TikTok, the most popular social media app for Gen Z, could be facing a ban in the United States based on fears (maybe facts, not sure) that China is using the app to gain information on US citizens. Another country who is at odds with China, has already banned more than 250 apps originating from the country. TikTok is one of those, and on June 30, 2020, it was suddenly nowhere to be found on the app stores in India. The fallout in the country's social media landscape could have insights into what might play out in the US.

Temu, the ecommerce company owned by Pinduoduo, has had its mobile app installed by 50 million people since it launched in September 2022. Even with its late 2022 launch, it managed to become the 8th most downloaded shopping app in the United States last year. Both SHEIN and Wish took about 3 years to cross 50 million installs whereas it's taken Temu about seven months.

The top 10 quick-service restaurant apps in the U.S. were downloaded 10.5 million times in February, 4.2 percent more than those the month prior. Year-over-year in the month of February, downloads of the top 36 quick-service restaurant apps are up 33.7 percent. A download represents a new user and the first conversion on the mobile app customer’s journey.

The top 10 quick-service restaurant apps in the U.S. were downloaded 11.6 million times in December, 1.4 percent more than those the month prior. Year-over-year in the month of December, downloads of the top 36 quick-service restaurant apps are up 6.6 percent. A download represents a new user and the first conversion on the mobile app customer’s journey.

Welcome in to our sixth annual worldwide and U.S. download leader charts, the full year scoreboard of user acquisition winners - the most in-demand apps on the planet. We have 33 top charts below for you to review. Did your company's app make it this year? Before you start, you may want to understand what a mobile app download is, what this metric is good at measuring and what it does not measure.

The top 10 quick-service restaurant apps in the U.S. were downloaded 11.4 million times in November, seven percent less than those the month prior. Year-over-year in the month of November, downloads of the top 36 quick-service restaurant apps are up 18.6 percent. A download represents a new user and the first conversion on the mobile app customer’s journey.

The top 10 quick-service restaurant apps in the U.S. were downloaded 12.3 million times in October, 23 percent more than those the month prior. Year-over-year in the month of September, downloads of the top 36 quick-service restaurant apps are up 27.5 percent. A download represents a new user and the first conversion on the mobile app customer’s journey.

It’s been a minute (more specifically, a year) since Netflix made its foray into free mobile games, whose purpose was to increase the retention of its subscriber base. The streaming giant has launched and/or acquired 35 mobile games to date, for a total of 34.1 million global downloads, 16% of which come from the United States, its leading market.

The top 10 quick-service restaurant apps in the U.S. were downloaded 10.3 million times in August, 14.8 percent less than those the month prior. Year-over-year in the month of August, downloads of the top 36 quick-service restaurant apps are up 18.9 percent. A download represents a new user and the first conversion on the mobile app customer’s journey. While the order has changed, every one of July’s 10 most downloaded quick-service restaurant apps have returned in August’s lineup. Dunkin’ moved up two spots from No. 9 to No. 7, very likely due to the release of its pumpkin spice flavored drinks and treats.

The vibes surrounding consumer financial companies are not what they used to be, but Apptopia data makes one think the negative sentiment has gone too far. While installs (new users) of top consumer fintech apps are down 14% year-over-year in Q3, they are up 19.4% over Q3 in 2020. This is more of a situation where water is finding its level. Still, that doesn't mean that things are not shifting and responding to economic activity. Certain sectors of the fintech industry are being hit harder than others, while some are growing as opportunity (via inflation) presents itself.

In Q2, Apptopia's mobile data identified leading indicators and trend shifts in tickers weeks ahead of consensus for a number of stocks, as mobile performance correlates with company key performance indicators. As our team has worked alongside investors to uncover correlations that can help predict earnings outcomes, we find cases every quarter where the nuances to mobile performance metrics make all the difference. For example, when Netflix went after password-sharing, it impacted the metrics that mattered.

