After Antenna reported that Netflix is losing subscribers for the first time in a decade, some saw it as a sign that streaming services are on the verge of decline.

But the data tells a different story. Premium streaming subscriptions have grown nearly 25% year-over-year, with 37.4 million new subscribers in Q1 2022. At the same time, streaming services lost 29.8 million subscribers — suggesting that customers are ‘churning’, or bouncing from one service to another.

And they have plenty of options to choose from: While Netflix and Prime Video are still on top, new services like Peacock and Paramount Plus have been popping up every day. So how are the original streaming giants Netflix and Prime Video advertising to hang on to subscribers? And what do the ads reveal about how newcomers Peacock & Paramount Plus are jockeying for position among more established services?*

*Data gathered from Pathmatics Explorer from January 1, 2022 to June 11, 2022.

Netflix’s Ad Strategy Has Shifted

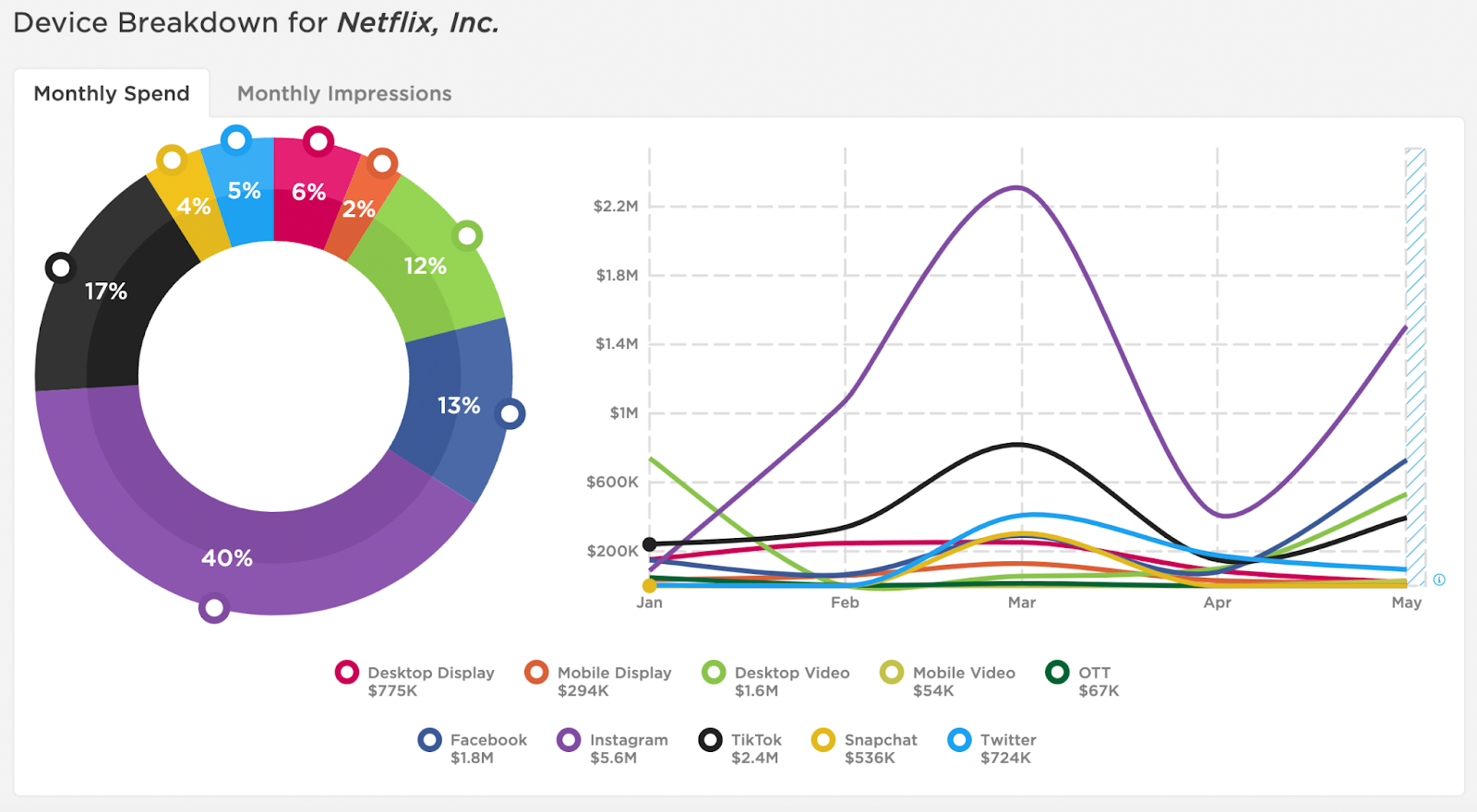

Netflix has spent $13.8 million on digital ads since the start of the year. Ad spend increased dramatically in March, which coincided with several highly anticipated releases, including Bridgerton Season 2, The Adam Project, and Pieces of Her. Spend dropped off in April, then ramped up again in May when Netflix released Season 4 of Stranger Things.

In 2022, we’re not seeing as much use of desktop display or desktop video as we have in the past. Instead, the streaming giant has advertised mainly on social media, with 40 percent of spend on Instagram and 80 percent overall. TikTok was the second largest device for Netflix, with 17 percent of spend. Pathmatics Explorer first started tracking TikTok data for Netflix on January 1. Since then, the brand has spent $2.4 million on this device.

