“Double 11” is on schedule, one of the peak cycles of the annual cell phone market.

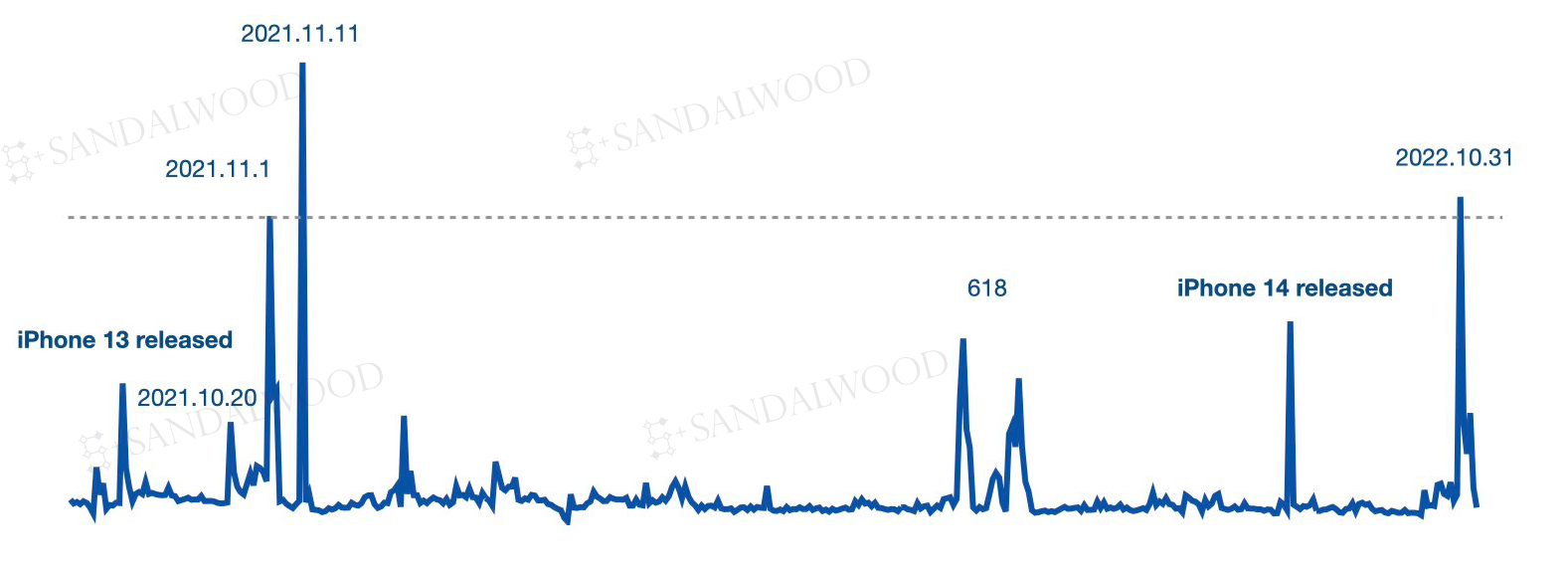

Tmall Cellphone Daily Sales Trend (Sep 1, 2021 – Nov 5, 2022)

