Introduction

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through November 2022.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes transition rates between states of delinquency and separate breakouts for 120+ day delinquency.

“Most homeowners are well positioned to weather a shallow recession. More than a decade of home price increases has given homeowners record amounts of equity, which protects them from foreclosure should they fall behind on their mortgage payments.”

-Molly Boesel

Principal Economist for CoreLogic

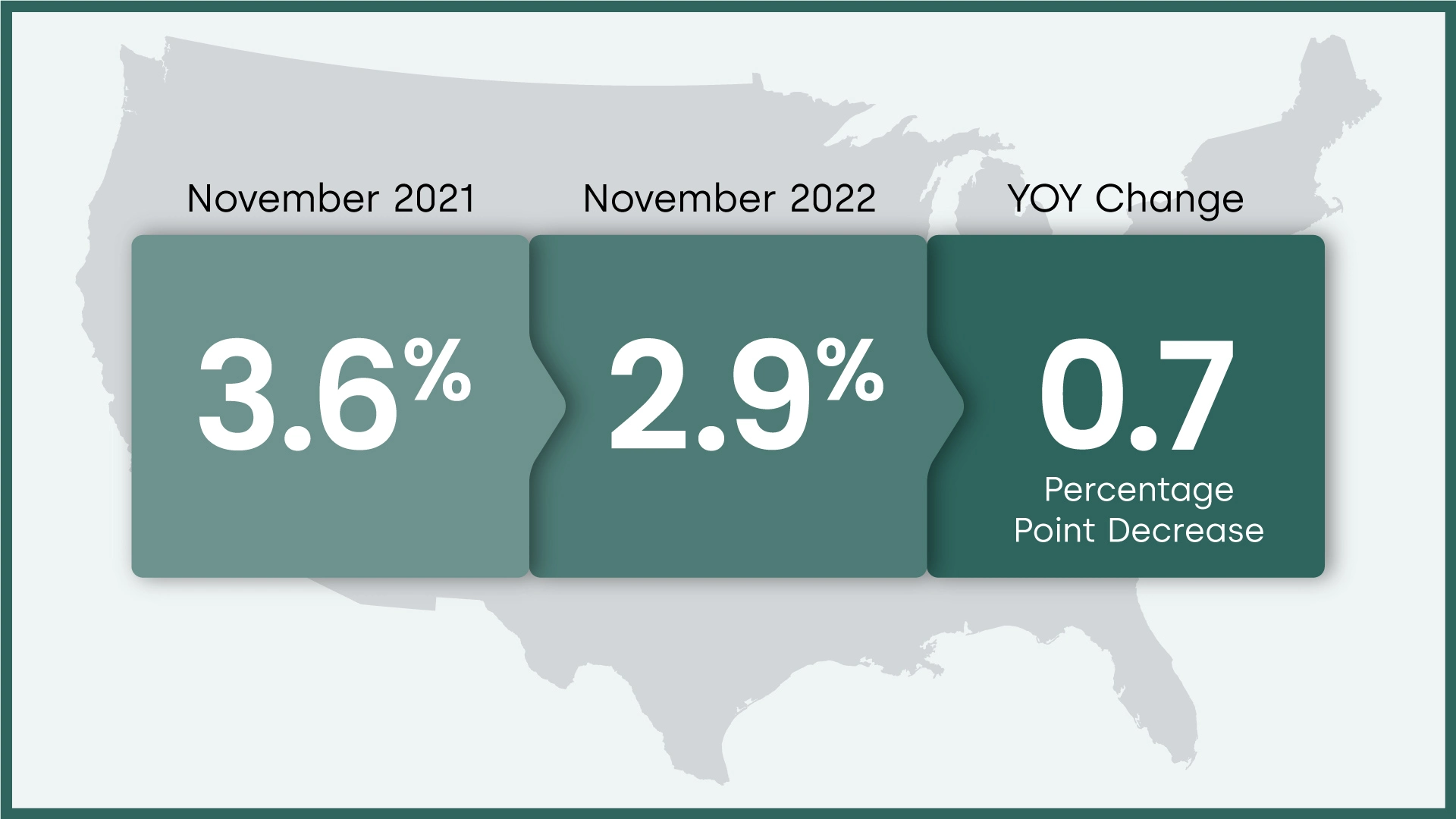

30 Days or More Delinquent – National

In November 2022, 2.9% of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 0.7 percentage point decrease in the overall delinquency rate compared with November 2021.