One of Netflix’s key strengths is its original content, which has doubled since February 2020 and now makes up over 40 percent of its library. Netflix’s ad strategy revolves around promoting individual titles, including Ozarks, The Pentaverate, Home Team, and Arcane: League of Legends — all with the creative text “Only on Netflix” stamped across the screen.

The streaming giant also has an ace up its sleeve: Squid Game Season 2. The first season was Netflix’s most-watched show ever, pulling in over 1.65 million viewing hours in its first month. Netflix released a teaser for the second season on June 12, and while we haven’t spotted any ads for it yet, we do know that the brand has been touting the show’s SAG Award nominations and campaigning for an Emmy nod, which will only serve to generate more hype for the series return.

Amazon Attacks From All Angles

Since the start of the year, Amazon has spent $71.8 million promoting Prime Video — nearly five times as much as Netflix. Instagram (20 percent) and TikTok (19 percent) were its top devices to advertise on, but you can see from the chart above just how diverse Prime Video’s ad mix is.

Digital advertising spend for Prime Video has been steadily trending upward since the start of the streaming wars in 2019. Then, in January 2022, it reached an all-time high of $18 million in a single month. Prime Video’s top ads during this time period revolved around the release of The Legends of Vox Machina, as well as its live coverage of the NFL Wild Card game leading up to the Super Bowl.

Prime Video sought to differentiate itself from Netflix with teasers for its own original and exclusive content like The Rings of Power, Outer Range, and Reacher, as well as a deal for “1 month free”. It also leveraged its $1 billion partnership with the NFL to offer exclusive coverage of Thursday Night Football, positioning Prime Video against other services like Hulu Plus and Peacock TV that offer live sports programming.

