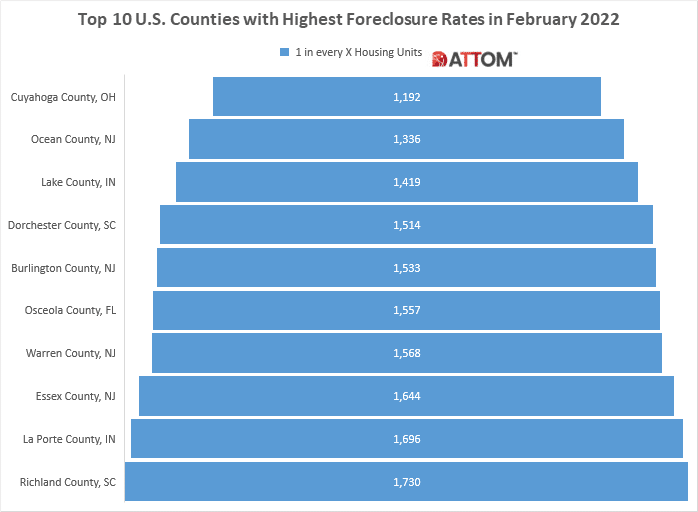

Top 10 Counties with Worst Foreclosure Rates

In this post, we dig deeper into the data behind the ATTOM February 2022 U.S. Foreclosure Market Report to uncover those top U.S. counties with the worst foreclosure rates in February 2022. Among those counties with a population of 100,000 or more, those with the highest foreclosure rates included: Cuyahoga County, OH (one in every 1,192 housing units with a foreclosure filing); Ocean County, NJ (one in every 1,336 housing units); Lake County, IN (one in every 1,419 housing units); Dorchester County, SC (one in every 1,514 housing units); Burlington County, NJ (one in every 1,533 housing units); Osceola County, FL (one in every 1,557 housing units); Warren County, NJ (one in every 1,568 housing units); Essex County, NJ (one in every 1,644 housing units); La Porte County, IN (one in every 1,696 housing units); and Richland County, SC (one in every 1,730 housing units).

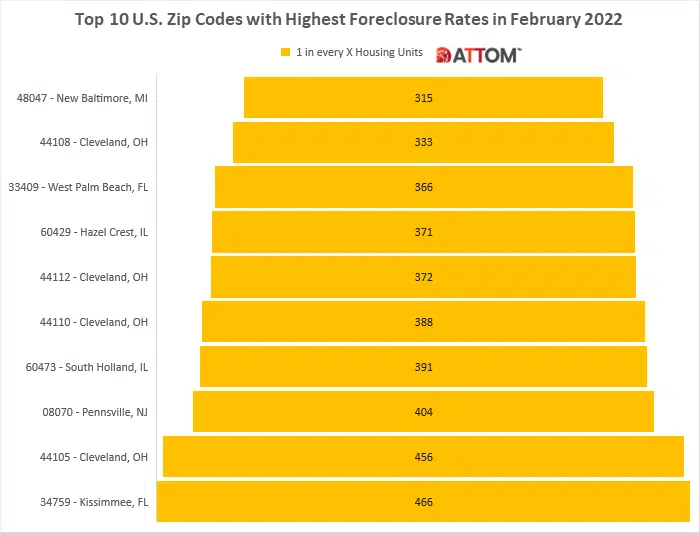

Top 10 ZIPS with Worst Foreclosure Rates

Also, in this post, we dig even deeper into the data behind the ATTOM February 2022 U.S. Foreclosure Market Report to uncover those top U.S. zip codes with the worst foreclosure rates in February 2022. Among those ZIPS with a population of 10,000 or more, those with the highest foreclosure rates included: 48047 in New Baltimore, MI (one in every 315 housing units with a foreclosure filing); 44108 in Cleveland, OH (one in every 333 housing units); 33409 in West Palm Beach, FL (one in every 366 housing units); 60429 in Hazel Crest, IL (one in every 371 housing units); 44112 in Cleveland, OH (one in every 372 housing units); 44110 in Cleveland, OH (one in every 388 housing units); 60473 in South Holland, IL (one in every 391 housing units); 08070 in Pennsville, NJ (one in every 404 housing units); 44105 in Cleveland, OH (one in every 456 housing units); and 34759 in Kissimmee, FL (one in every 466 housing units).

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.