One emerging use case for Consumer Edge data is better understanding real estate investments, both for real estate investors and for companies looking at the best other tenants to position themselves with. In today’s Insight Flash, we illustrate how either of these groups would think about a potential location strategy based on which subindustries are growing fastest locally, which other tenants are most likely to be cross-shopped, and which businesses are retaining their in-store appeal.

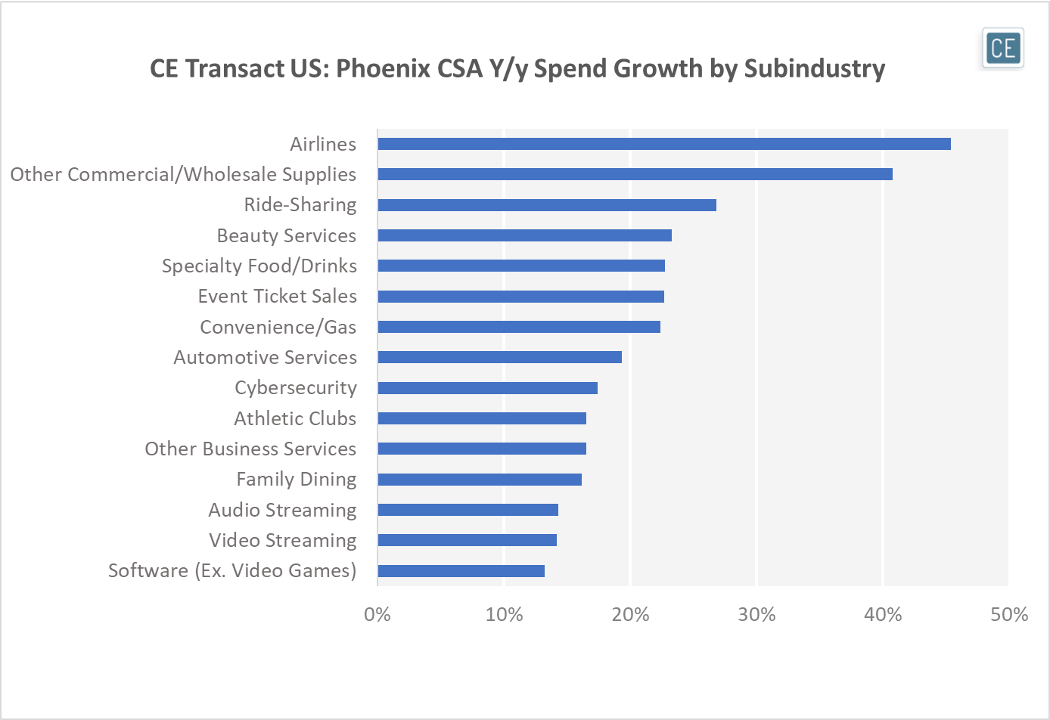

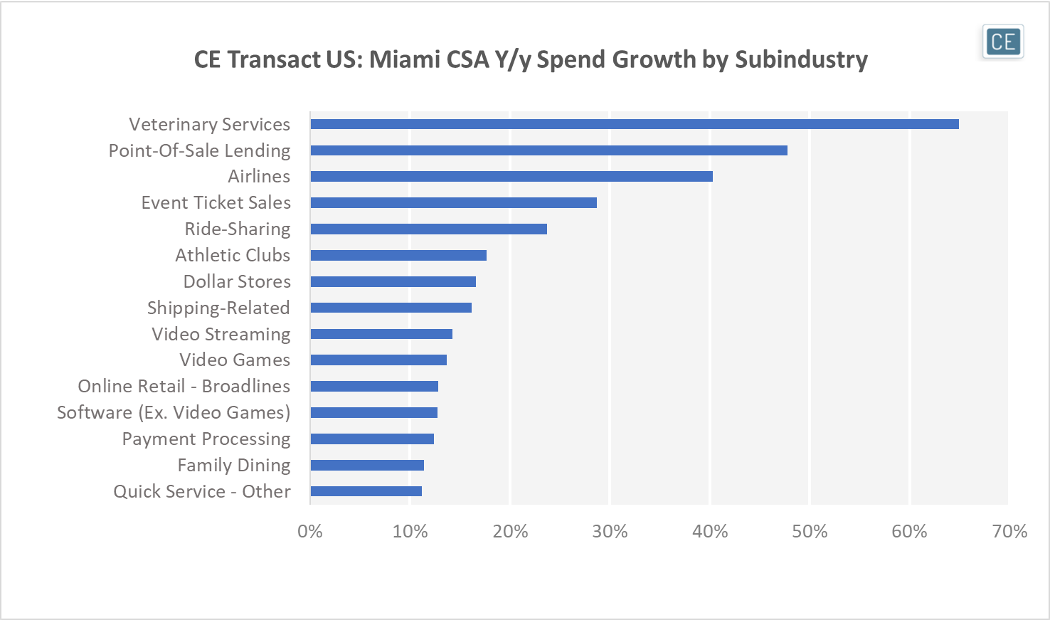

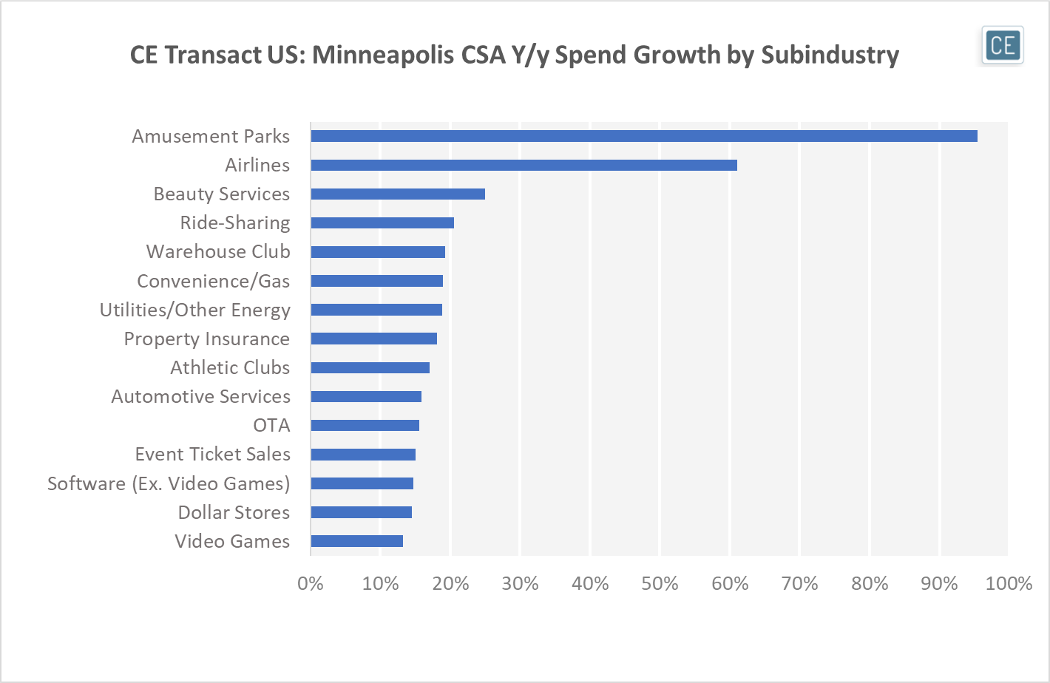

Consumer Edge’s flexible platform allows users to see which businesses are growing the fastest in which geographies, allowing stores in a development to be tailored toward what’s popular in the local economy. For instance, Beauty Services and Specialty Food/Drinks are among the fastest growing subindustries in Phoenix, so might be good choices for a shopping center or mall space. In Miami, Veterinary Services and Athletic Club spend are growing faster, so there might be more room for these types of businesses in the market. In Minneapolis, Beauty Services are showing high spend growth as they are in Phoenix, but Warehouse Club spend is also growing and might make a center with a Warehouse Club anchor a desirable spot for other tenants to open a new location.

