Beauty sales have seen seismic shifts over the last few years, with the pandemic limiting going out occasions, the rise of cult beauty, and subscription boxes taking share. Sephora and Ulta have tried to maintain share by entrenching themselves with mass merchants Kohl’s and Target (respectively). But as shoppers shift to more niche offerings, what has happened to the larger players? In today’s Insight Flash, we dig into channel trends, cross-shop, and price per item to understand what has changed and what may have stayed the same.

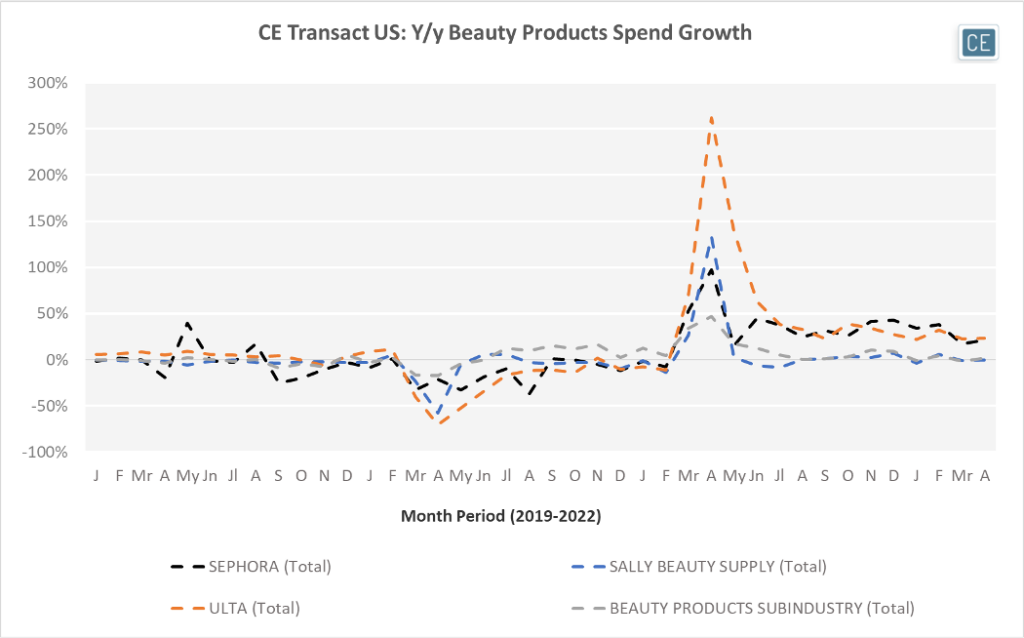

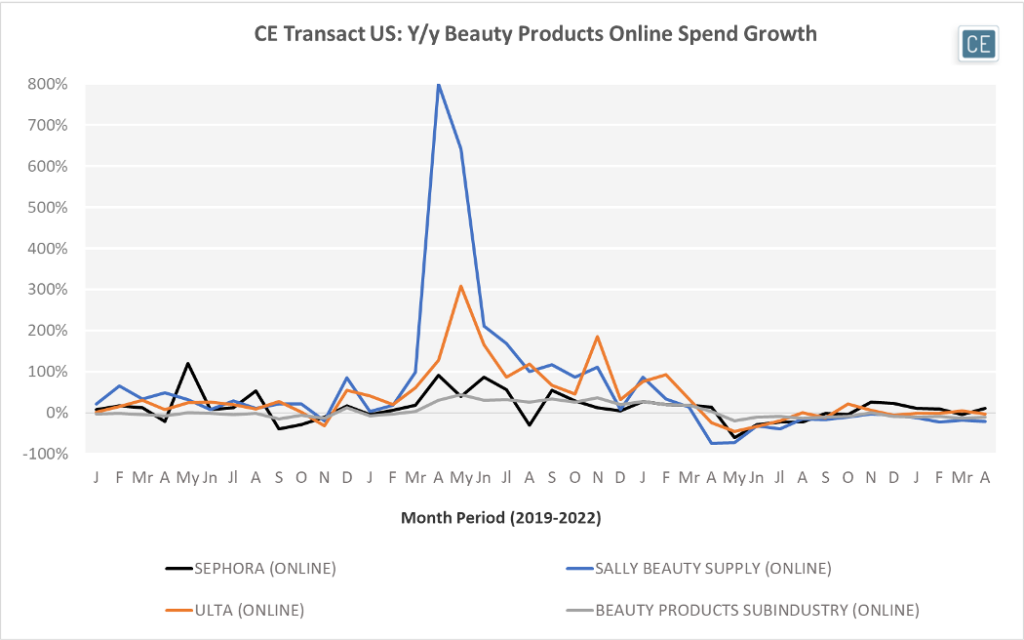

In general, Ulta and Sephora have substantially outperformed the broader Beauty Products Subindustry. Both companies saw over 20% y/y retail spend growth in March of this year, following strong double-digit growth performance in the first calendar quarter. Sephora also saw double-digit growth online. While Ulta saw small e-commerce declines y/y in April, the overall subindustry saw an even sharper y/y drop in spend. With overall online Beauty Products sales slowing down versus total growth, Sephora and Ulta continue to outperform both overall and on the web.

