Key takeaways:

Under $55k Earners Are Flocking to Dollar Stores

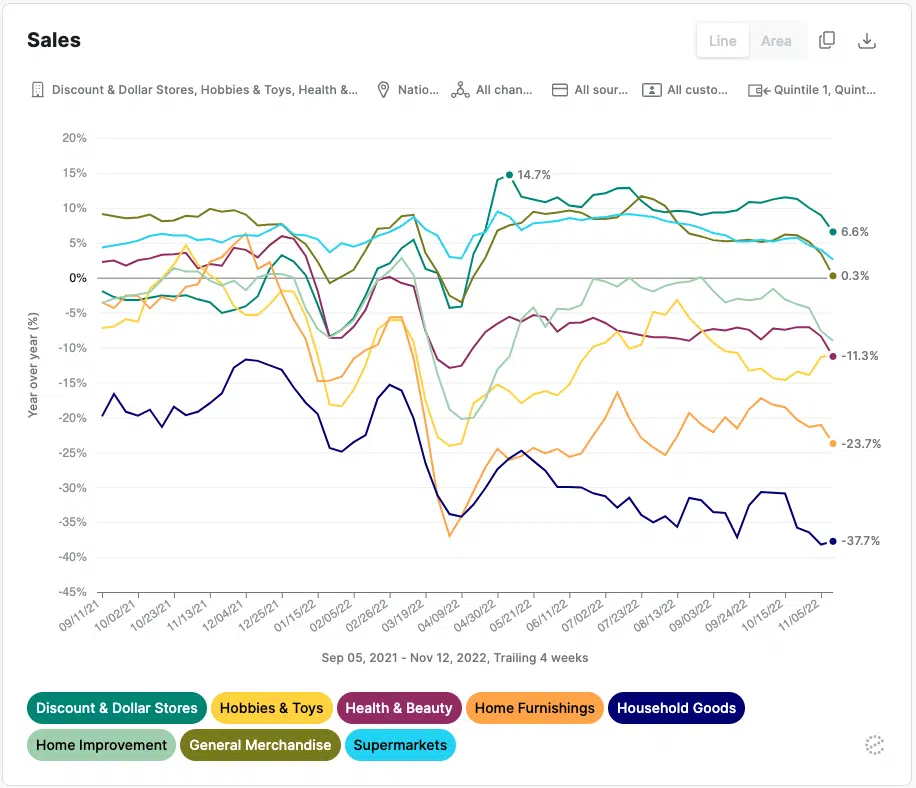

Low-income consumers are moving their wallets to dollar stores according to Earnest Analytics’ credit and debit card data in the face of high inflation. Spending by households making under $55k per year at national dollar store chains like Big Lots (BIG), Dollar General (DG), Dollar Tree (DLTR), Five Below (FIVE), and Olli’s Bargain Outlet (OLLI) materially outgrew spending across other major categories since April. Hobbies & Toys, Health & Beauty, Supermarkets, Home Furnishings, Household Goods, and Home Improvement. This suggests low income earners are trading down for cheaper alternatives compared to 2021 when they benefited from stimulus checks and more optimistic economic outlook.

