In this Placer Bytes, we dive into Hibbett’s growth and the overall strength of the sporting goods sector, and break down the latest from Panera.

Sporting Goods Dominance

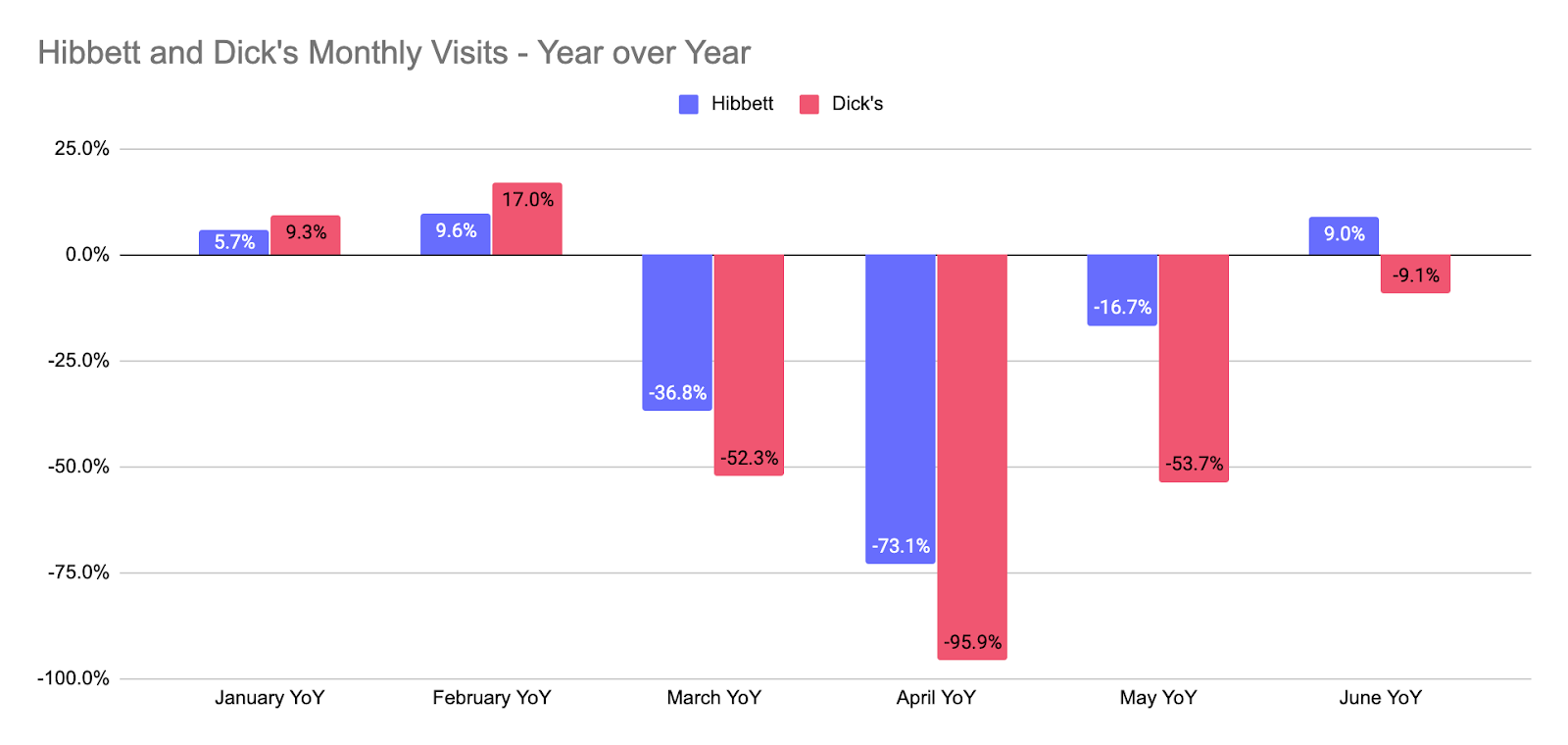

Hibbett Sports has had an exceptionally strong run lately, and analyzing visit trends for the brand shows that this should be of little surprise. Like industry leader Dick’s Sporting Goods, Hibbett kicked off 2020 with a bang, with 5.7% and 9.6% year-over-year visit growth in January and February respectively. Yet, even more impressively, following the obvious downturns from COVID shutdowns, Hibbett already returned to visit growth of 9.0% year over year in June. And while the overall numbers are much lower than Dick’s and Hibbett operates in fewer states, it does speak to the brand’s strength that offline visits have already returned to growth.

