Off-price stores, which sell branded clothing at a discount, have overperformed compared to the wider apparel sector throughout the pandemic. Much like the grocery segment, this market seemed to thrive in an uncertain world. Now, with a new set of challenges – including inflation, gas prices, and supply-chain disruptions – impacting almost all retail segments, we checked in with the category to see how it’s holding up.

How These Retailers Weathered the Pandemic

When COVID’s retail impact first began, the future of retail seemed uncertain.

Analysts predicted a pivot to e-commerce and some even questioned whether we were seeing the end of brick and mortar retail. But while the e-commerce sector did indeed grow in the past two years, and some offline stores did shutter, many other brick and mortar retailers found themselves thriving.

Off-price retail was one such success story. We analyzed four industry leaders – Marshalls and T.J. Maxx (owned by TJX Companies,) Burlington Coat Factory, and Ross Dress for Less. Over the past two years, these companies outperformed many of their retail counterparts, even though two of them – Ross and Burlington – do not operate online stores at all. With omni-channel shopping increasingly being touted as the future of retail, the success of these brands is all the more impressive.

Yearly Visit Trends Remain Impressive

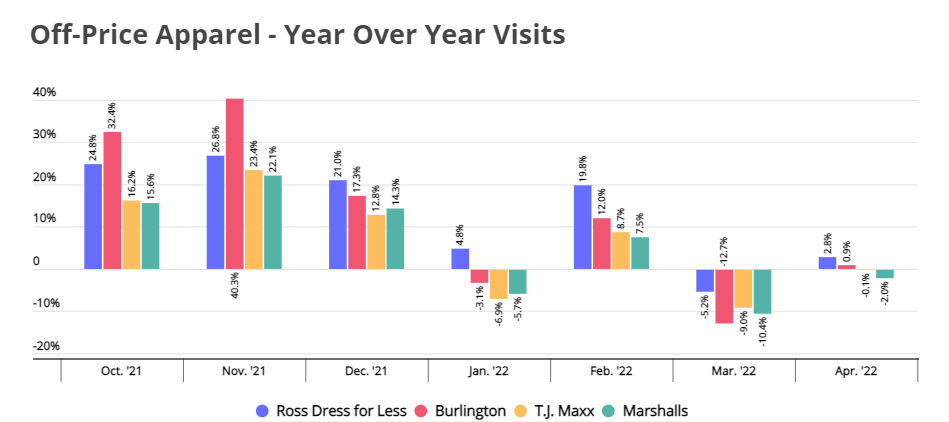

Comparing foot traffic trends to prior years reflects the industry’s overall success. Even amidst a wave of unique challenges – from Omicron in January and February to the lingering impact of inflation and the sharp effect of rising gas prices – the sector has managed to show strong relative performances.

While those months that were more impacted by these challenges did see year-over-year visit declines, visit rates proved resilient as shopping behaviors quickly normalized. Following sharper declines in March, visit rates returned to growth or near growth for all four chains. Considering the magnitude of the challenges faced – especially for apparel – the quick rebound speaks for itself.

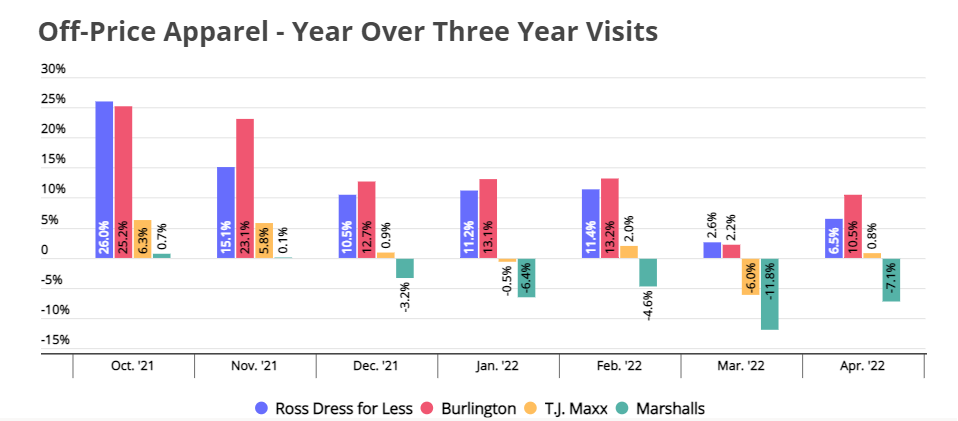

A glance at year-over-three-year (Yo3Y) visit trends are equally noteworthy, as visits are up even compared to pre-pandemic levels. In February 2022, Burlington visits were 11.7% higher than in 2019, while T.J. Maxx saw an 8.7% increase compared to the equivalent month in 2019.

And despite March’s YoY slump, by April all the chains but Marshalls had pulled forward, with T.J. Maxx visit trends 1% higher than they were three years ago, and Burlington receiving 10.5% more visitors.

And while many predictions assumed omni-channel would be the lifeboat keeping retail afloat, the two stores with the strongest Yo3Y foot traffic – Ross and Burlington – are the two that don’t offer any online shopping. The data here shows the clear value that the offline experience offers in this segment, but also the jump forward that the sector took as a whole during the pandemic.

Monthly Foot Traffic Pulling Ahead

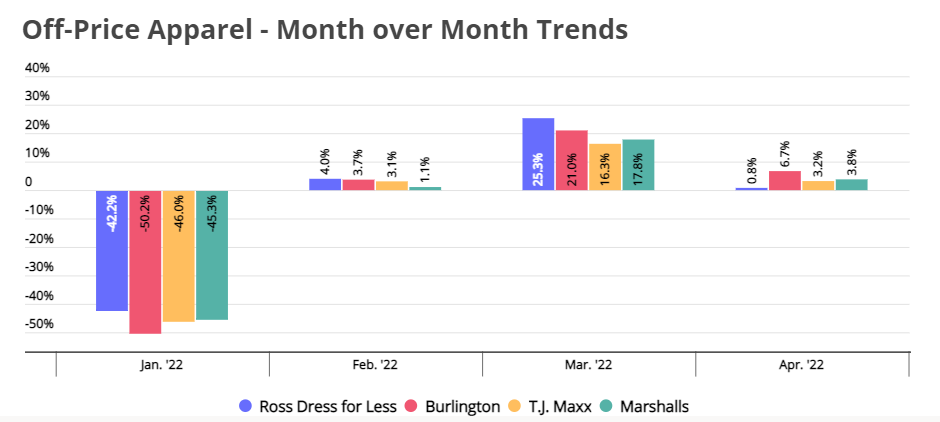

Off-price’s resilience becomes even more apparent as we dig deeper into foot traffic patterns. A glance at Q1 2022 shows a significant downturn in January ‘22, with visit shares down between 40 and 50%. This pattern can be attributed to the Omicron wave and to regular seasonality. December is generally one of the strongest months for off-price retailers.

By February, visit shares were pulling forward, with all four retailers seeing more visits than in January, despite February’s fewer days. And month-over-month (MoM) visits increased again in March and April showing the strong momentum the sector is seeing, even in the face of elements like inflation that can reduce demand. As the segment continues to normalize, it may actually benefit from these trends as they tend to give an added boost to value-oriented retailers.

Final Thoughts

As prices continue to rise, we may see more and more shoppers opt for bargains at their local off-price retailers. And despite a rocky start to the quarter, the recent upturn may signal real reason for optimism.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.