After a contentious battle between JetBlue and Frontier, Spirit Airlines has finally announced a deal with JetBlue. In today’s Insight Flash, we look at what the deal will mean for their combined consumer spend share, how close the companies really are when it comes to ticket prices, and which competitors are the most at risk in key hubs based on cross-shop.

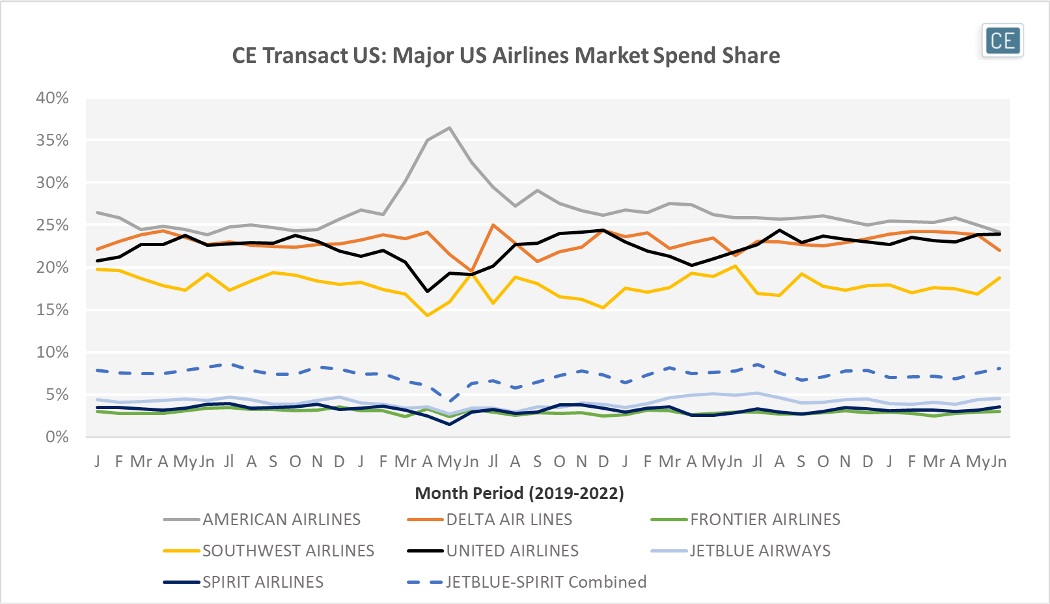

Consolidation among smaller airlines has long been a trend in US aviation, creating larger networks and allowing carriers to consolidate redundant routes. JetBlue, Spirit, and Frontier have all lagged the consumer spend share of larger carriers over the last three years, with Spirit and Frontier’s respective shares hovering around 3% for the first half of 2022 and JetBlue’s only about a percentage point higher. The combined JetBlue-Spirit entity would have had 7-8% market share in the first six months of the year, still about a third of the share of the next-largest player Southwest Airlines.