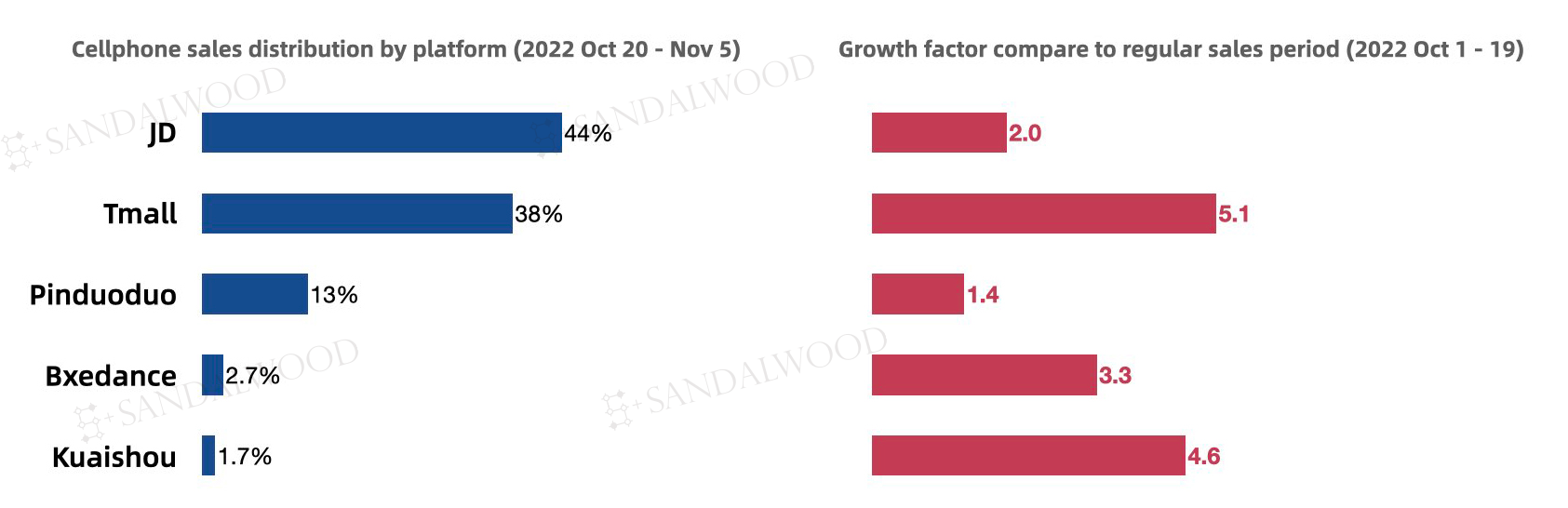

Double 11 Cellphone Sales Distribution by Platform & Growth Factor

Sandalwood E-Commerce data showed online cellphone sales reached 6.8 million units during Oct 20 – Nov 5 in China, 2.3 times the sales volume during regular period (Oct 1-19). JD accounts for 44% of the overall online sales, whereas Tmall, Pinduoduo, Douyin, Kuaishou account for 39%, 13%, 4%, 4% respectively. Sales on JD, Tmall, Pinduoduo, Douyin, Kuaishou were 2, 5, 1.4, 3.3, 4.6 times that of regular sales period (Oct 1-19).