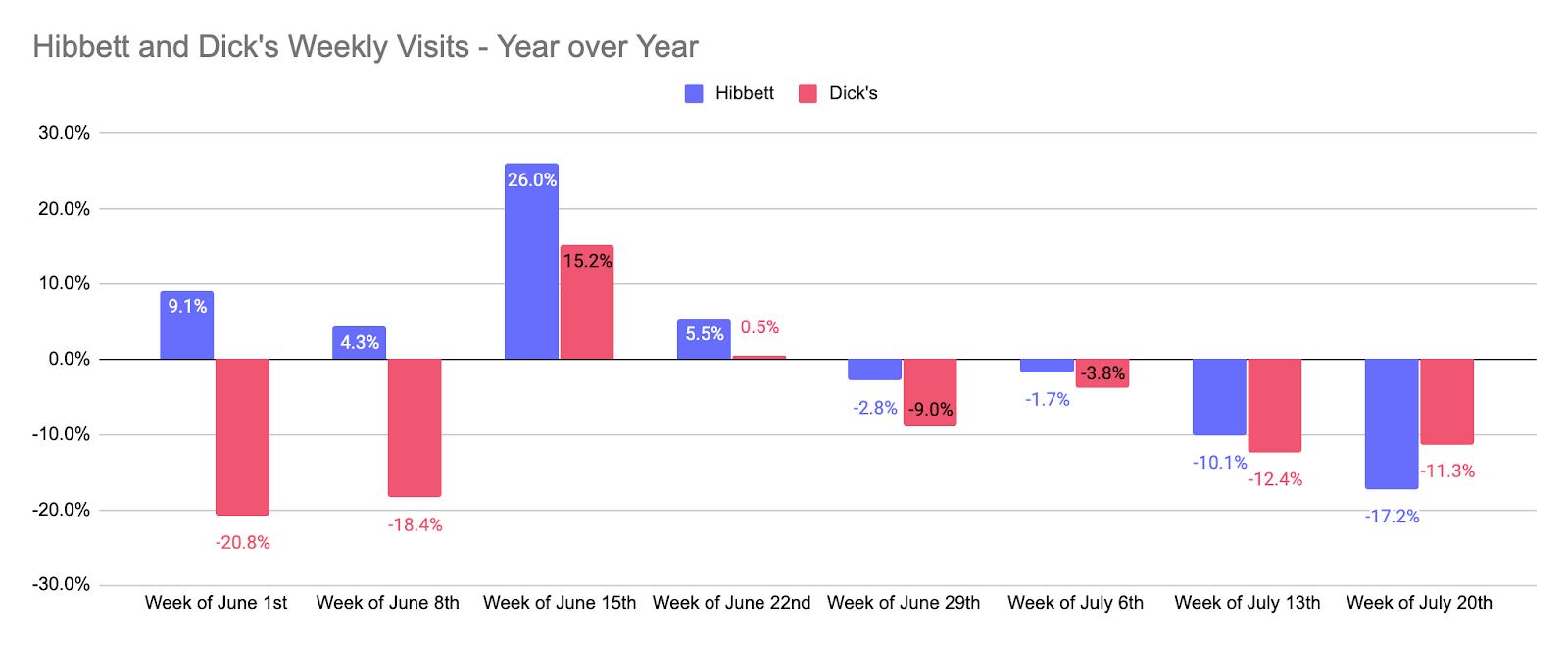

However, the resurgence of cases does appear to be impacting this sector as well, and in a very interesting way. The mid-June surge that both brands enjoyed was a combination of reopenings, dropping COVID concerns, and pent-up demand. Yet, the reverse has been taking place since late June, with cases rising in key states for both companies. And they each see their pain points in different states. While Hibbett relies heavily on Texas, Dick’s is far more exposed to challenges in California and New York, with both feeling the pain in Florida.