Medium-to-High Income Earners Are Reducing Spend Across the Board

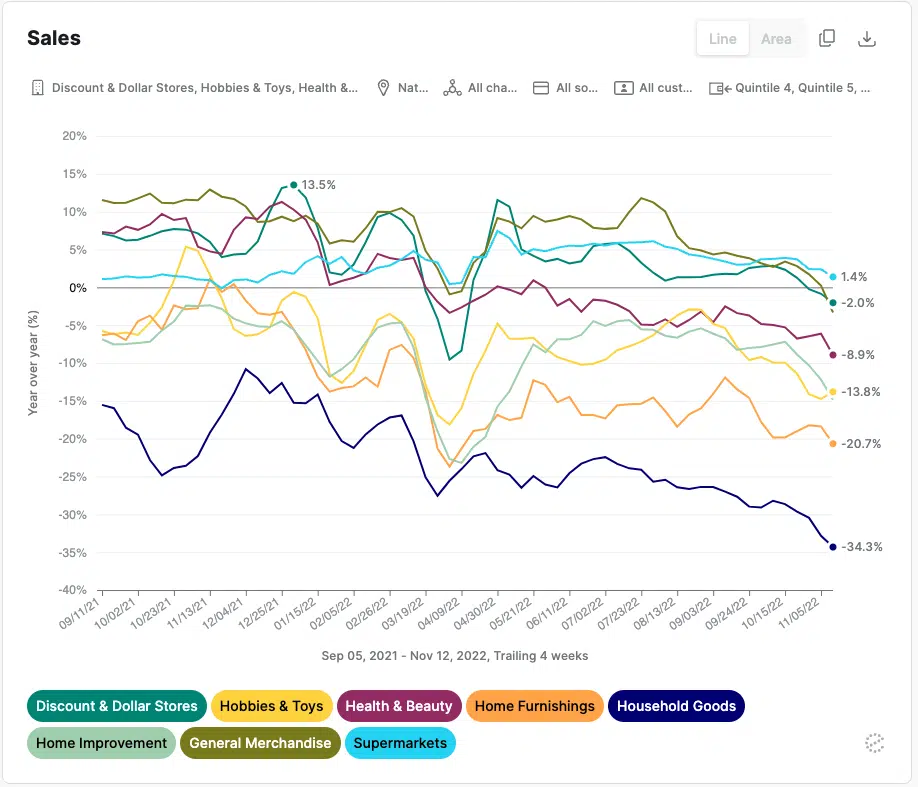

In contrast, Dollar Store spending by shoppers earning over $55k was in-line with other consumer staples categories like Supermarkets and General Merchandise (like Walmart) retailers. This despite a similar slowdown in spend across other the same major categories. This suggests higher income individuals have not traded down to Dollar Stores, though they may be substituting for lower priced products.

Dollar General’s move upmarket with its new Popshelf banner could also help it hedge its bets with higher income earners if they do decide to trade down, as well. According to Earnest’s Orion dataset, 29% of Popshelf customer spend in 2021 came from households with annual earnings of more than $150K, while this figure was 22% at its parent, Dollar General.

Dollar Tree and Dollar General Outperform Big Lots

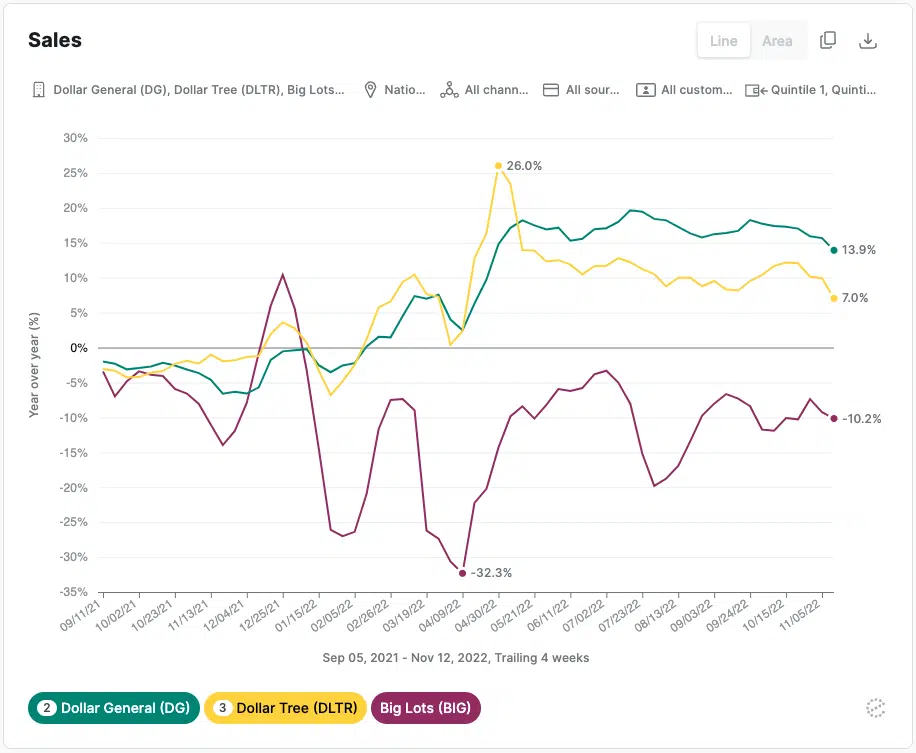

Dollar General led Dollar Tree among low-income consumers, though both outgrow the rest of the dollar story industry brands. Discretionary focused stores such as Big Lots trailed among the cohort. The industry’s growth began to diverge early in 2022 as inflation first began to peak. Dollar stores and discount retailers are likely to continue to benefit in a highly inflationary environment according to some studies.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.