Source: https://www.data.ai/en/insights/mobile-gaming/state-of-mobile-gaming-2022-regional-analysis/

The mobile gaming market surged during the pandemic. But were the gains shared equally across all regions? data.ai’s State of Mobile Gaming 2022 Report teases out the differences in performance across 28 countries.

The headline numbers for data.ai’s State of Mobile Gaming 2022 Report reveal the extraordinary success of the mobile gaming space over the ‘COVID’ period.

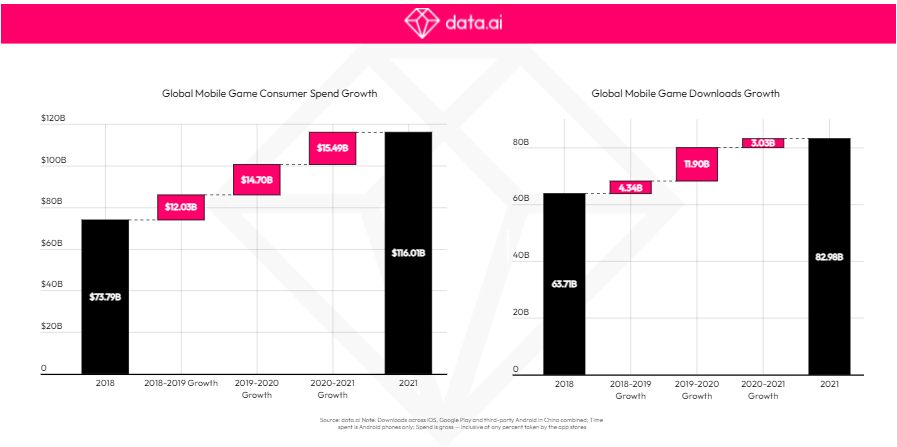

If we look at the figures for 2018 to 2021, they show that consumer spend on mobile games rose from $73.8 billion to $116 billion. That’s a rise of 60%.

Over the same period, downloads grew from 63.7 billion to hit 82.98 billion – a rise of 30%.

Was this growth experienced equally across all regions? No, and data.ai’s mobile gaming data helps unearth the biggest differences and areas of opportunity.

data.ai’s State of Mobile Gaming 2022 Report provides an excellent source for teasing out local nuances. It contains an expanded regional focus, with 28 countries included in the analysis for the first time.

Consumer Spend Doubles Across Numerous Markets

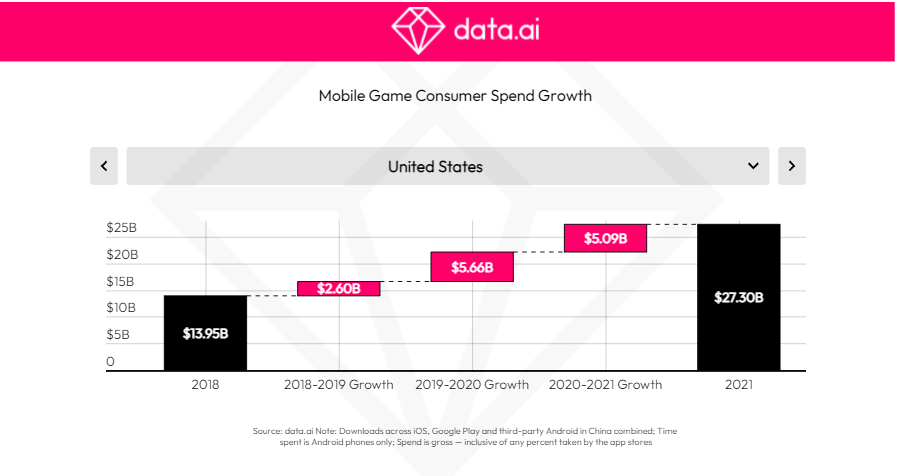

In terms of spend, a large cohort of countries have witnessed a doubling of gaming revenues in the past three years. They include Germany, US, Russia, Turkey, Mexico, Brazil, Columbia and Thailand.

Those that have outperformed even this impressive return include Chile ($70 million to $200 million) and Vietnam ($105 million to $296 million).

On the flip side, a handful of countries experienced much smaller rates of growth over the period. In this group are Argentina ($61 million to $69 million), Japan ($13.3 billion to $15.8 billion) and India ($130 million to $170 million).

Looking at the growth data for 2021 alone, a similar picture emerges – but with some noticeable differences. The global market grew by $15.5 billion (up 15%), but again this rate of increase was exceeded by a number of markets. The biggest leaps were in Chile and Taiwan.

Developing Markets Lead the Surge in Download Numbers

Turning to downloads, a large number of countries in the study outperformed the 30% global rise over three years. Notably, they are all in developing economies.

The outstanding performer here was the Philippines. Its downloads increased from 620 million in 2018 to 1.43 billion last year. That’s a 130% uplift. Peru, Colombia and India were among those to experience around 100% gains.

