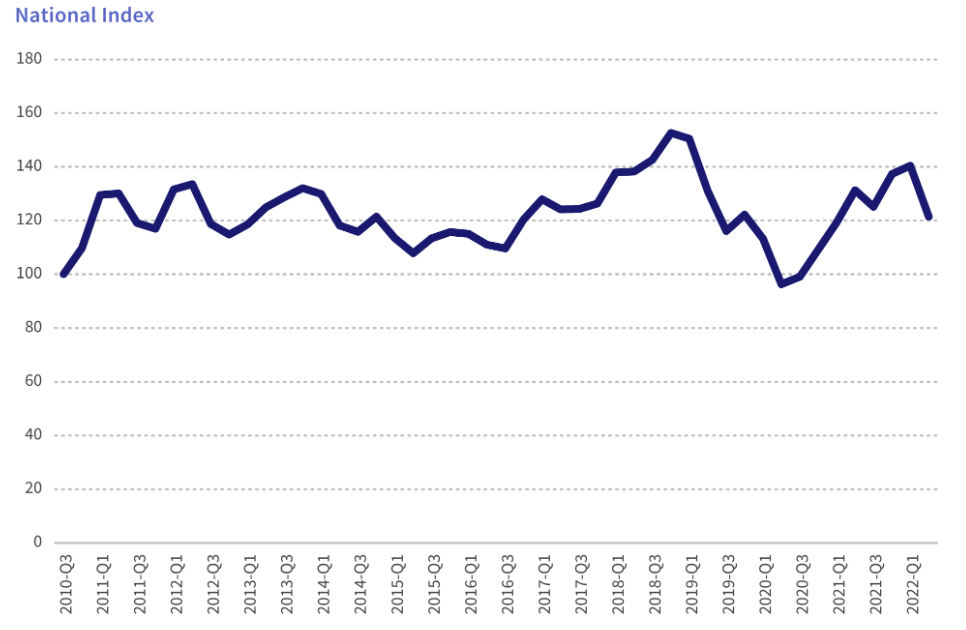

After large increases in mortgage fraud risk for much of 2021, our 2022 Annual Mortgage Fraud Report shows a 7.5% year-over-year decrease in fraud risk at the end of the second quarter of 2022. The decline is partially due to the recalibration of our scoring model in the first quarter of 2022. However, higher risks were recorded during months in the second quarter, particularly for certain types of mortgage fraud.

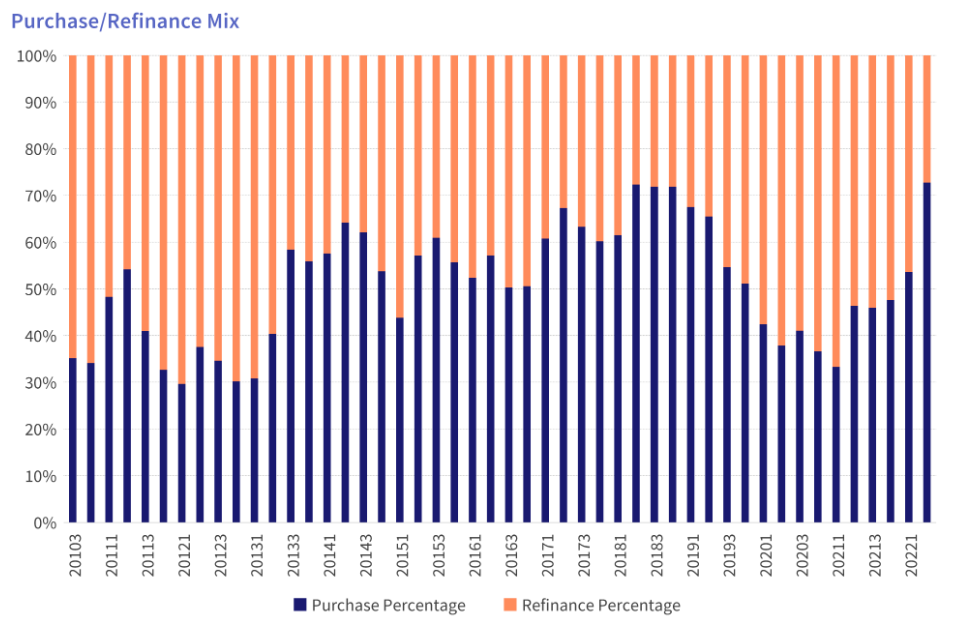

Risks of income and property fraud posted the largest year-over-year increases in the second quarter, a respective 27.3% and 22.6%. This trend is expected, as purchase loans now account for more mortgage transactions than refinances, and that the former are more susceptible to fraudulent activity.

We estimate that in the second quarter of 2022, 0.76% of all mortgage applications were estimated to contain fraud, about 1 in 131 applications. The highest risk segment remains 2- to 4- unit properties, with an estimated 1 in 34 transactions estimated to have indications of fraud. Purchases in this segment showed higher risk than refinances, but they all showed significant risk and an increase from the prior year.

FHA loans also showed a large increase in risk year-over-year, with a current estimate of 1 in 96, up from 1 in 172 last year. Meanwhile, Investment purchase risk improved this year, with a current estimate of 1 in 57. Last year the estimate was 1 in 23.

One trend we’ve identified to watch is the increase in income fraud risk. Most industry experts and risk managers state that this is their number one concern. Income fraud can come from a variety of areas, such as doctored paystubs or W-2’s to longer term falsification schemes involving using false information with “seasoned” bank account information.

To help combat this added risk, we have added a layered risk alert that is a combination of our income validation red flags, found in our LoanSafe reports. Back-testing of this alert have shown a significant increase in firing rate since 2019.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.