Oh, Snap! Peacock TV Makes A Splash On Snapchat

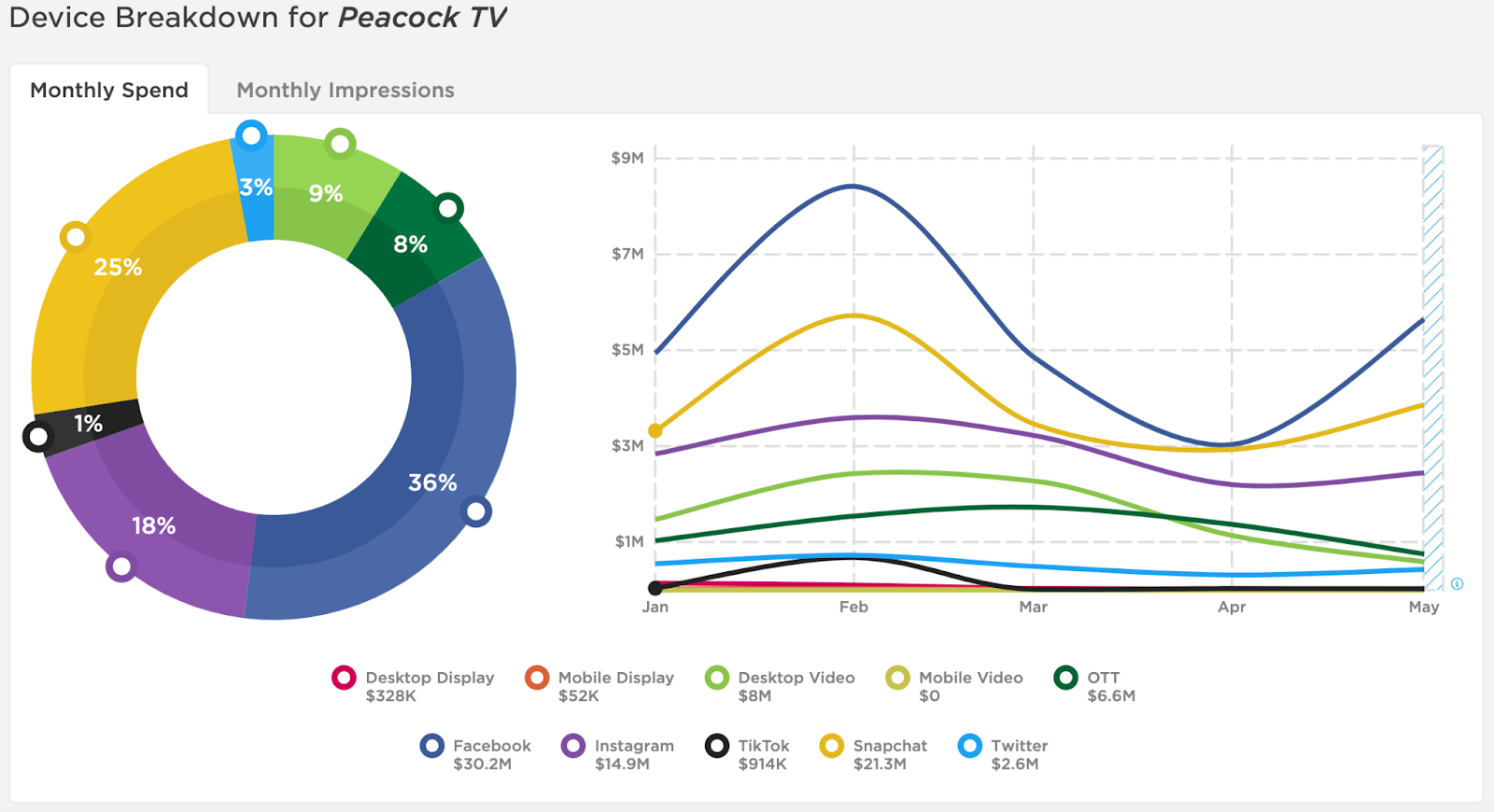

Peacock TV, which is owned by NBCUniversal, launched in April 2020 — just as millions of people were stuck at home with nothing to do but binge their favorite shows. Since then, NBCUniversal has thrown a massive amount of money into promoting the streaming service. The media company has spent $84.9 million on digital ads for Peacock TV in 2022 alone, which is more than either Prime Video or Netflix. And it appears to be working: Along with Paramount Plus, Peacock has accounted for most of the growth in streaming subscriptions since 2019, according to Antenna.

