As we begin lapping COVID-19 shutdowns two years ago, the world has changed in unexpected ways. In order to best see which companies have recovered and which are still suffering, Consumer Edge has been quick to add three-year growth calculations to its CE-Q dashboard suite for both US Transact and UK Transact. In today’s Insight Flash, see how growth rates compare across companies from these different time horizons. Keeping track of these differences in the next few weeks will be crucial to understanding the true pandemic recovery.

It should be no surprise that the home of Buckingham Palace and the Crown Jewels is no stranger to luxury sales. But what are luxury trends like across different countries in the UK, and which price points are most appealing to UK shoppers? In today’s Insight Flash, we dig into these questions using our new UK Cohort dashboards to track luxury sales by country, average price point by country for US-based brands like Tommy Hilfiger and Ralph Lauren, and how Tommy Hilfiger and Ralph Lauren sales are distributed across ticket buckets.

As Home Improvement spend growth slows in the UK, which home improvement brands have the strongest foundation? In today’s Insight Flash, we examine consumer DIY trends for Kingfisher’s B&Q and Screwfix as well as The Range and Homebase using our new UK Cohort dashboards to see spend trends versus the industry and subindustry, where cross-shop is strongest, and what an analysis of B&Q ticket buckets implies about the shopping basket.

UK shoppers over the years have taken advantage of ordering online to save themselves the time and effort of going to stores. Yet, the joy of cooking is one effort they’re still willing to make. Grocery delivery services like Ocado and meal kit purveyors like HelloFresh and Gousto have managed to take advantage of both sides of the coin to give consumers fresh foods delivered straight to their homes.

One of the most interesting questions when it comes to consumer behavior is how city dwellers spend differently from those living in the suburbs or rural areas. Our newly launched UK cohort dashboards allow a deep dive into spend for the London region to complement our existing CSA-level analysis in the US. In today’s Insight Flash, we do a side-by-side comparison of spending in London, Los Angeles, and New York to see whether cities worldwide are more similar to each other than they are to surrounding areas.

Happy Valentine’s Day from Consumer Edge! In light of the recent holiday, today’s Insight Flash provides a sneak peak of our new CE Transact UK Cohort data to analyze similarities and differences in how Americans and Brits find love online. We dig into which daters spend more on app bonus features, how many return to spend on the app when their dates are unsuccessful, and what cross-shop looks like in the US and across the pond in the UK.

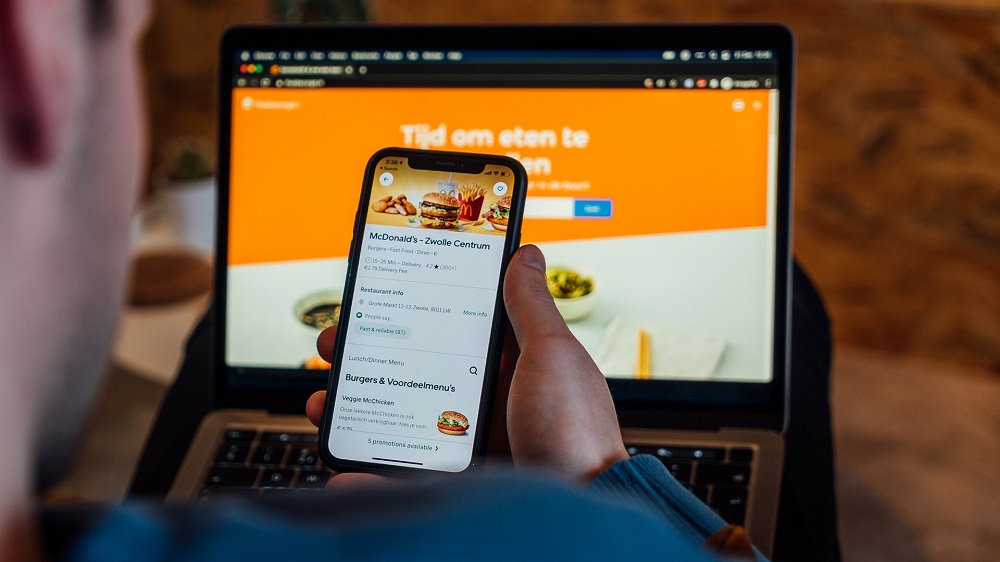

Though Fish and Chips may be a British staple, fast food popularity in the UK is quite diverse overall. In today’s Insight Flash, we take advantage of our newly launched CE Transact UK Cohort data to analyze where Brits go for a quick bite. We dig into which chains are the most popular in which countries, which pizza chains have seen the highest return behavior, and what cross-shop looks like across burger brands.

Pets can be extremely loyal to their owners, showering affection in exchange for food and shelter. But are pet owners as loyal to the retailers supplying pet necessities? In today’s Insight Flash, we look at 1-800-PETMEDS, Chewy, Petco, and PetSmart using our newly launched CE-Q Subscription Dashboard and CE Receipt Data to evaluate which brands do the best at earning repeat business, attracting new customers, and leveraging basket size.

