We dove into foot traffic trends for Popeyes, KFC, and Taco Bell to see how menu changes impact visits. Although the data presented here does not include all drive-thru and pick-up orders – and so does not represent the totality of the brands’ foot traffic – these metrics still show how a single popular item can significantly boost traffic across a QSR brand.

Popeyes’ Chicken Sandwich Still Boots Visits

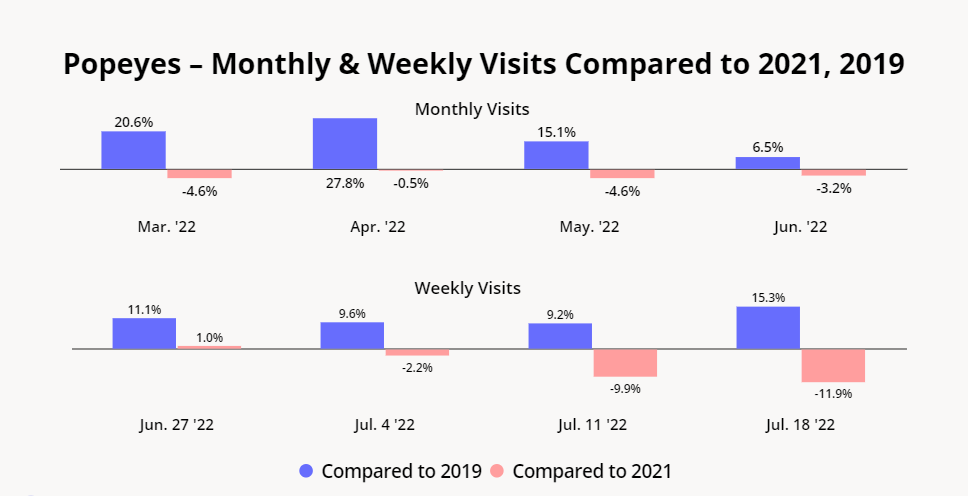

Like other players in the space, Popeyes has seen its year-over-year (YoY) foot traffic slip recently as consumers shift their spending to favor groceries over restaurants. But thanks to the brand’s beloved chicken sandwich, year-over-three-year (Yo3Y) visits are still going strong, with June 2022 visits up 6.5% relative to June 2019.

The brand introduced the fried chicken sandwich in August 2019 and sold out in just two weeks before re-introducing the popular item in November 2019. Since then, the brand has consistently beat its pre-chicken sandwich traffic numbers – and it looks like the sandwich is still playing a key role in helping the brand weather the current economic challenges.

Year-over-year (YoY) weekly visits fell throughout July, impacted by the strength of visits in July 2021 resulting from pent-up demand and retail’s wider reopening. But the Yo3Y weekly visit numbers stayed strong, with foot traffic for the week of July 18th up 15.3% compared to the equivalent week in 2019. Popeyes impressive Yo3Y performance is a testament to the potential of popular menu items to drive up traffic for an entire brand.