Top Subindustries

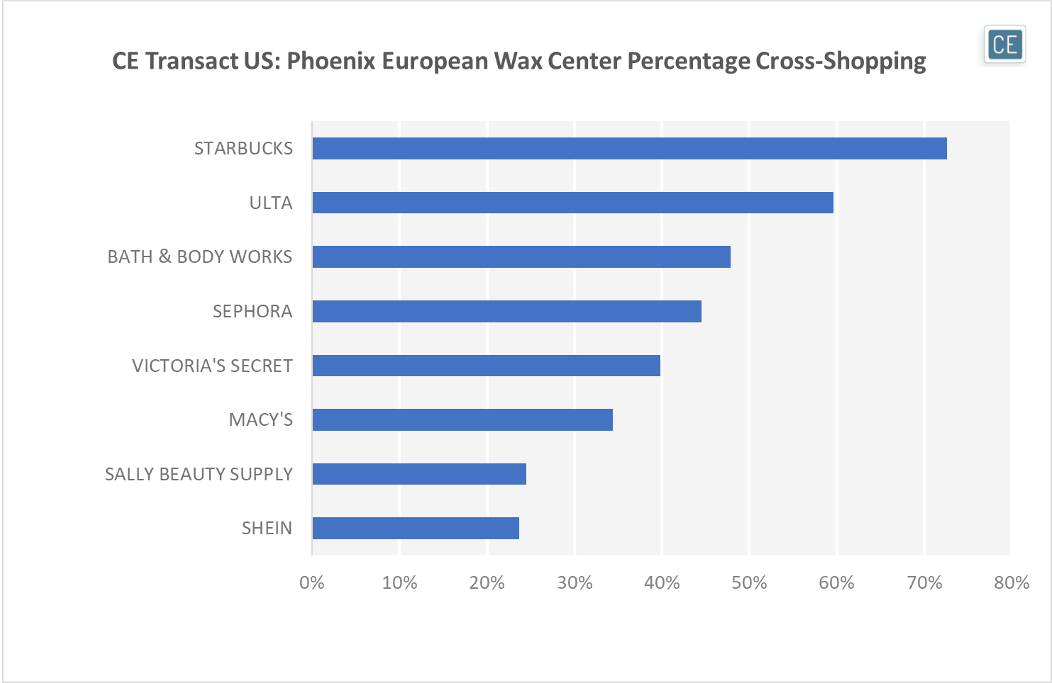

Although a particular subindustry like Beauty Services is growing, that doesn’t mean that shoppers for a Beauty Services company like European Wax Center will necessarily be attracted by other tenants in a development. Cross-shop is a good way to measure which businesses have similar shoppers and therefore could benefit the most from collocation. For instance, in Phoenix 73% of European Wax Center shoppers also made a purchase from Starbucks in the last 35 days, with 60% also shopping at Ulta and 48% buying something from Bath & Body Works. Given the high cross-shop rate, these brands might be more interested in store locations near a European Wax Center to get impulse customers wanting to treat themselves after an appointment. The convenience of having several desirable retailers in one place may make a shopper more likely to visit a particular mall or shopping center.

Cross-Shop

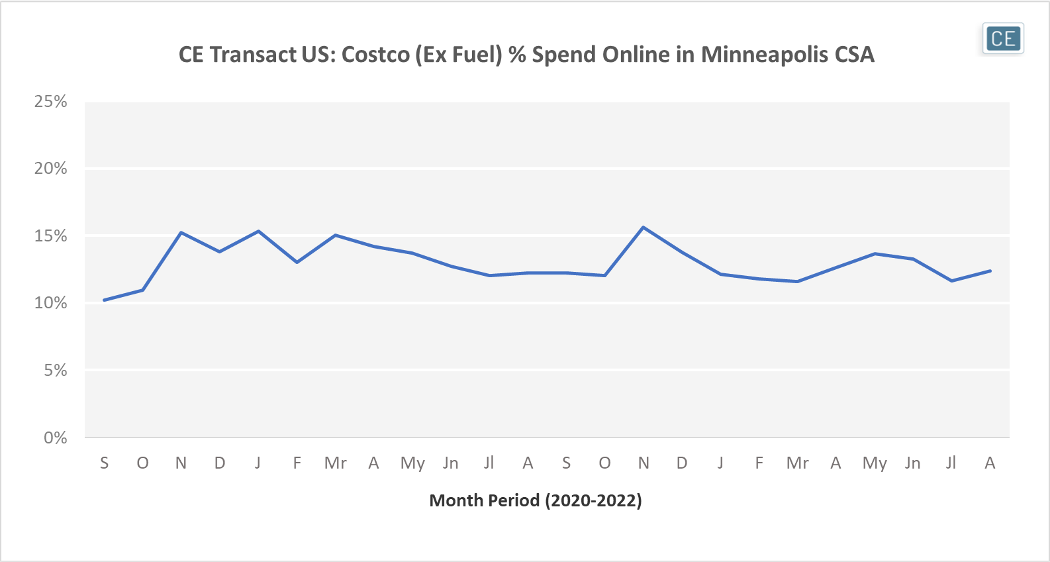

One important consideration when choosing a real estate anchor or smaller tenant is whether the store will actually drive physical traffic to a brick-and-mortar location, or whether spend is moving online. In Minneapolis, although Warehouse Clubs are growing spend y/y, is that spend getting shoppers out of their houses? According to Consumer Edge data, Costco’s spend has remained very steadily 85-90% in stores over the past two years. This could make Costco an even more attractive tenant given its continued in-store appeal.

Online Spend

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.