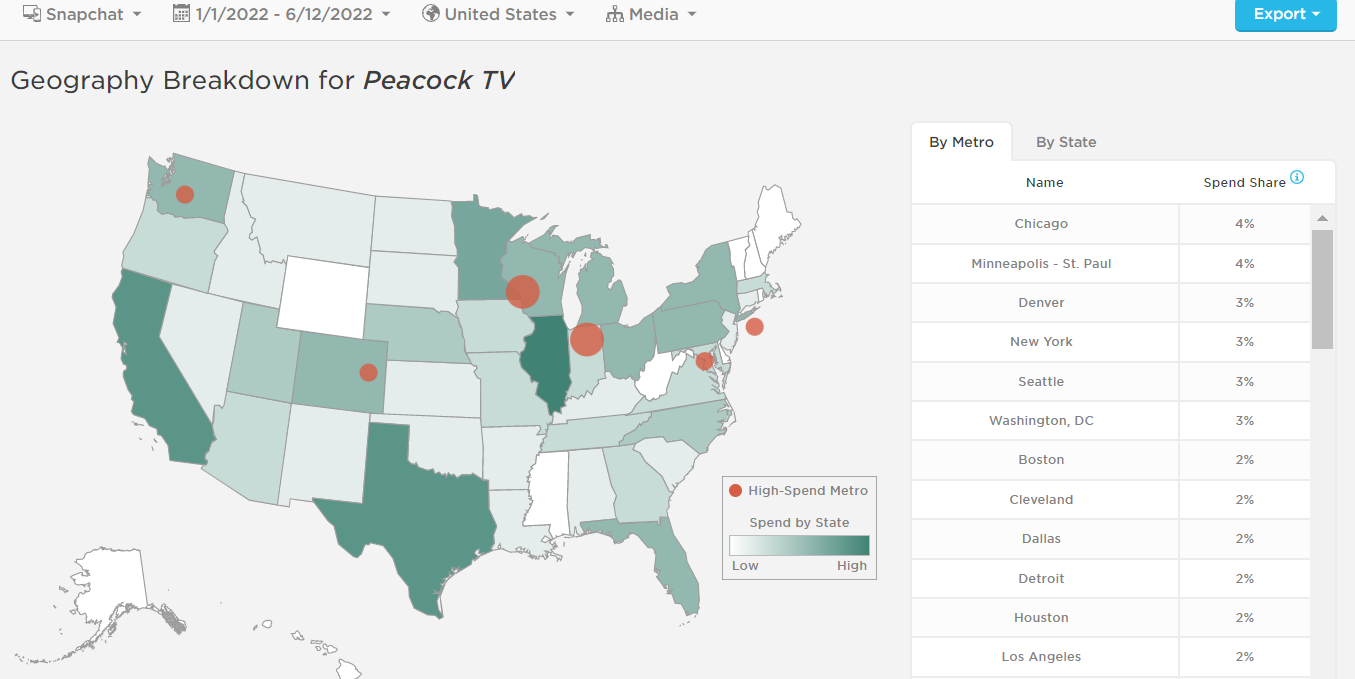

Following Prime Video’s lead, Peacock’s spending spiked in February at $23.2 million, gradually declined in March and April, and increased again in May. The largest share of its budget went toward Facebook ads (36 percent) followed by Snapchat (25 percent) — making Peacock TV the only streaming service doing any significant advertising on this channel.

We do know that NBCUniversal recently inked a deal with Snapchat to allow users to add theme songs and sound bites from popular titles like The Office and Saved by the Bell to their snaps, so Peacock may be trying to leverage this partnership. Pathmatics Explorer shows that Peacock ran ads for these shows on Snapchat, with creative text like, “Stream All Episodes Of The Office” and “Stream Saved by the Bell Season 2”.

Other Snapchat ads targeted metro areas like Chicago, Minneapolis-St. Paul, Denver, Seattle, and New York with messaging like “Stream Tigers vs. Yankees LIVE” and “MLB on Peacock”, which could signify that Peacock is trying to capitalize on its live sports coverage to win new subscribers. This is in line with Peacock’s messaging on other channels, which often focuses on the wide range of content available on Peacock: live sports, favorite shows, and new movies.