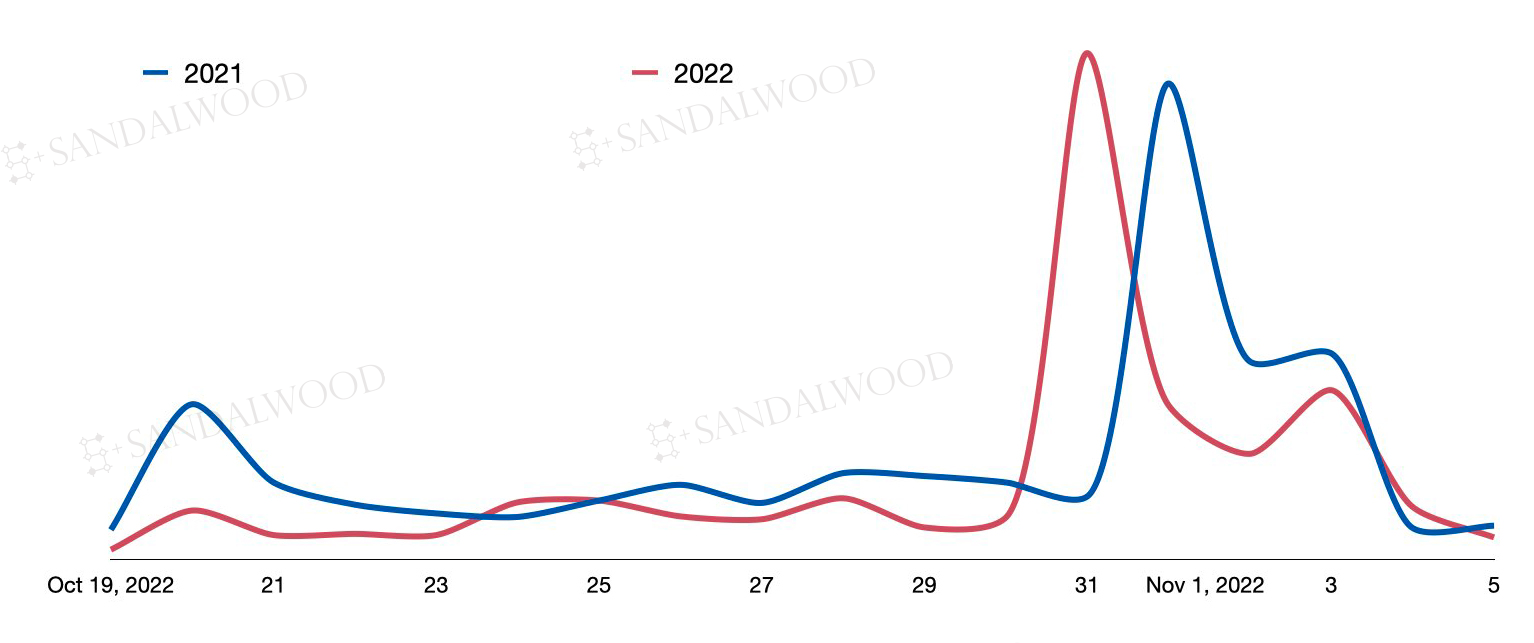

Though significantly improved from regular sales period during Double 11, China online cellphone sales declined compared to same period last year. Under such market downturn, Apple Tmall phone sales grew 28% y/y while Android declined 40% y/y.

Double 11 Tmall Cellphone Daily Sales Trend (Oct 19 – Nov 5, 2022)

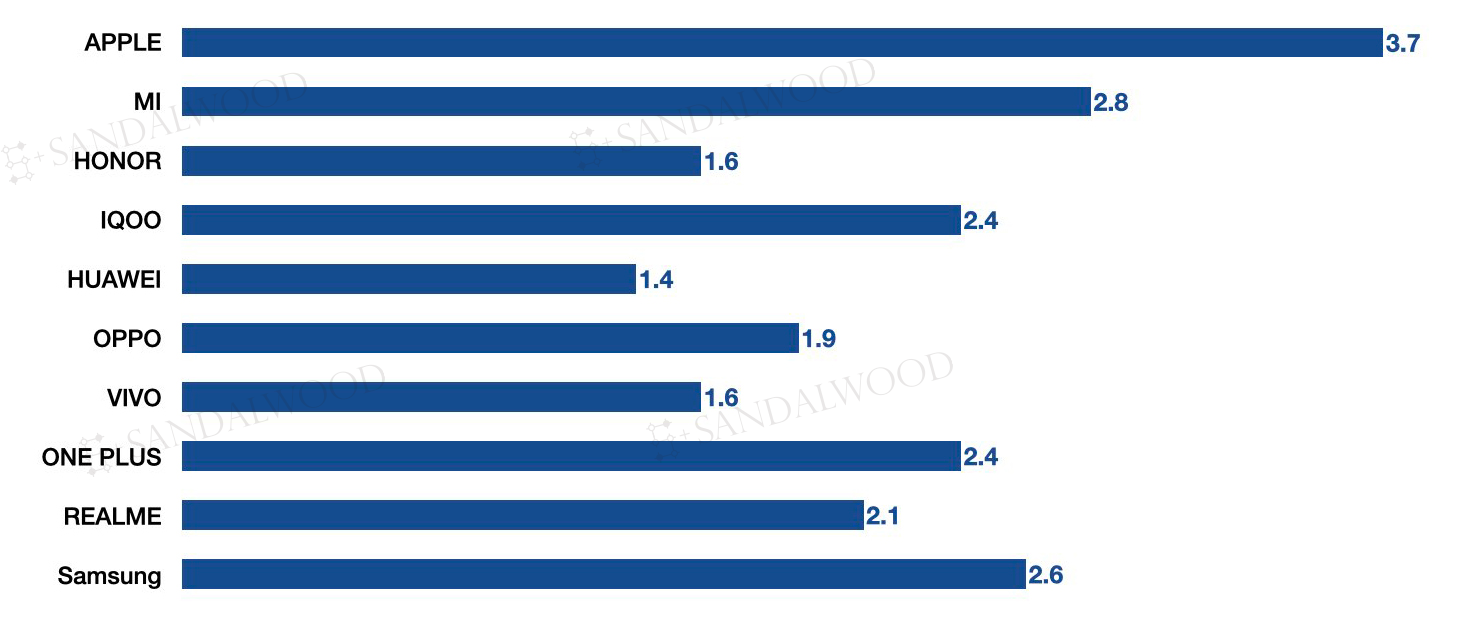

Apple has the highest by-brand growth factor during Double 11 – its sales volume reached 3.7 times that of regular period. Xiaomi ranked second with 2.8 times regular sales, followed by IQOO, One Plus, Samsung, OPPO, Realme, Huawei etc.

