Costco, BJs and Sam’s Club mobile app downloads are expected to close out Q2 at a growth rate of 74% year-over-year, as shoppers commit to membership clubs for inflation relief. This is the highest YoY growth among clothing, fast food and home improvement retail categories.

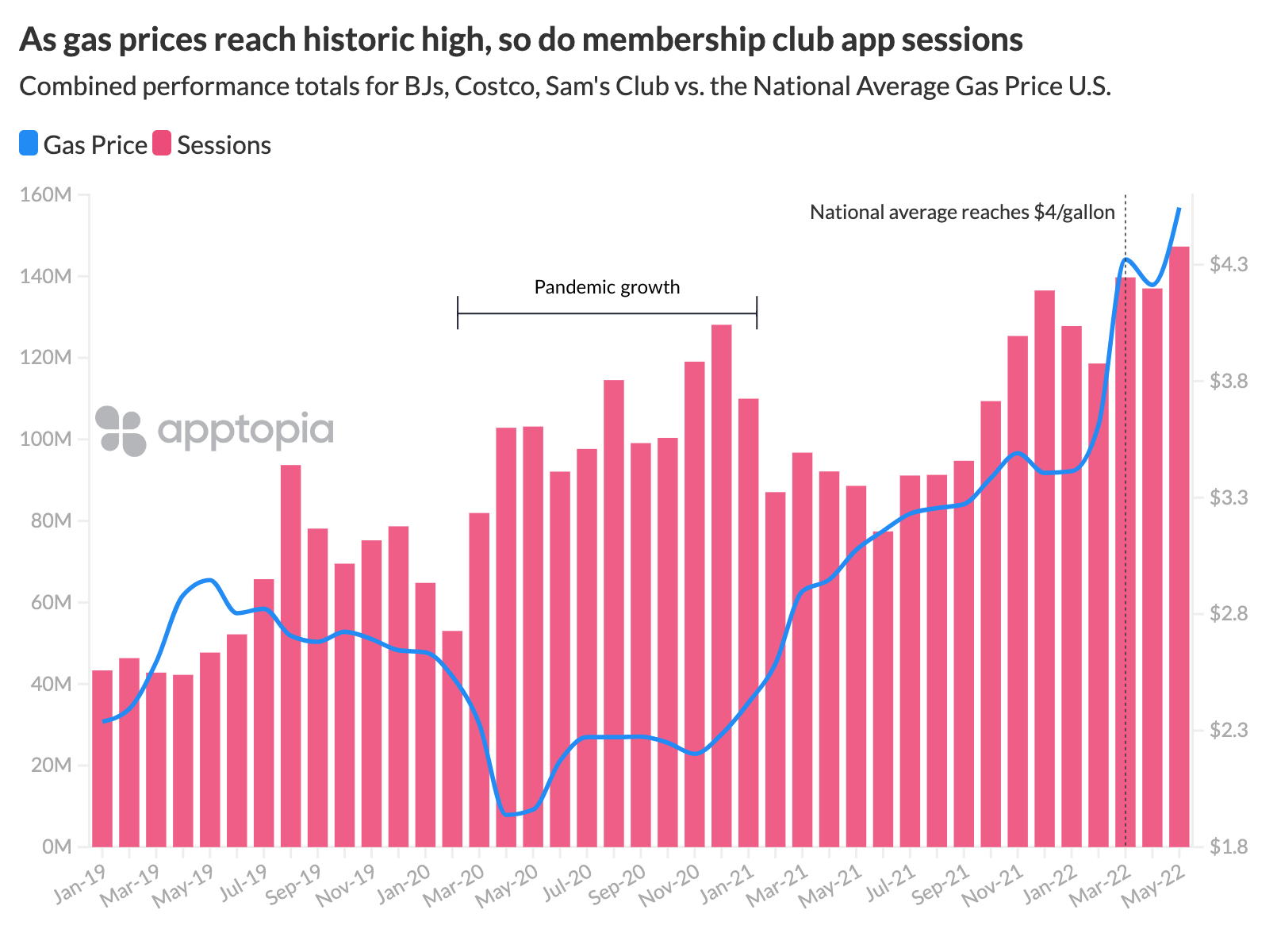

The user sessions correlation charted below indicates why: combined mobile sessions for the three store apps reached an all-time-high when the national gas average reached $4 per gallon in March. Accordingly, sessions dipped slightly along with price in April, before setting a new record in May when the average price of gas shot past $4.50.

Membership Clubs are a segment of grocers, but all three clubs have a store brand gas station available only for member use. In the last month, this is what the discounts on each club’s gas have looked like:

Like Grocery Stores, Membership Clubs are also benefitting from consumer interest in cost-saving on food, since Membership Clubs sell grocery in bulk at wholesale prices. Coupled with gas discounts, mobile session volume, shown above, is 23% above the Q2 2020 peak.

For $45 to $60 annual fee, shoppers can get on the basic tier at any of the stores and access discounts on bulk grocery, household goods from electronics to furniture, and member-only gas stations, making this subscription seem an all-in-one answer to managing inflation. In fact, grocery stores with gas stations like Kroger and Walmart have expanded their own membership programs recently to follow this model. Subscription fatigue may be out there, but shoppers see the opportunity to make that fee back at routine-spending retailers.