Paramount Plus Launches A $214 Million Ad Offensive

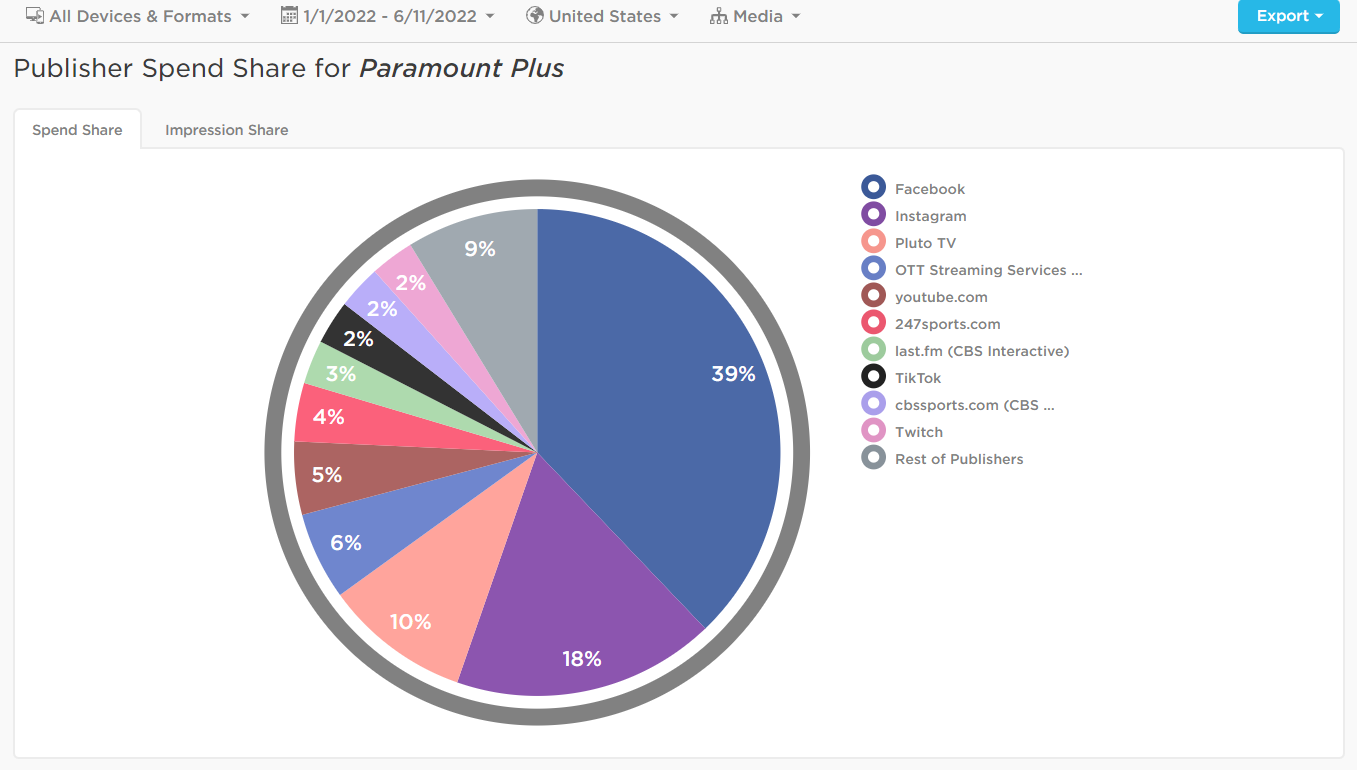

Paramount Plus launched on March 4, 2021, making it the newest streaming service we looked at. However, none of the other three services even came close to Paramount Plus in terms of advertising spend. The newcomer has spent a whopping $231.5 million on digital ads since the start of 2022 — more than Netflix, Prime Video, and Peacock TV combined. Looking at spending timelines, Paramount Plus went the opposite of Prime Video and Peacock, with relatively lower spending in January and February followed by a record high of $55.9 million in March.

But what’s even more interesting is how much Paramount Plus is spending on OTT ($39.3 million). From January to June, OTT streaming services accounted for 17 percent of Paramount’s overall ad spend. Pluto (51.33 percent) was its top streaming service to advertise on, followed by general streaming services (37.2 percent), Hulu (9.58 percent) and Peacock (1 percent). One ad that appeared across various streaming services touted a bundle-and-save deal for Showtime and Paramount Plus for $11.99 with the creative text “Everything you want now together”. Another appealed to kids with characters like Dora the Explorer, Peppa Pig, and Spongebob that “live on Paramount Plus”. Clearly, Paramount Plus is hoping to draw subscribers away from other, more established services by targeting their viewers directly.

Paramount Plus also ran display ads on a plethora of sports and entertainment sites including 247sports.com, cbssports.com, last.fm, and etonline.com. Creatives featured different programming depending on the site but all revolved around a call to action to “Try It Free”.

The streaming wars may have been going on since 2019, but things are just getting interesting. Newcomers Peacock TV and Paramount Plus are outspending more established services, but Netflix and Amazon Prime Video are investing heavily in their vast and growing libraries of exclusive content. So, who will come out on top? Stay tuned for the next episode of the streaming wars!

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.