Introduction

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through December 2022.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes transition rates between states of delinquency and separate breakouts for 120+ day delinquency.

“Mortgage delinquency rates continued to post some of the strongest performance in three years in December, as a healthy job market helped borrowers remain current on their payments. High amounts of home equity cushioned those borrowers who were far behind, keeping them from moving into foreclosure. While there was a small uptick in early-stage delinquencies and foreclosure inventory over 2022, other delinquency measures fell to new lows throughout the year.”

-Molly Boesel

Principal Economist for CoreLogic

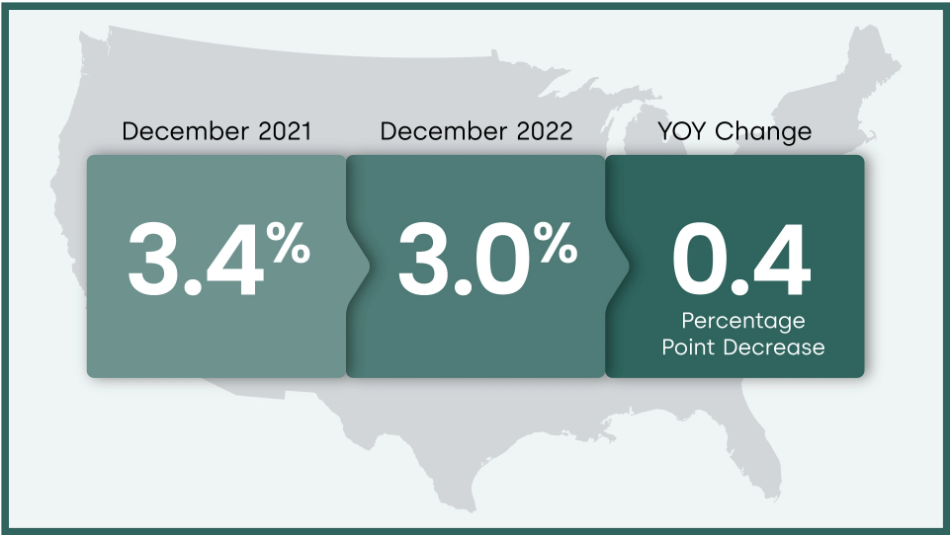

30 Days or More Delinquent – National

In December 2022, 3% of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 0.4 percentage point decrease in the overall delinquency rate compared with December 2021.

Mortgage Delinquencies Remain Near All-Time Lows, Though 17% of U.S. Metro Areas Post Increases From December 2021

U.S. mortgage delinquency and foreclosure rates remained consistently low throughout 2022 and closed the year in the same way. December’s 3% overall delinquency rate and the 0.3% foreclosure rate were only slightly higher than numbers recorded over the previous six months. Both types of delinquencies bottomed out in early 2022 and are now showing signs of minor upticks.

Most of that small increase comes from a change in early-stage delinquencies, which began inching up in mid-2022 after hovering near historic lows in the spring of 2021. Still, even with that slight market adjustment, delinquencies remain at the lowest level since the data series began in 1999.

On the other hand, December’s 1.2% serious delinquency rate has barely moved since last spring, which suggests that while some borrowers may have missed several mortgage payments, most are likely to recover relatively quickly.

Despite 2022’s exceptionally high mortgage performance, 65 U.S. metro areas posted at least slight annual increases in overall delinquency rates in December. This marks a substantial uptick from November and represents 17% of markets for which CoreLogic tracks data. While national home price annual gains are projected to continue slowing and may decline by the spring of 2023, positive employment reports and healthy amounts of home equity should help maintain a solid housing market foundation.