Mortgage Delinquency and Foreclosure Rates Remain Near Historic Lows

Overall mortgage delinquency and foreclosure rates remained near record lows in November 2022, 2.9% and 0.3%, respectively. While national mortgage delinquencies declined for the 20th straight month on an annual basis, 18 U.S. metro areas saw at least slight increases in late borrower payments, up from six in October and one in September. Despite that uptick and slowing home price growth in recent months, most owners are in good shape due to healthy amounts of equity. CoreLogic’s latest Home Equity Report shows that U.S. homeowners with a mortgage saw their equity increase by 15.8% year over year in the third quarter of 2022, for an average gain of $34,300 per borrower.

Loan Performance – National

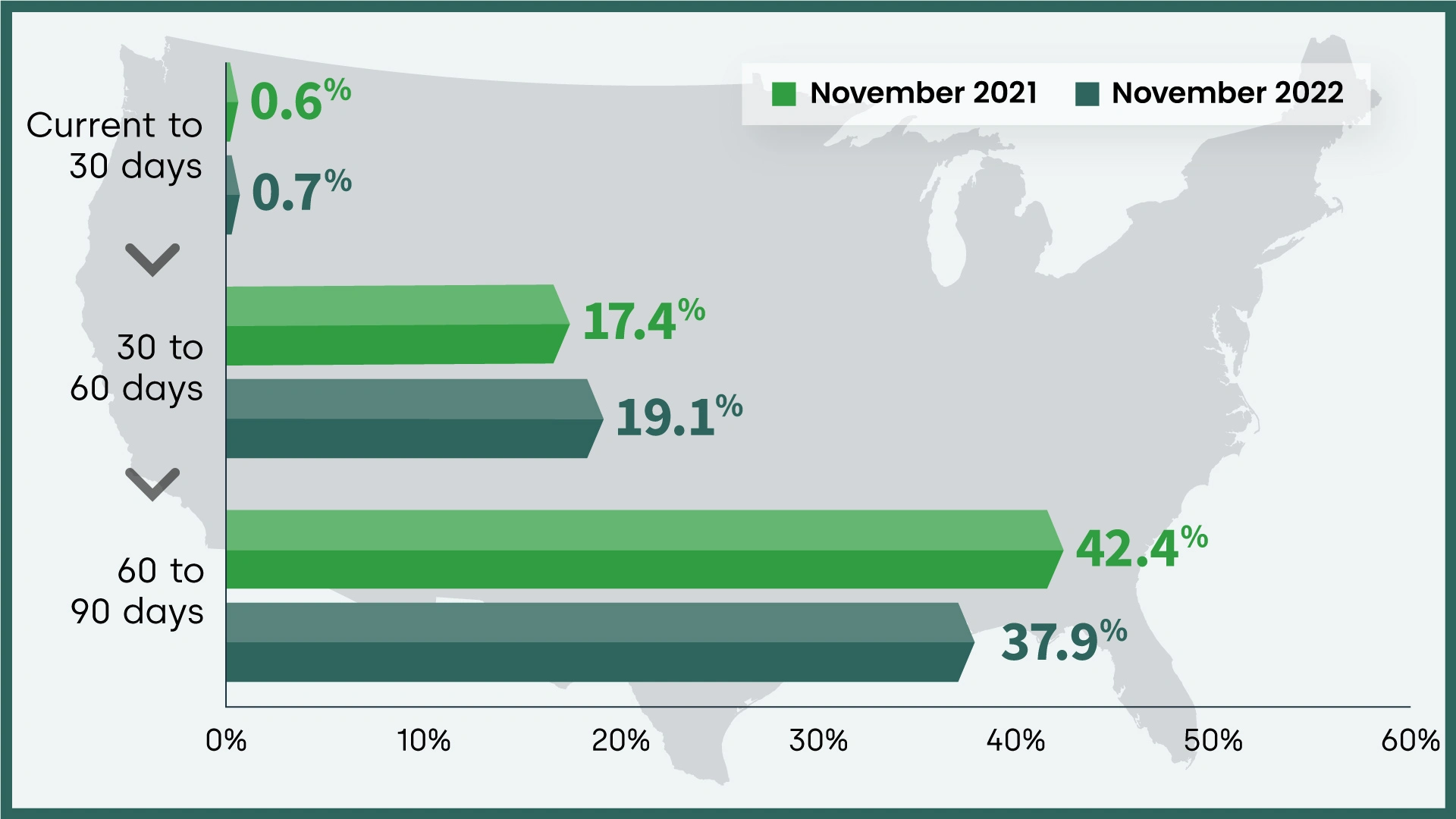

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for November was 2.9%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.4% in November 2022, up slightly from November 2021. The share of mortgages 60 to 89 days past due was 0.4%, also up from November 2021. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.2% down from 2% in November 2021.

As of November 2022, the foreclosure inventory rate was 0.3%, up slightly from November 2021 but still near an all-time low.