But, the overall picture still shows a sector led by two brands that are rising quickly with the pandemic serving as the only seeming obstacle in their path.

Panera’s Bold Move

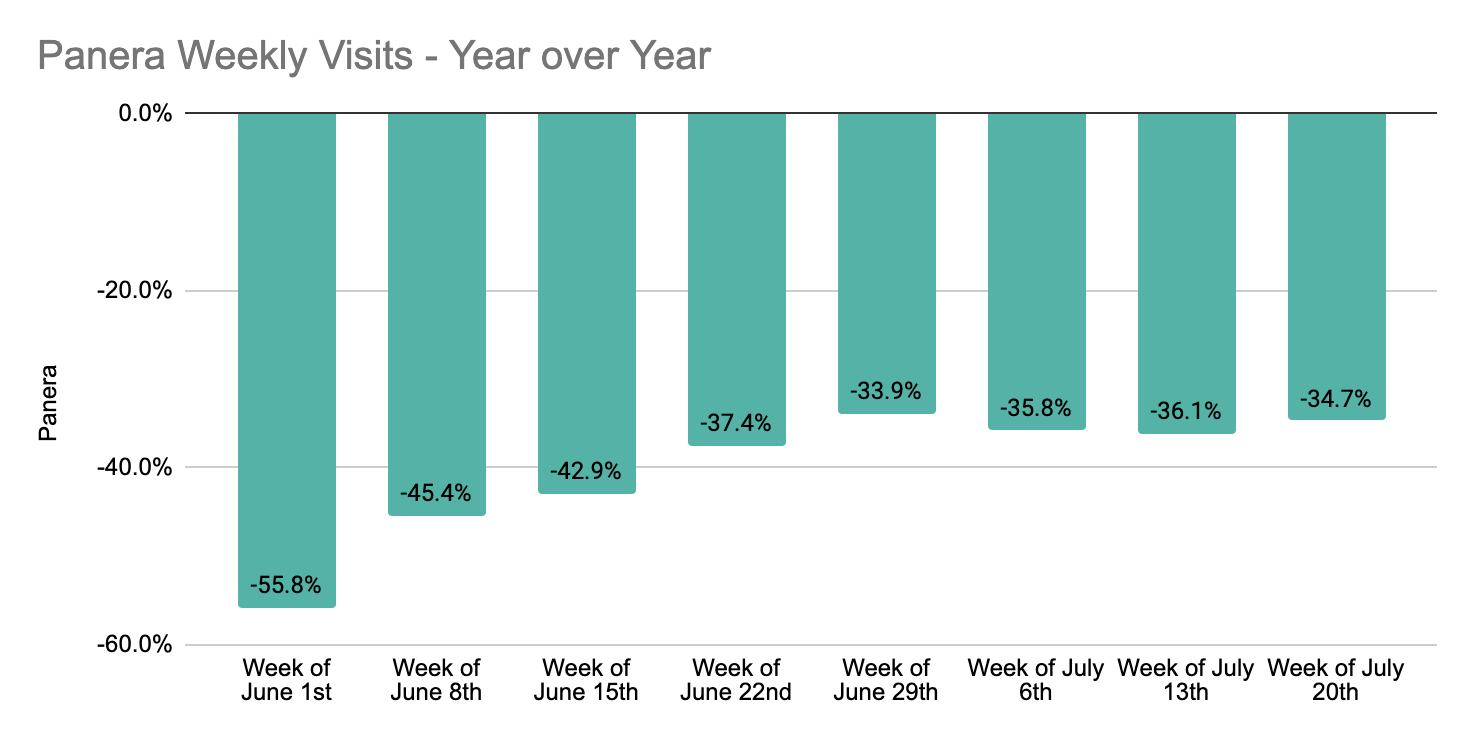

Panera has been making some bold moves lately, and there are increasing signs from its offline traffic that these moves will pay off. Even with challenges in some of its most important regions, the brand has seen steady increases in visits since early June. While the resurgence in cases did stall that growth, the ability to show traction in these especially difficult times is impressive.