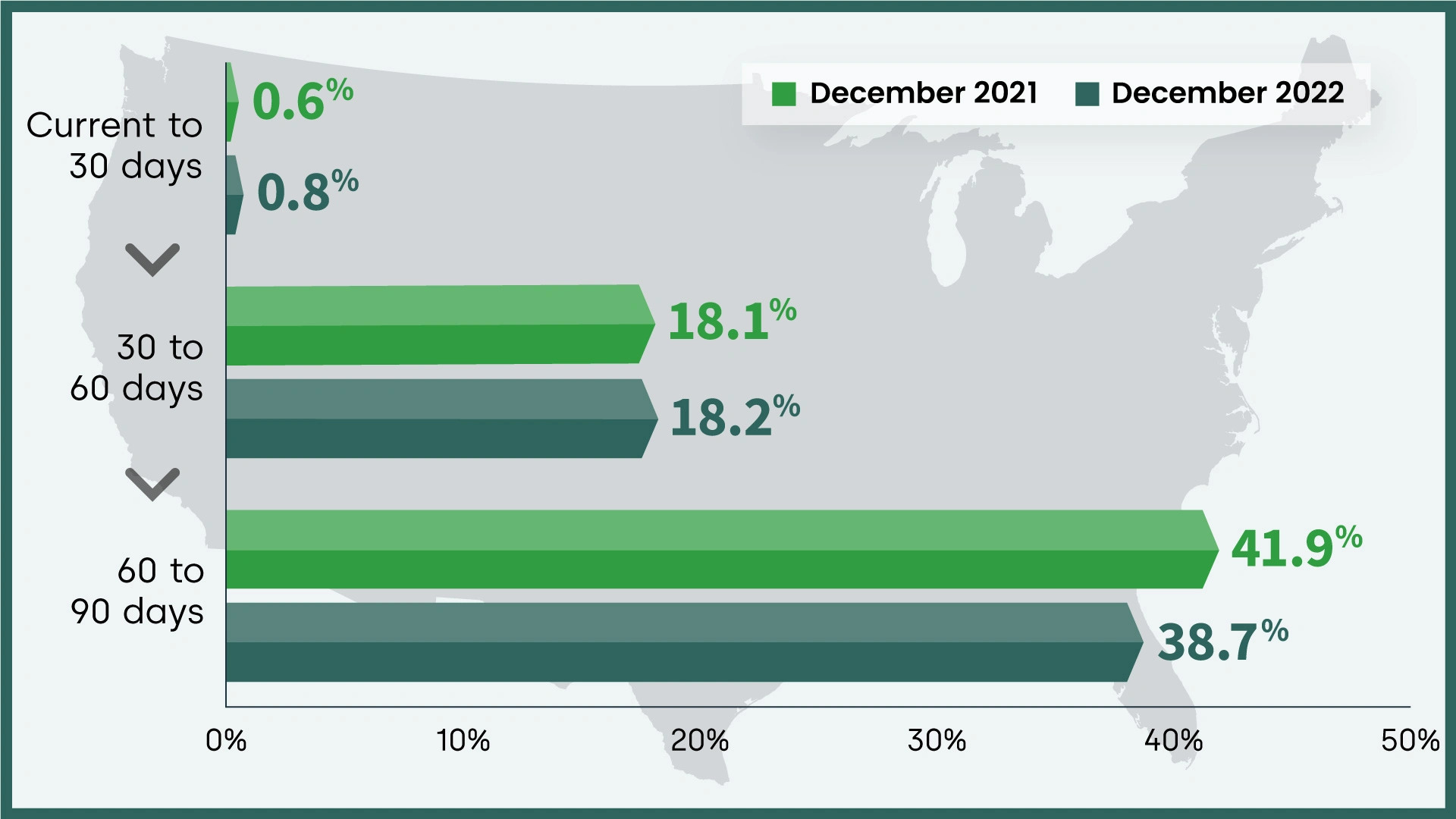

Loan Performance – National

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for December was 3%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.4% in December 2022, up slightly from December 2021. The share of mortgages 60 to 89 days past due was 0.4%, also up from December 2021. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.2% down from 1.9% in December 2021.

As of December 2022, the foreclosure inventory rate was 0.3%, up slightly from December 2021 but still near an all-time low.