Taco Bell’s Mexican Pizza Drives Visit Surge

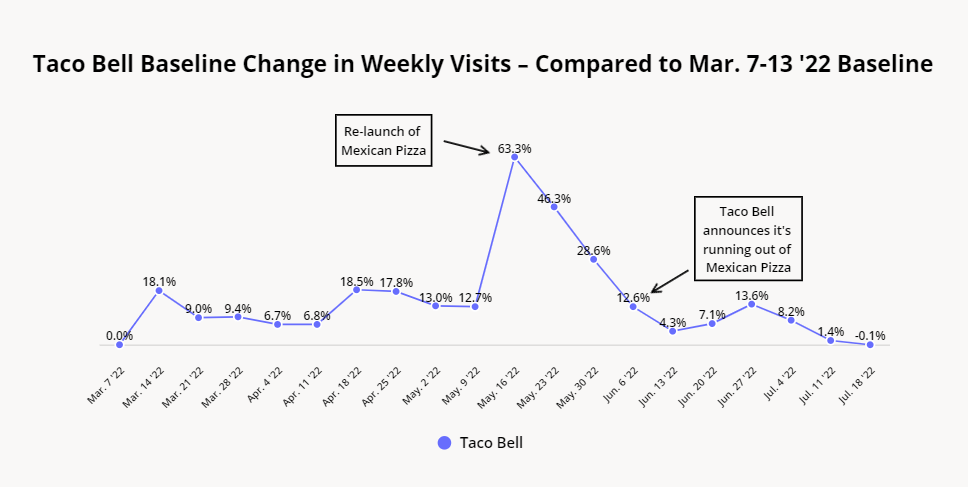

Like Popeyes, Taco Bell is tapping into the power of the menu refresh to draw in customers. Taco Bell’s Mexican Pizza was first introduced in 1985 and was discontinued in November 2020 as part of a wider menu culling initiated by the pandemic. Outraged fan Krish Jagirdar launched a petition that garnered over 200,000 signatures and – according to the brand – played a key role in Taco Bell’s decision to reintroduce the item nationwide on May 19th, 2022. But Taco Bell underestimated the massive demand for the item, and began selling out of the popular pizza just two weeks later.

The re-introduction – and quick liquidation – of the Mexican Pizza is reflected in the brand’s foot traffic. Nationwide Taco Bell visits relative to the week of March 7th, 2022 spiked nationwide the week of May 16th with the launch of the pizza and stayed elevated for the two weeks during which the item was fully stocked at Taco Bell branches around the country. But as the pizza supply dwindled, so did visits to brands. The brand plans to bring the pizza back in the fall – at which point visits are likely to surge once again.

KFC’s Chicken Nuggets Help Charlotte Beat Nationwide Trends

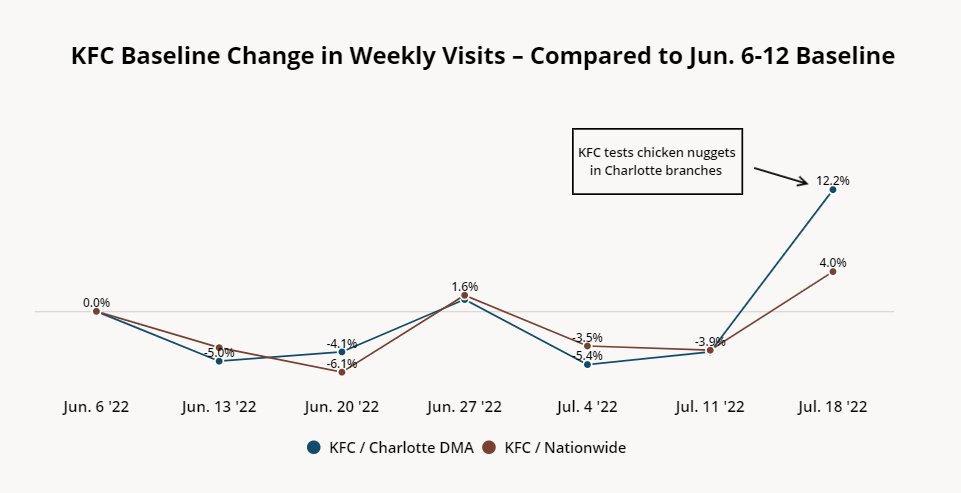

KFC is also experimenting with new products through its recently introduced chicken nuggets. The Louisville, Kentucky-based brand began testing this new menu item in select locations in Charlotte, North Carolina beginning on July 18th. The nuggets are designed to appeal to Gen-Z consumers who are less interested in eating chicken on the bone – and if the current trial launch goes well, the nuggets may permanently replace the popcorn chicken currently on KFC menus nationwide.

Comparing foot traffic to KFC restaurants nationwide with visits to KFC branches in the Charlotte, NC DMA shows that the nuggets are already driving demand. Prior to the release of the nuggets, nationwide visits and visits to KFCs in Charlotte, NC followed similar patterns. But foot traffic to Charlotte KFCs pulled ahead the week of July 18th – the same week that the chicken nuggets launched locally. This indicates once again the significant impact that a single menu item can have in the QSR space.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.