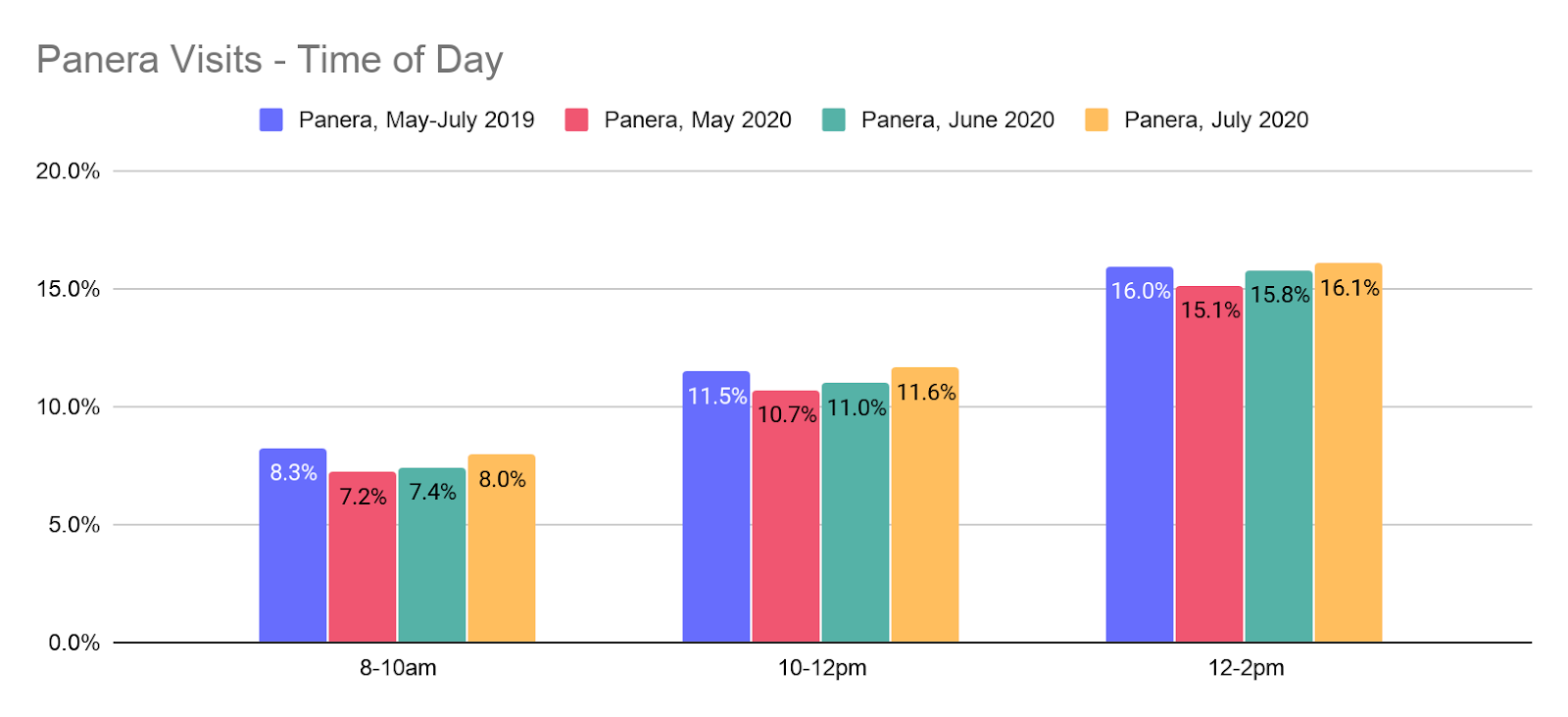

And the most promising sign may actually be coming from the times these visits are taking place. Comparing visits from May, June, and July 2020 to the benchmark of May through July 2019, shows that the times visits take place are increasingly reverting to their traditional norm. And this is especially important for more routine-oriented visits like coffee pick-ups and midday lunches from work. These signs point to a very positive situation for Panera that could help the brand return to normal visit levels in the near term.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.