Most areas show balance between price gain, cap rate drop and net revenue rise

Home prices rose a whopping 20% over the past year and rents on single-family homes were up 13%, according to the CoreLogic national Home Price Index and Single-Family Rent Index. With prices up more than rent, is it a sign that homes are overvalued?

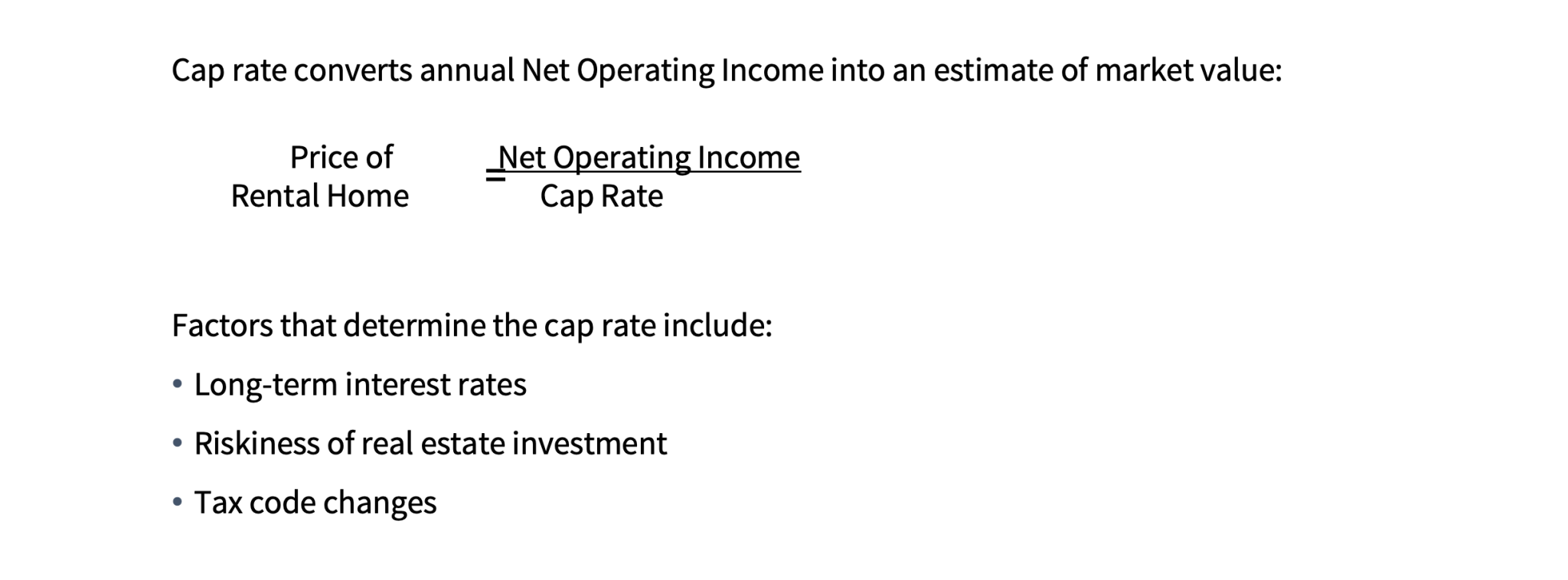

Price growth that outstrips rent gains over an extended period could be a sign that homes are overvalued if capitalization rates, otherwise called cap rates, had remained unchanged. A cap rate is used by real estate professionals to convert net operating income on an investment property into a market value. When cap rates decline, the market value of a rental home increases.

Figure 1: What Affects Capitalization (Cap) Rates?

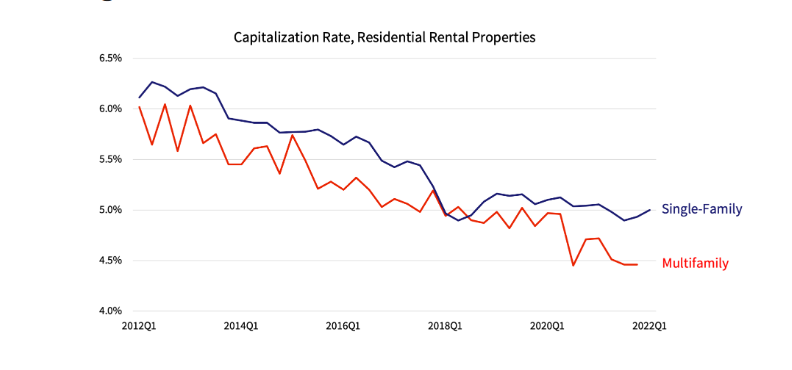

While a cap rate is relatively stable over short periods within a metro area, cap rates will vary across metros and over long periods. Over sustained time horizons, cap rates fluctuate based on the level of long-term interest rates, the perceived riskiness of real estate investments and tax code changes that affect real estate profitability. Of these three factors, the one that has changed the most during the last two decades is long-term interest rates. Consequently, cap rates for single-family rental homes dropped by nearly 20% during the last decade, and by almost 50% from 20 years ago.

Figure 2: Cap Rates Have Fallen About 20% During the Last Decade

This cap rate decline implies that prices can rise significantly even with no change in net operating income and the local market would not be overvalued. If net operating income also rose, then that would raise the price of single-family rental homes further.

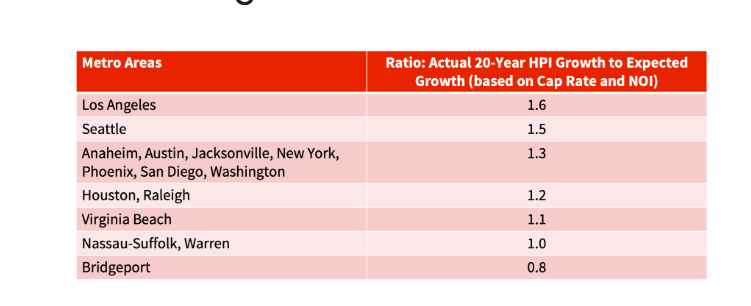

Using rent increases adjusted for inflation as a proxy for net operating income growth, we can compare home prices, net operating income and cap rate changes over time. In doing so, we find that single-family home prices in most metros appear to have been anchored in economic fundamentals.

Figure 3: Most Metros Had Price Growth Consistent with Cap Rate and Net Operating Income Change

The Los Angeles and Seattle metros may be an exception. Price gains during the last 20 years appear to have exceeded what may have been expected given the decline in cap rates and estimated change in net rental income.

Analysis of over- or under-valued markets should not rely on one metric but should be based on several measurements. Comparing price with rent growth is one such indicator.

Summary:

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.