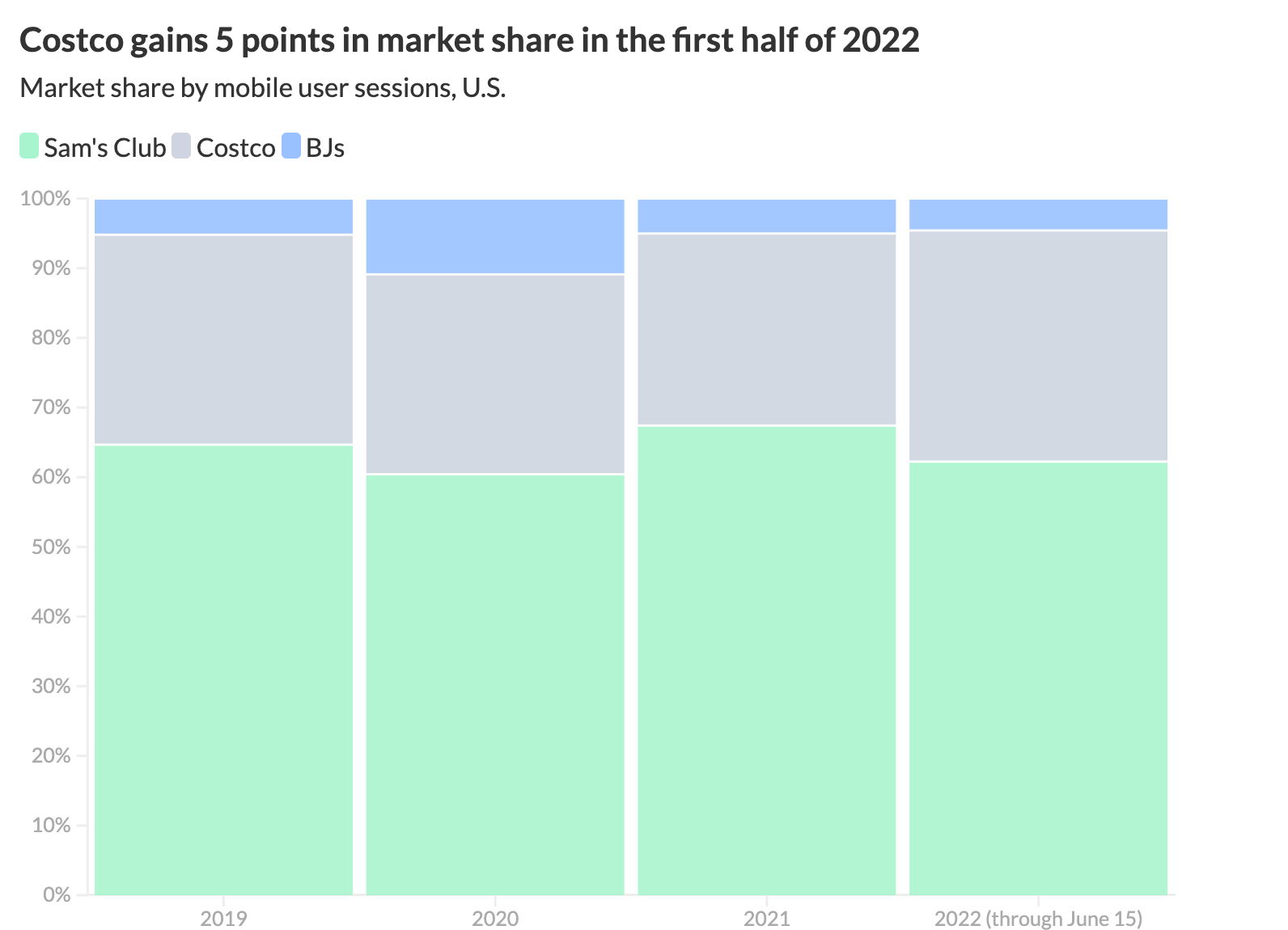

The instant gratification of a lower tab at the BJs or Costco pumps, compared to a delayed 10% cashback (also requiring a credit card) from Sam’s Club, could be what’s moving the needle for BJs and Costco. Though you can’t see in the market share chart above, BJs is the fastest grower so far in 2022 with 23% quarter-over-quarter (QoQ) growth in user sessions in Q1 and 16% QoQ growth in Q2. As a regional club on the East Coast, its session count is significantly less than Costco and Sam’s Club, so the relative numbers are only enough to maintain its market share among Costco and Sam’s Club. Meanwhile, Costco’s combined QoQ gains in sessions (14% in Q1 and 8% in Q2) added 5 points to its market share by user sessions, directly impacting Sam’s Club (-2% in Q1 and 5% in Q2).

Costco is known for catering to the most affluent demographic of all the clubs, so its increase in downloads by 110% YoY in May could represent when inflation was felt among the upper middle class. Sam’s Club grew 69% YoY in May and BJs was at 63%. Annual growth in June, however, fell for BJs (43%) and Costco (92%), and rose for Sam’s Club (87%).

We expect to see more movement in the next 6 months, as adjustments are made for shopper experience. Our Review Intelligence does not bode well for Costco, which continues to see “Sam” in its top 10 review keywords. The associated reviews are from unsatisfied Costco shoppers that are aware of how Sam’s Club’s mobile experience makes for a better in-person shopping experience.

To learn more about the data behind this article and what Apptopia has to offer, please reach out to Connor Emmel at cemmel@apptopia.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.