Our latest white paper dives into retail media networks and explores several retailers on the cutting edge of this advertising revolution.

Brick and Mortar’s Media Potential

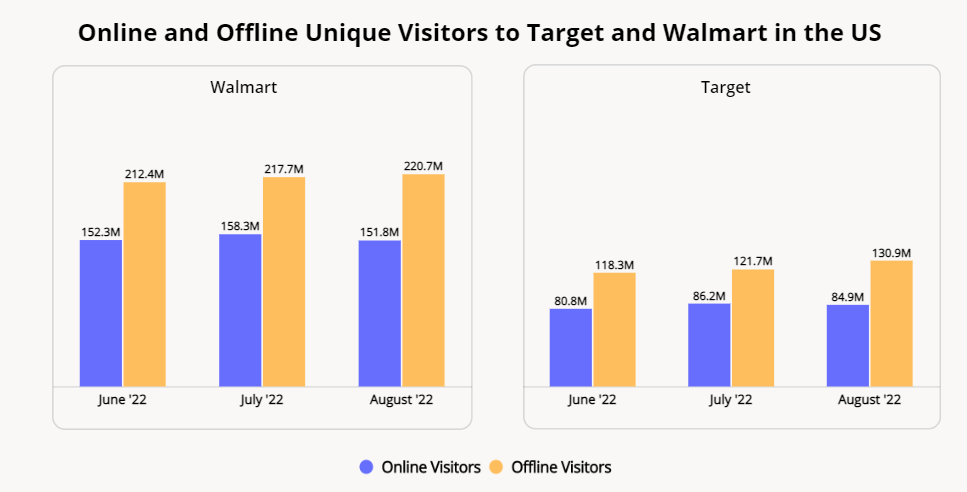

In spite of the gloomy predictions regarding the future of brick and mortar retail, major retailers are continuing to see their physical visits outnumber their online ones. Visits to Walmart and Target’s U.S. venues alone significantly outpace the brands’ global online reach, according to web data from Similarweb. So although, up until recently, these brands have focused their media placements on their digital channels, it is becoming increasingly clear that these chains’ physical stores hold powerful – and currently untapped – advertising potential.

Using Brick and Mortar Networks to Advertise to Hard-to-Reach Audiences

And these channels have the potential to help improve the way brands reach key audiences.

Residents of rural areas use the internet less frequently, and have lower levels of technology ownership than their urban and suburban counterparts. As a result, companies that stick to digital advertising may have a harder time reaching rural consumers. Retailers with a large physical presence in smaller markets can fill in the gaps and help brands promote their products and services to this hard-to-reach audience.

Dollar General has been serving rural residents for years, with the majority of the company’s stores located in communities with fewer than 20,000 residents. The company has also been operating a media network since 2018. The Dollar General Media Network (DGMN) enables advertisers to reach Dollar General consumers across the company’s channels to build awareness both digitally and in physical spaces. Advertisers with DGMN can display in-store bollard, blade, and wipe stand signs, security pedestals, basket bottomers, and shelfAdz to deliver in-store messaging from parking lot to purchase. Recently, Dollar General announced that its ad platform was now working with 21 new advertising partners, including Unilever, General Mills, Hershey’s, and Colgate-Palmolive.

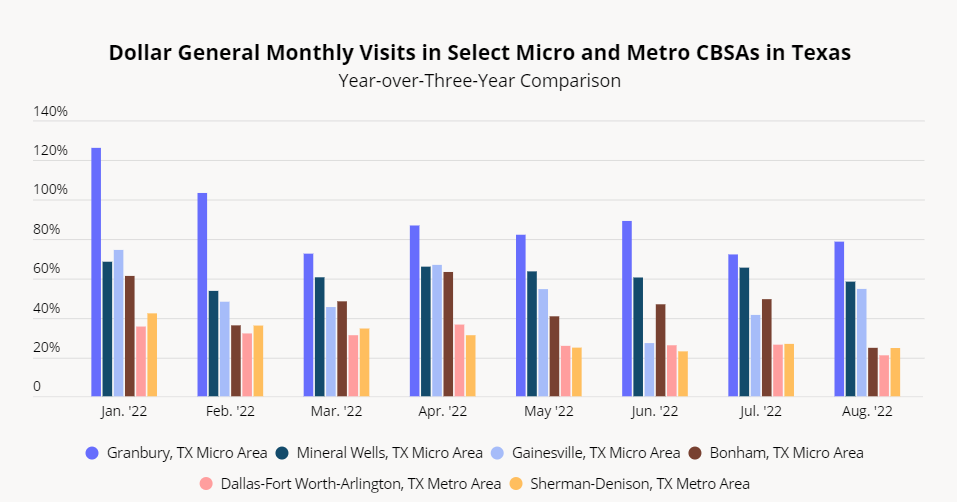

Comparing year-over-three-year (Yo3Y) visit change to Dollar General stores in metropolitan and micropolitan core based statistical areas (CBSAs) highlights the company’s success in smaller markets. According to the United States Office of Management and Budget, metropolitan and micropolitan CBSAS have over and under 50,000 residents, respectively. Since January 2022, monthly Yo3Y visit growth to Dollar General venues in select Texas micropolitans has consistently outpaced foot traffic to nearby metropolitan areas. While the Sherman-Denison metro area saw August 2022 foot traffic hit a solid 24.5% increase over August 2019, the Gainesville, Texas micro area – around 35 miles east of Sherman – saw its foot traffic increase 54.5% in the same period.

Dollar General’s presence across a significant number of smaller markets means that advertising partners can use the growing DGMN to increase awareness and drive purchase consideration among these harder-to-reach consumers.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.