Transition Rates – National

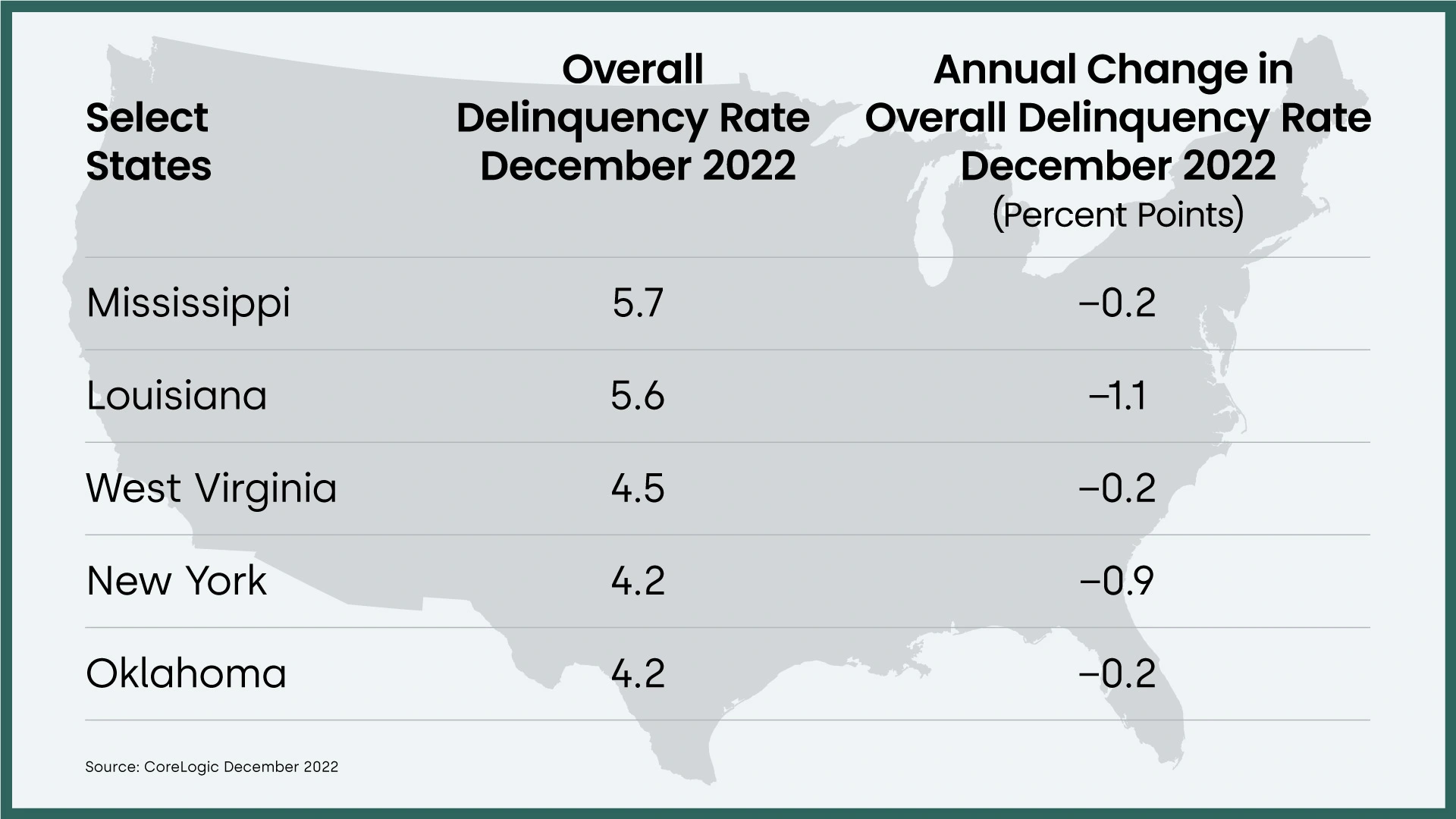

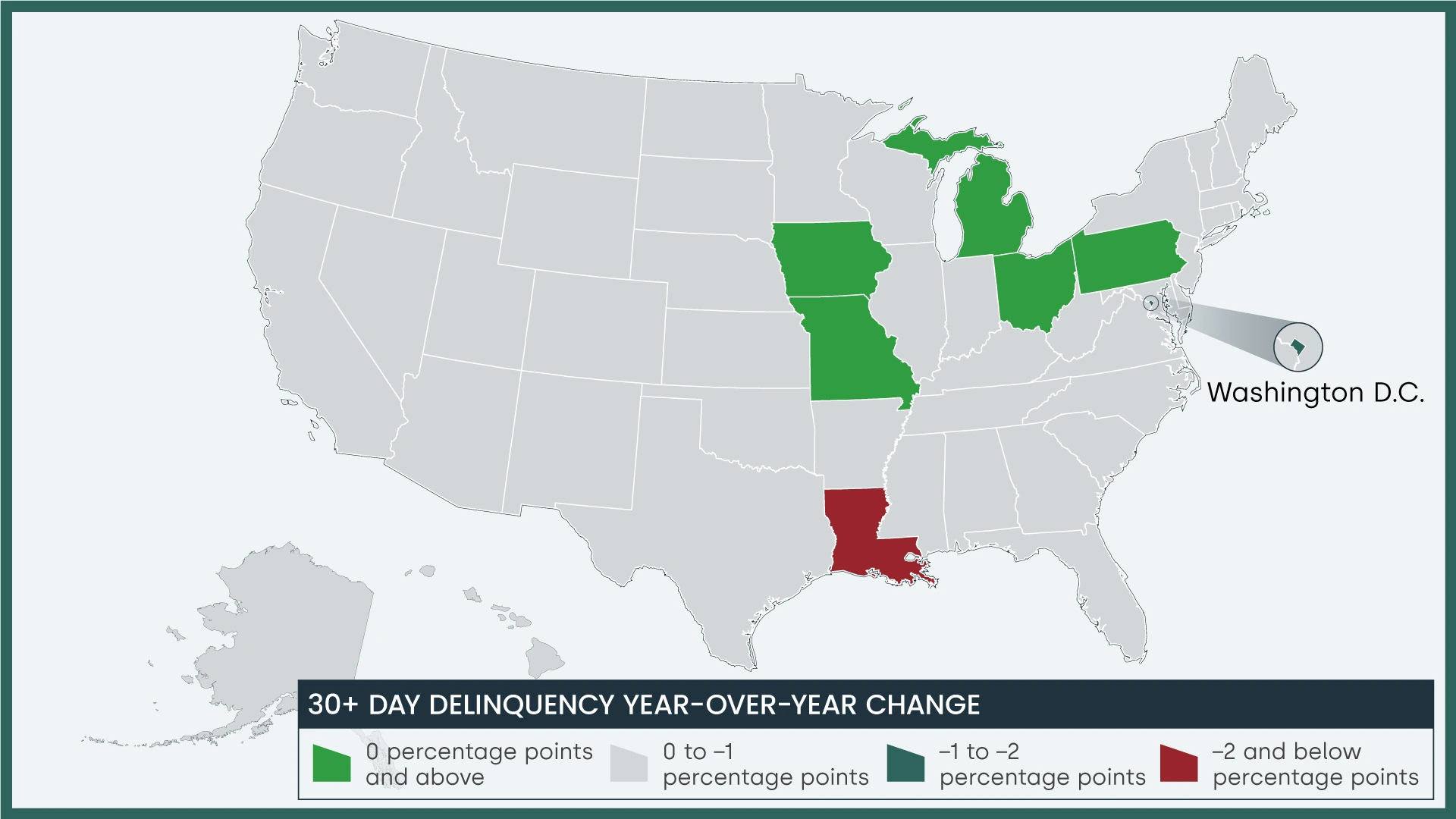

Overall Delinquency – State

Overall delinquency is defined as 30 days or more past due including loans in foreclosure.

In December 2022, one state (Iowa) posted a small year-over-year increase in its overall delinquency rate. The states and districts with the largest delinquency declines were Louisiana (1.1 percentage points); Washington, D.C. (1 percentage point); and Alaska, Hawaii and New York (all 0.9 percentage points).