Transition Rates – National

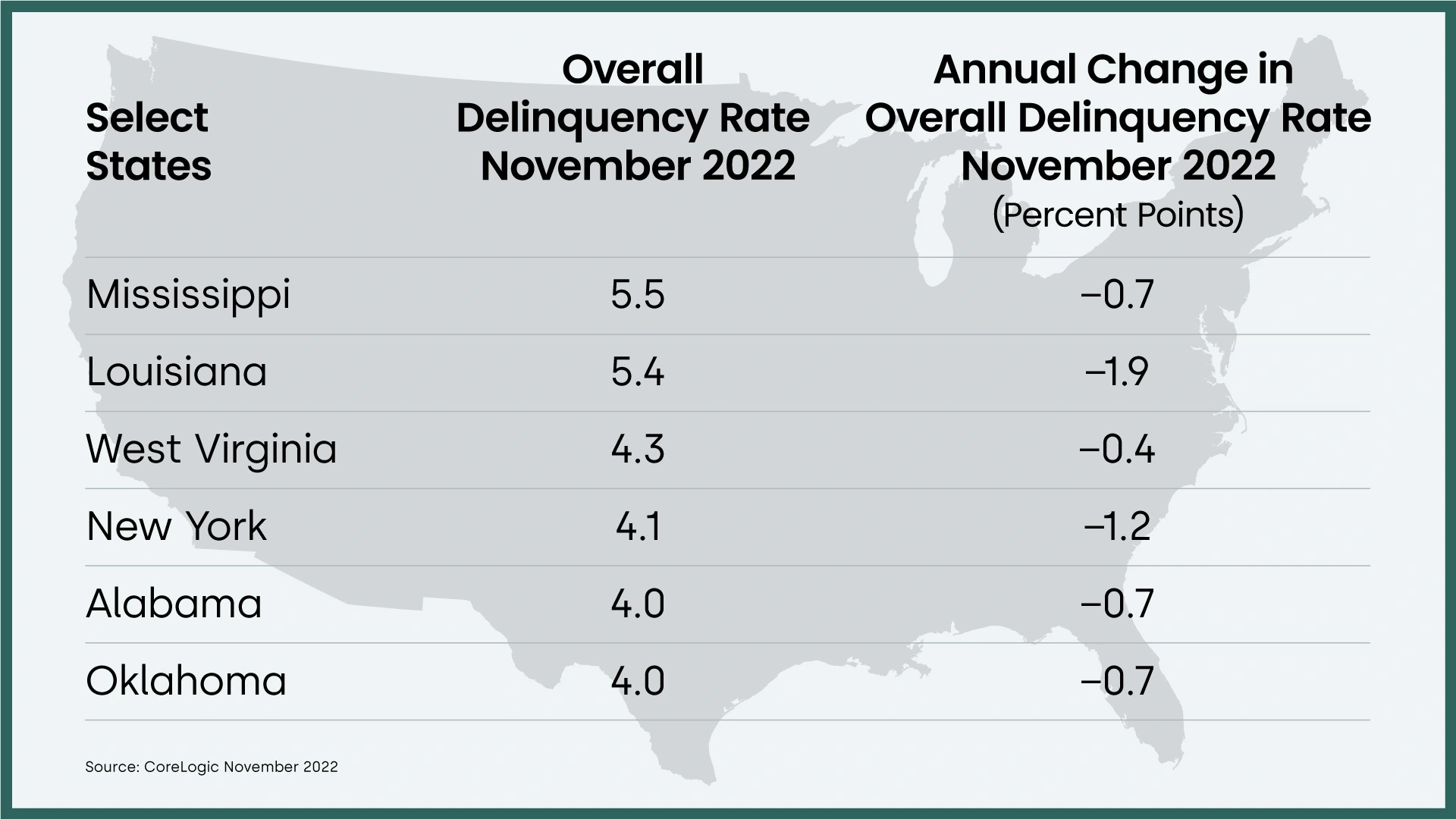

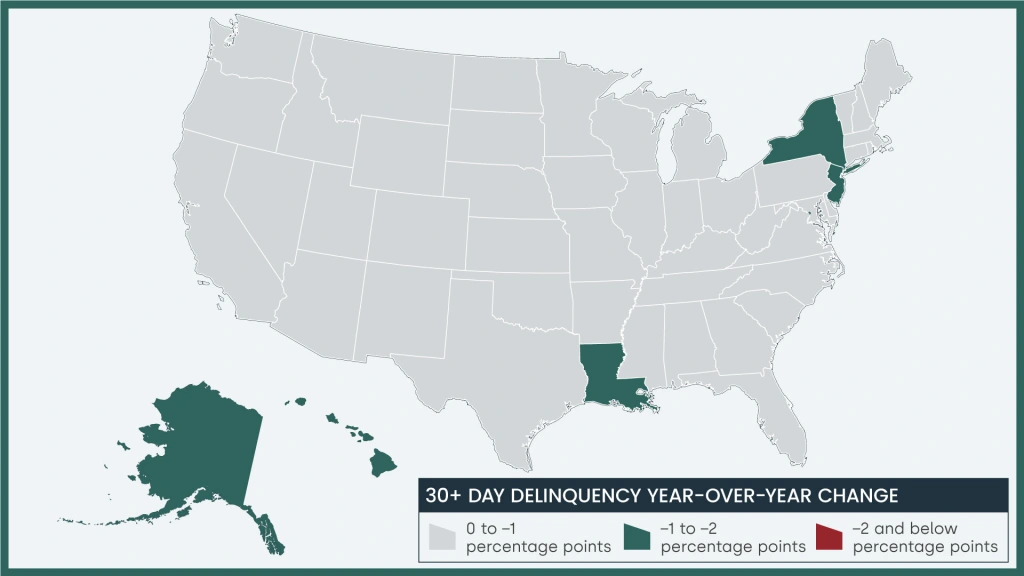

Overall Delinquency – State

Overall delinquency is defined as 30 days or more past due including loans in foreclosure.

In November 2022, all states logged year-over-year declines in their overall delinquency rates. The states and districts with the largest declines were Louisiana (1.9 percentage points) Alaska (1.6 percentage points) and the District of Columbia and Hawaii ( both 1.3 percentage points).