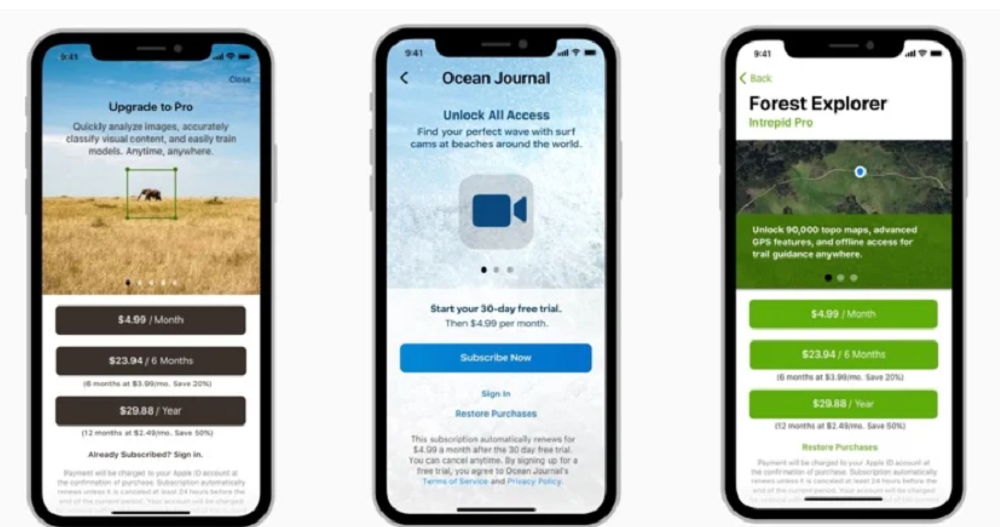

The average price of an in-app purchase (IAP) in the U.S. on the iOS App Store has increased 40% year-over-year (YoY) in the month of July. That number is 9% on the Google Play store. With the Consumer Price Index up 8.5% YoY, people are seeing prices rise almost everywhere. Apptopia data has been tracking consumer behavioral shifts due to these rising prices, and we now see the app stores are no exception.

As college football kicked off in the U.S. on August 27, the top 5 Sports Betting apps did too, accumulating half a million downloads through Labor Day. This combined new install count among DraftKings, FanDuel, BetMGM, Barstool, and Caesars is up 39% from the same period last year. Barstool Sportsbook's daily downloads grew the most between the two weeks, reaching a 329% increase on Sunday. Its growth slowed Monday, while second-fastest grower FanDuel continued to pickup, and the two apps met at 257%.

Amazon just had its best month of U.S. downloads on record, bringing in 5.5 million downloads this August. The 65% year-over-year (YoY) growth for the month is also its highest YoY growth rate for any given month in the last seven years. Setting this record in August signals that Amazon has hit it off with back to school shoppers — the target audience of its multimillion dollar ad campaigns for the past two months — even as brick and mortar retail app performance is stronger than ever this quarter.

Peloton IAP Revenue reached a new all-time-high in May, earning 41% above its previous best month, May 2021. Since April, monthly IAP Revenue estimates have been above the May 2021 peak. While IAP Revenue has never looked better for Peloton, monthly active users (MAU) declined -36% year-over-year (YoY) in Q2 and negative YoY growth continues in the summer months. Average MAU for Peloton and fitness competitors (Nordic Track, Echelon, Bowflex) has declined -53% since April 2021, as Gym and Fitness Studio apps grew average MAU 84%.

Beauty Retail and Direct-to-Consumer (D2C) Apparel apps are driving more daily active users (DAU) in the last 30 days than during the peak of 2021 holiday shopping. Daily users engaging with D2C Apparel apps have increased 5% from December 2021, and 2% for Beauty Retail apps. Historically for these retail categories, they reach a new all-time-high engagement rate each December. In the last three years, the record engagement would not be surpassed until Q4.

Calm just announced it is laying off 20% of its staff. The top two meditation apps have had a steady downward trend for engagement metrics since January 2021. User sessions of Calm are down 26.4% YoY in July, and Headspace is down a whopping 60.3%. As you can see in the graphic below, Calm did get a bump at the beginning of the year when almost all health & fitness apps have their best few months, but it started to decline dramatically shortly after Memorial Day.

The top 10 quick-service restaurant apps in the U.S. were downloaded 12.1 million times in July, 16.3 percent more than those the month prior. Year-over-year in the month of July, downloads of the top 36 quick-service restaurant apps are up 42.2 percent. A download represents a new user and the first conversion on the mobile app customer’s journey.

Competition for non-niche streaming video subscription apps is growing, but not just in terms of the number of players - in terms of actual performance. The fastest growing SVOD (subscription video on-demand) apps, by way of in-app purchase revenue, are Peacock TV, Paramount+ and discovery+. Over the past 12 months, they've grown by 133%, 107% and 25%, respectively.

The Home Depot is climbing the ranks of Retail apps. For two quarters in a row, Home Depot gained twice as many new installs than direct competitor, Lowe's. It's was also the 11th most-downloaded Shopping app in the U.S. in Q2 2022, up from #20 a year ago. On average between the two home improvement competitors, Home Depot has pulled in 100% more monthly downloads since January. A paid App Store Optimization (ASO) keyword strategy appears to be a key driver to Home Depot’s comfortable margin ahead of Lowe's this year.