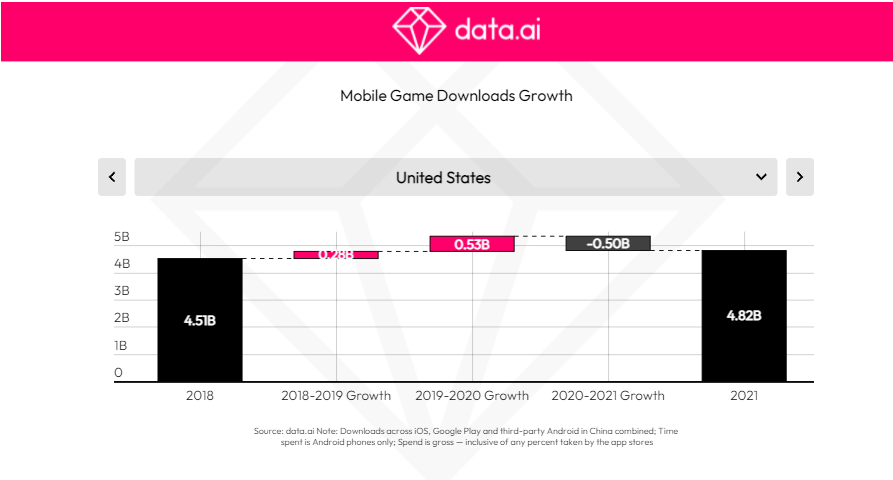

By contrast, some of the world’s most mature gaming markets saw downloads flatline in 2021. They include the US, Canada and Australia. Downloads slightly dipped in Japan and South Korea, amidst stable consumer spend growth. We expect to see this in mature economies, where many longstanding favorites were downloaded in years past. The healthy level of downloads indicate demand is still ripe for new games and the audience is expanding.

Hypercasual Rules Across the World, but Not in China

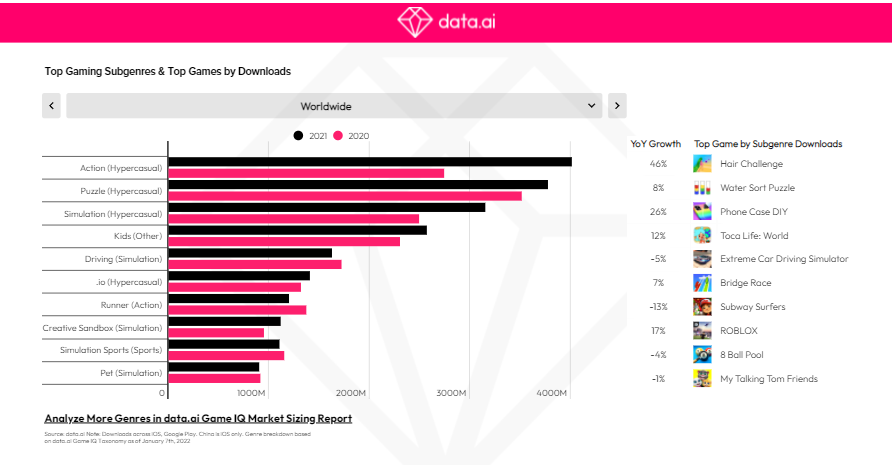

data.ai’s State of Mobile Gaming 2022 Report also looks at the gaming genres that are driving the market to new records. There is one big story here when it comes to downloads: Hypercasual.

Last year, gamers downloaded nearly 13 billion hypercasual games across the top 4 subgenres: Action, Puzzle, Simulation and .io.

Indeed, downloads of action hypercasual titles alone grew by an incredible 46% in 2021 alone to reach 4 billion.

The rise of hypercasual gaming has been sudden and transformative. The category scarcely existed before 2014. But looking at the market by region, last year the action and puzzle hypercasual subgenres topped the download chart in 24 of 28 countries.

Among the exceptions were China, whose consumers downloaded 106 million MMORPG games (nearly double the number of hypercasual puzzle games in the market) and India – the only market in which driving games topped the chart.

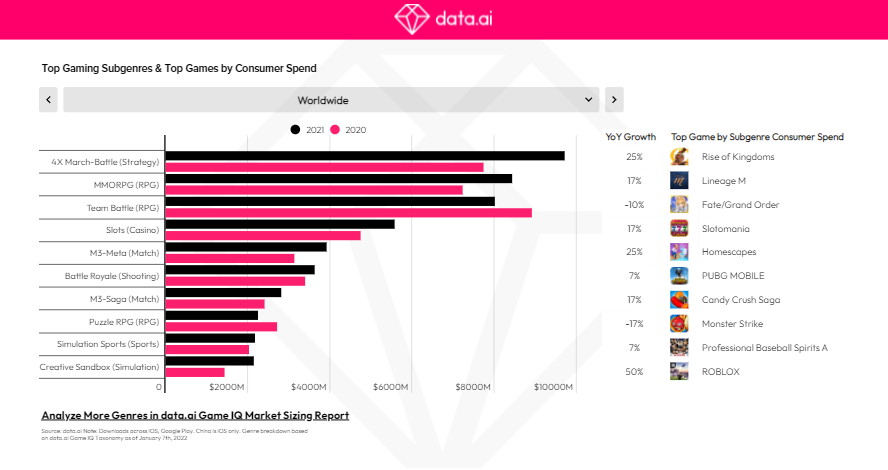

Battle Games and Slots Bring in the Cash

Of course, hypercasual games are mostly free to play and funded by ads. They don’t figure in the direct consumer spend charts. Instead, this is an area dominated by ‘core’ games with committed long-term user bases.

In 2021, 4X March-Battle (Strategy) games lead the way. They grossed $9.7billion – up nearly $2 billion YoY. Across the 28 countries in the study, 25 saw their spend chart for 2021 topped by subgenres with heavy competitive gameplay (either 4X March-Battle, Battle Royale or MMORPG).

The three that broke the pattern were Australia, Canada and the US. Their consumers spent the most on Slots (Casino) games. In the case of Australia the gap at the top was pretty huge. Spend on Slots was $302 million – nearly double that of the $176 million spent on the #2 category 4X March-Battle (Strategy).

These regional differences and granular subgenre analyses are pivotal to crafting a successful mobile gaming strategy. Understanding cultural nuances, preferences and areas of opportunity are needed to succeed in the rapidly changing and highly competitive mobile gaming environment.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.