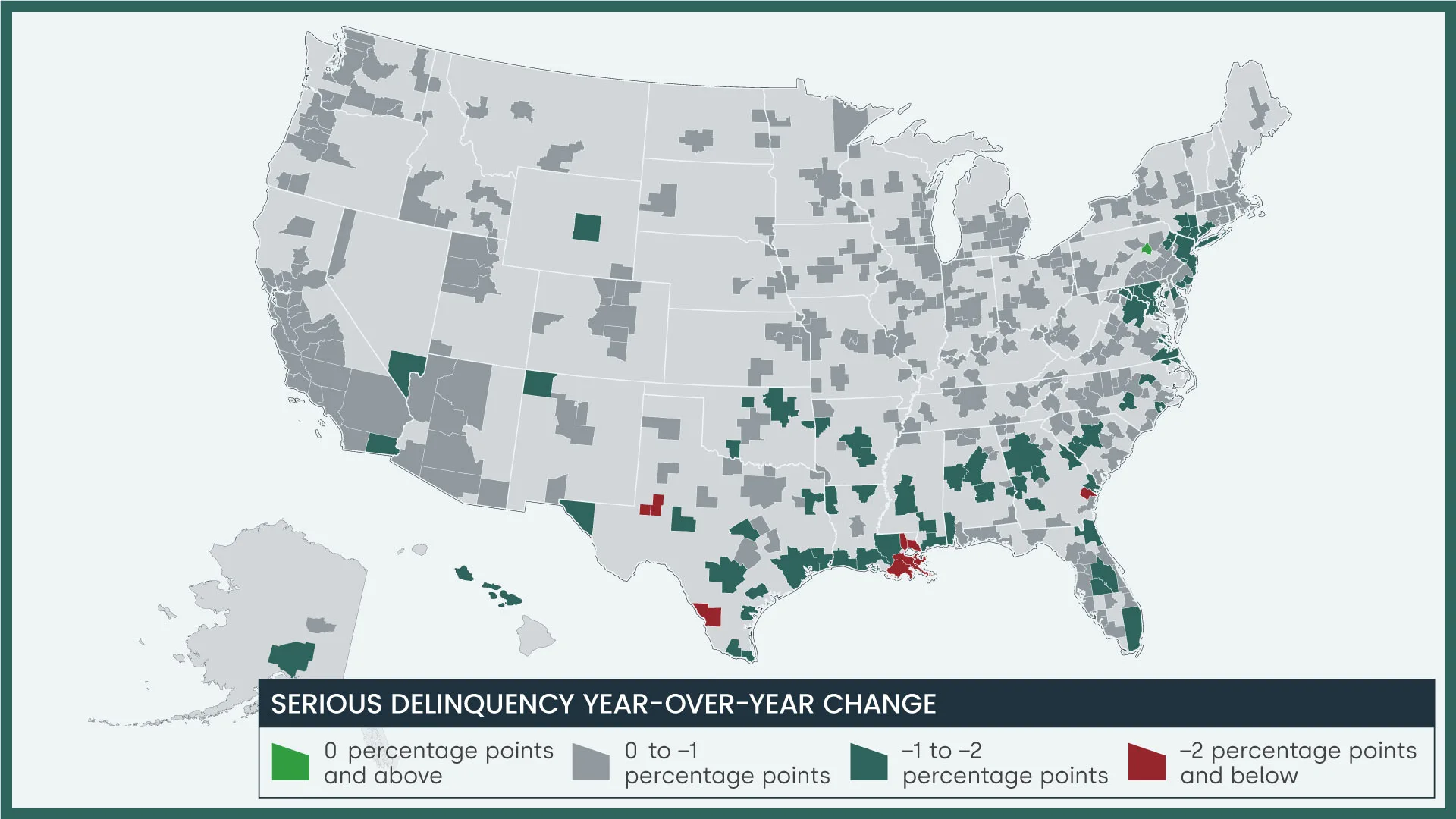

Serious Delinquency – Metropolitan Areas

There was one metropolitan area where the Serious Delinquency Rate increased.

There were 383 metropolitan areas where the Serious Delinquency Rate decreased.

Summary

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.