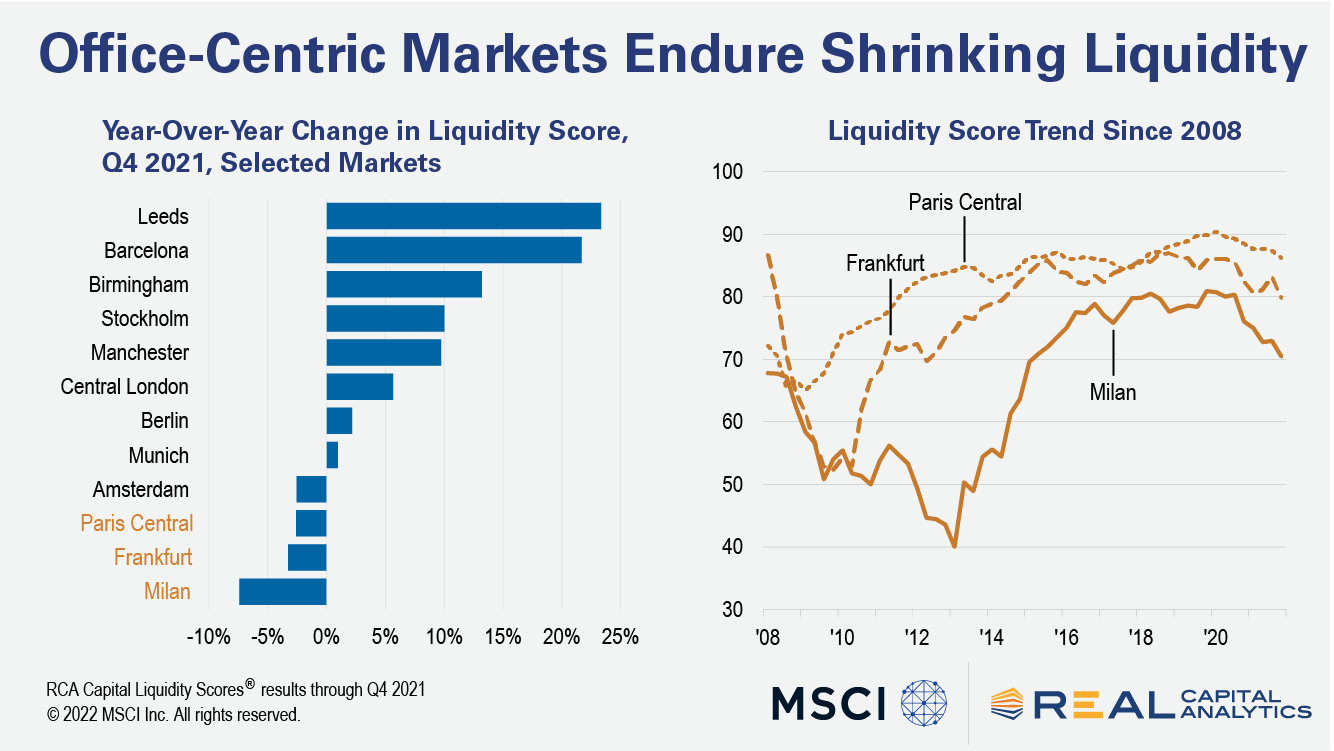

Liquidity fell in some of Europe’s leading real estate markets in 2021 despite acquisition volume on the continent reaching a new annual record, the latest update of RCA’s Capital Liquidity Scores shows. A shift in investors’ sector preference is behind the weaker outturn, and also explains the leap in liquidity in other markets.

In Central Paris, liquidity fell by 3% to a four-year low at the end of 2021, and liquidity in Frankfurt dropped to its lowest level since 2014. In Milan, liquidity dropped by 7% year-over-year to its lowest score since 2015.

In all three markets, the liquidity scores declined because transaction volumes were lower than they were a year prior and because the number of unique buyers active in the markets dropped. (Other inputs in calculating the Capital Liquidity Scores include a market’s share of institutional and global cross-border investment.)

This slowdown in transaction activity and buyer count in Central Paris, Frankfurt and Milan comes as investors have become much more cautious when deploying capital into the office sector. Office tenants are still adjusting to a hybrid model of work, which means many investors have reverted to core assets that are likely to remain attractive to tenants. Secondary and tertiary quality buildings, meanwhile, are perceived to be at greater risk of obsolescence.

Falling volumes and fewer buyers means less upward pressure on prices, which is reflected in the pricing outturn over the last year. Commercial prices in Central Paris, as measured by the RCA CPPI, fell on an annual basis for the first time since 2011. Looking at office assets alone, as measured by the RCA Hedonic Series, prices in Central Paris, Frankfurt and Milan were flat over 2021.

The contrast with those markets where liquidity increased last year is rooted in the change in sector preference. Cities in the U.K. regions were among the best performing in 2021 in terms of liquidity gains. Liquidity rose 23% year-over-year in Leeds, 13% in Birmingham and 10% in Manchester on the back of exceptional demand from local and international players for industrial assets.

Industrial property was the number one sector by acquisition volume in the U.K. for the first time ever in 2021 and the number one target for cross-border players, also for the first time. As such, U.K. industrial prices, as measured by the RCA CPPI, rose 30% year-over-year, which makes the asset class one of the best performers on a global basis in 2021.

Rising inflation and the conflict between Russia and Ukraine mean the post-pandemic outlook has clouded over. However, Europe’s office sector did start on a brighter note in 2022, with preliminary data showing first quarter office transaction volume already ahead of the same period a year ago. For the industrial sector, meanwhile, the Q1 2022 is already the second-strongest quarter on record.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.