Double 11 Cellphone Sales Growth Factor

JD, Tmall, Pinduoduo, Douyin, Kuaishou Combined

In Comparison to Regular Sales Period (Oct 1-19, 2022)

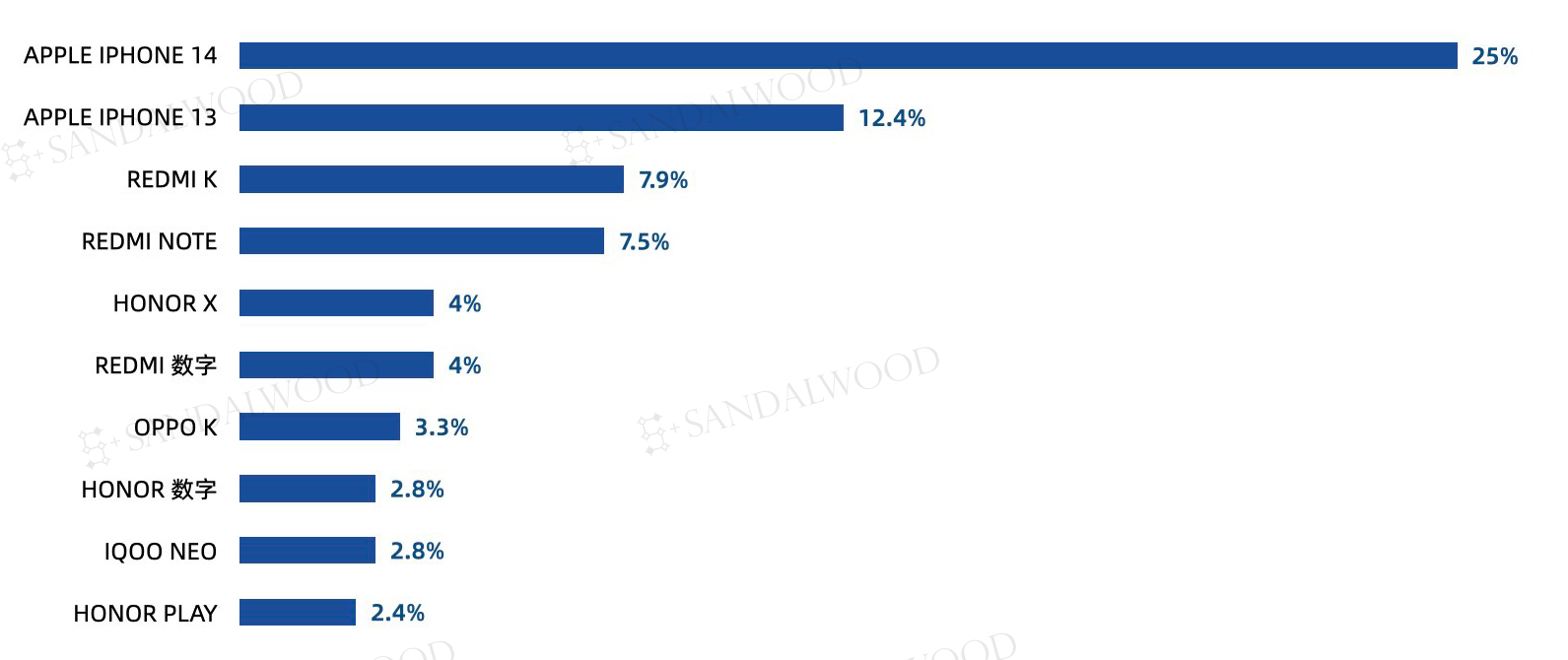

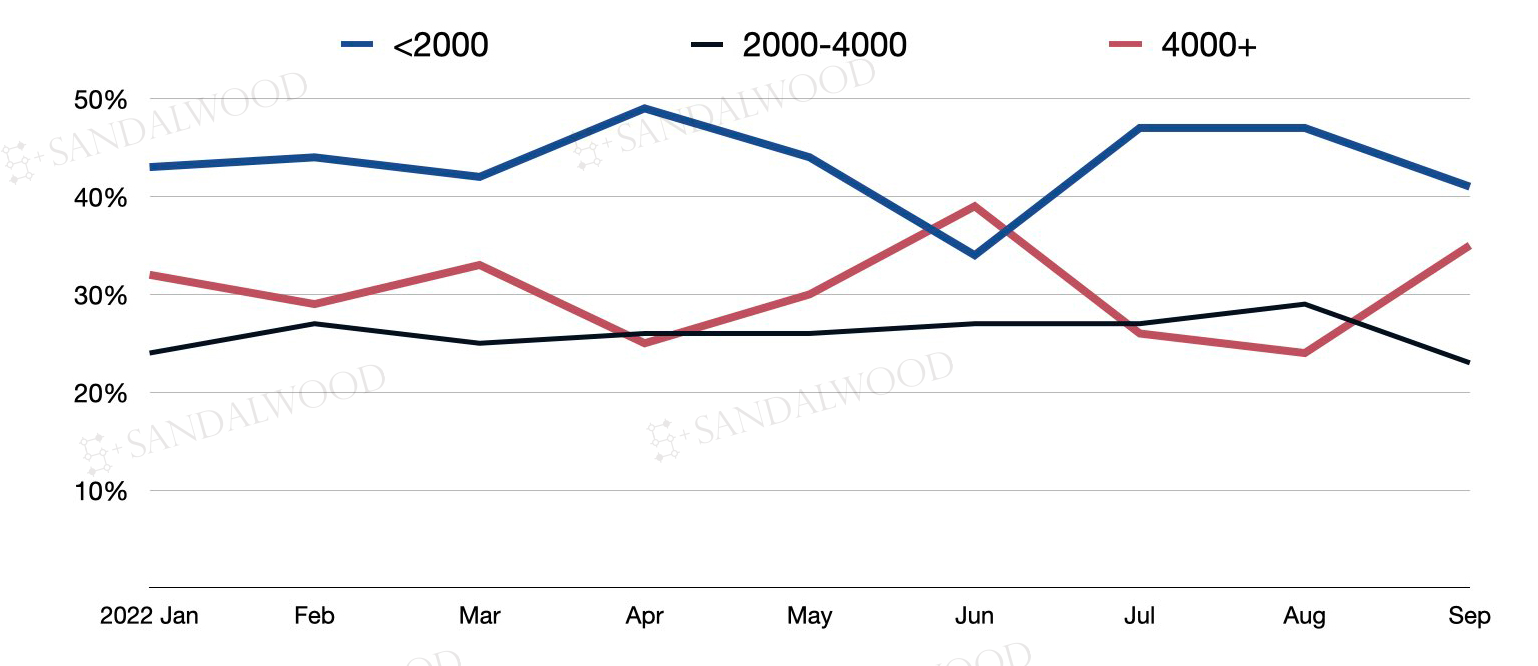

Among the top ten cellphone models during Double 11, sales of iPhone 13 and 14 combined account for 37%. Redmi, Honor, OPPO K series, IQOO Neo series also made the list. Aside from Honor Digital, the average price was marked around 2000 RMB. The top ten model sales distribution mirrors the consumption structure of cellphone e-commerce — products above 4000 RMB took around 30% of market share (close to 40% at promotion periods) during the first 3 quarters of 2022; phones below 2000 RMB are the main market driver, making up about 45% of the market.

2022 Double 11 Top 20 Cellphone Model Sales Ranking

JD, Tmall, Pinduoduo, Douyin, Kuaishou Combined

Oct 20 – Nov 5, 2022

China E-Commerce Cellphone Market Share by Price

Includes JD, Tmall, Pinduoduo, Douyin, Kuaishou, Taobao, Suning, Vipshop

Sales during Double 11 reflects overall cellphone market nosedive and polarization. For the first 3 quarters of 2022, China online cellphone sales volume reached 69.17 million, a 3% y/y decline compared to 2021. Apple sales, despite market downturn, grew 22% y/y and reached 17.22 million units, while Android sales declined 9% y/y with 51.95 million phones sold. Facing the new normal with equanimity, and seeking long-term steady growth amidst market volatility might be the to-go strategy for players in the consumer electronics industry.

To learn more about the data behind this article and what Sandalwood has to offer, visit http://www.sandalwoodadvisors.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.