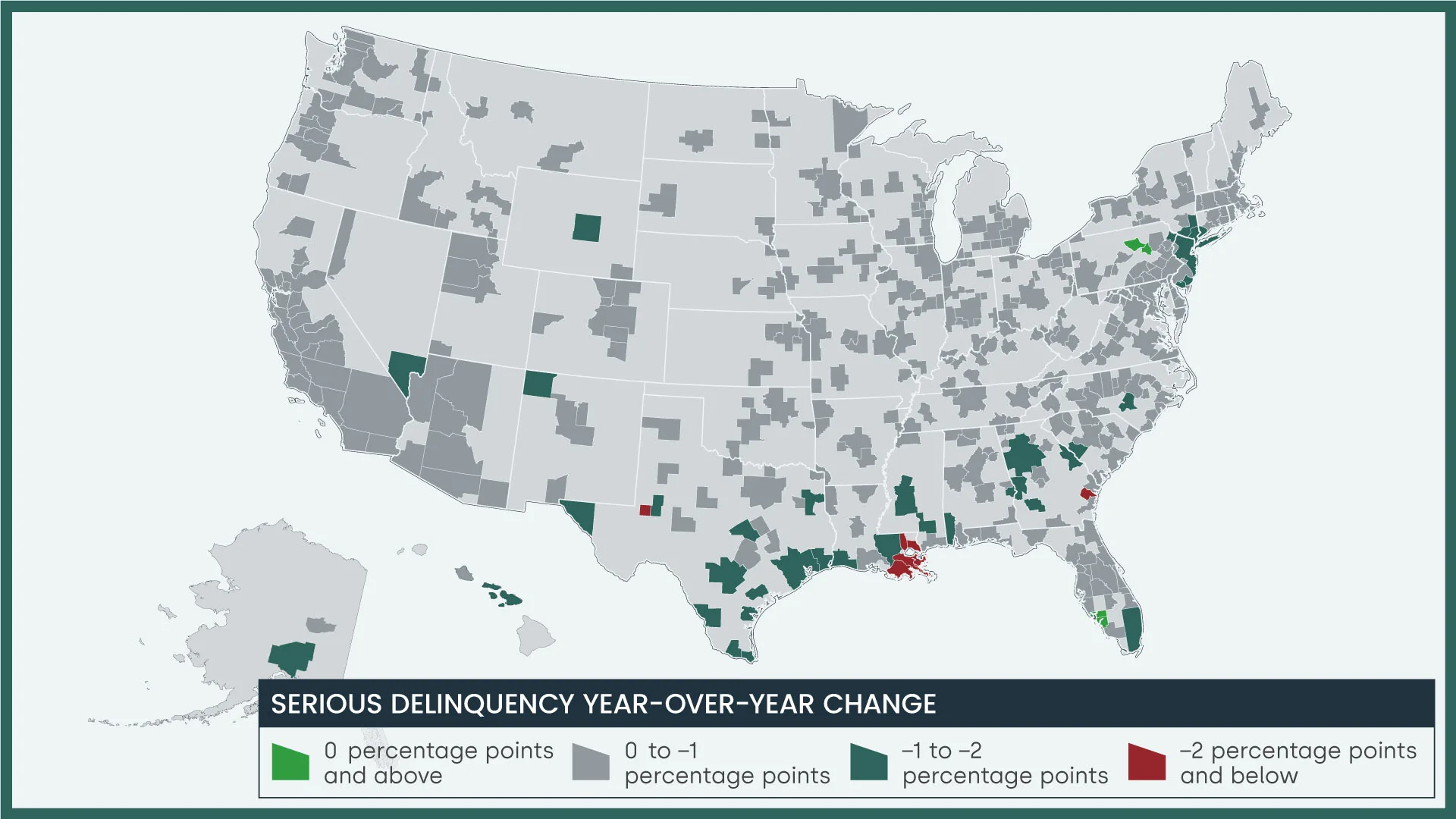

Serious Delinquency – Metropolitan Areas

Serious delinquency is defined as 90 days or more past due including loans in foreclosure.

There were four metropolitan areas where the Serious Delinquency Rate increased.

There were 380 metropolitan areas where the Serious Delinquency Rate decreased.

Summary

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.