Peloton has been plagued with troubles recently. First there were safety concerns with its treadmills. Then there was negative PR as popular shows depicted characters suffering heart attacks while riding. Finally, there was an announcement this week of layoffs for 2,800 employees and a new CEO. But will Peloton’s loyal customer base ride on? In today’s Insight Flash, we use our newly launched Subscription dashboard as well as our CE Web data to look at Peloton’s retention over time, how it has compared to other workouts in attracting new customers, and whether class innovation has led to expanded adoption.

First Take-Two bought Zynga. Then, Microsoft acquired Activision Blizzard. Now, Sony is going after Bungie. The video game world seems to be consolidating more quickly than a Minecraft God Bridge. But will these acquisitions bring in the new customers and strengthen the loyalty that the new parents expect? In today’s Insight Flash, we answer these questions through our newly launched CE Transact Subscription Metrics dashboard and CE Receipt data, focusing on customer loyalty, new versus repeat user mix, and average price per item.

Last month, Netflix raised the price of its US subscription plans for the third time since 2019. Are the increased fees just keeping up with inflation, or will Netflix see a dip in subscribers in a saturated marketplace? In today’s Insight Flash, we provide a sneak preview of our soon-to-launch Subscription Spend dashboard to answer this question, including retention over time, cohort behavior surrounding the last price increase, and new customer metrics. Consumer Edge US Transact Subscribers can use these dashboards to continue to track these metrics in reaction to the most recent increase.

According to WeatherOptics predictions, a major storm will move across the country from today (Wednesday) to Friday, with 80 million people under some sort of winter weather advisory and a large forecast impact on retail sales. Today’s Insight Flash shows where the biggest sales losses are expected to be as the storm moves across its path, with discounters the most likely to lose business. As the storm moves across the country, there are varying impacts by retailer by state by day.

Over the course of the day yesterday, WeatherOptics’s highly sensitive forecasting systems began to show increasing probability of a Northeast blizzard this weekend. With this early warning, today’s Insight Flash demonstrates how to use CE’s unique set of weather impact tools to assess which companies will see the biggest impact to their sales in the Boston area and nationwide. Looking at the brands whose sales are most heavily indexed to the Boston area, which is extremely likely to be one of the hardest hit this weekend, discretionary retailer Marshalls stands out as having the largest impact, with a -60% sales decline due to weather over the two-day weekend.

Etsy, even moreso than most marketplace businesses, has built success on sourcing a unique set of one-of-a-kind items from a diverse set of creators and collectors. What is inside the Etsy basket has changed dramatically over the last two years, with its ability to quickly take advantage of a demand for custom masks filling a void in the mass production marketplace. In today’s Insight Flash, we demonstrate how our CE Receipt and CE Web data can work together to show what’s happening below the Etsy top line

Throughout the Leisure & Recreation Industry, entertainment businesses in both the US and UK have been seeing a strong start to 2022. Whether it’s hours-long lines for a popcorn bucket at a theme park or a Spidey-driven boost to the box office, growth seems extremely positive versus last year. But how quickly we forget – how does this growth stack up when compared to two years ago?

The New Year usually brings with it a slew of diet and fitness resolutions. Along with new workout routines often comes new workout wear and gear. In today’s Insight Flash, we take advantage of the basket-level detail provided by our CE Receipt data to examine how January online sales for companies selling these products usually compare to the rest of the year, and how January-to-date is tracking so far.

The sales mix for club stores online can be very different than in-store. In today’s Insight Flash, we use our CE Receipt data to dig into individual online transactions for Costco and BJ’s. Although Costco is generally more likely to be thought of as a destination for higher-end goods like wine and jewelry, we dig into how the item mix really differs versus BJ’s and what role seasonality plays. Although Costco online sees substantially more transactions than BJ’s online, BJ’s was chipping away at that share in the beginning of 2020.

Although “Black Friday Preview” deals from many retailers in early November pulled forward the holiday shopping season in 2021, the week before Christmas is still crucial for many retailers to pick up last-minute purchases. In today’s Insight Flash, we dig into how important this week was for online sales tracked by our CE Receipt data based on the percent of sales for the week, growth in items per transaction, and growth in price per item.

With the holiday season now closed and US Transact data available through December 24, we look back on December holiday spend to examine key trends by region, subindustry, and channel. US NAICS Retail spend was up double digits year-over-year across all census divisions for the pre-Christmas December shopping period. The strongest growth was in the East South Central and Middle Atlantic divisions at 17.2% and 16.7%, respectively. The West North Central and West South Central divisions had the weakest growth, still at 11.2% each.

CE Receipt can help users understand company performance not only by tracking topline spend, but also by digging into margin drivers with a breakout of shipping costs. Free or reduced cost shipping promotions for online orders can eat away at retailer margins, making this a key area to track for the holiday season. Despite supply chain issues and a shift back to brick-and-mortar shopping this year, average shipping charges in our CE Receipt Shipping Index have remained remarkably similar to last year’s in the holiday shopping period to date.