Spend Share on Consumer Credit and Debit Cards

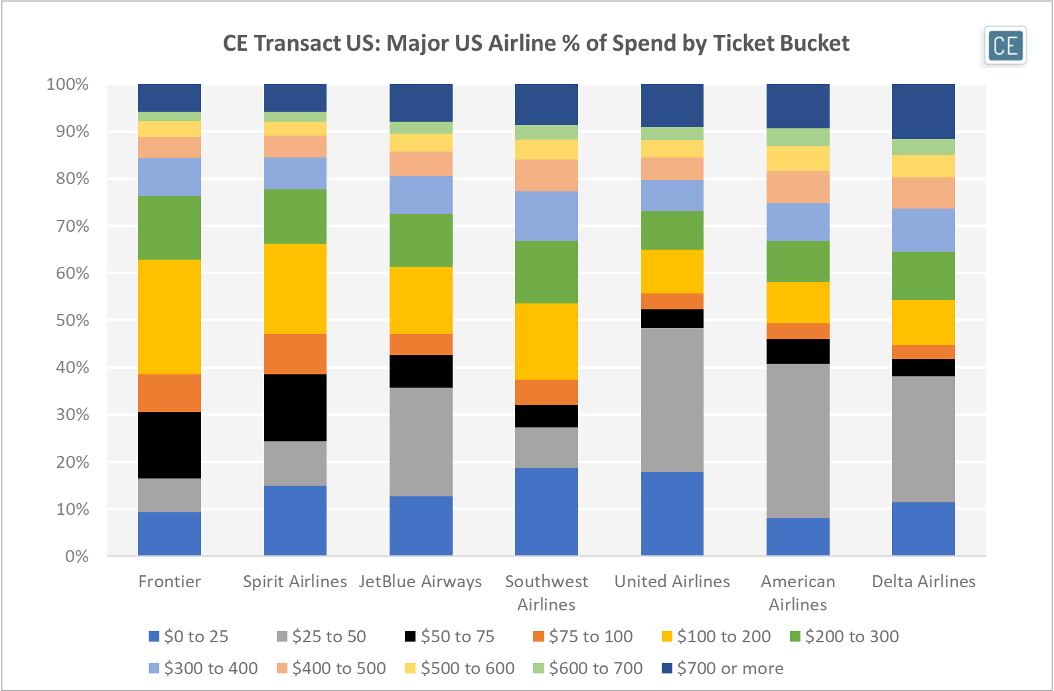

JetBlue and Spirit (along with the vanquished Frontier) have similar positioning as lower-cost airlines. In the last three months, only about 11% of payments to Spirit (including add-ons and onboard purchases) were over $500, and only 14% of payments to JetBlue were above that level. In contrast, 16% of payments to Southwest, 18% of payments to Delta, and 20% of payments to American Airlines were over $500.

Ticket Buckets

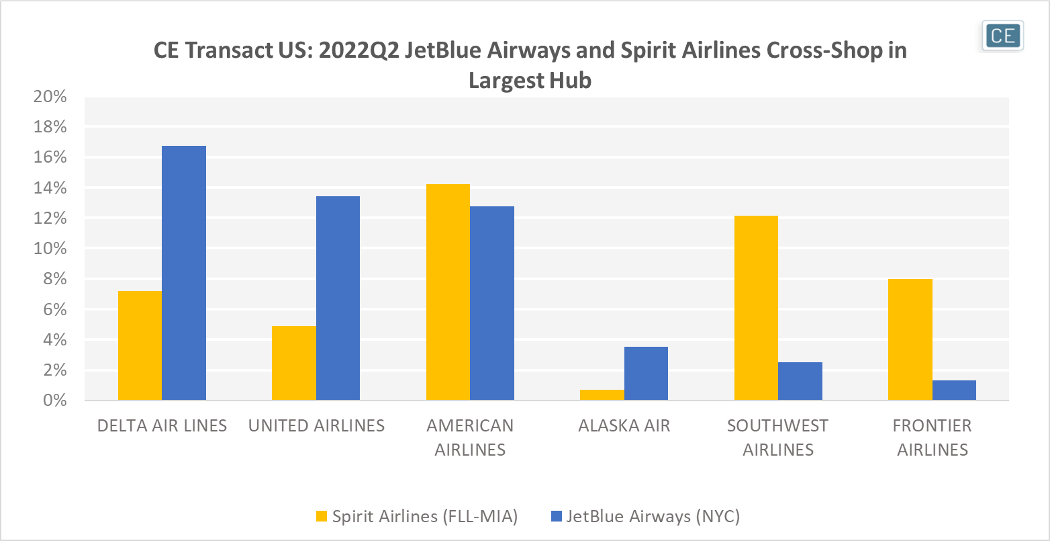

Which competitors may have the most to lose as JetBlue and Spirit solidify their bases? In JetBlue’s largest hub of NYC, Delta and United have the most cross-fliers. In Spirit’s largest hub of Fort Lauderdale-Miami, American Airlines is the most likely to feel pressure. These airlines will need to think about potential strategies to offset the impact of the merger.

Cross-Shop

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.