Beauty Products Sales by Channel

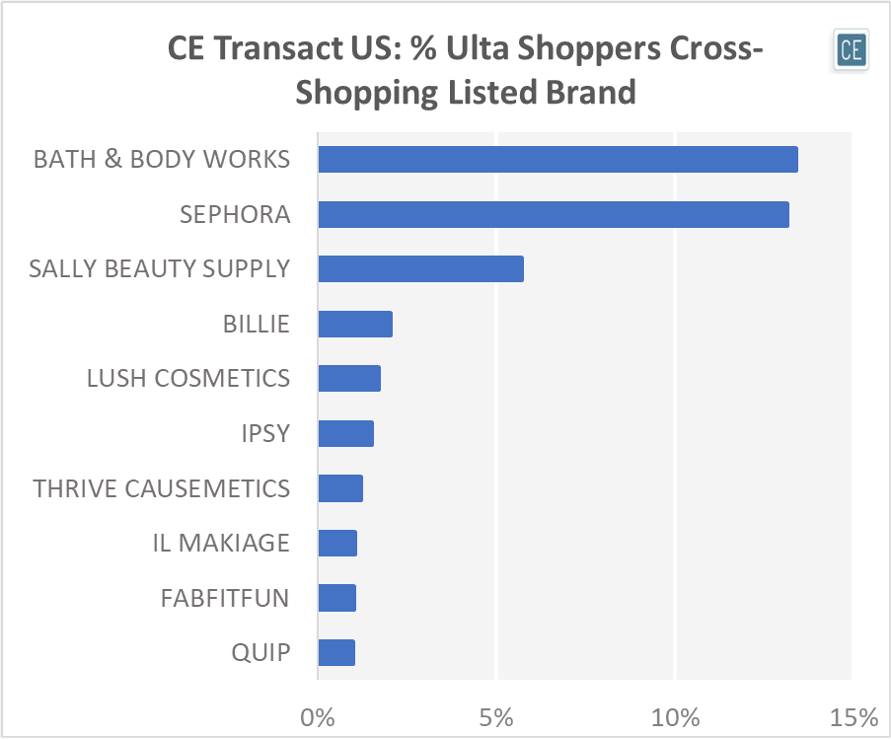

The beauty business is fragmented, and loyalty is hard to come by. Sephora and Ulta see high cross-shop with each other, as well as with smaller brands. In calendar 1Q22, 25% of Sephora shoppers also made a purchase at Ulta, and 13% of Ulta shoppers also spent money at Sephora. This is in addition to high cross-shop rates from smaller personal care and beauty brands. Billie and Lush were common cross-purchases with 3% of Sephora and 2% of Ulta shoppers buying their razors and bath products at these brands. Sephora shoppers were also likely to frequent Glossier, while Ulta shoppers were likely to try new brands through Ipsy.

Cross-Shop

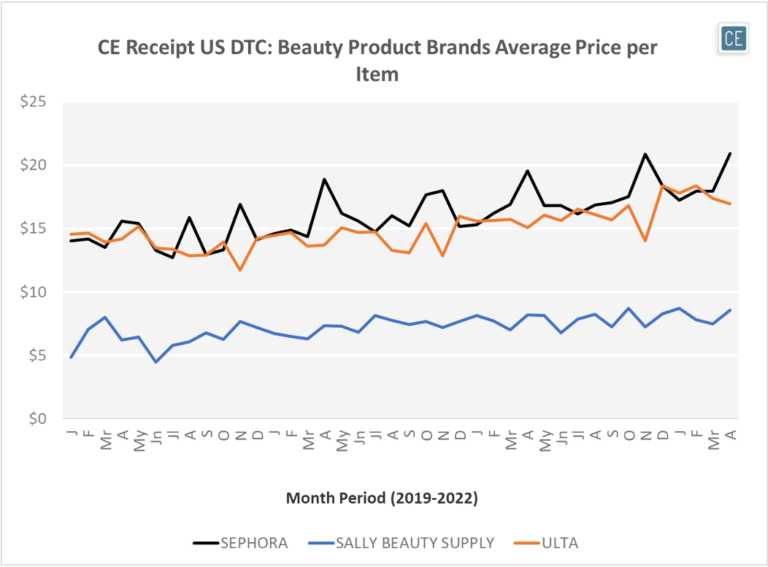

Sephora and Ulta do see a premium price per item versus competitive brands such as Sally Beauty. Over the last six months, Ulta shoppers spent over $17 per item while Sephora shoppers spent almost $19. Interestingly, Sephora sees its highest prices of the year in November as shoppers treat themselves and their loved ones with holiday sales, while Ulta sees its lowest prices of the year as shoppers save on gifting.

Price per Item

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.